GUSD: The Evolution of Stablecoins into Smart Yield Assets

The New Generation of Stablecoins Has Arrived

In the early crypto markets, stablecoins provided investors with a safe haven—delivering price stability, simplified settlement, and a reliable place to temporarily park funds. As DeFi and real-world assets (RWA) become more intertwined, stablecoins are evolving beyond simple transactional tools into financial assets capable of generating sustained returns.

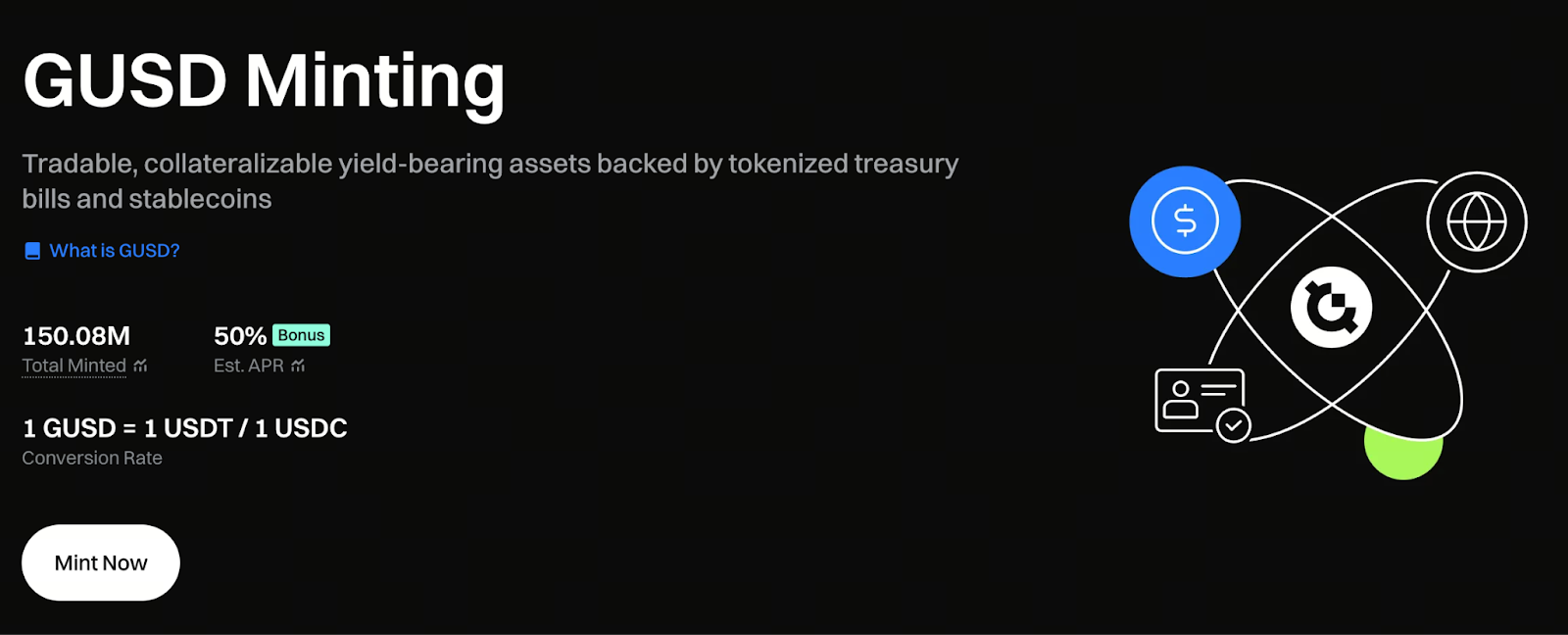

GUSD retains the core stability of a 1:1 US dollar peg but introduces a yield mechanism, transforming stablecoins from passive holdings into smart assets that grow in value automatically over time.

On-Chain Yields Backed by Real-World Assets

GUSD derives its yield from low-risk real-world financial instruments rather than from an artificial token model. These include:

- U.S. Treasury bills

- High-grade corporate notes

- Other financial assets with stable interest income

This structure allows GUSD to offer:

- Price stability—maintaining a 1:1 peg to the US dollar and remaining largely unaffected by market volatility.

- Real-world yield—delivering steady interest returns backed by tangible assets.

GUSD provides investors with a stable allocation option that combines capital preservation with the potential for growth, functioning as an interest-bearing dollar.

Flexible Entry and Exit Mechanisms

GUSD supports a variety of participation methods to meet the needs of different investor profiles:

- Exchange conversion: Instantly swap USDT or other stablecoins for GUSD, ideal for users looking for immediate access.

- On-chain minting: Mint GUSD at a 1:1 ratio using smart contracts, participating directly and transparently in on-chain yield distribution.

Investors can flexibly switch strategies to enjoy stable yields without sacrificing liquidity.

Users can mint GUSD to earn yields that accrue daily on an annualized basis: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

A Self-Growing Yield Model

GUSD uses a cumulative interest and periodic settlement model, allowing yields to accrue automatically over time with no manual intervention needed.

For example:

If you mint GUSD with 100 USDT at a 20% annualized yield, you could redeem approximately 120 GUSD at maturity.

This approach combines the stability of traditional bonds with DeFi’s flexibility, enabling users to earn secure, time-based returns.

A Key Building Block for On-Chain Finance

GUSD is more than an interest-bearing stablecoin—it is a foundational pillar of the Web3 financial ecosystem. It has already been widely adopted across multiple use cases, including:

- Staking and lock-up: Holders can participate in long-term lock-up programs to earn extra rewards.

- Community activities and airdrops: Used to reward active contributors and early participants.

- DeFi module integration: Supports lending, margin trading, yield pools, Launchpool, and more.

These applications bring GUSD into active capital circulation. This transforms it from a static wallet token into a key driver of the on-chain financial ecosystem.

Three Major Advantages

- Long-term holding rewards

GUSD yields increase with holding duration—the longer you hold, the higher the returns—making it ideal for long-term strategies. - High liquidity and flexible access

Supports both exchange and on-chain operations, allowing users to redeem or swap assets at any time for maximum capital flexibility. - Comprehensive ecosystem integration

GUSD is integrated into multiple DeFi protocols, enhancing asset utility and market circulation efficiency.

These advantages position GUSD as an essential component of the on-chain yield market, moving beyond the limitations of traditional stablecoins.

Compliance and Risk Notice

This content is for general informational purposes only and does not constitute investment advice. Before participating in GUSD or other yield-generating stablecoin products, users should fully understand associated risks, yield structures, and platform policies and consult a professional financial advisor.

User Agreement: https://www.gate.com/legal/user-agreement

Summary

The emergence of GUSD signals a new era of yield-generating stablecoins. By leveraging real-world assets and automated on-chain interest distribution, stablecoins have evolved from static value carriers to digital assets capable of self-appreciation. As the Web3 financial system matures, GUSD stands not only as the next step in stablecoin evolution but also as a bridge between traditional finance and the decentralized world. In the future, each GUSD functions as an enhanced digital representation of the US dollar.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data