Gate Research: Slower Rate-Cut Expectations Trigger Market Pullback | Aave Horizon RWA Scale Expands Significantly

Summary

- Over the past week, bitcoin has traded between $107,500 and $116,388, with its consolidation phase expected to continue.

- Mastercard plans to acquire crypto infrastructure company Zerohash for $2 billion.

- The pace of interest rate cuts may slow, with traders lowering bets on a December rate cut.

- Aave Horizon’s RWA market has surpassed $425 million.

- Bitwise’s Solana ETF recorded a second-day trading volume exceeding $72 million.

- KALSHI’s monthly trading volume reached a record high, surpassing $4 billion.

Market Overview

Market Commentary

- BTC market — Over the past 24 hours, bitcoin has traded in a narrow range around the MA5 and MA10. Weighed down by disappointed rate cut expectations, the price briefly dipped to $109,216 before quickly recovering above $110,000. Market volatility led to total liquidations across the network of $532 million in the past 12 hours, including $426 million in long positions and approximately $224 million in bitcoin-specific liquidations. Overall, bitcoin remains in a neutral-to-bullish consolidation phase, trading between the 100-day and 200-day moving averages, with the consolidation expected to continue. Short-term resistance is around $116,000, and a break above could extend the rebound trend, while support near $109,000 is critical for maintaining the bullish structure.

- ETH market — Over the past 24 hours, ethereum has weakened, trading between $3,839 and $4,037. The 4-hour chart shows ETH has fallen below the MA5, MA10, and MA30, with the price at the lower Bollinger Band, indicating clear short-term pressure. On the daily chart, the moving average golden cross range is narrowing, and ETH remains below the 100-day MA, which serves as the main current resistance. A sustained break above $4,000 could retest the $4,200 supply zone, while failure to break the uptrend line may signal further short-term weakness. Key support remains around $3,500.

- Altcoins — Mainstream altcoins have generally declined this week. The altcoin seasonality index is 32, slightly up from last week but overall market sentiment remains bearish.

- Stablecoins — The total market capitalization of stablecoins currently stands at $307.9 billion, reaching a new high with steady upward growth.

- Gas fees — Ethereum network gas fees have fallen from the October 10 peak average of 15.9 Gwei. As of October 30, the daily average gas fee was 0.117 Gwei.

Trending Tokens

Over the past 24 hours, the crypto market has broadly retreated under macro news pressure, with most major coins declining. BTC fell 1.70%, ETH dropped 1.58%, SOL remained flat, and XRP fell 1.90%. BNB was among the few major coins to rise, gaining around 1.42%. Meanwhile, as most assets entered short-term consolidation, RZTO, SAPIEN, and LUMIA tokens performed notably. The following analyzes the drivers behind their gains.

RZTO (+231.55%, circulating market cap $19.34M)

According to Gate data, RZTO is now priced at $0.00434, up 231.55% in 24 hours, continuing last week’s 386% surge and outperforming the overall crypto market, which declined 0.9%. RZTO focuses on integrating AI and Web3 technologies, aiming to enhance blockchain efficiency and user experience through smart trading, ZK technology, and decentralized applications. Its primary goal is to build next-generation DeFi infrastructure with privacy, security, and intelligence. The price surge was mainly driven by exchange listing and social media buzz. RZTO launched on a centralized exchange on October 18 and opened withdrawals on October 19, injecting new liquidity and buying momentum, with daily trading volume soaring 246% to $1.66M. Additionally, a cryptic tweet from RZTO.IO on October 26 sparked community discussion and speculation, garnering over 1,000 likes, amplifying retail sentiment and short-term trading. Overall, this rally was fueled by both the “listing effect” and “social momentum,” though fundamental support remains limited.

SAPIEN (+19.84%, circulating market cap $48.93M)

Gate data shows SAPIEN at $0.1966, up 19.84% in 24 hours, with market cap rising by $6.1M. Sapien is a decentralized data foundry aimed at converting collective human knowledge into enterprise-grade AI training data. It focuses on high-quality, vertical AI datasets, including 3D/4D annotations, expert-led data collection, and industry-specific customized datasets. Its open market provides curated datasets to support AI deep learning and innovation. Recently, on October 30, Sapien completed a $10.5M seed round led by Variant. The funding will expand its global data collection network and optimize platform infrastructure, strengthening its core position in decentralized data and AI training ecosystems. With its decentralized model and large-scale human participation, Sapien is becoming a key infrastructure linking AI models to real-world data.

LUMIA (+22.97%, circulating market cap $12.09M)

Gate data shows LUMIA at $0.1622, up 22.97% in 24 hours. Lumia is a Web3 protocol focused on cross-chain liquidity and asset tokenization, aiming to break multi-chain asset barriers and provide efficient, secure cross-chain trading for users and institutions. Through technological innovation and ecosystem partnerships, it is becoming an important player in DeFi and RWA infrastructure. Lumia’s recent price surge was driven by three key factors. First, on October 11, Lumia announced a strategic partnership with blockchain infrastructure giant Alchemy, providing institutional-grade network support and enhancing stability and security. Second, on October 18, Lumia partnered with Avail to advance tokenization solutions for physical assets, leveraging the RWA narrative to boost market attention. Third, on October 24, the project launched an Omnichain Liquidity Layer, significantly improving cross-chain liquidity and trading experience. These developments, combined with renewed market sentiment toward liquidity infrastructure, jointly propelled Lumia’s token price upward.

Key Market Data Highlights

Mastercard plans $2 billion acquisition of crypto infrastructure company Zerohash

Global payments giant Mastercard is in talks to acquire crypto infrastructure firm ZeroHash in a deal valued at up to $2 billion. The acquisition would expand Mastercard’s crypto operations into stablecoins and tokenization infrastructure. Founded in 2017, ZeroHash provides infrastructure for stablecoin issuance, fiat-to-crypto conversion, custody, and staking services, serving major banks and trading platforms. The deal signals traditional payment systems’ growing attention to stablecoins and blockchain settlement technology, potentially accelerating corporate adoption of crypto. For retail and institutional users, integrating ZeroHash’s technology could make fiat-to-crypto conversion more seamless, transparent, and compliant. Industry-wide, the move may prompt other payment giants and financial institutions to accelerate crypto infrastructure deployment, pushing the ecosystem toward mainstream financial integration.

Grayscale Solana spot ETF launches, boosting demand for Solana exposure

On October 29, the Grayscale Solana Trust ETF (ticker GSOL) converted from a trust to an ETF and officially listed on the NYSE, becoming the second Solana spot ETF after Bitwise. On its first day, GSOL saw net inflows of $1.4 million and trading volume of $4.86 million, with total net assets of $103 million. The ETF currently supports cash subscriptions and redemptions only, with a management fee reduced from 2.50% (trust stage) to 0.35%. It allows Solana staking for additional yield, with 23% of staking rewards allocated to Grayscale, custodians, and staking providers, and 77% added to ETF assets. The ETF provides a regulated channel for institutions and retail investors to gain Solana exposure via brokerage accounts, bypassing direct coin purchases and wallet custody, while further integrating crypto assets with traditional financial products, enabling greater participation from mainstream institutions, pensions, and large-scale capital.

Pace of rate cuts may slow, traders lower December cut bets

Following the highly anticipated policy meeting, the market did not receive clear guidance on a December rate cut. Officials indicated that absent new information and with unchanged economic conditions, there may be reason to slow the pace of cuts. Compared to the last two meetings where some officials favored immediate cuts, more officials now suggest waiting at least one cycle before the next reduction. As a result, bitcoin briefly fell to $109,949, down 4.17% in 24 hours, with $532 million in network-wide liquidations over 12 hours, including $426 million in longs. Inflation Insights analyst Omair Sharif noted that a government shutdown and lack of official economic data could hinder a third consecutive December rate cut. Without official data reflecting October and November economic activity, consensus on another cut may be difficult, especially given the FOMC dot plot showing internal divergence in September. Traders have adjusted their December expectations: CME data shows only a 67.8% probability of a 25 bp cut, down from a 90.5% expectation for a 50 bp cut just one day prior.

Focus of the Week

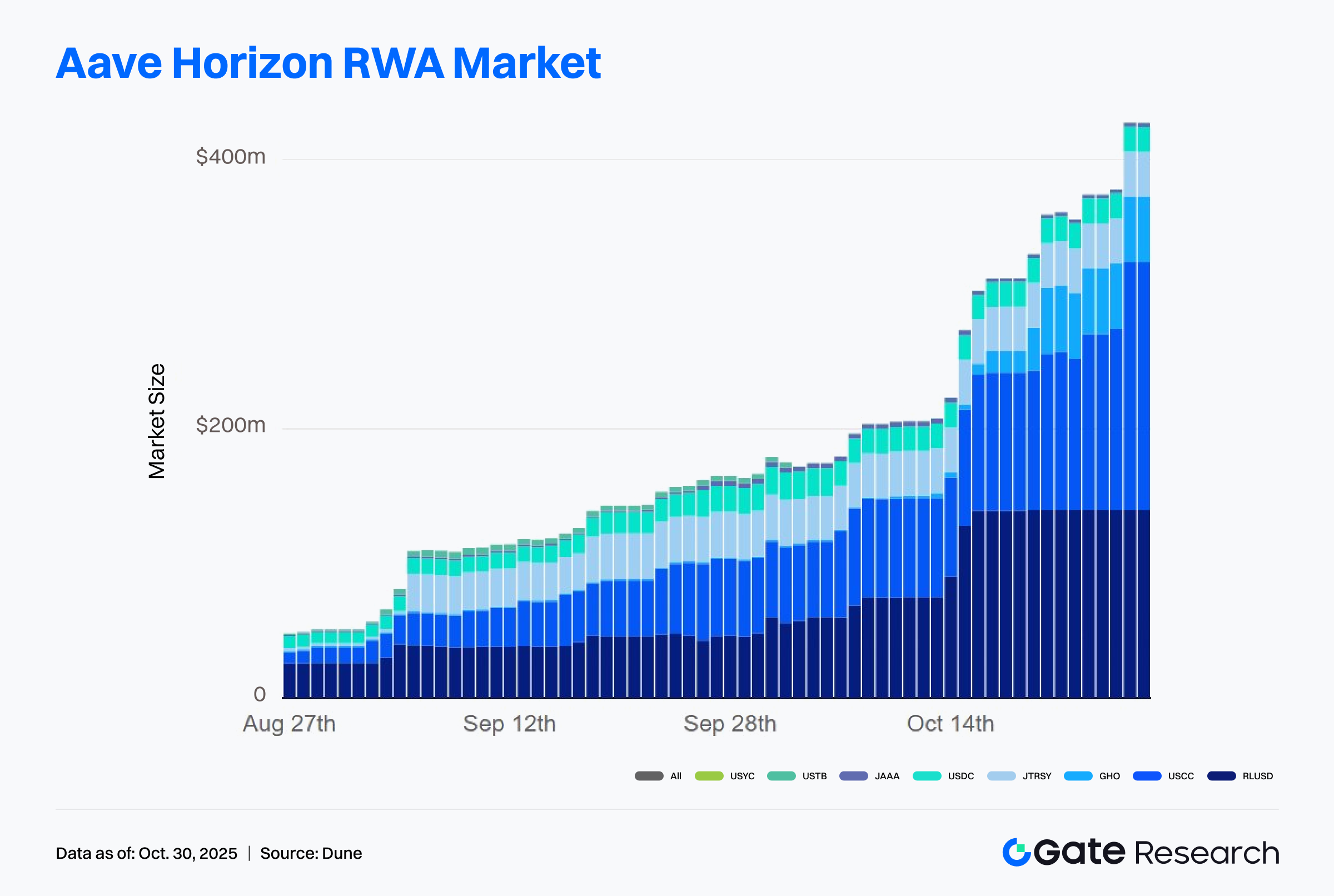

Aave Horizon RWA market surpasses $425 million

Aave’s Horizon RWA market has recently expanded significantly, with total size exceeding $425 million, making it one of the most promising real-world asset (RWA) sectors in DeFi. Growth has been driven mainly by Superstate Inc.’s Crypto Carry Fund (USCC), which now exceeds $180 million in capital. Current lending totals over $110 million, including approximately $64 million in RLUSD, $29 million in GHO, and $16 million in USDC. To attract liquidity, RLUSD lending rates remain below 3%, while GHO and USDC are slightly above 4%, with USDC also benefiting from additional incentives on the Merkl platform.

The rapid growth of Aave Horizon highlights RWAs as a core source of new capital in DeFi. By incorporating regulated asset managers like Superstate, Horizon balances compliance and yield, providing institutional capital with low-risk, stable-return entry points. The RLUSD and GHO rate strategies demonstrate Aave’s flexibility in guiding capital allocation and interest spread management. As more RWA funds integrate, Aave Horizon is poised to become a representative “yield-focused DeFi + real-world assets” model, accelerating the shift of DeFi from pure crypto-collateralized to real-asset-driven.

Bitwise Solana ETF posts over $72 million in second-day trading

Bitwise’s Solana spot staking ETF (BSOL) saw second-day trading volume exceed $72.4 million, up from $56 million on the first day, continuing the record for the “highest single-day volume for a new ETF this year.” In comparison, other newly listed crypto ETFs during the same period, such as Canary Litecoin ETF (LTCC) and Canary HBAR ETF (HBR), had trading volumes of roughly $8 million and $1 million, respectively. Grayscale’s Solana Staking ETF (GSOL) recorded about $4 million on its first day, while REX Osprey Solana ETF (SSK) saw approximately $18 million inflows.

BSOL’s strong performance reflects investor interest in the Solana ecosystem and staking-yield assets, and indicates growing market acceptance of “non-Bitcoin crypto ETFs.” Its high liquidity suggests traditional capital is increasingly allocating to Solana and may draw further institutional attention to on-chain yield assets.

Kalshi monthly trading volume hits record, surpasses $4 billion

On October 30, prediction market platform Kalshi reached a historic milestone, with monthly trading volume exceeding $4 billion, the highest since its launch. Rising macroeconomic uncertainty has driven active trading in contracts related to political events, inflation data, and Federal Reserve policy, pushing overall volume upward.

Kalshi’s record volume demonstrates that prediction markets are becoming a convergence point for mainstream finance and public sentiment. Operating within a regulated framework, it allows institutions and individual investors to legally bet on future events, providing a new dimension for price discovery beyond traditional derivatives. Current trading activity reflects heightened sensitivity to macro events and suggests rapid growth potential for event-driven financial products. With the integration of AI, data analytics, and on-chain oracles, prediction markets may become a key bridge connecting information, speculation, and decision-making efficiency.

Funding Weekly Recap

According to RootData, between October 24 and October 30, 2025, a total of 14 crypto and related projects announced completed funding or acquisitions, spanning multiple sectors including payment networks, stablecoins, AI, and infrastructure. Below is a brief overview of the week’s top-funded projects:

ZAR

On October 28, ZAR announced a $12.9 million funding round led by a16z. ZAR is a digital USD wallet that allows users to securely and conveniently convert cash into digital currency at nearby merchants. Its accompanying ZAR debit card can be used anywhere Visa is accepted, providing users with a seamless digital payment experience.

StraitsX

On October 28, StraitsX completed a $10 million funding round to build stablecoin infrastructure integrated with fiat payment networks and the Web3 ecosystem. StraitsX is a leading Southeast Asian digital asset payment infrastructure provider, offering personal and business accounts for fund transfers, storage, and connections to digital asset platforms. Its enterprise accounts support B2B API integration with various digital payment channels. StraitsX also issues the SGD-backed stablecoin XSGD and the IDR-backed stablecoin XIDR, providing compliant and stable value for the regional digital economy.

Standard Economics

On October 28, Standard Economics raised $9 million in a seed round led by Paradigm. The startup focuses on cross-border payment solutions for the unbanked, aiming to eliminate the complexity and high fees of international remittances using stablecoin technology, enabling users to easily access global currencies like the US dollar.

Next Week to Watch

Token Unlocks

According to Tokenomist, the next seven days (October 31 – November 6, 2025) will see significant token unlocks in the market. The top three are:

- SUI: Approximately $111 million worth of tokens will unlock, representing 1.2% of the circulating supply.

- ENA: Approximately $94.19 million worth of tokens will unlock, representing 3.0% of the circulating supply.

- EIGEN: Approximately $40.5 million worth of tokens will unlock, representing 9.5% of the circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Grayscale, https://etfs.grayscale.com/gsol

- The Block, https://www.theblock.co/post/376840/mastercard-acquire-crypto-infrastructure-startup-zerohash-deal-worth-2-billion-fortune

- CME, https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- X, https://x.com/AliTslm/status/1983118019585851662

- The Block, https://www.theblock.co/post/376839/huge-number-bitwise-solana-etf-crosses-70-million-volume-second-day

- X, https://x.com/DeItaone/status/1983591272766959644

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025