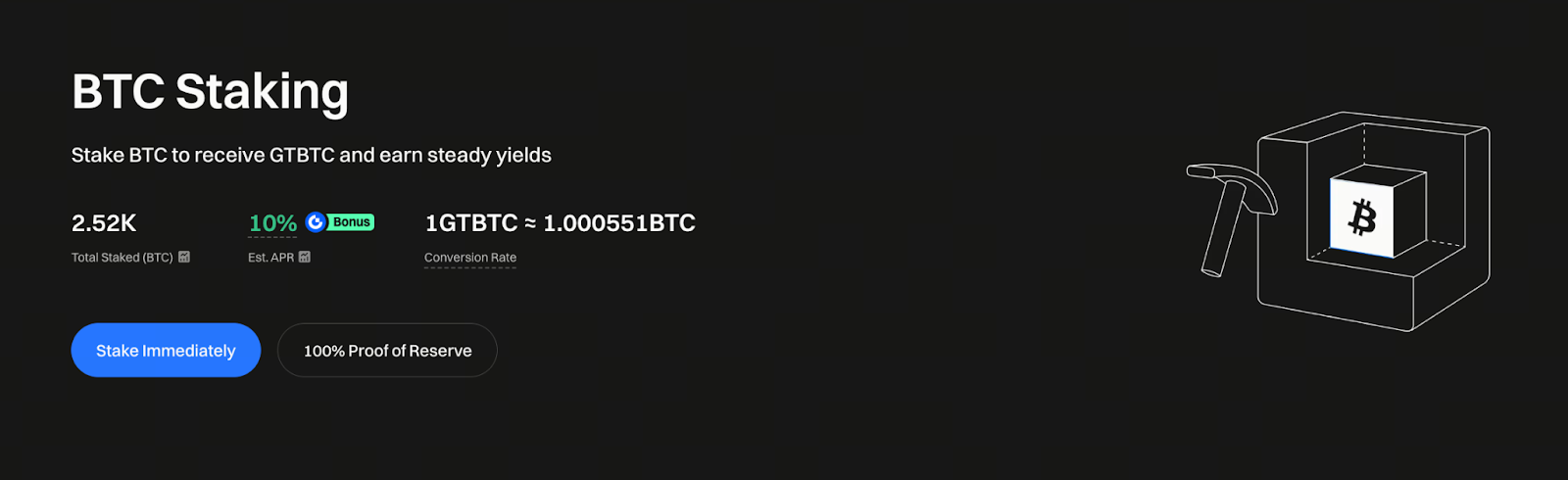

Gate Launches BTC Staking with 10% APY: A Stable Choice in a Volatile Market

Image source: https://www.gate.com/staking/BTC

Recently, Bitcoin’s price has remained at high and volatile levels, leading to significant differences in market sentiment. For many investors, the key challenge is how to achieve steady asset appreciation amidst this turbulence. Gate offers a BTC staking product with annualized yields of up to 10%, providing holders with a secure and profitable option.

Why Choose to Stake BTC on Gate

Staking involves locking your Bitcoin on the platform in exchange for earning interest. Compared to simply holding BTC, staking generates additional cash flow for investors. Among major exchanges, Gate is a top choice for BTC staking due to its strong regulatory compliance and robust risk control framework.

The Advantages of a 10% Annualized Yield

Gate’s BTC staking products currently offer annualized returns as high as 10%, far surpassing traditional financial products. The platform automatically compounds your earnings through the growth of net asset value. This allows users to benefit from ongoing returns without needing any complex operations. For long-term BTC investors, this not only increases the value of their holdings but also significantly boosts their capital efficiency.

Investment Strategies for Volatile Markets

As Bitcoin’s price fluctuates, market uncertainty only grows. Staking BTC on Gate at this juncture allows investors to hold their assets long-term while earning a stable 10% annualized yield. This approach helps investors maintain confidence and stability in their capital, reducing risk compared to relying solely on price appreciation.

Risk and Liquidity Analysis

While staking returns can be attractive, liquidity considerations remain important. Gate’s BTC staking offers flexible withdrawal options, with a typical withdrawal period of around 3 days, ensuring a balance between earning potential and capital accessibility. The platform also provides robust security measures to protect user assets and minimize risk exposure.

How to Start BTC Staking on Gate as a Beginner

To get started, follow these steps:

- Sign up for a Gate account and complete identity verification.

- Deposit BTC into your platform wallet.

- In the “On-chain Earn” section, select the BTC staking product (10% annualized yield).

- Confirm your staking with a single click; your earnings will automatically accumulate over time.

This streamlined process is ideal for newcomers—you can start earning stable returns easily without complex financial knowledge.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution