Gate BTC staking offers an annualized yield of 9.99%, providing a secure high-yield solution amid market turbulence.

BTC Market Volatility Overview

Bitcoin has seen sharp price swings recently. For many investors, frequent trading under such conditions can lead to considerable stress and heightened financial risk. In this environment, staking BTC to lock in stable returns offers an appealing solution.

Benefits and Returns of BTC Staking

Staking BTC enables investors to earn a fixed annual yield while continuing to hold their Bitcoin. By locking BTC on the platform, investors receive annual yield provided by the platform—no complex actions are required. In volatile markets, BTC staking helps enhance capital efficiency and buffers against the risks of short-term price fluctuations.

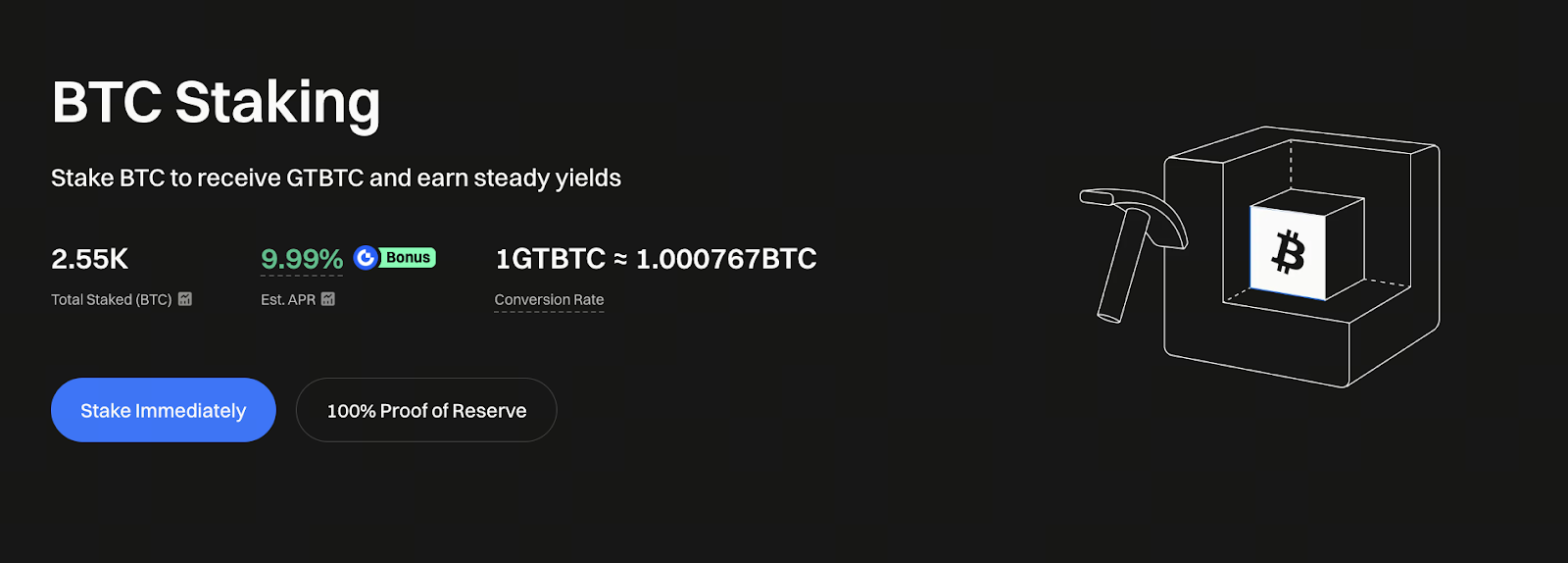

Gate BTC Staking: 9.99% Annual Yield Highlights

Image: https://www.gate.com/staking/BTC

Gate offers BTC staking with an annual yield of 9.99%—one of the highest available in today's market. Compared to traditional financial products and other crypto-based investment options, Gate’s BTC staking delivers several key advantages:

- High annual returns: The 9.99% rate far outpaces bank deposits and most conventional investment products.

- Flexible redemption: Users can request withdrawals at any time; although the staking period is longer, liquidity remains strong.

- Automatic compounding of yields: The platform automatically compounds daily yields, so users benefit from compound interest without manual management.

- No maximum staking limit: Both large- and small-scale investors are eligible to participate with no maximum staking limit.

Achieving Stable Income with BTC Staking in a Volatile Market

While BTC's price is highly volatile, staking BTC enables investors to secure a fixed annualized yield and reduces the impact of market uncertainty on returns. Key strategies include:

- Layered staking: For substantial holdings, stake in increments to decrease exposure to market timing risks.

- Long-term holding: Investors confident in Bitcoin’s future can use staking for additional passive income, regardless of short-term price movements.

- Active strategy: Periodically review market conditions and your portfolio to adjust staking amounts, leveraging BTC’s liquidity to optimize returns.

Risk and Liquidity Considerations

Although BTC staking delivers stable returns, market downturns can still affect your principal. Even with a 9.99% annual yield, steep declines may result in losses on staked assets. Gate’s staking products offer flexible redemption options, but withdrawal timing may be restricted, resulting in lower liquidity compared to regular trading assets.

Robust risk management is also essential. As a leading crypto exchange, Gate maintains stringent compliance and risk control measures to safeguard user assets.

Summary

Gate’s BTC staking at a 9.99% annualized rate stands out as a high-yield solution for Bitcoin holders seeking stable returns. Even in choppy markets, staking BTC provides predictable rewards. This enables investors to grow their assets steadily without constant trading. Whether you’re a long-term Bitcoin holder or pursuing higher yields, BTC staking on Gate can help boost portfolio growth.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution