Ethena is driving the value flywheel

The final piece of the puzzle has just come together: USDe is now listed on Binance, setting the stage for Ethena to activate its fee switch.

Once all metrics are met, $ENA holders will soon be invited to vote. This decision will redefine how value accrues to the token and marks a pivotal moment in Ethena’s journey.

This article explains:

- How Ethena generates revenue and returns value to holders

- The catalysts driving the next surge of buying pressure

- Why this is Ethena’s flywheel endgame

Fee Switch Calculation

Ethena’s fee switch is a governance-approved mechanism that channels a portion of protocol revenue—such as USDe income and trading fees from exchanges—directly to ENA holders.

Distribution may take the form of buybacks or direct allocation to staked ENA (sENA), aligning protocol growth incentives with community rewards.

The final implementation details will be determined by the Risk Committee.

Let’s review the numbers:

Assumptions:

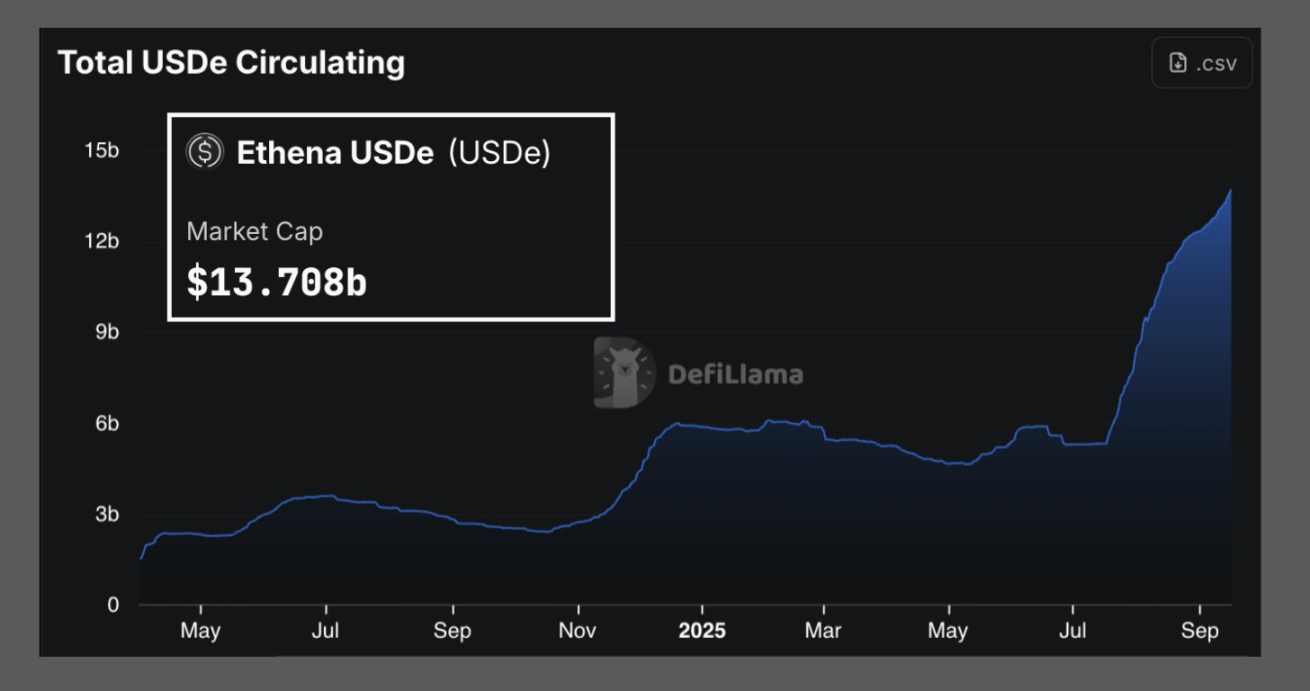

- Current USDe supply: $13 billion

- Considering the $7 billion added during rapid growth over the past two months, a final supply of $20–$30 billion is realistic.

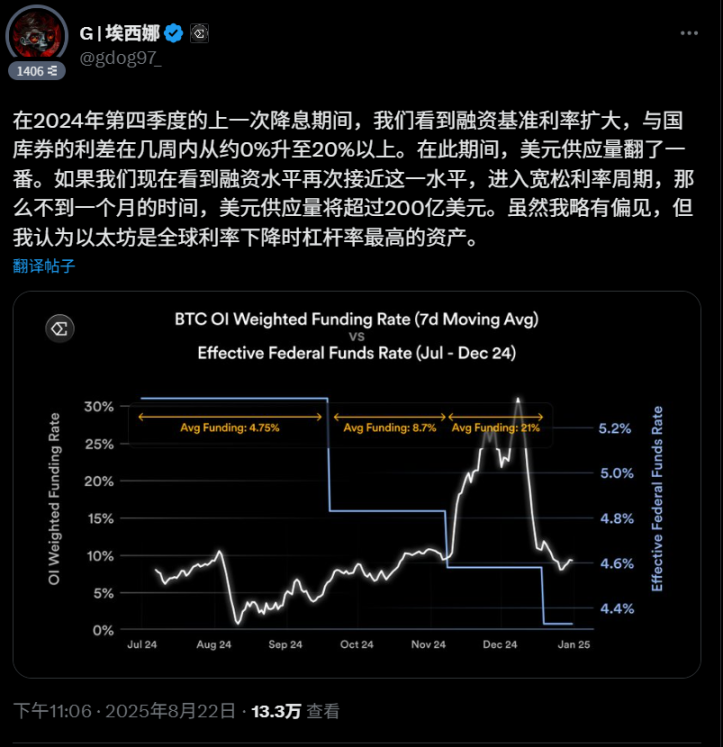

- The funding rate, which drives USDe yield, is currently about 8%. In bullish market conditions, it could climb to 20%, with new sources such as Hyperliquid emerging.

- Take rate: The percentage of fees reallocated for ENA buybacks, ultimately set by the Risk Committee and community vote.

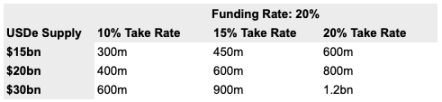

Scenario Calculations

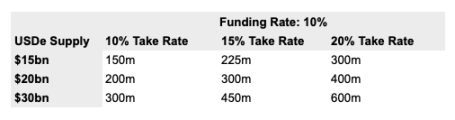

Scenario 1: 10% Funding Rate

At a $15 billion USDe supply and a 10% funding rate, Ethena would earn $1.5 billion in annual protocol revenue. Even with only 10% allocated for buybacks, ENA would gain roughly $150 million in annualized purchasing power. If supply grows to $20 billion and 15% is allocated, buying power climbs to approximately $300 million.

This baseline is enough to reward holders while keeping sUSDe yields competitive.

Scenario 2: 20% Funding Rate

In a true bull market, the funding rate could surge to 20%. With $4 billion in revenue and 20% allocated to buybacks, that creates about $800 million in purchasing power—and with $30 billion supply, annual buying power exceeds $1 billion.

Demand at this scale is transformative for ENA’s tokenomics.

Key Takeaways

Even under conservative assumptions, the fee switch can channel hundreds of millions in structural buying power to ENA. In aggressive scenarios, it becomes a billion-dollar flywheel engine.

This is just the beginning. Upcoming catalysts will expand supply and funding rates, unlock new revenue streams across Ethena, and accelerate the flywheel’s impact.

Catalysts for Ethena Flywheel Acceleration

The fee switch is only one lever. Ethena is quietly accumulating additional catalysts to drive value back to ENA.

Here are the most significant catalysts to watch:

- StablecoinX, ENA’s Digital Asset Treasury (DAT)

- Ethena’s Hyperliquid products

- Ethena’s Stablecoin-as-a-Service (SaaS)

StablecoinX: ENA’s Digital Asset Treasury (DAT)

StablecoinX recently upgraded its ENA accumulation strategy: whenever ENA’s price drops below $0.70 or falls more than 5% in a day, DAT steps in and accumulates more ENA.

StablecoinX has secured $530 million in new PIPE funding, bringing total financing to nearly $890 million and providing strong support for ENA demand.

My previous article on Ethena’s “Saylor Model” covered this in detail, but the key point is straightforward: DAT creates sustained buying pressure, especially during market pullbacks.

Ethena’s Products on Hyperliquid

Hyperliquid is rapidly becoming Ethena’s most important venue, with two main initiatives: HyENA and Based.

Both directly boost USDe adoption and funnel new revenue to ENA.

HyENA (@hyenatrade) = HYPE + ENA?

Rumors suggest Ethena will launch its own perpetual contract market, “HyENA,” via Hyperliquid (HIP-3). If confirmed, this strengthens USDe as core trading collateral and opens new revenue streams.

Why it matters:

- Traders use USDe as collateral for perpetual contracts.

- Holding USDe on the platform may also earn sUSDe yield, making it a stickier asset.

Based (@BasedOneX), Powered by Ethena

Based is a full-stack Hyperliquid trading app (desktop, web, mobile, Telegram) powered by Ethena.

It will likely serve as the main gateway for Hyperliquid traders to access Ethena products such as USDe, USDtb, and future offerings like stock perpetuals.

Based currently accounts for about 15% of Hyperliquid’s perpetual trading volume.

Calculation: New Revenue Streams

Ethena’s revenue from Hyperliquid comes from two sources:

- HyENA: As HIP-3 deployer, Ethena captures 50% of trading fees.

- Based: Revenue share from trading volume related to Ethena products (USDe, USDTb, new integrations).

Approximate calculation:

- $1 billion = Hyperliquid’s annualized revenue

- 35% = Estimated market share for Ethena-related products

- 50% = Fee split

Ethena yields about $175 million in additional revenue.

This is a conservative estimate. If market share or trading activity expands, the impact could be much greater, positioning Hyperliquid as a long-term growth engine for ENA.

Ethena’s Stablecoin-as-a-Service (SaaS)

Ethena has launched its Stablecoin-as-a-Service model with @megaeth_labs, debuting MegaUSD (USDm) as MegaETH’s native stablecoin.

USDm operates as the primary settlement layer for MegaETH, backed by Ethena’s USDtb reserves.

This is only the start. As more chains and apps look to launch their own native stablecoins, Ethena’s infrastructure provides immediate liquidity and credibility.

Why it matters:

- Any project can now launch a stablecoin using Ethena’s backend.

- SaaS offers flexibility, supporting both USDtb and USDe.

- Each new deployment grows Ethena’s ecosystem and returns value to ENA.

SaaS positions Ethena as a foundation for the stablecoin economy. Every new chain or app that plugs into this stack becomes another gear in Ethena’s flywheel.

Flywheel Endgame

Ethena’s fee switch is more than just a toggle—it’s the engine for long-term value flow to ENA. Even conservatively, hundreds of millions in buying power will flow to the token. In bull market conditions, that could exceed $800 million.

Yet the flywheel doesn’t stop there. USDe remains Ethena’s revenue engine, with every new product integration amplifying the effect.

On top of that, the Stablecoin-as-a-Service (SaaS) model allows any app or chain to launch its own stablecoin via Ethena’s backend. Ethena powers its own ecosystem and seeds others, with every new partnership adding momentum to the flywheel.

This is the flywheel endgame: a sustainable business model, reinforced by aligned partners, operating in the right arena.

Ethena is building not just a protocol, but an economic system—one where every catalyst cycles value back to ENA.

Disclaimer:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Tindorr]. For concerns about reproduction, contact the Gate Learn team for prompt processing according to established procedures.

- Disclaimer: The views and opinions expressed in this article are exclusively those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Reproduction, distribution, or copying of translated articles without mention of Gate is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?