Cryptocurrency, Stocks, and Bonds: A Leveraged Cycle Perspective

Financial cycles are fundamentally driven by leverage. From the rapid boom and bust of meme coins to the decades-long technological waves, humanity consistently invents mechanisms, beliefs, and organizations to generate new wealth. To understand the significance of the convergence among tokens, stocks, and bonds, let’s briefly review the historical evolution of global finance.

Since the Age of Discovery in the late 15th century, the world’s leading capitalist economies have transformed as follows:

- • Spain and Portugal — Physical gold/silver and brutal colonial plantation systems

- • The Netherlands — Equities and corporate structures (Dutch East India Company)

- • England — Gold standard and the “colonial scissors” (military dominance, systemic design, imperial privileges)

- • United States — U.S. dollar, Treasuries, and strategic military bases (eschewing direct colonization for control of key centers)

Successive powers have incorporated the strengths and weaknesses of former regimes—Britain adopted the corporate stock system, the U.S. exercised military dominance, and so forth. The key point is to highlight what each rising hegemon brought as innovation. From these patterns, two main features of classical capitalism stand out:

- • Koep’s Law of Hegemony: Like the evolutionary tendency of animals toward greater size, each economic core grows in scale (Netherlands → England → U.S.).

- • Economic Debt Cycles: Tangible assets and commodity production yield to financialization. The classic trajectory for capitalist powers is driven by innovative financial capital aggregation.

- • Ultimate Collapse of Leverage: From Dutch stocks to Wall Street derivatives, increasing return pressures erode the value of collateral, debts cannot be cleared, and rising economies take the lead.

The U.S. now operates at the limits of global dominance, signaling a drawn-out period of mutual entanglement in global finance.

Eventually, U.S. Treasuries will become uncontrollable—echoing Britain’s challenges after the Boer War. A graceful wind-down, however, requires financial instruments like tokens, stocks, and bonds to extend the countdown to debt unwinding.

Tokens, equities, and bonds form a mutually reinforcing system: gold and BTC collectively back Treasuries as collateral, stablecoins uphold global dollar adoption, and socialized loss mitigates deleveraging impacts.

Six Ways Tokens, Stocks, and Bonds Intersect

Every source of happiness is, essentially, a fleeting illusion.

The natural law in finance and biology alike is growth in scale and complexity. At peak periods, both financial instruments and species face escalating internal competition—often manifesting in ever more elaborate features or structures, like horns or feathers, as competition for advantage intensifies.

Tokenomics originated with Bitcoin, building an on-chain financial system from nothing. Bitcoin’s $2 trillion market capitalization pales against the nearly $40 trillion scale of U.S. Treasuries—its impact is inherently limited. Ray Dalio’s consistent advocacy for gold as a dollar hedge follows similar logic.

Stock market liquidity is emerging as a new pillar for tokens. The pre-IPO market now shows tokenization potential; tokenized stocks have become a new post-electronic format, while DAT (Treasury Asset Tokenization) strategies will be central through the first half of 2025.

It’s important to note: on-chain Treasuries are becoming a reality, but tokenized corporate debt, including company-issued on-chain bonds, remains at the pilot stage—with small-scale experiments underway.

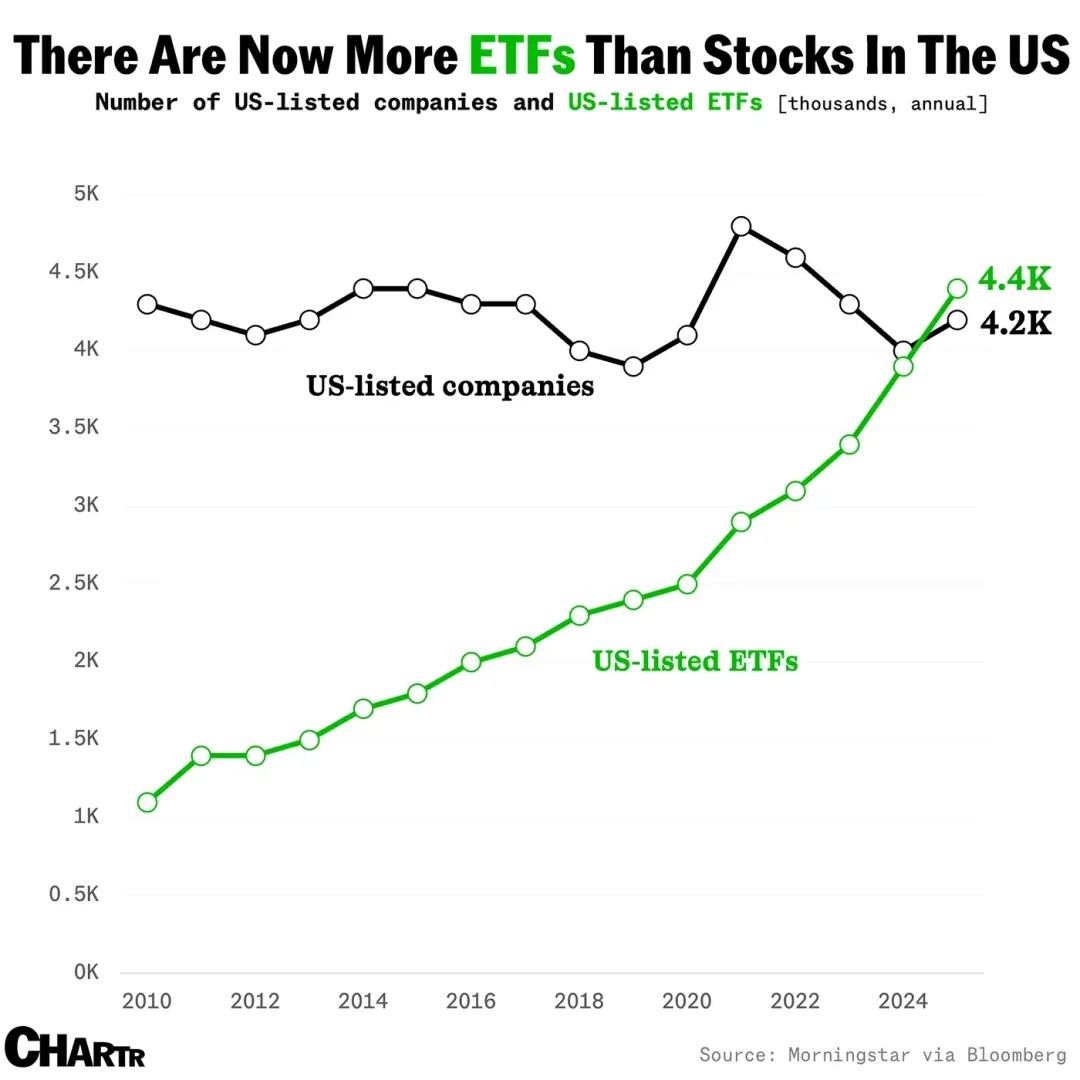

Image: ETF Growth

Source: @MarketCharts

Stablecoins have become a narrative unto themselves. Tokenized funds and debts now define the latest RWA (Real World Asset) trend, while multi-asset ETFs, incorporating token-stock-bond concepts, are starting to attract institutional capital. Will the liquidity-absorbing effect of traditional ETFs and index funds repeat in crypto?

It’s difficult to predict, but structures like altcoin DAT and staked ETFs signify the start of a rise in leverage.

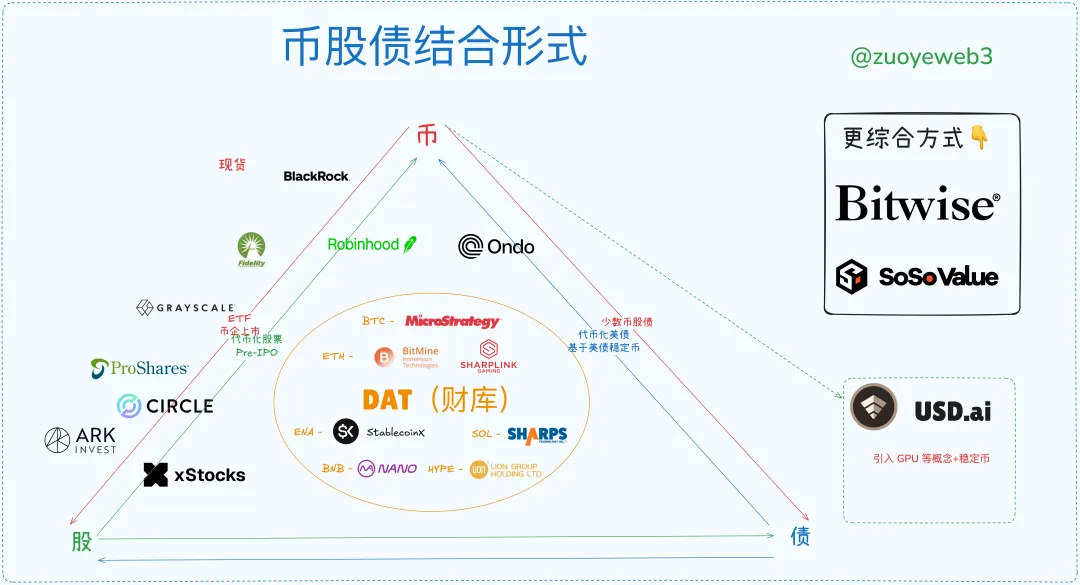

Image: Token-Stock-Bond Integration Models

Source: @zuoyeweb3

Tokens as collateral are growing less potent in DeFi and conventional finance alike. On-chain, USDC/USDT/USDS are needed—they all, in some form, represent derivatives of Treasuries. Off-chain, stablecoins are trending. Before this, ETFs and RWAs have set practical precedents.

In summary, the market has produced six main models for integrating tokens, stocks, and bonds:

- • ETFs (including futures, spot, staking, and universal models)

- • Token-Stock (using financial engineering to create new on-chain asset utilities)

- • Token Company IPOs (Circle illustrates the current “hard cap” trend for stablecoins)

- • DAT (comparing MSTR token-stock-bond, ETH token-stock, and ENA/SOL/BNB/HYPE tokens)

- • Tokenization of Treasuries and funds (Ondo’s RWA theme)

- • Pre-IPO market tokenization (not mainstream yet, dormant and risky, but with potential for transforming traditional finance on-chain)

No one can precisely predict when the leverage cycle will end or when markets will exit, but we can outline its contours.

Theoretically, emergence of altcoin DAT signals the top of a long cycle—just as BTC can consolidate near $100,000, the dollar and Treasuries are destined for virtualization. The resulting momentum takes decades to absorb—think 29 years from the Boer War to Britain abandoning the gold standard (1931-1902), or from Bretton Woods to its end (1973-1944).

Ten thousand years is too long; we must seize the day. At least until the U.S. midterm elections in 2026, crypto markets have another year of promise.

Image: The Current State of Token-Stock-Bond Markets

Source: @zuoyeweb3

Presently, token-company IPOs are the most elite and exclusive niche—only a handful of crypto companies have completed U.S. IPOs, reflecting the enormous challenge of selling oneself as an asset.

The next-best approach is to recycle existing premium assets, as BlackRock now dominates the spot BTC and ETH ETF markets. Upcoming innovations in staked and universal ETFs are likely to reset the competitive landscape.

DAT (Treasury Asset Tokenization) firms have become the only entities successfully navigating tri-directional cycles among tokens, stocks, and bonds. For example, based on BTC, they can issue debt to boost share prices, then reinvest spare funds in BTC. This demonstrates market confidence in BTC as collateral and validates strategies that treat BTC as a proxy for asset value.

In contrast, ETH treasury companies like BitMine and Sharplink have managed only token-stock coupling, lacking market conviction in their ability to issue debt (aside from capital operations during token purchases). The market partly acknowledges ETH’s value but not the intrinsic worth of ETH treasury firms, evidenced by mNAV below 1 (share value less than the underlying asset value).

But if ETH’s market value becomes mainstream, high-leverage competition will select winners. Long tail treasury companies will disappear, and market leaders will emerge as ETH’s representatives post-leverage cycle.

Tokenized stocks are currently smaller than DAT, IPOs, or ETFs, but hold the greatest promise. Stocks today are electronic and server-based; in the future, stocks will be fully on-chain, becoming tokens that can represent any asset. Robinhood’s ETH L2, xStocks on Ethereum and Solana, and SuperState’s Opening Bell for tokenizing Galaxy stocks on Solana all point toward this trend.

Ultimately, tokenized stocks will compete across Ethereum and Solana, though the service aspect will be more technical and less transformative for asset capture. Here, market effects will flow through $ETH or $SOL.

Tokenization of Treasuries and funds is trending toward single-entity dominance (ex: Ondo), owing to Treasury-stablecoin bifurcation. RWA expansion must look beyond Treasuries—analogous to non-dollar stablecoins—which could scale substantially in the long run, but remain a long-term project.

Pre-IPO tokenization takes two forms: (1) pooling capital before buying equity, and (2) purchasing equity first and then distributing tokens. xStocks operates in both the secondary market and Pre-IPO. The key is to incentivize tokenization of private markets, driving broader public participation—a mechanism that illustrates how stablecoins expand.

Current legal frameworks leave room for regulatory arbitrage, but substantial adjustment is needed. Pre-IPO tokenization won’t go public quickly, as the heart of the issue is asset pricing power—not technology. Wall Street’s entrenched distributors will resist these changes.

Unlike that, tokenized equity distribution and incentive distribution can be decoupled: “Crypto participants care more about incentives than rights.” Taxation and regulatory issues for equity income have precedents globally; on-chain transition is not a barrier.

For comparison, Pre-IPO tokenization challenges Wall Street’s pricing power; tokenized stocks magnify Wall Street’s returns via broader distribution channels and liquidity. These are fundamentally distinct cases.

Convergent Bull Markets, Ruthless Bear Markets

Leverage cycles tend to fulfill their own predictions. Every bullish catalyst can spark multiple rallies, inflating leverage across the system. In downturns, institutions cross-hold collateral and sell off riskier tokens first, fleeing to safer assets, while retail is usually left with the losses—either willingly or by force.

With high-profile purchases—Jack Ma buying ETH, China Renaissance acquiring BNB, CMB International issuing Solana tokenized funds—global institutions are using blockchain as connective tissue, driving a new financial era.

The U.S. exemplifies Koep’s Law—lowest cost, highest efficiency, and maximal scale—but faces unprecedentedly complex interdependencies. The new “Monroe Doctrine” isn’t realistic in today’s economy; the internet might fragment, but blockchain remains naturally unified, with L2s, nodes, and assets able to interoperate on Ethereum.

In practical terms, token-stock-bond integration is a process of market makers and retail swapping positions. The “Bitcoin up, altcoins lag; Bitcoin down, altcoins crash” phenomenon is most visible in on-chain dynamics.

Let’s outline this mechanism:

- During bull markets, institutions use leverage to buy low-volatility collateral; in bear markets, they sell off alt assets to preserve high-value positions.

- Retail does the opposite: in uptrends, retail sells BTC/ETH/stablecoin for higher-volatility tokens, but cash constraints mean that once the market turns bearish, they must sell core assets to maintain their leveraged alt positions.

- Institutions can weather larger drawdowns, buying retail high-value assets. Retail’s efforts to maintain leverage increase institutional resilience, forcing retail to sell further.

- The cycle ends when leverage collapses. If retail loses momentum, the entire cycle ends; if institutions fail, a systemic crisis arises, and retail is hurt most, as high-value assets have already moved to institutional hands.

- Institutional losses are diffused socially. For retail, leverage becomes a noose—fees paid to institutions. Beating the pack is as hard as reaching the moon.

The segmentation and assessment of collateral is surface-level—the real economic driver is pricing leverage based on asset forecasts.

This explains, in part, why altcoins fall harder. Retail is more eager for higher leverage than the issuers. In bear markets, retail ends up as counterparty to the system. Institutions possess diversified portfolios and sophisticated hedging, and retail bears the brunt.

In essence, tokens, stocks, and bonds align leverage and volatility. Financial engineering could, for example, create a partially Treasury-backed, delta-neutral hybrid stablecoin that intertwines all three asset classes. Such an instrument would synchronize volatility and enable effective hedging—potentially boosting returns.

ENA/USDe partially realize this concept. Predicted outcome: higher leverage attracts more TVL and retail activity, until volatility peaks. Project teams prioritize maintaining USDe’s peg, sacrificing ENA’s price; DAT company valuations drop, institutions exit first, and retail is left holding losses.

Next, multi-layered leverage cycles trigger: ENA treasury investors dump shares to defend their ETH/BTC positions—some firms will implode, starting with smaller DAT tokens, then smaller DAT companies of major tokens, culminating in market-wide panic and scrutiny of “Strategy” moves.

In this framework, the U.S. stock market becomes the final source of liquidity, but can still be breached due to market feedback loops. This isn’t alarmism—U.S. regulatory measures couldn’t prevent crises like LTCM. With politicians now openly launching coins, the explosive integration of token, stock, and bond markets is hard to stop.

Global economies interconnected on-chain will likely face simultaneous turbulence.

During reversals, any remaining liquid venues—on-chain or off, across all six integration models—become exit points. The harsh reality: there is no “Fed” on-chain. When liquidity dries up, markets can fall to extreme lows before stabilizing.

Every cycle ends—and a new one begins.

After an extended period of pain, retail investors build up capital from gig work and steadily accumulate BTC, ETH, and stablecoins—offering new thematic catalysts to institutions. The next cycle commences. Even after financial magic and debt is purged, authentic value generation from real labor will remain fundamental.

Readers may ask: why not discuss the stablecoin cycle?

Because stablecoins are externalized expressions of cycles. BTC and gold prop up fragile Treasuries, stablecoins sustain dollar globalization. Stablecoins can’t form cycles by themselves—they must connect with more fundamental assets for genuine returns. Increasingly, stablecoins are pegged to BTC/gold rather than Treasuries, smoothing the leverage curve.

Conclusion

From “the classics shape me” to “I shape the classics.”

On-chain lending is still undeveloped. The fusion of DeFi and CeFi is underway, but its link to token-equity structures is limited, with some overlap in DAT—future analysis will cover institutional lending and credit systems in detail.

This article focuses on the structural interplay among tokens, stocks, and bonds—and what novel models or directions may emerge. ETFs are entrenched; DAT is still fiercely competitive; stablecoins are expanding rapidly; both on- and off-chain opportunities are vast. Token-stock and Pre-IPO models have significant potential, but transforming traditional finance isn’t feasible via pure compatibility—there’s no self-sustaining internal cycle yet.

Token-stock and Pre-IPO must resolve rights distribution, but “rights-based solutions” aren’t enough—real economic effects are needed to break through regulatory bottlenecks; regulatory accommodation alone leads to bureaucracy. The history of stablecoin development illustrates the paradigm: grassroots disruption works best.

Token company IPOs are traditional finance’s way of buying and pricing crypto; this process will become more routine over time. Those aiming to list should move quickly—once the concept is saturated, valuation becomes quantitative, as in fintech and manufacturing; creative potential diminishes as the number of listings grows.

Tokenized Treasuries/funds are a long-term play, unlikely to yield outsized returns, and largely irrelevant to individual investors—highlighting blockchain’s role as a technical solution.

This piece primarily establishes a static macro framework; dynamic data is sparse, such as Peter Thiel’s allocation and investments in DAT and ETF structures.

When leverage unwinds, whales and retail move inversely—whales divest secondary assets and retain core holdings; retail sells core assets to support leveraged secondary plays. Bitcoin rises, altcoins may not; Bitcoin falls, altcoins drop significantly. These claims require data validation, but for now, a static framework brings clarity.

Notice:

- This article is reprinted from [Zuoye Crooked Tree]. Copyright belongs to the original author [Zuoye Crooked Tree]. If you have concerns regarding republication, please contact the Gate Learn team for expedited handling in accordance with relevant procedures.

- Disclaimer: Views and opinions herein are solely the author’s and do not constitute investment advice.

- This article’s other language versions were translated by the Gate Learn team. Unless Gate is explicitly referenced, copying, distribution, or plagiarism of translated versions is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?