Coral Finance: Redefining Pre-Market Liquidity Through DeFAI Architecture

The New DeFAI Narrative

(Source: Coral_Finance)

With DeFi maturing and innovation slowing, Coral Finance introduces “DeFAI” (Decentralized Finance + AI) as its central concept, charting a novel course for financial experimentation. This protocol is more than an asset trading platform—it acts as an intelligent market layer (Application Layer) that fuses artificial intelligence with predictive mechanisms, focusing on price discovery and liquidity generation before projects launch. Coral empowers users to engage in early-stage market sentiment, build liquidity, and realize genuine returns, while advancing a new asset pricing logic centered on market expectations.

Building the World’s Smartest Expectation-Driven Financial Market

Coral Finance’s mission is to serve as the liquidity hub and expectation aggregator for early-stage crypto assets. Unlike traditional DeFi, which focuses primarily on spot trading and yield, Coral emphasizes monetizing user behaviors and market sentiment. Its algorithms capture expectations, enabling participants to trade value across multiple vectors, including:

- Predicting and wagering on future token prices;

- Analyzing project performance before and after TGE;

- Estimating returns from specific actions (such as airdrops or staking).

This expectation-driven model lets Coral simulate the full early-market liquidity cycle, creating a data-driven, decentralized pre-market ecosystem.

Core Feature Breakdown

1. Point Hub: A New Experiment in Point Marketization

Coral’s Point Hub is the first pre-market platform for point circulation, enabling users to tokenize Points gained from various protocols or activities as tradable corTokens. Users can now instantly monetize previously illiquid points in the open market, unlocking potential returns. This not only increases point utility but also allows early adopters to establish market positions, creating a new category of expectation-driven financial assets.

2. corSwap: A DEX Engineered for Early Markets

corSwap, Coral’s native DEX, is the ecosystem’s trading backbone. Built on Uniswap V2 architecture and optimized for corToken liquidity, it offers:

- Ultra-low 0.25% transaction fees, making frequent trades viable;

- Liquidity Provider-driven market depth, ensuring every corToken has stable order flow;

- Cross-platform aggregation, combining external DEX liquidity to make corSwap a smart trading aggregator.

corSwap ultimately acts as the Coral ecosystem’s price discovery engine, allowing users to seamlessly exchange corTokens and major cryptocurrencies.

3. CorToken Mint & Claim: Unlocking Anticipated Value

Coral Finance provides an end-to-end flow: Points → Tokens → Returns. Users can mint corTokens from Points earned in various protocols and claim them progressively after unlocking. This process turns early contributions into valuable, tradeable assets. Participants can trade corTokens on the market and use them to qualify for future airdrops or revenue sharing, creating a sustainable value cycle for participants.

Tokenomics and Governance Structure

Coral’s native token, $CORL, anchors ecosystem governance. Far from being just a utility token, $CORL integrates incentives, governance, and value capture. Token allocation:

- 56.4% Ecosystem incentives and community growth: liquidity rewards, partnership programs, and long-term user rewards;

- 14% Core contributors: incentives for developers, advisors, and protocol maintainers;

- 12.6% Foundation operations: supports compliance initiatives and global strategy;

- 10% Investors and early backers: fuels Coral’s initial growth;

- 7% Liquidity reserve: maintains market depth and trading stability.

(Source: Coral_Finance)

This structure secures economic stability and open participation for the entire system by balancing short-term incentives with long-term governance.

From Speculation to an Expectation Economy

Coral Finance is not just building a trading tool—it is pioneering a market structure where expectations become quantifiable, tradable assets. Here, market participants don’t have to wait for tokens to go live; they can engage in value creation and risk diversification from the outset. This approach boosts early market transparency and efficiency, bringing DeFi closer to the maturity of traditional finance, while maintaining its decentralized principles.

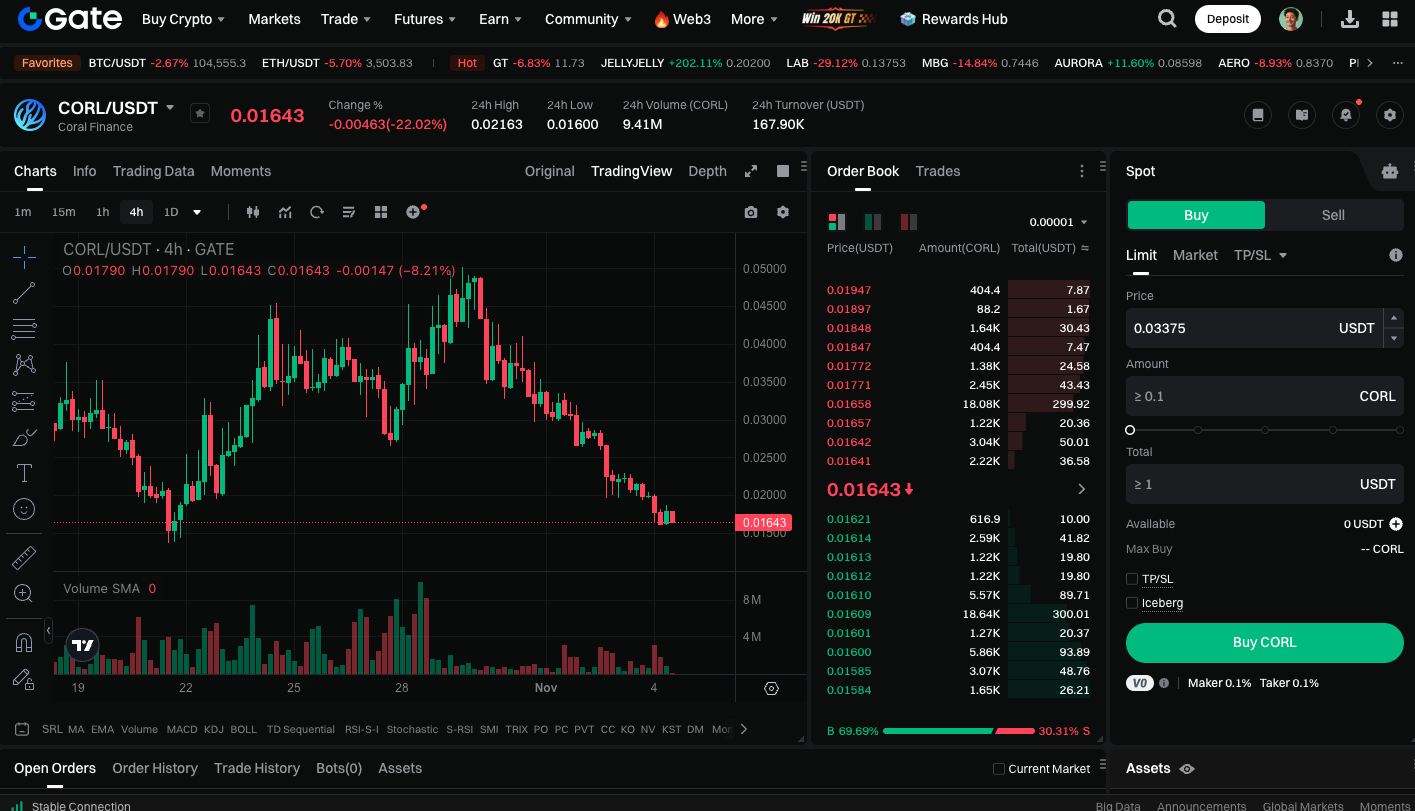

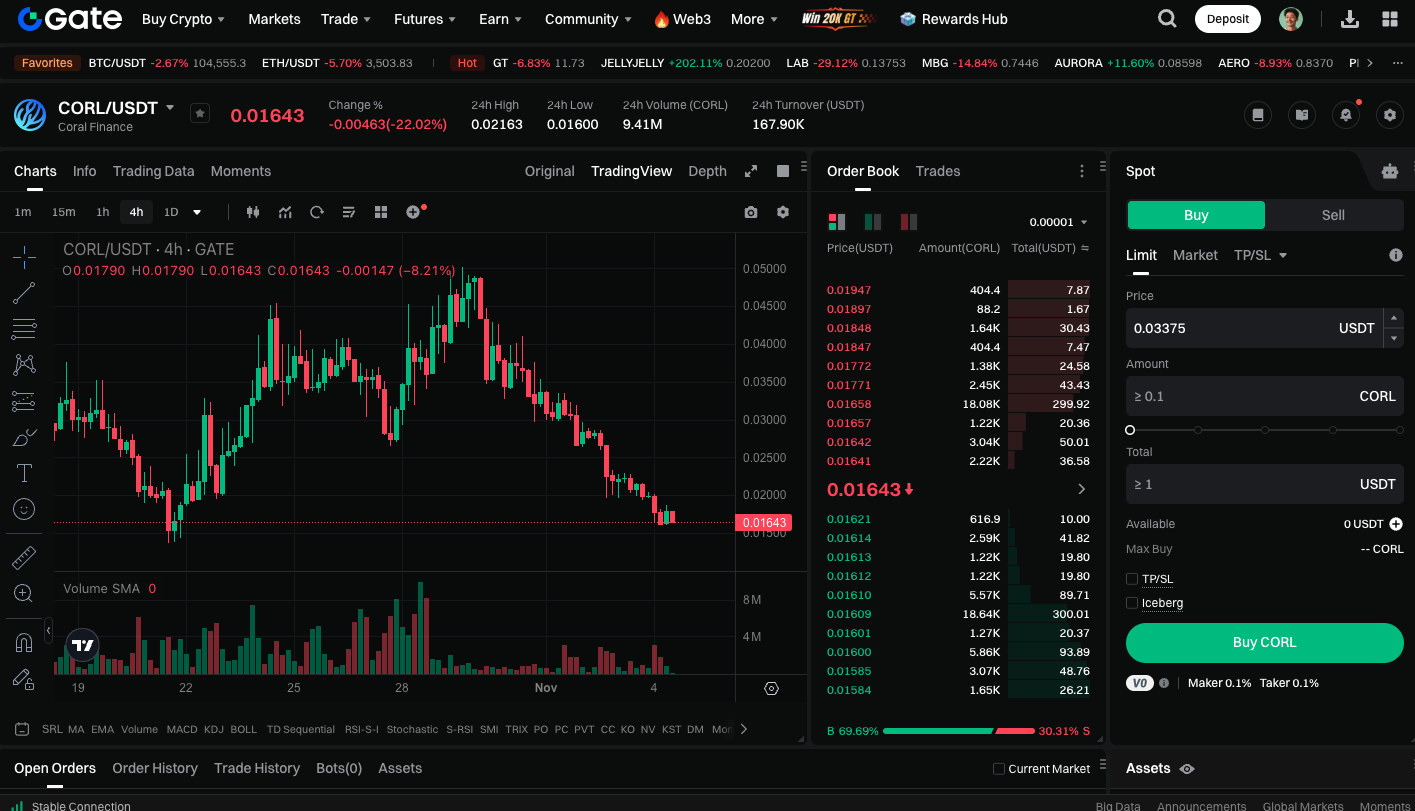

Start spot trading CORL now: https://www.gate.com/trade/CORL_USDT

Conclusion

Coral Finance leverages AI-powered expectation models and liquidity mechanisms to shape a new financial narrative for the Web3 era. Rather than chasing short-term trends, the focus is on ensuring that every pre-market asset is visible, priced, and tradable. As DeFi and AI converge, Coral’s DeFAI architecture may set a new benchmark for on-chain value discovery.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution