Cardano Price Prediction: $ADA Aims for 300% Rally Toward $4 After Hitting $1.5 - $2 Range

Cardano Retains Investor Attention

Despite recent market volatility and consolidation, Cardano (ADA) continues to attract investor interest.

Although the market has experienced multiple downturns, ADA has demonstrated resilience. It has consistently held above key support zones over the long term, which sustains optimism about its future performance. As Bitcoin’s momentum becomes more fragmented and Ethereum remains steady above $4,400, some analysts predict the altcoin market could soon see fresh capital inflows, with Cardano identified as a primary area of focus.

Technical Analysis and Potential Outlook

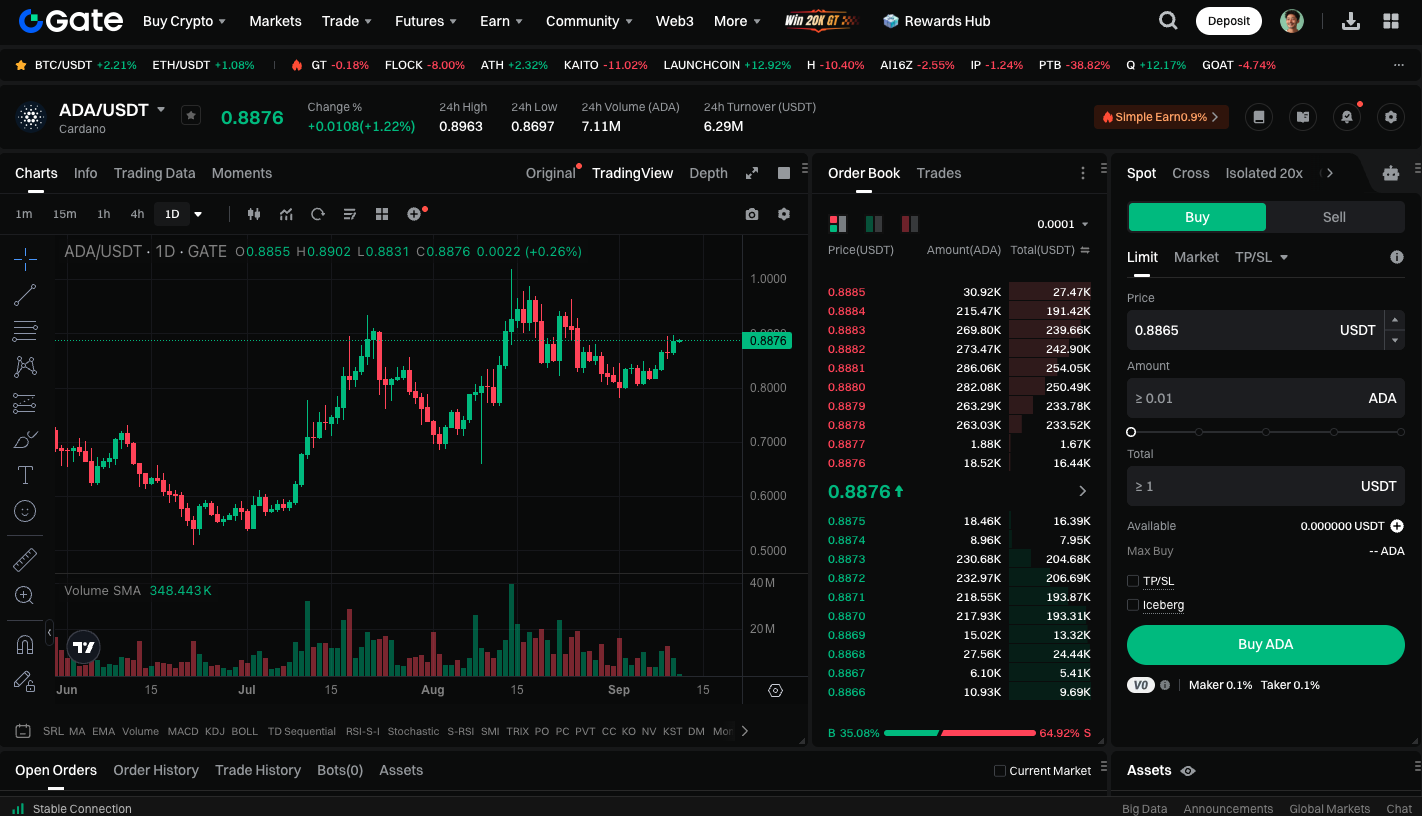

Based on historical price action and technical indicators, analysts observe that ADA may achieve a short-term rebound within the $1.47 to $2 range. If market sentiment turns decisively bullish and breaks through this range, the most optimistic projections anticipate ADA could revisit the $4 threshold before year-end—an increase of approximately 300% from current price levels. However, industry experts caution that this target is highly optimistic; whether it materializes depends on broader macroeconomic factors, investor sentiment, and overall crypto market liquidity.

Investment Strategies and Risk Considerations

Historically, Cardano has generated returns of two times or more for investors after deep corrections; however, the cryptocurrency market is extremely volatile, and overreliance on short-term predictions can introduce significant risks. Long-term investors may benefit from accumulating during price dips and maintaining their positions over time.

Trade ADA spot: https://www.gate.com/trade/ADA_USDT

Conclusion

Cardano remains an attractive asset due to its potential for price appreciation. Its solid blockchain infrastructure and active community further contribute to its appeal. If market conditions are favorable, ADA could establish a base between $1.5 and $2 and potentially reach $4.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution