Analyzing the underlying logic of the "gold surge"

When gold soared past $4,000 per ounce in 2025, it surprised many—proving that this “conservative” asset can experience a significant price increase.

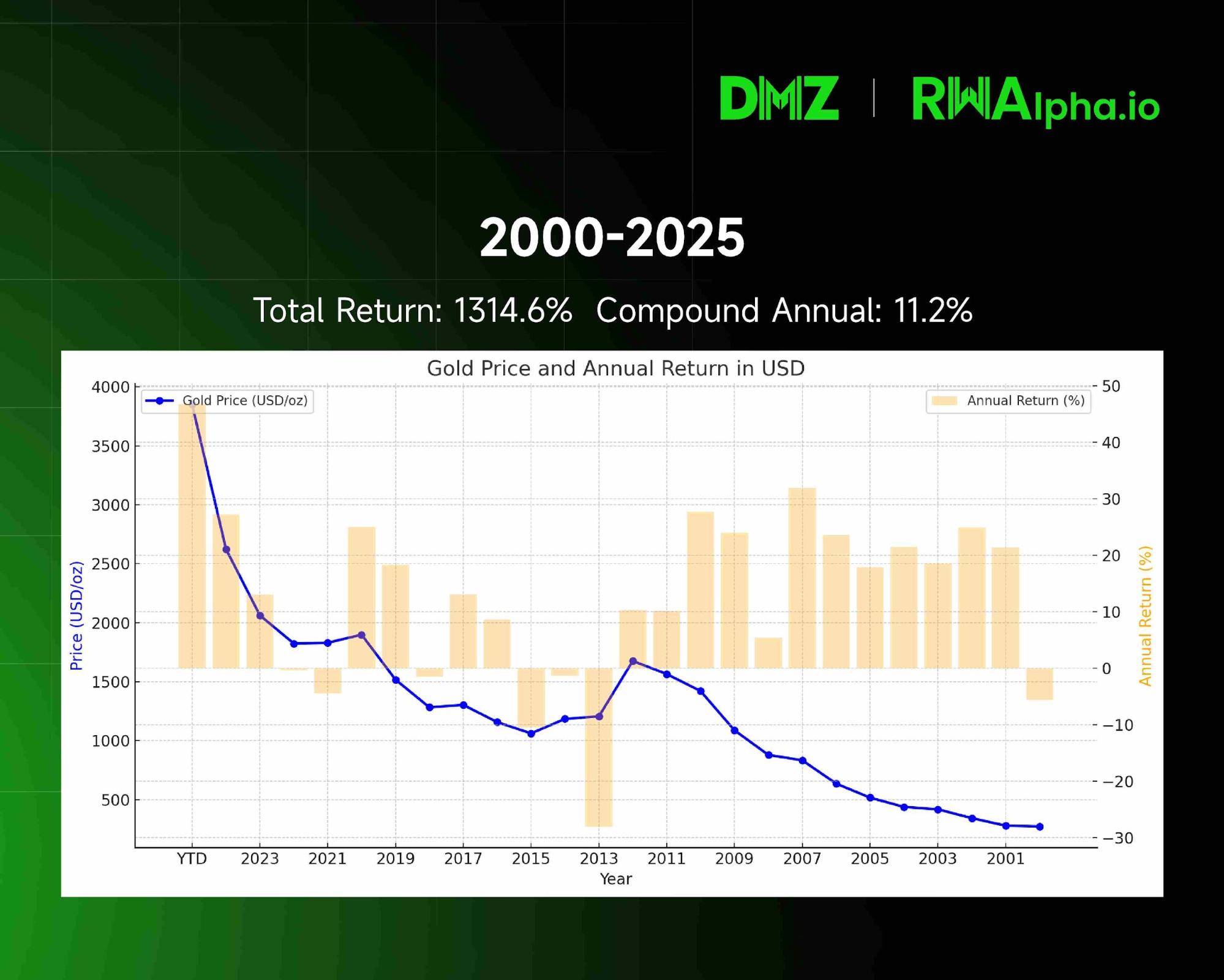

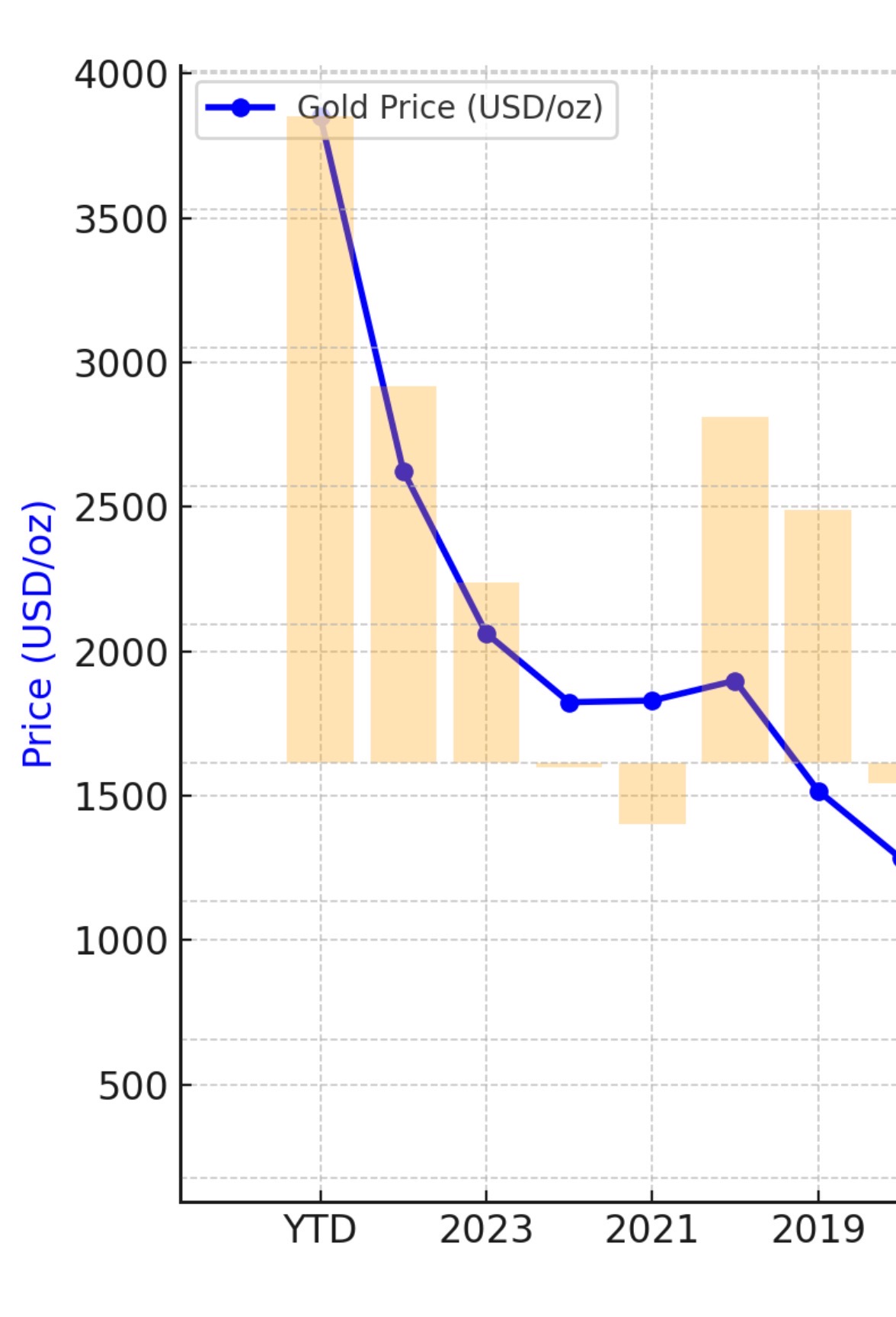

Gold price trajectory and annual returns (2001-2025): Historical data reveals gold’s unmistakable upward path.

Gold’s accelerating price rally from 2019 to 2025

Examining the data since 2019, gold climbed from $1,500 to $4,000 per ounce by 2025, delivering a compound annual return over 18%—far outpacing most traditional asset classes.

This rally was the inevitable outcome of four powerful, converging forces.

1. 2019 – Regulatory Overhaul: Basel III Redefines Gold’s Role

Gold’s watershed moment began with the international banking regulation known as Basel III.

Rolled out in the wake of the 2008 financial crisis and fully implemented around 2019, Basel III’s mission was clear: ensure banks maintain enough high-quality liquid capital to absorb risks. Under this new regime, gold’s classification was fundamentally reshaped.

Previously, gold was viewed as a “Tier 3 asset,” saddling banks with steep capital costs for holding it. In modern finance, this ancient store of value had become a liability.

Basel III, however, made a game-changing move: setting the risk weight of physical gold at zero. Gold is now classified alongside cash and top-tier sovereign debt in bank risk calculations.

This shift slashed banks’ costs for holding gold, incentivizing its inclusion in high-quality liquid asset portfolios. Gold reclaimed its central place in the financial system, laying the groundwork for the price surge that followed.

2. 2022 – Russia-Ukraine Conflict: $300 Billion Freeze Sparks Global De-Dollarization

Basel III set the stage in 2019, but the Russia-Ukraine war in 2022 lit the fuse for gold’s breakout.

When roughly $300 billion of Russia’s foreign reserves were frozen, the world saw “credit” collapse in a new light—even sovereign-backed bonds and deposits can evaporate overnight amid political risk.

The episode forced central banks worldwide to reassess reserve safety. IMF statistics show the dollar’s share of global reserves slid from 72% in 2000 to just 58% by 2025—a three-decade low. Simultaneously, over 20% of central banks said in 2024 they plan to keep boosting gold holdings in the next two years.

The trend is global: India’s central bank added more than 200 tons of gold between 2023-2025, lifting gold to 8% of its reserves; Poland bought about 130 tons in the same period, citing “geopolitical risk” as key; and Singapore’s monetary authority announced a 15% gold reserve increase in 2024 to fortify financial resilience.

This wave of central bank moves signals a deep global reserve realignment. As sovereign credit risk comes into focus, gold—free from counterparty promises—is emerging as the go-to asset for central banks in a shifting geopolitical landscape.

3. Three Pandemic Years – Monetary Expansion: Persistent Dollar Erosion

Gold’s explosive rise also highlights the dilution of fiat currency buying power—especially the dollar.

As a rare physical asset, gold historically serves as an inflation hedge. When governments flood markets with money, gold’s scarcity allows it to be priced in ever-larger currency amounts.

During three years of pandemic, central banks unleashed unprecedented monetary stimulus. The Fed’s balance sheet ballooned from about $4 trillion in early 2020 to nearly $9 trillion by 2022—a surge of over 125%. At the same time, US M2 money supply jumped from $15 trillion to $21 trillion, up more than 40%—the fastest pace since WWII.

Gold’s performance as an inflation hedge is uneven, but at key moments its impact is undeniable. In the 1970s, the US suffered “stagflation” with CPI averaging 7.1% annual growth. Gold rocketed from $35/oz in 1970 to a 1980 peak near $670/oz—a more than 1,800% leap.

In 2021-2023, pandemic-driven supply shocks and massive fiscal stimulus drove inflation sky-high. US CPI hit a 40-year peak of 9.1% in June 2022. Despite aggressive Fed rate hikes pressuring gold, persistent inflation provided vital support.

Since 2000, the dollar’s real purchasing power has eroded about 40%. This chronic decline is pushing investors in search of value preservation to seek alternatives outside dollar-denominated assets.

4. China’s Reserve Shift – Strategic Rebalancing by Global Central Banks

China’s approach to foreign reserve management is becoming a pivotal driver in the gold market.

From the end of 2019, China’s reserves show a clear “less debt, more gold” pattern: US Treasury holdings dropped from $1.0699 trillion to $0.7307 trillion (as of July 2025), a net cut of $339.2 billion (-31.7%). Gold reserves rose from 1,948 tons to 2,303.5 tons (as of September 2025), a net increase of 355 tons (+18.2%). These moves reflect China’s central bank’s deep strategic calculus.

China’s reserve scale is vast, but the underlying asset allocation is shifting—gradually trimming Treasuries and steadily raising gold exposure.

As of September 2025, gold made up just 7.7% of China’s official reserves—well below the global average of about 15%. That leaves plenty of room for further accumulation.

This pattern is not unique to China. The World Gold Council reports global central bank gold purchases hit a record 1,136 tons in 2022 and remain robust. Markets expect net annual buying will top 1,000 tons for the fifth straight year in 2026. Russia, meanwhile, switched from net gold exporter to importer in 2006, with reserves rising ever since.

This central bank gold-buying spree reflects profound strategy: gold, as a universally accepted final settlement asset, strengthens sovereign currency credibility and advances monetary internationalization.

5. Outlook: Why Gold Could Still Multiply Tenfold in the Next 10-15 Years

Fundamental analysis suggests gold’s tenfold appreciation over the next 10-15 years is entirely plausible. Here’s the logic:

First, global de-dollarization is just beginning. The dollar still commands nearly 60% of global reserves, while gold sits around 15%. If this ratio rebalances in the next decade, central bank demand alone could unleash trillions in new inflows to gold.

Second, global money supply keeps expanding—while new gold supply grows less than 2% per year. Major economies’ M2 has grown almost fivefold over two decades, creating a persistent supply-demand mismatch that should keep supporting prices.

Third, persistent geopolitical instability will reinforce gold’s safe-haven appeal. With dollar credibility waning and alternative reserve currencies still immature, gold’s status as a neutral reserve asset is set for a major revaluation.

Conclusion: Seize the Historic Opportunity

Gold’s breakout is the result of four core forces: regulatory change, geopolitical shifts, monetary expansion, and reserve realignment.

Looking forward, institutions like Goldman Sachs remain bullish, with Goldman’s December 2026 gold forecast now up to $4,900 per ounce.

“Gold is money; everything else is credit.” As fiat currency faces its latest test, gold offers proven wealth protection across centuries. Appropriate allocation is critical for resilience through the market cycle.

Statement:

- This article is republished from [TechFlow], with copyright held by the original author [Nathan Ma, Co-Founder, DMZ Finance]. For concerns regarding republication, contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without referencing Gate.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market