USD1 nedir: Amerika Birleşik Devletleri finansal sisteminde bir dolar para birimi ünitesinin ne anlama geldiği

USD1'in Konumlandırılması ve Önemi

2025 yılında World Liberty Financial (WLFI), USD1'i piyasaya sürerek dijital işlemlerdeki verimsizlikleri ve itibari para ile dijital varlıklar arasındaki sorunsuz entegrasyon ihtiyacını çözmeyi hedefledi.

İtibari para teminatlı bir stablecoin olarak USD1, dijital ödemeler ve sınır ötesi işlemler alanında kritik bir görev üstlenmektedir.

2025 yılı itibarıyla USD1, stablecoin pazarında önemli bir oyuncu konumuna yükseldi ve 2.149.870.657 $ piyasa değeri ile geniş bir aktif kullanıcı kitlesine sahip oldu. Bu makalede USD1’in teknik altyapısı, piyasa performansı ve gelecekteki potansiyeli ele alınacaktır.

Kökeni ve Gelişim Süreci

Oluşumun Arka Planı

USD1, World Liberty Financial (WLFI) tarafından Nisan 2025’te, itibari para ve dijital varlıklar arasında kolay ve kesintisiz değişim imkânı sunarak dijital işlemleri sadeleştirmek için geliştirildi.

Artan kripto ekosisteminde istikrarlı dijital varlıklara duyulan ihtiyaç doğrultusunda hayata geçen USD1, dijital işlemleri iyileştirmek ve güvenilir, USD’ye endeksli bir dijital varlık sunmak amacıyla tasarlandı.

USD1’in piyasaya çıkışı, dijital varlık alanında istikrarlı değer transferi arayan kullanıcılara yeni fırsatlar sundu.

Önemli Kilometre Taşları

- Nisan 2025: USD1’in 1:1 USD’ye endeksli stablecoin olarak lansmanı gerçekleştirildi.

- 2025: BitGo Trust Company ile yapılan ihraç ve yasal yönetim ortaklığı sayesinde, tam ABD regülasyon uyumu sağlandı.

World Liberty Financial (WLFI) ve BitGo Trust Company desteğiyle USD1, istikrar, güvenlik ve gerçek dünyadaki kullanım alanlarını sürekli olarak iyileştiriyor.

USD1 Nasıl Çalışır?

Merkeziyetçi Kontrol Olmadan

USD1, düzenlenmiş finans kurumları ağında faaliyet göstererek merkeziyetsizlik ile düzenleyici uyum arasında denge yaratır.

Bu yapı sayesinde şeffaflık ve güvenlik sağlanırken yasal gereklilikler de yerine getirilir; kullanıcılara istikrarlı ve güvenilir bir dijital varlık sunulur.

Blokzincir Temelli Altyapı

USD1, işlemleri şeffaf ve değiştirilemez şekilde kayıt altına almak için blockchain teknolojisini kullanır.

İşlemler, bloklar halinde gruplanıp kriptografik hash’lerle birbirine bağlanır ve güvenli bir zincir oluşturulur.

Sistem, USD endeksli istikrarı korurken kayıtların kamuya açık doğrulanmasına da olanak tanır.

Adil İşleyiş

USD1, ABD dolarına 1:1 sabiti sağlamak için düzenlenmiş ihraç ve geri çağırma mekanizması uygular.

BitGo Trust Company, düzenlenmiş güven kurumu sıfatıyla USD1’in ihraç ve yasal süreçlerini yöneterek uyum ve istikrarı temin eder.

Bu yenilikçi yaklaşım, blockchain’in esnekliğini geleneksel finansal gözetimle birleştirir.

Güvenli İşlemler

USD1, işlemleri güvence altına almak amacıyla açık ve özel anahtar şifrelemesi kullanır:

- Özel anahtarlar işlemleri imzalamak için kullanılır

- Açık anahtarlar sahipliği doğrulamak için kullanılır

Bu sistem, varlık güvenliğini sağlarken işlemlerin düzenleyici izlenebilirliğini de mümkün kılar.

Ek güvenlik unsurları arasında, USD1’in gerçek ABD doları rezervleriyle tam desteklenmesi sayesinde stablecoin’in istikrarı ve güvenilirliği öne çıkar.

USD1’in Piyasa Performansı

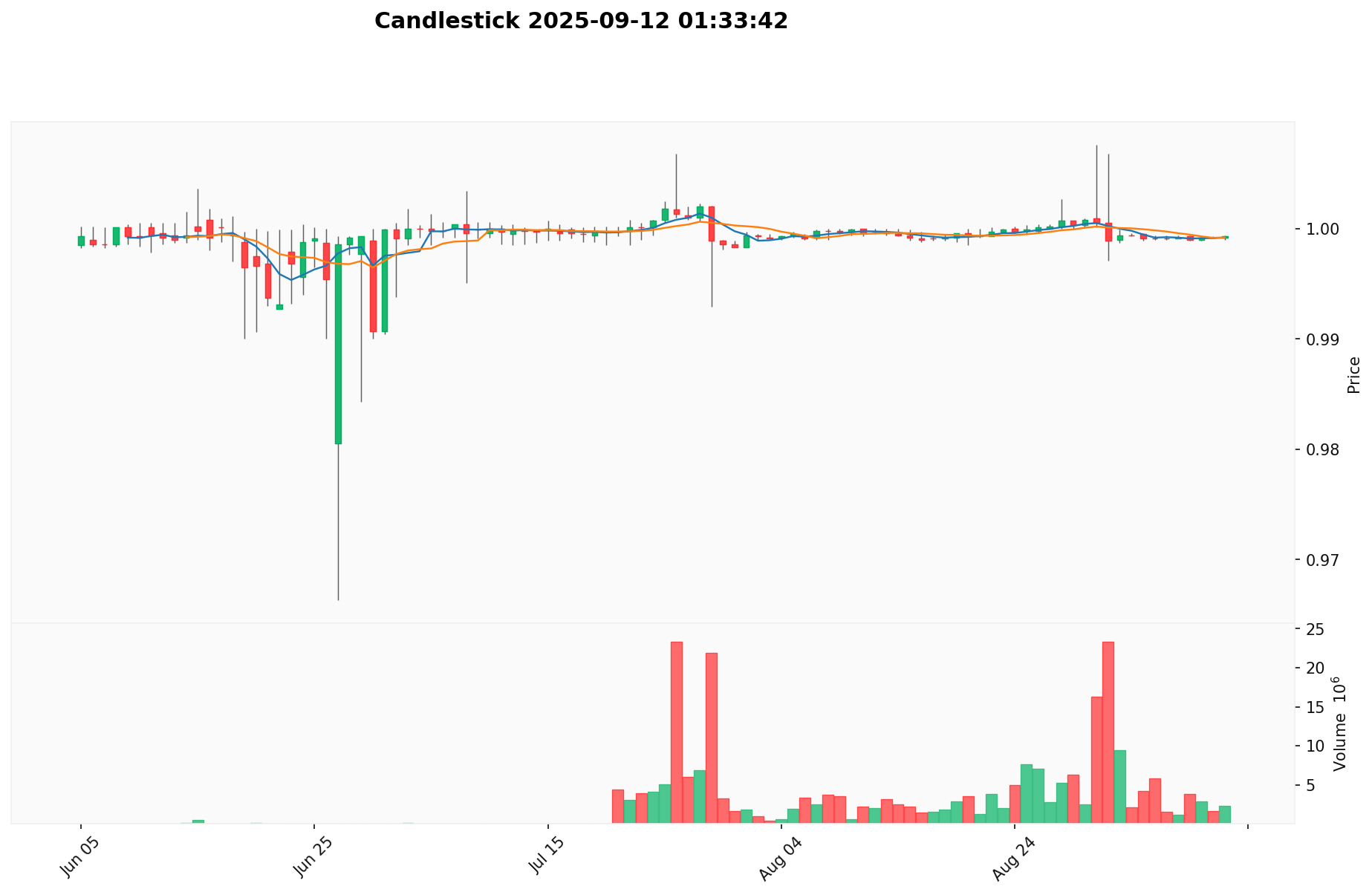

Dolaşımdaki Arz Genel Bakış

12 Eylül 2025 itibarıyla USD1’in dolaşımdaki arzı 2.151.591.931 adettir ve bu rakam toplam arzı ile aynıdır.

Yeni token’lar BitGo Trust Company tarafından ihraç edilerek arz-talep dengesine yön verir.

Fiyat Dalgalanmaları

USD1, 2 Haziran 2025’te 5.000 $ ile tüm zamanların en yüksek değerine ulaşmıştır; bu artış sistemsel bir anomali veya veri hatasından kaynaklanmıştır.

En düşük fiyatı ise 0,9663 $ ile 27 Haziran 2025’te görülmüş ve bunun nedeni geçici piyasa dalgalanması olarak öne çıkmıştır.

Bu dalgalanmalar, piyasa psikolojisini, benimseme trendlerini ve dış etkenleri yansıtır; ancak USD1, bir stablecoin olarak ABD doları ile 1:1 sabitini korumayı hedefler.

Güncel USD1 piyasa fiyatını incelemek için tıklayın

Zincir Üzeri Veriler

- Günlük İşlem Hacmi: 1.219.115,206716 $ (ağ üzerindeki aktiviteyi gösterir)

- Aktif Adres Sayısı: 50.655 (kullanıcı katılımını gösterir)

USD1 Ekosistem Uygulamaları ve İş Birlikleri

Temel Kullanım Alanları

USD1 ekosistemi, çeşitli uygulamaları destekler:

- Dijital Ödemeler: İtibari para ile dijital varlıklar arasında kesintisiz işlem kolaylığı sağlar.

- DeFi: Merkeziyetsiz finans protokollerinde ve uygulamalarında istikrarlı bir değer sunar.

Stratejik Ortaklıklar

USD1, BitGo Trust Company ile gerçekleştirdiği iş birliğiyle düzenleyici uyumunu ve güvenliğini pekiştirmiştir. Bu ortaklıklar, USD1’in ekosistemini büyütmesi için sağlam bir altyapı sağlar.

Tartışmalar ve Karşılaşılan Zorluklar

USD1’in karşılaştığı öne çıkan zorluklar şunlardır:

- Düzenleyici Denetim: Finansal düzenleyici otoriteler tarafından artan gözetim olasılığı.

- Piyasa Rekabeti: Diğer stablecoin’ler ve merkez bankası dijital paralarından gelen rekabet.

- Güven ve Şeffaflık: USD1 token’larının 1:1 teminatının kullanıcı güvenini koruması.

Bu başlıklar, topluluk ve piyasa nezdinde tartışmalara yol açarak USD1’in sürekli gelişimini teşvik ediyor.

USD1 Topluluğu ve Sosyal Medya Ortamı

Topluluk İlgisi

USD1 topluluğu 12 Eylül 2025 itibarıyla 50.655 sahip ile istikrarlı bir şekilde büyümektedir. X platformunda, USD1 ile ilgili paylaşımlar ve etiketler, özellikle önemli piyasa gelişmelerinde öne çıkmaktadır. İstikrar ve düzenleyici uyum topluluk ilgisinin temel sebepleridir.

Sosyal Medyada Duygu Analizi

X platformundaki görüşler çeşitlilik göstermektedir:

- Destekçiler, USD1’in düzenleyici uyumu ve istikrarını övgüyle karşılayarak onu “klasik finansla kripto arasında köprü” olarak tanımlar.

- Eleştirmenler ise merkezileşme kaygılarına ve potansiyel düzenleyici risklere dikkat çekmektedir.

Son dönem trendlerinde, USD1’in dalgalı piyasalardaki istikrarı nedeniyle genellikle olumlu bir hava gözlemlenmektedir.

Gündemdeki Başlıca Konular

X platformu kullanıcıları, USD1’in DeFi’deki konumunu, düzenleyici gelişmeleri ve stablecoin piyasasına etkisini tartışarak, hem potansiyelini hem de kitlesel benimsemedeki zorluklarını öne çıkarmaktadır.

USD1 ile İlgili Daha Fazla Bilgi Kaynağı

- Resmi Web Sitesi: Özellikler, kullanım alanları ve en son gelişmeler için USD1’in resmi web sitesini ziyaret edin.

- X Güncellemeleri: X platformunda, @worldlibertyfi hesabı 12 Eylül 2025’ten itibaren düzenleyici uyum, yeni ortaklıklar ve piyasa gelişmeleri paylaşmaktadır.

USD1’in Gelecek Yol Haritası

- Ekosistem Hedefleri: Önde gelen DeFi protokolleri ve ödeme sistemleri ile entegrasyonda büyüme

- Uzun Vadeli Vizyon: Küresel dijital ekonomide lider, düzenlenmiş stablecoin olmak

USD1’e Nasıl Katılabilirsiniz?

- Satın Alma Kanalları: Gate.com üzerinden USD1 satın alın

- Saklama Çözümleri: BEP-20 ve ERC-20 token’larını destekleyen güvenli cüzdanları tercih edin

- Ekosisteme Katılım: USD1’i DeFi uygulamalarına entegre edin ya da dijital ödemelerde kullanın

Özet

USD1, blockchain teknolojisi sayesinde dijital parayı istikrar, regülasyon uyumu ve verimli işlem avantajlarıyla yeniden tanımlar. Giderek büyüyen kullanıcı kitlesi, güçlü regülasyon temeli ve piyasa başarısı, USD1’i kripto sektöründe farklı bir konuma taşıyor. Her ne kadar düzenleyici denetim ve piyasa rekabeti ile karşı karşıya olsa da, USD1’in uyuma ve vizyona bağlılığı onu merkeziyetsiz finansın geleceğinde anahtar bir oyuncu yapıyor. İster yeni ister deneyimli yatırımcı olun, USD1 dijital varlık ekosisteminde istikrarlı değer arayanlar için dikkate değer bir seçenek.

Sıkça Sorulan Sorular (SSS)

USD1 nasıl çalışır?

USD1, ABD doları ve diğer varlıklarla 1:1 oranında tamamen desteklenen itibari paraya endeksli bir stablecoin’dir. Şeffaf rezervlerle fiyat istikrarı sağlar ve piyasada geniş likidite hedefler.

Trump’ın kripto parası nedir?

Trump'ın kripto parası $TRUMP olarak adlandırılır. Solana blokzincirinde yer alan ve Donald Trump ile ilişkilendirilen bir meme coindir.

USD1 neyle destekleniyor?

USD1, ABD doları mevduatları ve hazine bonoları ile 1:1 oranında desteklenir. Tamamen teminatlıdır ve istikrar ile uyum için aylık olarak denetlenir.

USD1 satın alınabilir mi?

Evet, USD1 çeşitli platformlar üzerinden farklı ödeme yöntemleriyle satın alınabilir. Satın alma için miktarı belirleyip cüzdan adresinizi girmeniz yeterlidir.

USD1 stablecoin: 2025 yılında Kripto Varlıklar ekosistemindeki avantajlar ve özellikler

FDUSD nedir: First Digital USD ve Stablecoin Ekosistemindeki Rolü

Federal Reserve, Ödeme İnovasyonuna ve Kripto Entegrasyonuna Kapı Açıyor

Fed'in Ödeme İnovasyonu Konferansı'nın Kripto Varlıklar ve stablecoin'ler için önemi.

İstikrarın Yeniden Tanımlanması: Stablecoin Ekosisteminin Gelişen Dinamikleri

FDUSD nedir: Kripto piyasasında yeni stablecoin’i anlamak

SC nedir: Modern İş Dünyasında Tedarik Zinciri Yönetimine Kapsamlı Bir Rehber

VANA Nedir: Devrim Yaratan Merkeziyetsiz Yapay Zekâ Veri Ağına Kapsamlı Rehber

2025 SUSHI Fiyat Tahmini: Lider DeFi Token’a Yönelik Uzman Analizi ve Piyasa Tahmini

2025 ALEO Fiyat Tahmini: Uzman Analizi ve Gelecek Yıla Yönelik Piyasa Öngörüsü

2025 SNEK Fiyat Tahmini: Uzmanların Analizi ve Gelecek Yıla Yönelik Piyasa Tahmini