Gate Ventures Weekly Crypto Recap (September 22, 2025)

TL;DR

- The Federal Reserve announced a 25 bps rate cut as expected, bringing down the federal funds rate target range to 4%-4.25%.

- This week’s incoming data includes the final reading of US 2025Q2 GDP, core PCE, wholesale inventories and home sales data.

- BTC/ETH: BTC ETFs saw $886M inflows with prices steady, while ETH ETFs drew $556M but ETH fell ~3.4%, pushing ETH/BTC down to 0.0378.

- Top 30 Performance: Market mostly red; only BNB (+11.2%), AVAX (+6.9%), and WLFI closed higher. BNB strength came from CZ’s return and Aster hype; AVAX rose on ETF speculation.

- New Tokens: Aster surged nearly 20x post-launch, driven by CZ advocacy and its “Hidden Orders” feature.

- Google debuts AP2 to bring secure payments to AI agents with stablecoin support.

- Ethereum Foundation launches ‘dAI’ department to position Ethereum as AI settlement layer with ERC-8004.

- Helius Medical Secures $500M+ to Build Solana Treasury Vehicle Backed by Pantera, Summer Capital.

Macro Overview

The Federal Reserve announced a 25 bps rate cut as expected, bringing down the federal funds rate target range to 4%-4.25%.

The Federal Reserve released its policy statement last week, announcing a rate cut of 25 basis points as expected, bringing the federal funds rate target range down to 4%–4.25%. Ahead of the meeting, the market was divided over whether the Fed would cut by 25 or 50 bps. This divergence traces back to the Fed’s move in September 2024, when it delivered a larger-than-expected 50-basis-point cut at its policy meeting.

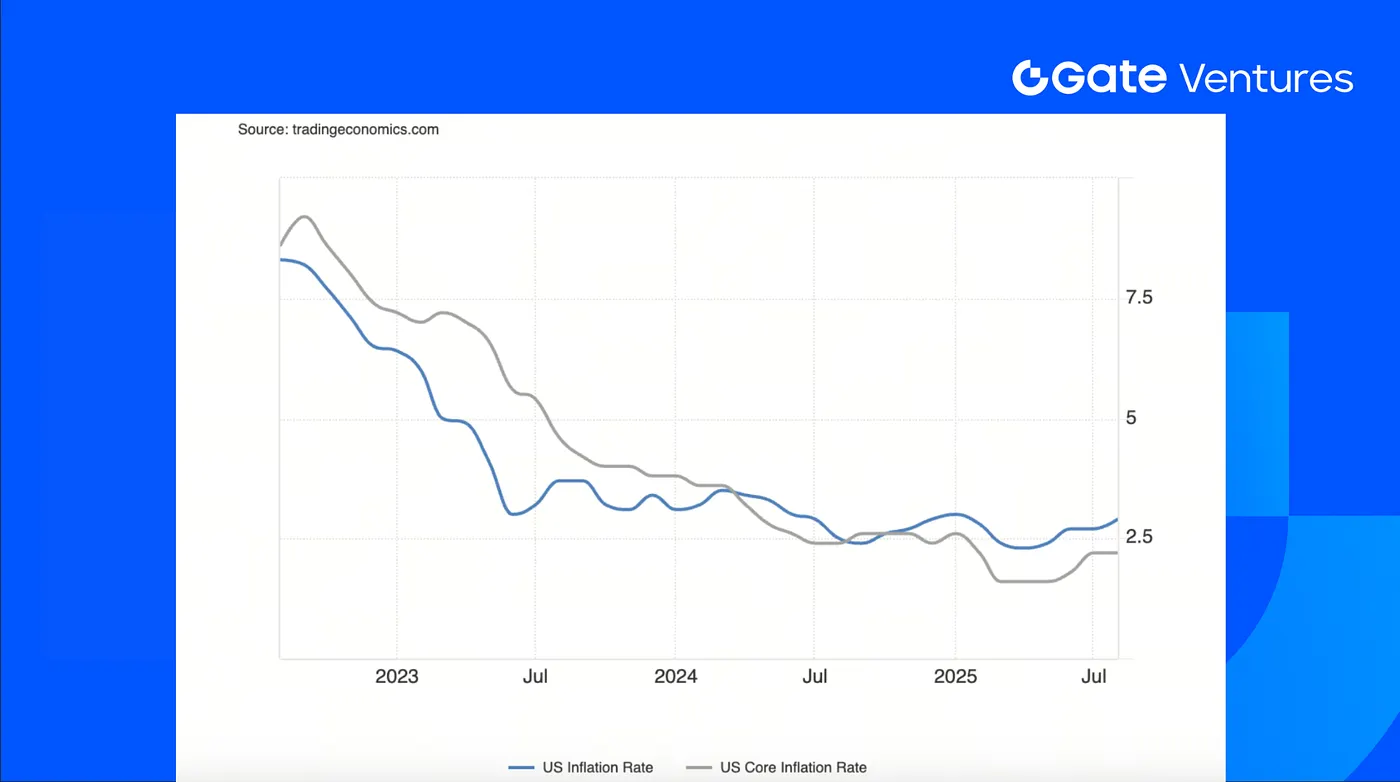

However, last year’s inflation trajectory made the Fed more optimistic. Core CPI had been declining continuously for more than a year without any rebound, falling from 3.9% at the start of the year to 3.2%. Headline CPI fell even more quickly, dropping from 3.1% to 2.5%. For this year, Core CPI has crept up from 2.8% in April to 3.1%, while headline CPI has risen from 2.3% to 2.9%. This shows relatively sticky inflation, and the outlook is less encouraging. Adding to this, President Trump’s tariffs on multiple countries significantly raised the effective tariff rate. Tariffs related concerns have undermined confidence in inflation returning to target levels, and have constrained the Fed’s ability to cut rates further.

This week’s incoming data includes the final reading of US 2025Q2 GDP, core PCE, wholesale inventories and home sales data. The publication of the Fed’s preferred measure of core PCE inflation follows mixed signals on recent price trends. While consumer price inflation picked up from 2.7% to 2.9% in August, wholesale prices showed a surprise 0.1% decline during the month. Softer inflation will likely be needed to open the door for further rate cuts in the months ahead. (1, 2)

TradingEconomics: US Inflation Rate and Core Inflation Rate

DXY

The US dollar remains largely supported following the Fed’s dovish rate cut and Powell’s hawkish press conference. While the dollar index dropped to below $97 level that day, it quickly rose back in the following 2 days. (3)

US 10 Year Bond Yield

The US 10 year bond yield quickly recovered from previous weeks’ lower level and rose back to around 4.1%, as the dovish Fed rate cut was followed by Powell’s hawkish speech on a current “challenging situation”. (4)

Gold

Gold prices hit record high last week, fueled by market expectation for a Fed rate cut that was later confirmed to be a 25 bps off. Deutsche Bank forecasted the gold price could hit $4,000 per ounce in 2026. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

U.S. Bitcoin ETFs saw $886M in net inflows over the past week, with BTC prices hovering largely unchanged from the previous week. Ethereum ETFs also attracted $556M in inflows, though ETH prices slipped ~3.4%, marking a modest pullback despite the capital rotation into funds. (6)

Given ETH’s weaker performance against BTC, the ETH/BTC ratio eased to 0.0378.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap held largely steady, while the market cap excluding the top 10 tokens slipped 1.64%, as ETH weakness pressured the broader altcoin market, dragging the segment modestly lower.

3. Top 30 Crypto Assets Performance

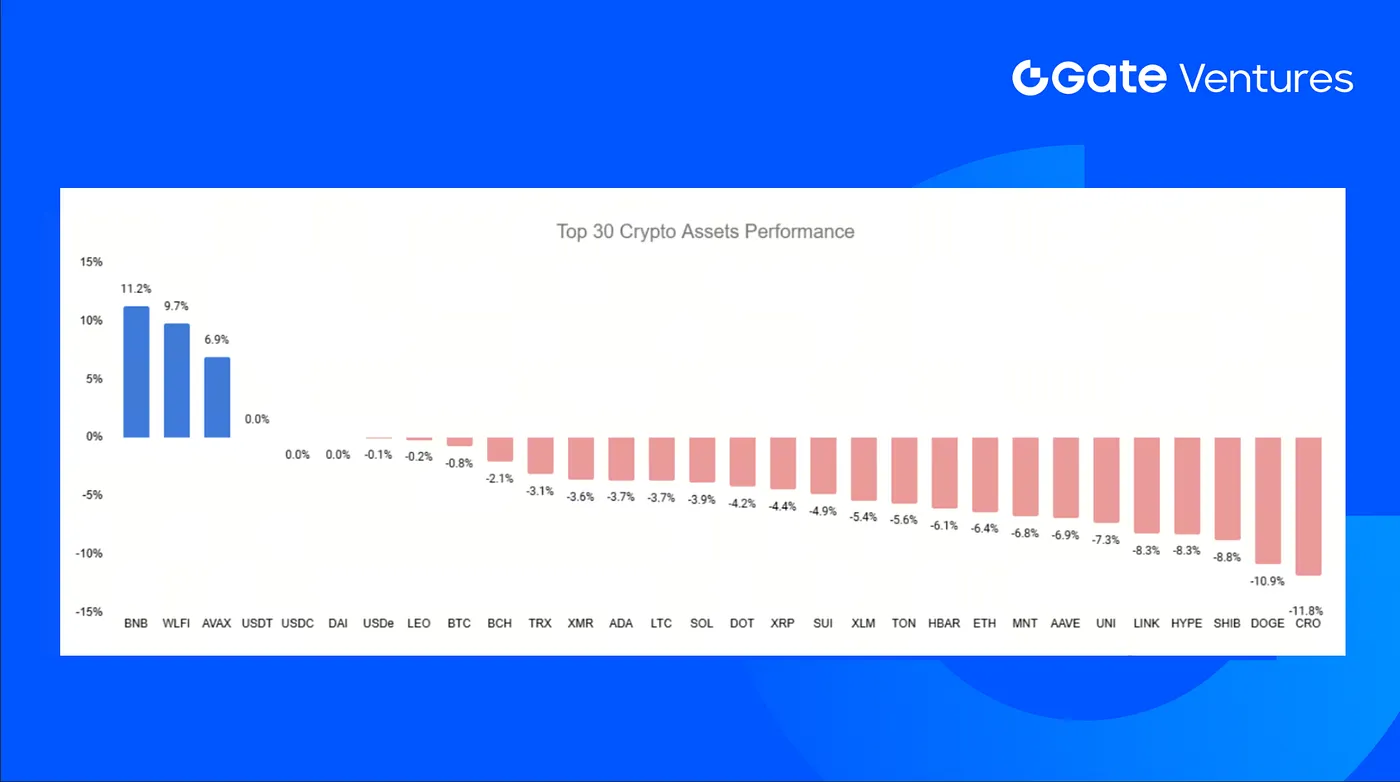

Source: Coinmarketcap and Gate Ventures, as of Sept 22th 2025

The market trended lower last week, with most of the top 30 tokens posting declines. Only BNB, AVAX, and WLFI managed to close in the green.

BNB led the gains with an 11.2% jump, fueled by CZ’s return to Binance and BNB Chain which highlighted by his updated Twitter bio, alongside his promotion of the new BSC-based perp DEX, Aster, which itself rallied nearly 20x to the ATH. Momentum extended across the broader BNB ecosystem. (7)

Meanwhile, AVAX climbed 6.9%, supported by ongoing speculation around a potential Avalanche ETF that continues to stoke market optimism. (8)

4. New Token Launched

Aster, a newly launched perpetual DEX on BNB Chain and actively championed by CZ, has quickly become a focal point within the BNB ecosystem. One of its key innovations is Hidden Orders, a flagship feature on Aster Pro that enables fully integrated stealth execution. This allows traders to place limit orders without revealing size, price, or even their presence on the public order book.

Following its debut and CZ’s ongoing promotion on Twitter, Aster’s token has surged nearly 20x to a new all-time high. The rally has also lifted sentiment across the BNB ecosystem, with premiums spilling over into related tokens and even extending to other perp DEX plays such as AVNT.

The Key Crypto Highlights

1. Google debuts AP2 to bring secure payments to AI agents with stablecoin support

Google launched the Agent Payments Protocol (AP2), an extension of its Agent-to-Agent (A2A) framework, adding a universal payments layer so AI agents can authenticate intent, verify authority, and transact across traditional rails and blockchains. Backed by 60+ participants (e.g., American Express, Mastercard, PayPal, Coinbase, MetaMask), AP2 is integrated with Google’s Cloud Universal Ledger to bridge Web2 payments and programmable Web3 assets. By supporting both fiat and stablecoins, it targets fragmentation by giving merchants, banks, and developers one scalable protocol. If adopted, AP2 could enable verified, auditable, programmable transactions and catalyze agent-driven commerce. (9), (10)

2. Ethereum Foundation launches ‘dAI’ department to position Ethereum as AI settlement layer with ERC-8004

The Ethereum Foundation launched a dedicated dAI research team, led by Davide Crapis, to position Ethereum as the settlement/coordination layer for AI agents. Near term, the team will debut ERC-8004 at Devconnect in November, a standard for AI-agent identity and transactions that lets apps verify provenance, rules, and permissions, reducing fragmentation across wallets, agents, and dApps while enabling trust-minimized payments and coordination. With Ethereum averaging over 12 million daily smart contract calls, the network is already positioned as a scalable infrastructure for a machine-driven economy. The Foundation envisions Ethereum as a trust layer for decentralized AI, countering risks posed by centralized AI platforms. (11), (12)

3. Helius Medical Secures $500M+ to Build Solana Treasury Vehicle Backed by Pantera, Summer Capital

Helius Medical Technologies (Nasdaq: HSDT) announced an oversubscribed $500M+ PIPE led by Pantera Capital and Summer Capital, with backers including Animoca Brands, FalconX, HashKey Capital, and Arrington Capital. The deal adds up to $750M in stapled warrants, lifting potential proceeds above $1.25B. Proceeds fund a Solana-centric digital-asset treasury: SOL as primary reserve, accumulated over 12–24 months, with ~7% staking and conservative DeFi/lending. Helius joins a growing DAT cohort (e.g., Forward Industries’ $1.65B Solana program), and Helius and Pantera highlight Solana as a “productive” treasury model for institutions. (13), (14)

Key Ventures Deals

1. Bio Protocol raises $6.9M Seed to build Onchain Scientific Agents

Bio Protocol raised $6.9M in a seed round led by Maelstrom Fund (Arthur Hayes’s family office), with Mechanism Capital, Animoca Brands, Mirana Ventures, Foresight Ventures, Big Brain Holdings and others participating. Bio turns research into decentralized AI “BioAgents” that generate hypotheses, coordinate work, and raise funding via token sales — lowering costs and speeding discovery. Its first agent, Aubrai, produced 1,000+ hypotheses, raised $250K within weeks, and peaked near ~$40M FDV after a 150× move. Near-term milestones span VITA-FAST, Percepta/CLAW, and Curetopia/CURES. Since 2024, Bio says it has routed $50M+ to labs. The raise follows Bio V2, an upgraded DeSci platform targeting an on-chain “scientific super-intelligence.” (15), (16)

2. Titan raises $7M Seed led by Galaxy Ventures, launches Solana meta-DEX aggregator to the public

Titan raised $7M in a seed round led by Galaxy Ventures, with participation from Frictionless Capital, Mirana Ventures, Ergonia, Auros, Susquehanna, and angels, alongside the public launch of its meta-DEX aggregator on Solana. Unlike standard aggregators, Titan sits above multiple routers, including Jupiter, OKX, DFlow, and its proprietary Argos — to compare quotes and route best execution. The team reports Argos beats quotes in ~70–75% of cases, reflecting market-structure-aware routing and fast updates. Titan also launched Titan Prime API, a meta-aggregator for programmatic access. Exiting private beta after processing $1.5B+ in spot volume, Titan positions itself as a gateway to internet capital markets. (17),(18),(19)

3. Stablecore Raises $20M to bring Stablecoins and Tokenized Deposits to Community Banks

Stablecore raised $20M led by Norwest, with Coinbase Ventures, Curql, BankTech Ventures, Bank of Utah, EJF Ventures, and others; collectively, their LP networks span 290+ Banks/Credit Unions. The platform unifies custody, key management, blockchain connectivity, compliance, orchestration, and on-chain ledgering into one stack, enabling instant cross-border payments and treasury, digital-asset custody/exchange, and asset-backed lending while preserving choice of custodians, exchanges, and issuers. Following the GENIUS Act (July 2025) and updated OCC/FDIC/Fed/SEC guidance, Stablecore will use the funding to speed rollout of its digital-asset core. The platform lets community and regional banks and credit unions offer stablecoins, tokenized deposits, and other digital-asset products without replacing their existing core systems. (20), (21)

Ventures Market Metrics

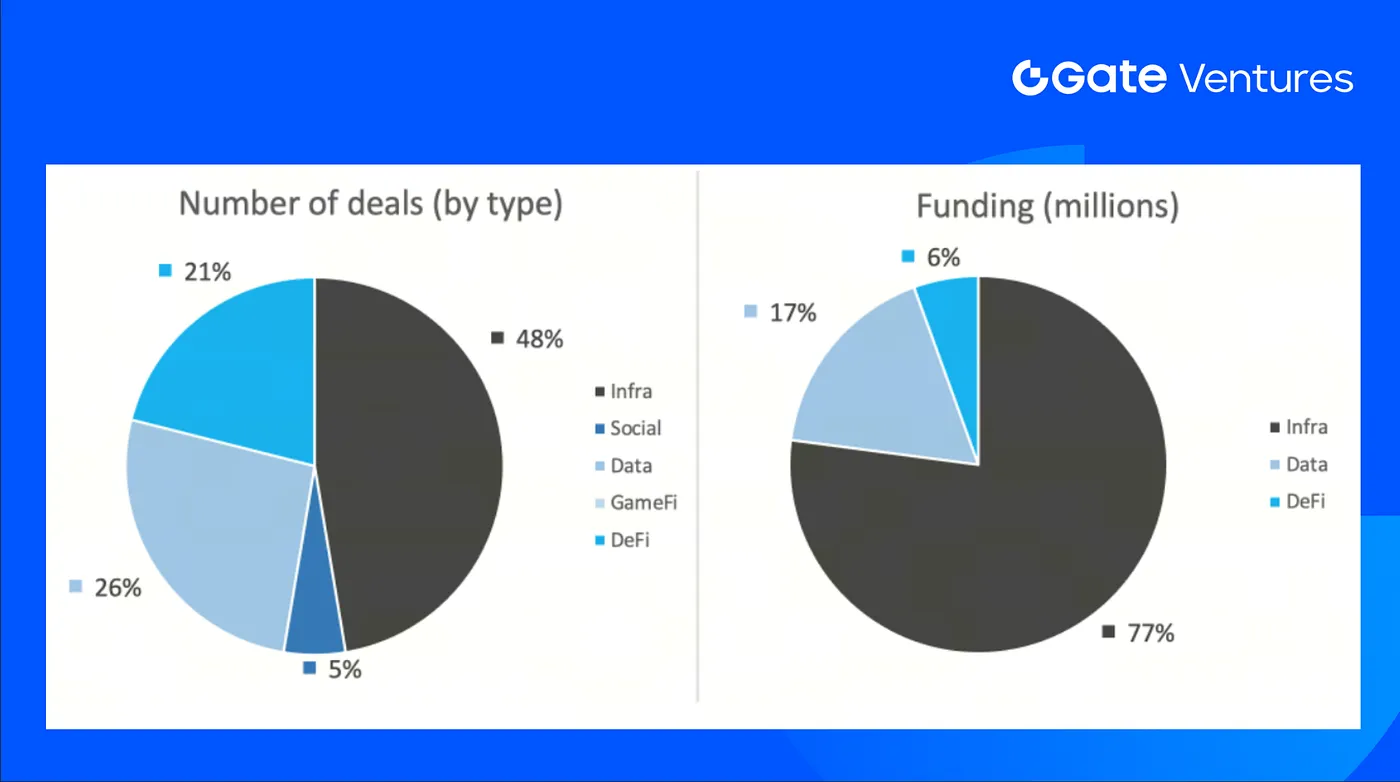

The number of deals closed in the previous week was 19, with Infra having 9 deals, representing 47% of the total number of deals. Meanwhile, Social had 1 (5%), Data had 5 (26%), had and DeFi had 4 (21%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 22nd Sep 2025

The total amount of disclosed funding raised in the previous week was $741M, 26% deals (5/19) in last week didn’t disclose the raised amount. The top funding came from Data sector with $506M. Most funded deals: Helius Medical Technologies $500M, Soluna $100M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 22nd Sep 2025

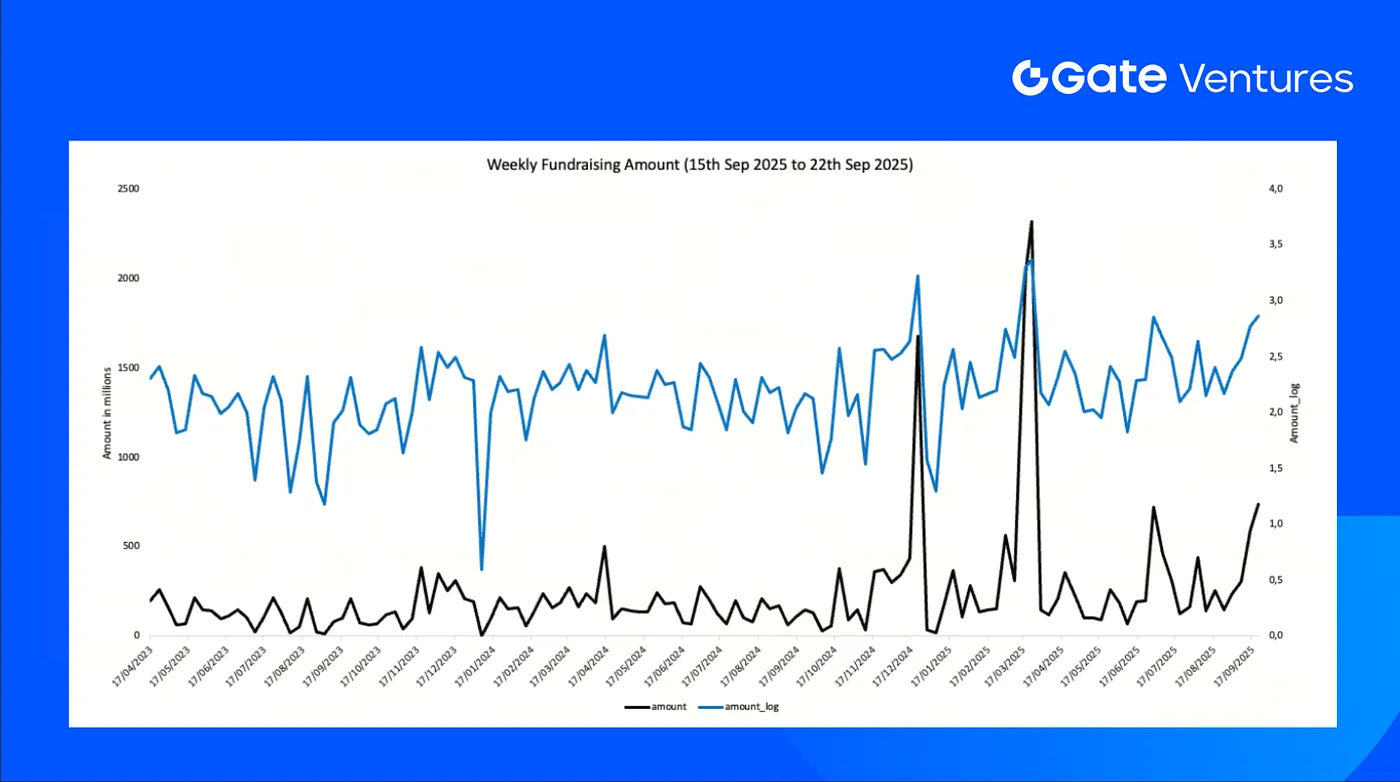

Total weekly fundraising rose to $741M for the 3rd week of Sep-2025, an increase of +25% compared to the week prior. Weekly fundraising in the previous week was up +80% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-22-september-2025.html

- US inflation rate and core inflation rate, TradingEconomics https://tradingeconomics.com/united-states/inflation-cpi

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- Tradingview on US 10 year bond yield, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow: https://sosovalue.com/assets/etf/us-btc-spot

- CZ’s Tweet on Aster: https://x.com/cz_binance/status/1969084937014780313

- Avalanche ETF: https://cointelegraph.com/news/grayscale-files-spot-avalanche-etf-ticker-avax

- Google announced Agent Payments Protocol (AP2): https://cloud.google.com/blog/products/ai-machine-learning/announcing-agents-to-payments-ap2-protocol

- Google launches Agent Payments Protocol with stablecoin support (AP2): https://www.theblock.co/post/370871/google-launches-ai-agent-to-agent-payments-protocol-with-stablecoin-support

- Ethereum Foundation launches “dAI’ team and ERC-8004: https://www.theblock.co/post/370660/ethereum-foundation-forms-dai-team-to-make-ethereum-a-base-layer-for-the-ai-economy

- Ethereum Foundation launches “dAI’ team and ERC-8004: https://www.coindesk.com/tech/2025/09/15/ethereum-foundation-launches-ai-team-to-support-agentic-payments

- Helius Unveils Solana Treasury Plan With $500M Financing:

https://www.coindesk.com/markets/2025/09/15/pantera-backed-solana-treasury-firm-helius-raises-usd500m-stock-soars-over-200 - Helius Unveils Solana Treasury Plan With $500M Financing: https://www.theblock.co/post/370651/helius-medical-technologies-soars-250-on-500m-solana-treasury-raise-led-by-pantera-summer-capital

- Bio Protocol raises $6.9M Seed to build Onchain Scientific Agents:

https://www.theblock.co/post/370757/bio-protocol-funding-arthur-hayes-maelstrom-fund - Bio Protocol raises $6.9M Seed to build Onchain Scientific Agents: https://www.coinglass.com/fr/news/697459

- Titan raises $7M Seed led by Galaxy Ventures, launches Solana meta-DEX aggregator:

https://x.com/Titan_Exchange/status/1968694972296692160 - Titan raises $7M Seed led by Galaxy Ventures, launches Solana meta-DEX aggregator: https://www.prnewswire.com/news-releases/titan-raises-7m-seed-from-galaxy-ventures-and-launches-publicly-on-solana-302560707.html

- Titan raises $7M Seed led by Galaxy Ventures, launches Solana meta-DEX aggregator: https://blockworks.co/news/titan-raise-meta-dex-aggregator

- Stablecore Raises $20M to bring Stablecoins and Tokenized Deposits to Community Banks: https://stablecore.com/blog/stablecore-raises-20m-to-power-stablecoins-and-digital-assets-at-regional-and-community-banks

- Stablecore Raises $20M to bring Stablecoins and Tokenized Deposits to Community Banks: https://www.businesswire.com/news/home/20250915212664/en/Stablecore-Raises-%2420M-to-Bring-Stablecoins-Tokenized-Deposits-and-Digital-Assets-into-Banks-and-Credit-Unions

Thanks for your attention.

Share

Content