2025 ZRX Fiyat Tahmini: 0x Protocol’e Yönelik Piyasa Trendleri ve Potansiyel Büyüme Unsurlarının Analizi

Giriş: ZRX'nin Piyasadaki Konumu ve Yatırım Değeri

0xProject (ZRX), Ethereum blokzinciri üzerinde merkeziyetsiz borsalar için geliştirilmiş açık kaynak protokol olarak, 2017'deki çıkışından bu yana önemli bir gelişim göstermiştir. 2025 itibarıyla, 0xProject’in piyasa değeri 203.615.175 ABD dolarına ulaşırken, dolaşımdaki yaklaşık 848.396.562 token ve yaklaşık 0,24 ABD doları fiyat ile işlem görmektedir. Sıkça "DEX sağlayıcı" olarak adlandırılan bu varlık, ERC20 tokenlarının eşler arası ticaretinde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, 0xProject’in 2025-2030 dönemindeki fiyat eğilimleri; tarihsel seyir, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler temelinde kapsamlı olarak analiz edilecek ve yatırımcılara profesyonel fiyat tahminleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. ZRX Fiyat Geçmişi ve Güncel Piyasa Durumu

ZRX Fiyatının Tarihsel Seyri

- 2017: ZRX, 0,05 ABD doları ICO fiyatı ile piyasaya sürülerek yolculuğunu başlattı.

- 2018: 13 Ocak 2018’de kripto boğa piyasası sırasında tüm zamanların en yüksek seviyesi olan 2,5 ABD dolarına ulaştı.

- 2020: 13 Mart 2020’de küresel piyasa çöküşüyle birlikte en düşük seviye olan 0,120667 ABD dolarına geriledi.

ZRX Güncel Piyasa Durumu

24 Eylül 2025 tarihi itibarıyla ZRX, 0,24 ABD dolarından işlem görmekte ve kripto para sıralamasında 294'üncü sıradadır. Son 24 saatte %0,96 artış gösteren tokenin işlem hacmi ise 159.761,11 ABD dolarıdır. ZRX'nin piyasa değeri 203.615.175 ABD dolarıdır ve dolaşımda 848.396.562,91 adet token bulunmaktadır. Mevcut fiyat, tüm zamanların zirvesinin yüzde 90,4 altında; fakat dip noktasına göre yüzde 98,89 oranında yüksek seyretmektedir. Saatlik bazda %1,05 yükseliş varken, haftalık %9,5, son bir yılda ise %28,13 değer kaybı yaşanmıştır.

Güncel ZRX piyasa fiyatını görüntüleyin

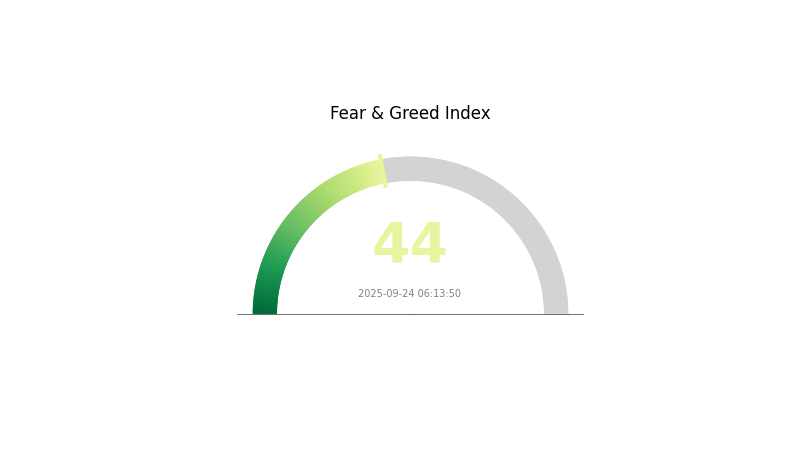

ZRX Piyasa Duyarlılığı Göstergesi

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni inceleyin

Kripto piyasası, 44 değerindeki Korku ve Açgözlülük Endeksi ile şu anda korku evresindedir. Bu durum, yatırımcıların daha temkinli ve riskten uzaklaştığını gösterir. Böyle dönemlerde satış baskısı artarken, karşıt yatırımcılar için alım fırsatları doğabilir. Ancak piyasa duyarlılığı hızla değişebileceğinden, yatırımcılar dikkatli olmalı, kapsamlı araştırma yapmalı ve Gate.com’un gelişmiş işlem araçlarını kullanarak piyasa dalgalanmalarında stratejik hareket etmeye özen göstermelidir.

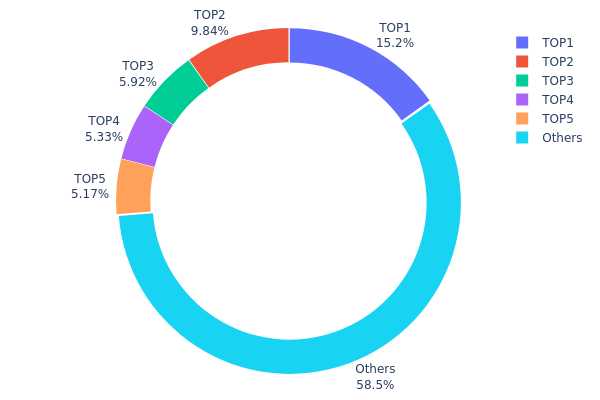

ZRX Varlık Dağılımı

ZRX adres varlık dağılımı, üst seviye sahiplerde ortalama bir yoğunlaşma olduğuna işaret etmektedir. En büyük adres toplam arzın %15,20’sini; ilk dört büyük adres ise ayrı ayrı %5 ile %10 arasında bir oranı elinde bulunduruyor. İlk beş adresin toplamında ZRX tokenlerinin %41,42’si bulunurken, kalan %58,58 ise diğer cüzdanlar arasında dağılmıştır.

Bu dağılım nispeten dengeli bir sahiplik yapısını göstermektedir. Üst sıralarda belirli bir yoğunlaşma bulunsa da, aşırı merkezileşme yoktur. Birden fazla büyük adresin varlığı, tek hâkim adres yerine piyasa istikrarını güçlendirebilir. Yine de, üst seviye adreslerin koordinasyonuyla fiyat hareketleri üzerinde etki oluşabileceği göz önünde bulundurulmalıdır.

Mevcut dağılım, ZRX’nin blokzincir merkeziyetsizlik ilkesine uygun şekilde, orta düzeyde bir dağılıma işaret eder. Tokenlerin farklı adreslere yayılması, ani piyasa dalgalanmalarına ve manipülasyon girişimlerine karşı direnci artırsa da, üst sıralarda önemli miktarda token bulunduğu için yine de dikkat gereklidir.

Güncel ZRX Varlık Dağılımını inceleyin

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x1743...f27440 | 152.076,07K | 15,20% |

| 2 | 0x2063...e0fd43 | 98.350,94K | 9,83% |

| 3 | 0xf977...41acec | 59.191,09K | 5,91% |

| 4 | 0xdb63...d97303 | 53.252,50K | 5,32% |

| 5 | 0xba7f...7a5eaf | 51.664,21K | 5,16% |

| - | Diğerleri | 585.465,19K | 58,58% |

II. ZRX'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Sınırlı Arz: ZRX’de maksimum arz limiti mevcut olup, bu durum kıtlık nedeniyle fiyat ve piyasa değerini etkileyebilir.

- Geçmiş Trend: Kısıtlı arz, fiyat istikrarı ve değer artışına katkı sağlamıştır.

- Mevcut Etki: Dolaşımdaki arz maksimuma yaklaştıkça, fiyat üzerinde yukarı yönlü baskı oluşabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Geliştiriciler ve piyasa yapıcılar, merkeziyetsiz borsaların kurulması ve yönetimi için ZRX kullanıp likidite sağlar ve işlem ücretlerinden gelir elde eder.

- Kurumsal Entegrasyon: Augur, Aragon, Maker ve Melonport gibi büyük Ethereum projeleri, 0x’i doğrudan kendi protokollerine entegre etmiştir.

- Yönetim Katılımı: ZRX sahipleri, protokol karar süreçlerinde oy hakkı kullanarak projeye yön verebilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Protokol İnovasyonu: 0x protokolünde yurttaş teknik yenilikler ve iyileştirmeler ZRX'nin değerini doğrudan etkileyebilir.

- Ekosistem Büyümesi: Merkeziyetsiz borsalar (DEX) ve DeFi ekosisteminin büyümesi, ZRX’nin fayda tokenı olarak talebini artırmaktadır.

- Ekosistem Uygulamaları: dYdX, Dharma ve Market gibi projeler, 0x protokolü ile yeni türev ve finansal ürünler geliştirerek kullanım alanını genişletmektedir.

III. 2025-2030 ZRX Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,19705 - 0,24030 ABD doları

- Tarafsız tahmin: 0,24030 - 0,28000 ABD doları

- İyimser tahmin: 0,28000 - 0,31479 ABD doları (piyasa iyimserliği ve projede gelişme gerektirir)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan benimseme ile büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,18154 - 0,36309 ABD doları

- 2028: 0,30499 - 0,45913 ABD doları

- Temel katalizörler: Genişleyen kullanım alanları, teknolojik gelişmeler ve genel kripto pazar büyümesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,39354 - 0,48208 ABD doları (istikrarlı büyüme ve yaygın benimseme varsayımıyla)

- İyimser senaryo: 0,48208 - 0,57063 ABD doları (güçlü piyasa performansı ve proje başarısı varsayımıyla)

- Dönüştürücü senaryo: 0,57063 - 0,70000 ABD doları (çığır açıcı yenilikler ve yaygın entegrasyon varsayımıyla)

- 31 Aralık 2030: ZRX 0,48208 ABD doları (2025’e göre olası %100 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,31479 | 0,2403 | 0,19705 | 0 |

| 2026 | 0,30808 | 0,27755 | 0,21926 | 15 |

| 2027 | 0,36309 | 0,29281 | 0,18154 | 21 |

| 2028 | 0,45913 | 0,32795 | 0,30499 | 36 |

| 2029 | 0,57063 | 0,39354 | 0,29515 | 63 |

| 2030 | 0,52547 | 0,48208 | 0,33746 | 100 |

IV. ZRX Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ZRX Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun portföy: Değer yatırımcıları ve blokzincir uzmanları

- İşlem önerileri:

- Piyasa düşüşlerinde ZRX token biriktirin

- Kısmi kâr için fiyat hedefleri oluşturun

- Varlıklarınızı güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve geri dönüş noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım ve satım seviyelerini analiz etmek için kullanılır

- Swing trading için ana noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini izleyin

- Zarar-durdur emirleri ile olası kayıpları yönetin

ZRX Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli portföy: Kripto portföyünün %1-3'ü

- Agresif portföy: Kripto portföyünün %5-8'i

- Profesyonel portföy: Kripto portföyünün %10-15'i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklarında pozisyon alın

- Zarar-durdur emirleri: Potansiyel kayıpları minimize edin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk cüzdan: Donanım cüzdanlarında uzun vadeli saklama

- Güvenlik: İki aşamalı doğrulama ve güçlü bir şifre kullanın

V. ZRX İçin Potansiyel Riskler ve Zorluklar

ZRX Piyasa Riskleri

- Oynaklık: Kripto piyasasında sık ve keskin fiyat dalgalanmaları

- Likidite: Yoğun stres dönemlerinde likidite sorunları

- Rekabet: Yeni DEX protokolleri ZRX’nin pazar payını azaltabilir

ZRX Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel regülasyonlar DEX faaliyetlerini etkileyebilir

- Uyum zorlukları: KYC/AML gerekliliklerine adaptasyon

- Yasal statü: Bazı bölgelerde menkul kıymet olarak sınıflandırılma riski

ZRX Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde güvenlik zaafları yaşanabilir

- Ölçeklenebilirlik: Ethereum ağındaki tıkanıklık kullanıcı deneyimini bozabilir

- Yükseltme zorlukları: Protokol güncellemeleri sırasında kesintisiz işlem sağlamak

VI. Sonuç ve Eylem Önerileri

ZRX Yatırım Değeri Analizi

ZRX, merkeziyetsiz borsalar için stratejik altyapı sunarak uzun vadeli potansiyel taşımaktadır; fakat kısa vadede piyasa oynaklığı ve DEX sektöründeki rekabet nedeniyle riskleri de barındırır.

ZRX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünüzde çeşitlendirme amacıyla küçük ve uzun vadeli pozisyonlar değerlendirin ✅ Tecrübeli yatırımcılar: Maliyet ortalaması yöntemi uygulayın ve DEX ekosistemindeki yenilikleri izleyin ✅ Kurumsal yatırımcılar: ZRX'yi geniş kapsamlı bir DeFi stratejisinin parçası olarak, düzenleyici süreçleri yakından takip ederek değerlendirin

ZRX Alım-Satım Yöntemleri

- Spot işlem: Gate.com’da ZRX token alın

- DeFi staking: ZRX destekli DEX’lerde likidite sağlama

- Türev işlemler: Uzman yatırımcılar için ZRX vadeli kontratlarında kaldıraçlı işlem

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk profillerini değerlendirerek karar almalı ve profesyonel finans danışmanlarından bilgi almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

ZRX ne kadar yükselebilir?

ZRX, güncel analiz ve tahminlere göre 2025 sonunda 1,5790 ABD dolarına ulaşabilir.

ZRX kripto para alınmaya değer mi?

ZRX kripto para birimi potansiyel vaat ediyor. Son fiyat artışları ve 0,55 ABD doları tahminleri büyüme olasılığını gösteriyor. Ox Protocol ile entegrasyonu sayesinde değeri artabilir ve bu pazarda cazip bir yatırım fırsatı sunabilir.

OX iyi bir kripto para mı?

OX, 2028’e kadar değer kazanma beklentisiyle potansiyel sunuyor. Tüm kripto para birimlerinde olduğu gibi, geleceği kesin değildir. Mevcut düşük fiyat seviyesi yatırımcılar için giriş fırsatı olabilir.

ZRX’nin sahibi kim?

ZRX; bireysel yatırımcılar ve alım-satım yapanlar tarafından tutulur. Tek bir kurum veya kişi tarafından kontrol edilmez. Merkeziyetsiz bir kripto paradır.

bir kripto coin bir ETF aldığında..

Şu Anda Alınacak En İyi Kripto: Akıllı Yatırımcılar için 2025 Rehberi

2025 UNI Fiyat Tahmini: Boğa Sonrası Piyasa Döneminde Uniswap'ın Token Değerlemesini Belirleyecek Temel Faktörlerin Analizi

2025 COMP Fiyat Tahmini: Compound Finance Token, DeFi Pazarında Yeni Zirvelere Ulaşabilir mi?

2025 UNI Fiyat Tahmini: Uniswap’ın Yerel Token’ı İçin Potansiyel Büyüme ve Karşılaşabileceği Zorlukların Analizi

Gelato (GEL) iyi bir yatırım mı?: Bu yükselen DeFi protokolünün potansiyeli ve riskleri üzerine analiz

2025 yılında Federal Reserve’in uyguladığı para politikaları ile enflasyon verileri, kripto para fiyatlarını nasıl etkiler?

Meme Token’larını Keşfetmek: TikTok Coin’i ve Etkisinin Anlaşılması

Borsa net girişleri ile kurumsal varlıklar, 2025'te ICP kripto varlıkları ve sermaye akışları üzerinde nasıl bir etki yaratır?

# Kripto Token Ekonomisi Modeli Nasıl İşler: Dağıtım, Enflasyon ve Yakım Mekanizmalarının Açıklaması