2025 XRP Fiyat Tahmini: Düzenleyici Faktörlerin ve Piyasa Benimsenmesinin Gelecekteki Değerleme Üzerindeki Etkilerinin Analizi

Giriş: XRP'nin Piyasa Konumu ve Yatırım Potansiyeli

Hızlı ve düşük maliyetli sınır ötesi ödemeler için tercih edilen dijital varlıklardan biri olan XRP (XRP), 2012'de faaliyete geçtiğinden bu yana önemli dönüm noktalarına ulaştı. 2025 itibarıyla XRP'nin piyasa değeri 179,49 milyar dolara yükselirken, dolaşımdaki arz yaklaşık 59,61 milyar adet ve fiyatı ise 3,011 dolar civarında seyrediyor. Finans dünyasında "bankacıların kripto parası" olarak bilinen XRP, küresel finans sisteminin ve uluslararası para transferlerinin dönüşümünde giderek daha kritik bir rol üstlenmektedir.

Bu makale, XRP'nin 2025-2030 yılları arasındaki fiyat trendlerini tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik unsurlar ışığında kapsamlı bir şekilde inceleyecek; yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. XRP Fiyat Geçmişi ve Güncel Piyasa Durumu

XRP Fiyat Hareketlerinin Tarihsel Seyri

- 2013: XRP piyasaya sürüldü, fiyatı 0,005874 dolar seviyesinden başladı

- 2018: Boğa piyasası zirvesi, fiyatı tüm zamanların en yüksek seviyesi olan 3,65 dolara ulaştı

- 2020: Piyasa toparlandı, fiyat 0,15 dolardan 0,60 dolara çıktı

- 2023: Ripple'ın SEC davasında olumlu gelişmeler, fiyat 1 doların üstüne yükseldi

XRP'nin Güncel Piyasa Görünümü

9 Eylül 2025 itibarıyla XRP, 3,011 dolardan işlem görüyor; 24 saatlik işlem hacmi 200.289.332 dolara ulaştı. Toplam piyasa değeri ise 179.486.328.718 dolar ile XRP’yi piyasa büyüklüğünde 3. sıraya yerleştiriyor. Son 24 saat boyunca %1,96 artan XRP, haftalık bazda %7,14 yükseldi; ancak son 30 günde %6,32 geriledi. Dolaşımdaki arz 59.610.205.486 XRP olup bu miktar, toplam arzın (%99.985.808.022 XRP) %59,61’ine karşılık geliyor. XRP’nin tüm zamanların zirvesi olan 3,65 dolar 18 Temmuz 2025’te, en düşük seviyesi olan 0,00268621 dolar ise 22 Mayıs 2014’te kaydedildi.

Güncel XRP piyasa fiyatını görüntülemek için tıklayın

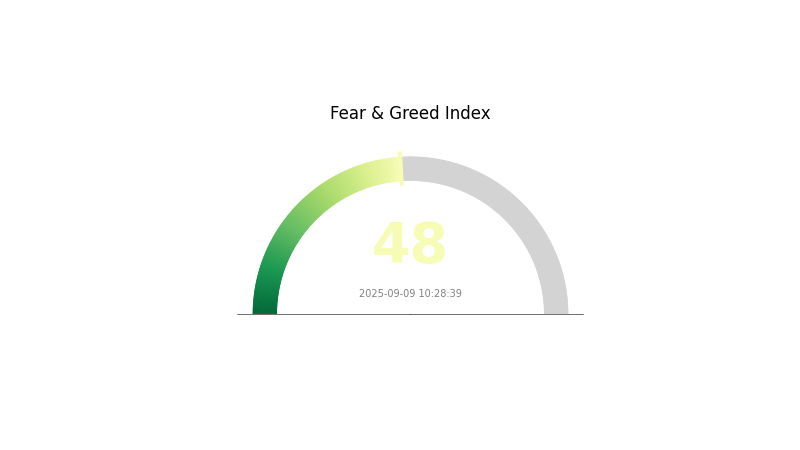

XRP Piyasa Duyarlılık Göstergesi

09 Eylül 2025 Korku/Açgözlülük Endeksi: 48 (Nötr)

XRP piyasasında duyarlılık dengede. Endeks 48 seviyesinde, ne aşırı korku ne de aşırı talep hakim. Bu denge, stratejik alım-satım fırsatları sunabilir. Piyasa koşulları hızlı değişebilir; portföyünüzü çeşitlendirin ve net giriş-çıkış noktaları belirleyin. Yatırım kararı almadan önce detaylı araştırma yapın.

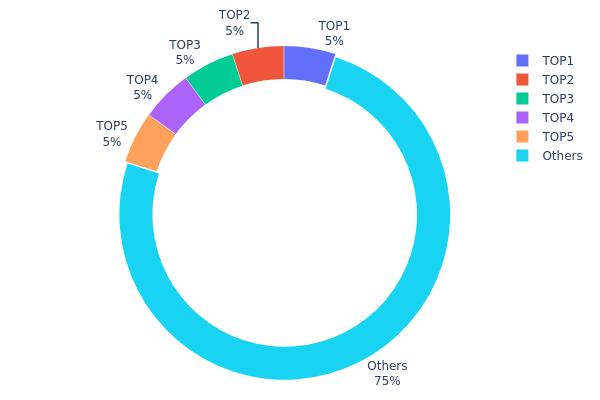

XRP Varlık Dağılımı Analizi

Adres bazlı varlık dağılımı, XRP sahipliğinin yoğunluğunu gösterir. Güncel veriler, en büyük 5 adresin her birinin toplam arzın yaklaşık %5’ine sahip olduğunu ve birlikte XRP’lerin %25’ini kontrol ettiğini ortaya koyuyor. Kalan %75 ise diğer adreslere dağılmış durumda.

Böyle bir konsantrasyon, XRP piyasasının yapısı üzerinde önemli etki yaratır. Büyük adreslerdeki varlıkların dengeli dağılımı fiyat manipülasyonu riskini azaltabilir; ancak bu cüzdanların büyük alım-satım işlemleriyle fiyat oynaklığını artırması mümkündür. İlk 5 adres arasındaki denge, tek bir aktörün piyasayı fazla etkileme riskini sınırlandırır.

Mevcut adres dağılımı, XRP’nin merkeziyetsizleşme düzeyinin orta seviyede olduğunu gösteriyor. Büyük adreslerde yoğunlaşma dikkat çekici olsa da, tokenlerin çoğunluğunun diğer adreslere yayılması ekosistemde daha geniş katılıma işaret eder. Bu yapı, hem etkili paydaşları hem de çeşitliliği koruyarak XRP ekosisteminin istikrarını artırabilir.

| En Büyük | Adres | Varlık Miktarı | Varlık Oranı (%) |

|---|---|---|---|

| 1 | rB3WNZ...oqscPn | 5.000.000,23K | 5,00% |

| 2 | r9UUEX...M6HiYp | 5.000.000,22K | 5,00% |

| 3 | rDdXiA...CFWeCK | 5.000.000,22K | 5,00% |

| 4 | rMhkqz...6bDyb1 | 5.000.000,21K | 5,00% |

| 5 | r9NpyV...BdsEN3 | 5.000.000,20K | 5,00% |

| - | Diğerleri | 74.999.998,92K | 75% |

II. XRP'nin Gelecek Fiyatına Etki Eden Temel Faktörler

Arz Mekanizması

- Sınırlı Arz: XRP’nin maksimum arzı 100 milyar token ile sabitlenmiş olup, bunun yaklaşık 59,6 milyarı dolaşıma çıkmıştır.

- Tarihsel Model: Ripple Labs’ın XRP’yi kontrollü biçimde piyasaya sürmesi, fiyat istikrarını destekledi; bazı dönemlerde ise aşağı yönlü baskıya neden oldu.

- Güncel Etki: Sınırlı arz ve kontrollü dağılım, talep yükseldikçe fiyat istikrarı ve büyüme potansiyeline katkı sağlayabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Yatırımlar: Önde gelen finans kuruluşları, sınır ötesi ödemelerde XRP’yi aktif olarak kullanmaya başladı; bu, talepte artışa neden olabilir.

- Kurumsal Benimseme: American Express ve Santander Bank gibi dev şirketler, Ripple ile işbirliği yaparak XRP teknolojisinden faydalanmaktadır.

- Devlet Politikaları: Başta ABD olmak üzere düzenleyici netlik, XRP’nin geleceğinde belirleyici rol oynuyor. SEC davasının çözümü, yakın dönemde fiyat hareketlerinde etkili oldu.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının, özellikle ABD Merkez Bankası’nın politikaları, XRP’yi alternatif varlık olarak daha cazip hale getirebilir veya talebi azaltabilir.

- Enflasyon Koruma Potansiyeli: XRP’nin enflasyon karşısında koruyucu bir araç olup olmadığı hâlâ gözlemlenmekte ve enflasyonist dönemlerdeki performansı analiz ediliyor.

- Jeopolitik Etkenler: Uluslararası gerilimler ve küresel ekonomik değişimler, sınır ötesi işlemlerde XRP kullanımına doğrudan etki edebiliyor.

Teknolojik Gelişmeler ve Ekosistem Oluşumu

- XRPL Güncellemeleri: XRP Ledger’da süren yenilikler; işlem hızını, ölçeklenebilirliği ve işlevselliği artırıyor.

- Akıllı Sözleşme Entegrasyonu: XRP Ledger’a akıllı sözleşme özelliklerinin eklenmesi, potansiyel kullanım alanlarını genişletecek.

- Ekosistem Projeleri: Gerçek varlıkların blokzincirde tokenleştirilmesi ve kurumsal DeFi gibi projeler dahil olmak üzere XRP Ledger üzerinde çeşitli DApp ve uygulama geliştirme çalışmaları yürütülüyor.

III. XRP’nin 2025-2030 Fiyat Tahmini

2025 Öngörüleri

- Konservatif tahmin: 1,59 - 2,50 dolar

- Nötr tahmin: 2,50 - 3,00 dolar

- İyimser tahmin: 3,00 - 3,16 dolar (olumlu regülasyon gelişmeleri gerekli)

2027-2028 Öngörüleri

- Piyasa fazı beklentisi: Olası boğa döngüsü

- Fiyat aralığı tahminleri:

- 2027: 2,39 - 3,70 dolar

- 2028: 1,89 - 4,50 dolar

- Kilit katalizörler: Kurumsal benimsemede artış, genel piyasa toparlanması

2030 Uzun Vadeli Öngörü

- Taban senaryo: 3,50 - 4,35 dolar (blokzincir benimsenmesi istikrarlı şekilde artarsa)

- İyimser senaryo: 4,35 - 5,05 dolar (olumlu regülasyon ortamı sağlanırsa)

- Dönüştürücü senaryo: 5,05+ dolar (sınır ötesi ödemelerde çok büyük olumlu gelişmeler yaşanırsa)

- 2030-12-31: XRP 4,35 dolar (kayda değer büyüme potansiyeli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 3,15735 | 3,007 | 1,59371 | 0 |

| 2026 | 4,03765 | 3,08218 | 2,21917 | 2 |

| 2027 | 3,70231 | 3,55991 | 2,38514 | 18 |

| 2028 | 4,50258 | 3,63111 | 1,88818 | 20 |

| 2029 | 4,6362 | 4,06684 | 2,88746 | 34 |

| 2030 | 5,04777 | 4,35152 | 2,69794 | 44 |

IV. Profesyonel XRP Yatırım Stratejileri ve Risk Yönetimi

XRP Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygulama için uygun yatırımcı tipi: Uzun vadeli büyüme hedefleyen temkinli yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde XRP biriktirin

- Kısmi kâr için fiyat hedefleri oluşturun

- Varlıkları güvenli soğuk cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar ile trend yönü ve dönüş noktalarını tespit edin

- RSI (Göreceli Güç Endeksi) ile aşırı alım/satım durumlarını değerlendirin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- XRP'nin Bitcoin ile korelasyonunu ve genel piyasa duyarlılığını izleyin

- Zararı sınırlamak için kesin stop-loss emirleri kullanın

XRP Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3'ü

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: Maksimum %15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto paralara dağıtın

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı: Gate Web3 Cüzdanı kullanılabilir

- Soğuk cüzdan: Uzun vadeli saklama için kağıt cüzdan tercih edilebilir

- Güvenlik önlemleri: İki faktörlü kimlik doğrulaması ve güçlü parolalar kullanın

V. XRP İçin Olası Riskler ve Zorluklar

XRP Piyasa Riskleri

- Volatilite: Aşırı fiyat dalgalanmaları ciddi zararlara sebep olabilir

- Likidite riski: Büyük satışlar fiyat istikrarını bozabilir

- Piyasa algısı: Olumsuz haberler ani satışlara yol açabilir

XRP Regülasyon Riskleri

- Hukuki belirsizlik: Düzenleyici tartışmalar XRP'nin sınıflandırılmasını ve piyasadaki konumunu etkileyebilir

- Uluslararası regülasyonlar: Ülkeler arası mevzuat farklılıkları benimsemeyi zorlaştırabilir

- Uyum gereklilikleri: Daha sıkı KYC/AML uygulamaları erişimi kısıtlayabilir

XRP Teknik Riskleri

- Ağ tıkanıklığı: Yüksek işlem hacmi süreçlerde gecikmelere neden olabilir

- Akıllı sözleşme açıkları: Uygulamada ortaya çıkabilecek yazılım hataları

- Ölçeklenebilirlik sorunları: Kullanım arttıkça verimliliğin korunması gerekliliği

VI. Sonuç ve Eylem Tavsiyeleri

XRP'nin Yatırım Değeri Değerlendirmesi

XRP, sınır ötesi ödeme sektöründe uzun vadeli büyüme potansiyeline sahip, benzersiz bir değer sunuyor. Ancak regülasyon belirsizliği ve piyasa oynaklığı kısa vadede önemli riskler oluşturuyor.

XRP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini kavramak için küçük ve düzenli yatırımlarla başlayın

✅ Tecrübeli yatırımcılar: Hem tutma hem de aktif alım-satım stratejilerini birleştirin

✅ Kurumsal yatırımcılar: XRP’yi çeşitlendirilmiş kripto portföyünün parçası olarak değerlendirin, ödeme sektöründeki potansiyeline odaklanın

XRP Alım-Satım Yöntemleri

- Spot işlemler: Gate.com spot piyasasında XRP alım-satımı yapın

- Vadeli işlemler: XRP vadeli sözleşmeleriyle kaldıraçlı pozisyon açın

- Staking: XRP staking programlarına katılarak getiri elde edin

Kripto para yatırımları çok yüksek risk içerir ve bu metin yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre verin ve profesyonel finans danışmanlarına danışın. Yatırım miktarınızı dikkatli belirleyin.

Sıkça Sorulan Sorular

2025’te XRP ne kadar yükselebilir?

XRP, 2025’in sonlarına doğru 5 dolara kadar yükselebilir. Mevcut eğilimler, istikrarlı bir toparlanmanın ve 3,50 doların üzerinde güçlü bir kırılmanın yeni yükselişler için zemin hazırlayabileceğini gösteriyor.

XRP 100 dolara ulaşır mı?

Evet, XRP teorik olarak 100 dolara ulaşabilir. Fiyatı, küresel finans sistemindeki kullanım ve benimsenme düzeyine bağlıdır. XRP yaygın olarak uluslararası para transferlerinde kullanılırsa, piyasa değeri sınırlamalarına bakılmaksızın fiyatında büyük artışlar görülebilir.

2030’da XRP ne kadar olacak?

2030’da XRP’nin fiyatı 90 ile 120 dolar arasında tahmin edilmektedir. Bu öngörü, XRP’nin kripto piyasasındaki gelecek büyümesi ve benimsenmesi açısından önemli bir kilometre taşıdır.

XRP 500 dolara ulaşır mı?

Teorik olarak mümkün olsa da, XRP’nin 500 dolara çıkması oldukça düşük bir ihtimaldir. Piyasa dinamikleri ve regülasyonlar, bu kadar yüksek fiyat tahminlerini belirsiz kılmaktadır. Daha gerçekçi uzun vadeli beklenti; 10-50 dolar aralığıdır.

Kripto Çöküşü mü Yoksa Sadece Düzeltme mi?

2025 XRP Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? Ripple'ın Kripto Parası İçin Olası Senaryoların Analizi

2025 XRP Fiyat Tahmini: Kurumsal Benimsemenin Artmasıyla 5 Dolar’a Olası Yükseliş

2025 yılında zincir üstü veriler, XRP'nin piyasa konumunu nasıl gözler önüne seriyor?

Kripto Rakip Analizi, 2025 yılında pazar payı üzerinde nasıl bir etki yaratır?

Büyük Yeniden Şekillendirme: Binance, OKX ve Gate'in 2025'te CEX Manzarasını Nasıl Yeniden Tanımladığı

RedotPay Seri B Yatırım Turu: Stablecoin ödeme çözümüne 107 milyon dolar yatırım alındı

Birleşik Krallık Kripto Düzenlemesi 2025: FCA, 2027'de yürürlüğe girecek kapsamlı düzenlemeler öncesinde borsalar, staking ve borç verme işlemlerine ilişkin geniş kapsamlı bir danışma süreci başlattı

Yeni Başlayanlar İçin Rehber: MetaMask Cüzdanı Nasıl Oluşturulur ve Web3 Cüzdanı Güvenle Nasıl Kullanılır

FDIC Stablecoin İhraç Planı: Bankalar Stablecoin İhraç Etmek İçin Başvuru Süreci

2026 Altın Fiyatı Tahmini ve Trend Analizi: Mum Çubuğu Grafikleri Temelinde Orta ve Uzun Vadeli Görünüm