2025 XAUT Fiyat Tahmini: Değişen Dijital Para Ekosisteminde Altın Destekli Stablecoin’lerin Analizi

Giriş: XAUT'un Piyasadaki Yeri ve Yatırım Potansiyeli

Tether Gold (XAUT), altın destekli bir stablecoin olarak, 2020 yılında piyasaya sürülmesinden bu yana kripto para pazarında önemli bir yer edinmiştir. 2025 yılı itibarıyla XAUT’un piyasa değeri 1.371.740.074 $’a ulaşmış; dolaşımdaki arzı yaklaşık 375.572 adet ve fiyatı 3.652,4 $ seviyelerinde seyretmektedir. Sıklıkla “dijital altın” olarak anılan XAUT, geleneksel altın yatırımları ile dijital varlık dünyası arasında köprü görevi görerek giderek daha stratejik bir pozisyona yükselmektedir.

Bu makalede, XAUT’un 2025’ten 2030’a kadar olan fiyat dinamikleri; geçmiş veriler, piyasa arz ve talep dengesi, ekosistem geliştirmeleri ve makroekonomik ortam doğrultusunda kapsamlı şekilde ele alınmakta, profesyonel fiyat öngörüleriyle birlikte yatırımcılara uygulanabilir yatırım stratejileri sunulmaktadır.

I. XAUT Fiyat Geçmişi ve Güncel Piyasa Durumu

XAUT Tarihsel Fiyat Seyri

- 2020: XAUT piyasaya sürüldü, ilk fiyatı 1.447,84 $ (tüm zamanların en düşük seviyesi)

- 2022: Küresel ekonomik belirsizlikler nedeniyle altın fiyatları yükseldi, XAUT 2.000 $’ı aştı

- 2025: XAUT, 9 Eylül’de 3.673,73 $ ile tüm zamanların en yüksek seviyesini gördü

XAUT Güncel Piyasa Görünümü

12 Eylül 2025 itibarıyla XAUT, 3.652,4 $ seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 2.549.852,58 $ olarak kaydedildi. Token, son 24 saatte %0,61 oranında değer kazandı ve son bir yılda %45,31’lik belirgin bir yükseliş yaşadı. XAUT’un piyasa değeri 1.371.740.074,94 $ olup genel kripto para piyasasında 93. sırada yer almaktadır. Dolaşımdaki arz ile toplam arz aynıdır: 375.572,247 adet. Fiyatı fiziki altın değerini yakından izleyen XAUT, dijital ortamda değerli metal temsilciliği arayan yatırımcıların ilgisini çekmeye devam ediyor.

Güncel XAUT piyasa fiyatını görüntülemek için tıklayın

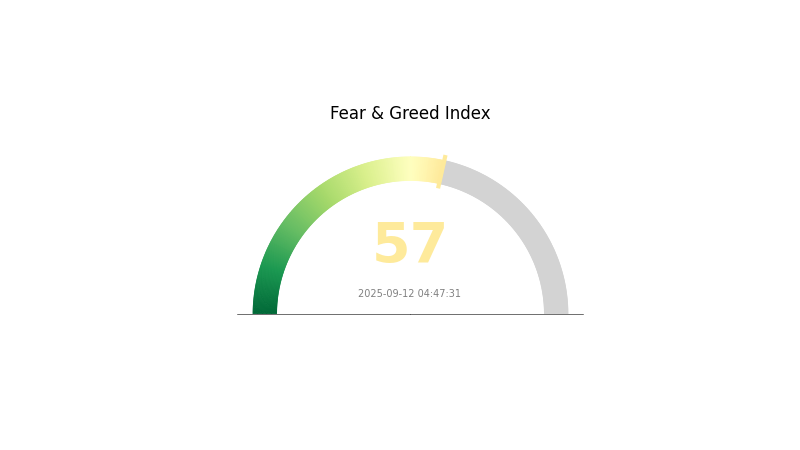

XAUT Piyasa Duyarlılık Göstergesi

12 Eylül 2025 Korku ve Açgözlülük Endeksi: 57 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi’ni incelemek için tıklayın

Kripto para piyasasında şu anda açgözlülük hâkim; Korku ve Açgözlülük Endeksi 57 seviyesinde bulunuyor. Bu seviye, yatırımcıların olumlu piyasa gelişmeleriyle giderek daha iyimser hale geldiğine işaret etmektedir. Yine de, yüksek açgözlülük piyasada aşırı değerlemelere ve volatilitenin artmasına sebep olabilir. Yatırım kararı öncesi derinlemesine araştırma ve risk analizi yapılması büyük önem taşır. Portföy çeşitlendirmesi ve güçlü bir risk yönetimi yaklaşımı, değişken kripto piyasasında başarı için vazgeçilmezdir.

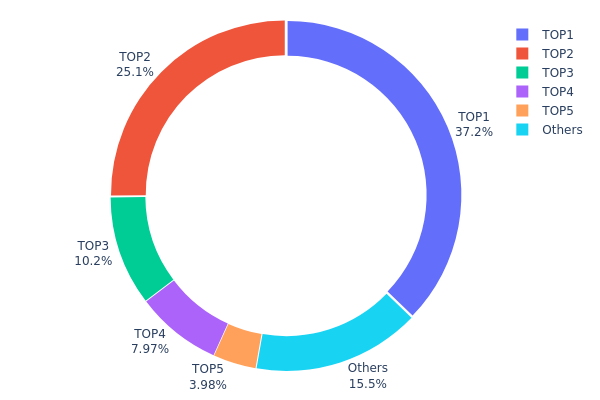

XAUT Varlık Dağılımı

Adres bazlı varlık dağılımı XAUT’ta sahipliğin yoğunlaştığını gösteriyor. En büyük beş adres, toplam arzın %84,44’ünü elinde bulundururken, en büyük adresin payı %37,22 seviyesindedir. Bu denli yüksek sahiplik yoğunluğu, olası piyasa manipülasyonu ve ani fiyat dalgalanmaları konusunda endişelere neden olmaktadır.

Böyle bir yoğunlaşma, XAUT piyasasının birkaç büyük yatırımcının hamlelerine karşı savunmasız olduğunu gösteriyor. Üst düzey adreslerdeki büyük hareketler fiyat ve likidite üzerinde orantısız bir etki oluşturabilir. Ayrıca, bu durum kripto para piyasalarında değer verilen merkeziyetsizlik prensibini de zedelemektedir.

Piyasa istikrarı açısından bakıldığında, XAUT’un mevcut varlık dağılımı zincir üstü yapının kırılgan olduğunu gösteriyor. Az sayıda adresin hakimiyeti, fiyat oynaklığını artırabilir ve token’ın altına birebir sabitliğini sürdürmesini zorlaştırabilir; oysa bu özellik XAUT’un dijital altın kimliği için temel niteliktedir.

Güncel XAUT Varlık Dağılımı’nı görüntülemek için tıklayın

| Sıra | Adres | Varlık Adedi | Oran (%) |

|---|---|---|---|

| 1 | 0x5754...07b949 | 139,80K | 37,22% |

| 2 | 0x785f...4eff76 | 94,35K | 25,12% |

| 3 | 0xf9b3...098057 | 38,18K | 10,16% |

| 4 | 0xba18...df717b | 29,94K | 7,97% |

| 5 | 0x742d...38f44e | 14,94K | 3,97% |

| - | Diğer | 58,35K | 15,56% |

2. XAUT'un Gelecekteki Fiyatını Belirleyecek Temel Unsurlar

Arz Mekanizması

- LBMA Altın Endeksi: XAUT’un fiyatı LBMA Altın Endeksi’ni yakından takip eder.

- Tarihsel Eğilim: Altın endeksi son yılda %40 yükselmiştir.

- Güncel Etki: Yükselen altın fiyatlarının XAUT’a pozitif yansıması beklenmektedir.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Varlıklar: XAUT, 800 milyon $ üzeri piyasa değeriyle ciddi büyüme kaydetmiştir.

Makroekonomik Çevre

- Para Politikası Etkisi: FED’in uzun vadeli sıkılaştırma politikalarına rağmen, 2025 Eylül itibarıyla altın fiyatlarında %44’lük artış yaşanmıştır.

- Enflasyon Koruması: XAUT, altının klasik enflasyona karşı koruyan yapısını yansıtarak, enflasyonist dönemlerde güçlü performans sergiler.

- Jeopolitik Etkiler: Küresel ekonomik belirsizlik ve jeopolitik riskler, XAUT gibi altın destekli varlıklara olan talebi artırmaktadır.

Teknik Gelişim ve Ekosistem Oluşumu

- Altının Tokenlaştırılması: XAUT, klasik altın yatırımlarıyla kripto para piyasası arasında dijital bir köprü kurarak altının küresel düzeyde dolaşmasını sağlar.

- Ekosistem Uygulamaları: XAUT, büyük DeFi kredi platformlarında sınırlı şekilde kullanılsa da, tokenleştirilmiş altın pazarında PAXG gibi rakiplerle birlikte önemli bir aktördür.

III. 2025-2030 İçin XAUT Fiyat Öngörüleri

2025 Tahmini

- Ihtiyatlı öngörü: 2.228 - 3.000 $

- Tarafsız öngörü: 3.000 - 3.800 $

- İyimser öngörü: 3.800 - 4.712 $ (güçlü altın piyasası performansı gerekli)

2027-2028 Görünümü

- Piyasa aşaması: Artan benimsenmeyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 3.848 - 6.974 $

- 2028: 4.183 - 7.483 $

- Başlıca katalizörler: Kurumsal benimsenme artışı ve küresel ekonomik belirsizlikler

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 6.687 - 7.925 $ (dengeli altın piyasası büyümesiyle)

- İyimser senaryo: 7.925 - 9.161 $ (güçlü altın performansı ve artan kripto benimsenmesiyle)

- Dönüştürücü senaryo: 9.161 - 9.906 $ (olağanüstü altın rallisi ve XAUT’un yaygın kabulüyle)

- 31 Aralık 2030: XAUT 7.924,64 $ (2025’e göre %116 artış)

| Yıl | Tahmini Maks. Fiyat | Tahmini Ortalama Fiyat | Tahmini Min. Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 4.712,11 | 3.652,8 | 2.228,21 | 0 |

| 2026 | 5.437,19 | 4.182,46 | 3.764,21 | 14 |

| 2027 | 6.974,25 | 4.809,82 | 3.847,86 | 31 |

| 2028 | 7.482,88 | 5.892,03 | 4.183,34 | 61 |

| 2029 | 9.161,82 | 6.687,46 | 6.018,71 | 83 |

| 2030 | 9.905,8 | 7.924,64 | 5.388,75 | 116 |

IV. XAUT için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

XAUT Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Altına maruz kalmak isteyen temkinli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde XAUT biriktirin

- Düzenli alım planları oluşturun

- Güvenli donanım cüzdanı veya kurumsal saklama kullanın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI: Aşırı alım/satım bölgelerini belirleyin

- Dalgalı al-sat için ipuçları:

- Altın piyasası duyarlılığını ve makroekonomik gelişmeleri takip edin

- Sıkı stop-loss ve kar al seviyeleri belirleyin

XAUT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Standartları

- Düşük riskli yatırımcılar: %5-10

- Orta riskli yatırımcılar: %10-15

- Yüksek riskli yatırımcılar: %15-20

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: XAUT’u farklı varlıklarla birlikte değerlendirin

- Opsiyon stratejileri: Fiyat düşüşlerine karşı koruyucu put kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Büyük varlık tutarlarında donanım cüzdanları

- Ek güvenlik: 2FA etkinleştirin, güçlü parola kullanın

V. XAUT’un Karşılaşabileceği Olası Riskler ve Zorluklar

XAUT Piyasa Riskleri

- Altın fiyatında dalgalanma: Altın piyasasındaki değişimler XAUT’un değerini etkiler

- Likidite riski: Düşük işlem hacmi, büyük miktarlı işlemleri zorlaştırabilir

- Karşı taraf riski: Tether’ın altın rezervlerine ve yönetimine bağımlılık

XAUT Düzenleyici Riskler

- Düzenleyici ortamda değişiklik: Altın destekli tokenlar için yeni mevzuat ihtimali

- Ülke kısıtlamaları: Farklı coğrafyalarda farklı regülasyonlar

- Uyum riskleri: AML ve KYC yükümlülüklerine uygunluk

XAUT Teknik Riskler

- Akıllı sözleşme açıkları: Kod zafiyetleri

- Blokzincir ağı sorunları: Ethereum ağında tıkanıklık veya yüksek ücretler

- Entegrasyon sorunları: Cüzdan ve borsa uyumluluğu

VI. Sonuç ve Uygulama Önerileri

XAUT’un Yatırım Değeri Değerlendirmesi

XAUT, enflasyon ve dalgalı piyasa koşullarına karşı dijital altın koruması sağlayan bir araçtır. Ancak, yatırımcılar düzenleyici belirsizliklerin ve blokzinciri kaynaklı teknik risklerin farkında olmalıdır.

XAUT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Çeşitlendirilmiş portföyde düşük oranlarla yatırım yapın ✅ Deneyimli yatırımcılar: Altın teması ve arbitraj fırsatları için XAUT’u kullanın ✅ Kurumsal yatırımcılar: Dijital altın ve hazine yönetimi için XAUT tahsisini değerlendirin

XAUT Katılım Yöntemleri

- Spot al-sat: Gate.com üzerinden XAUT satın alın

- Saklama: Yüklü miktar için kurumsal düzeyde saklama hizmetleri kullanın

- DeFi entegrasyonu: Merkeziyetsiz finans protokollerinde getiri fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk taşır; bu makaledeki bilgiler yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatlice vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaldıramayacağınız riskte yatırım yapmayın.

Sıkça Sorulan Sorular

XAUT bir stablecoin midir?

Evet, XAUT fiziki altın ile teminatlandırılmış bir stablecoindir. Değeri altın fiyatına dayalıdır; bu nedenle altına karşı stabil, ancak itibari paralara karşı sabitlenmiş değildir.

2025’te altın fiyatı kaç olacak?

Bloomberg Terminal öngörülerine göre 2025’te altın fiyatının, piyasa koşullarına bağlı olarak 1.709,47 $ ile 2.727,94 $ arasında değişmesi beklenmektedir.

XAUUSD 3.000 $’ı görecek mi?

Evet, XAUUSD’nin 2025’e kadar 3.000 $ seviyesine ulaşması mümkündür. Analistler, ekonomik ve piyasa koşullarının bu hedefi desteklediğini öngörmektedir.

XAUT altınla teminatlandırılmış mıdır?

Evet, XAUT tamamen fiziki altınla teminatlandırılmıştır. Her bir XAUT tokenı, güvenli kasalarda tutulan bir troy ons fiziksel altını temsil eder.

XAUT'nin Topluluk Katılımı, Ekosisteminin Büyümesini Nasıl Etkiler?

PAXG nedir: Altın destekli dijital varlık ve modern yatırım portföylerindeki yeri

Ondo Finance: Nedir ve ONDO Token Nasıl Çalışır

2025 PAXG Fiyat Tahmini: Belirsiz Ekonomik Koşullarda Altına Endeksli Token'ın Büyüme Potansiyelinin Değerlendirilmesi

Tether Gold (XAUT) iyi bir yatırım mı?: Altın destekli stablecoin'lerin riskleri ve potansiyeli üzerine analiz

GUSD: Gerçek dünya varlıklarıyla desteklenen bir stablecoin, Gate üzerinde güvenli zenginlik yönetimi için.

Bitcoin Ödeme Ağ Geçitleri İçin En İyi Çözümler

Merkezi Kripto Para Borsalarını Anlamak: Temel Özellikler ve Sağladığı Avantajlar