2025 USDC Fiyat Tahmini: Değişen Kripto Düzenleyici Ortamında Stablecoin İstikrarının Analizi

Giriş: USDC'nin Piyasa Konumu ve Yatırım Değeri

USD Coin (USDC), 2018 yılında piyasaya sürülmesinden bu yana ABD dolarına endeksli, tamamen teminatlandırılmış öncü bir stablecoin olarak öne çıkmıştır. 2025 yılına gelindiğinde USDC'nin piyasa değeri 72,63 milyar dolara, dolaşımdaki arzı ise yaklaşık 72,61 milyar adet tokene ulaşmış ve fiyatı 1 dolar seviyesinde istikrarını korumaktadır. Sıklıkla "dijital dolar" olarak anılan bu varlık, işlemlerin kolaylaştırılması, sınır ötesi ödemeler ve merkeziyetsiz finans (DeFi) uygulamaları açısından giderek kritik bir rol üstlenmektedir.

Bu makalede, USDC'nin 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel eğilimler, piyasa arz ve talebi, ekosistem gelişmeleri ve makroekonomik unsurlar çerçevesinde kapsamlı şekilde analiz edilecek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. USDC Fiyat Geçmişi ve Güncel Piyasa Durumu

USDC'de Tarihsel Fiyat Seyri

- 2018: USDC piyasaya sürüldü, fiyat 1 dolar civarında istikrarlı seyretti

- 2020: DeFi sektörünün yükselişiyle artan benimsenme, fiyat 1 dolar sabitini korudu

- 2023: Bankacılık krizi endişeleriyle, 11 Mart'ta fiyat kısa süreliğine 0,877647 dolara geriledi

USDC Güncel Piyasa Durumu

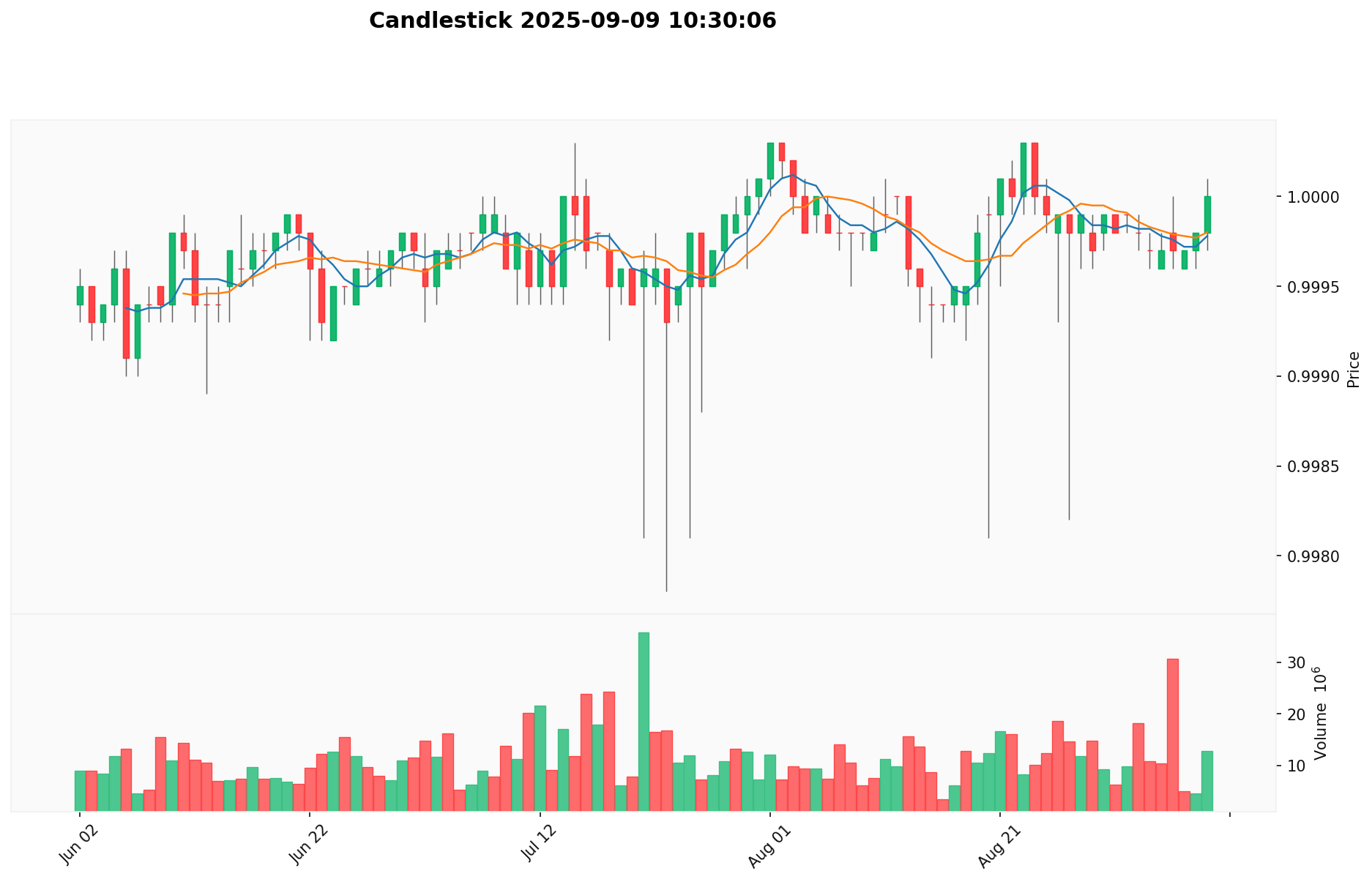

9 Eylül 2025 tarihi itibarıyla USDC, 1,00 dolar seviyesinden işlem görüyor ve ABD dolarına endeksini koruyor. 24 saatlik işlem hacmi 18.035.901,60 dolar olarak kaydedildi. USDC'nin piyasa değeri 72.607.478.728,91 dolar olup, toplam kripto paralar arasında %1,74 pay ile yedinci sıradadır. Dolaşımdaki arz, toplam arz ile aynı şekilde 72.607.478.728,91 USDC'dir. Son 24 saatte USDC'nin fiyatında %0,01'lik hafif bir düşüş yaşanırken, farklı zaman dilimlerinde fiyat istikrarı korundu ve dalgalanmalar 1 saatten 1 yıla kadar olan periyotlarda -%0,0086 ile -%0,02 arasında sınırlı kaldı.

Güncel USDC piyasa fiyatını görmek için tıklayın

USDC Piyasa Duyarlılık Göstergesi

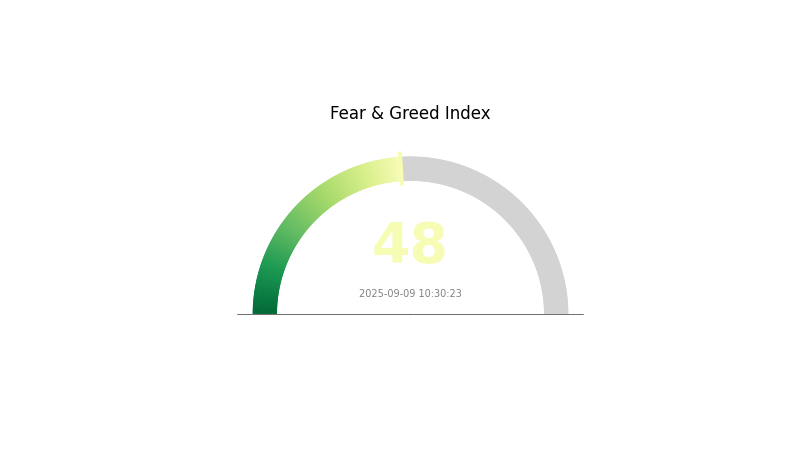

2025-09-09 Korku ve Hırs Endeksi: 48 (Nötr)

Güncel Korku & Hırs Endeksi'ni görmek için tıklayın

Kripto para piyasası duyarlılığı dengede kalmaya devam ediyor; Korku ve Hırs Endeksi 48 seviyesinde olup, piyasada nötr bir atmosferi yansıtıyor. Yatırımcılar ne aşırı endişeli ne de fazla iyimser; temkinli bir yaklaşım söz konusu. Ancak aynı zamanda iyimserliğe dair ipuçları da gözleniyor. Bu nötr seviye, genellikle büyük piyasa hareketlerinden önce görülür. Yatırımcılar bu dönemde araştırma yapabilir ve stratejik planlama gerçekleştirebilir.

USDC Varlık Dağılımı

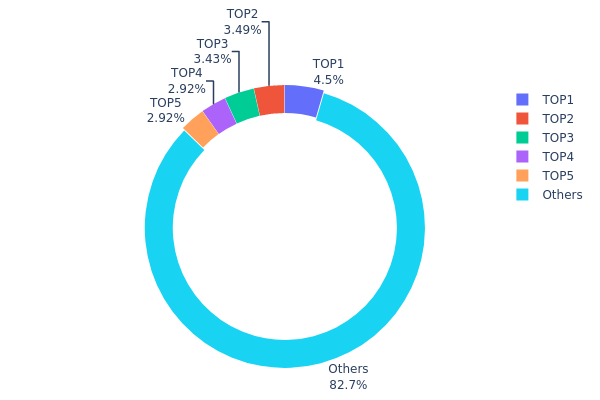

Adres bazında varlık dağılımı verileri, USDC sahipliğinin cüzdanlar arasında ne ölçüde yoğunlaştığını gösterir. Analize göre, ilk 5 adres toplam arzın %17,24'ünü elinde bulundururken, en büyük tek adresin payı %4,49'dur. Bu, piyasada orta dereceli bir yoğunlaşma olduğunu, ancak hiçbir adresin piyasayı domine etmediğini gösterir.

Üst düzey adresler kayda değer varlıklara sahip olsa da, USDC'nin %82,76'sının diğer adreslere dağılması, sağlıklı bir yayılım anlamına gelir. Bu dağılım, aşırı merkezileşmeye bağlı piyasa manipülasyonu veya toplu satış riskine karşı koruma sağlar. Ancak, büyük sahiplerin yüksek miktarda USDC hareket ettirmesi yine de piyasayı etkileyebilir.

Mevcut USDC adres dağılımı, dengeli bir piyasa yapısını ve makul düzeyde merkeziyetsizliği yansıtmaktadır. Bu model, stablecoin'in zincir üzerindeki istikrarına katkı sağlar. Ayrıca, birkaç büyük oyuncunun neden olabileceği ani fiyat oynaklığı riskini azaltır.

Güncel USDC Varlık Dağılımını görmek için tıklayın

| İlk | Adres | Varlık Miktarı | Oran (%) |

|---|---|---|---|

| 1 | 0x3730...fd7341 | 2.155.032,55K | 4,49% |

| 2 | 0x38aa...f9b200 | 1.672.188,17K | 3,48% |

| 3 | 0xee7a...3b4055 | 1.644.413,10K | 3,43% |

| 4 | 0xad35...329ef5 | 1.400.000,00K | 2,92% |

| 5 | 0xe194...6929b6 | 1.400.000,00K | 2,92% |

| - | Diğerleri | 39.661.564,53K | 82,76% |

II. USDC'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Rezerv Destekli: USDC, nakit (%23) ve kısa vadeli ABD Hazine bonoları (%77) olmak üzere %100 rezervle güvence altındadır.

- Tarihsel desen: Şeffaf rezerv yapısı, USDC'nin istikrarı ve kabul görmesi üzerinde olumlu rol oynamıştır.

- Güncel etki: Güçlü rezerv sistemi sayesinde, USDC fiyatının 1 dolar bandında istikrarı korunması beklenmektedir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal sahiplik: 2024 yılı itibarıyla USDC'nin kurumsal sahiplik oranı %38 seviyesindedir.

- Kurumsal benimseme: BlackRock ve Goldman Sachs gibi büyük kurumlar, sınır ötesi ödemelerde USDC'yi tercih etmiştir.

- Kamu politikaları: AB'nin MiCA regülasyonları, USDC'nin Avrupa pazarında bazı rakiplerine üstünlük sağlamasına olanak tanımıştır.

Makroekonomik Çevre

- Para politikası etkisi: ABD Merkez Bankası'nın (Federal Reserve) faiz gibi politikaları, USDC'nin yatırım çekiciliği ve benimsenmesini etkiler.

- Enflasyona karşı koruma: USDC'nin sabit değeri, yüksek enflasyon dönemlerinde talebi artırır.

- Jeopolitik faktörler: Küresel ekonomik belirsizlikler, USDC gibi stabil dijital varlıklara olan talebi yükseltebilir.

Teknolojik Gelişmeler ve Ekosistem Oluşumu

- Dijital Dolar Ödeme Geçidi: USDC, SWIFT ile yaptığı iş birliği kapsamında 2024'te 150 uluslararası bankayı "dijital dolar ödeme geçidi" ile birbirine bağlamıştır.

- Çoklu zincir kullanımı: USDC, farklı blockchain ağlarında mevcut olup, bu sayede erişilebilirliği ve işlevselliği artmaktadır.

III. 2025-2030 Dönemi için USDC Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,98-1,00 dolar

- Nötr tahmin: 0,99-1,01 dolar

- İyimser tahmin: 1,00-1,02 dolar (daha fazla benimsenme ve piyasa istikrarı varsayımıyla)

2027-2028 Görünümü

- Piyasa evresi beklentisi: İstikrarlı büyüme ve daha yaygın kabul

- Fiyat aralığı tahmini:

- 2027: 0,99-1,01 dolar

- 2028: 0,99-1,01 dolar

- Ana tetikleyiciler: Regülasyon netliği ve artan kurumsal benimseme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99-1,01 dolar (piyasa istikrarı devam ederse)

- İyimser senaryo: 1,00-1,02 dolar (küresel ölçekte yaygın benimsenme durumunda)

- Dönüşümsel senaryo: 1,00-1,03 dolar (USDC'nin hakim stablecoin haline gelmesiyle)

- 2030-12-31: USDC 1,01 dolar (yüksek talep nedeniyle küçük bir primle)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

USDC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Değer koruma odaklı temkinli yatırımcılar

- Öneriler:

- Portföy çeşitlendirmesi için itibari para varlıklarınızın bir kısmını USDC'ye ayırın

- Fiyat dalgalanmalarının etkisini azaltmak için düzenli aralıklarla USDC alımı yapın

- USDC'lerinizi güvenli donanım cüzdanlarında veya güvenilir saklama hizmetlerinde muhafaza edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli eğilimleri takip edin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım noktalarını belirleyin

- Dalgalı işlem için ipuçları:

- USDC/USD paritesini önde gelen borsalarda düzenli olarak takip edin

- Genel stablecoin pazar duyarlılığını ve benimsenme oranlarını takip edin

USDC Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Muhafazakâr yatırımcılar: Portföyün %5-10'u

- Orta riskli yatırımcılar: Portföyün %10-20'si

- Agresif yatırımcılar: Portföyün %20-30'u

(2) Riski Azaltma Çözümleri

- Çeşitlendirme: Birden fazla stablecoin ve platformda varlık bulundurun

- Sigorta: Büyük USDC tutarları için dijital varlık sigortasını değerlendirin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Kolay erişim için Gate Web3 Cüzdanı

- Soğuk cüzdan: Uzun vadeli ve yüksek hacimli saklama için donanım cüzdanları

- Güvenlik önlemleri: 2FA kullanın, güçlü parolalar belirleyin ve yazılımlarınızı düzenli güncelleyin

V. USDC'nin Karşılaşabileceği Potansiyel Riskler ve Zorluklar

USDC Piyasa Riskleri

- Likidite riski: Piyasa stres dönemlerinde toplu itfa işlemlerinde oluşabilecek zorluklar

- Rekabet riski: Yeni stablecoin projeleri USDC'nin pazar payını azaltabilir

- Benimsenme riski: Ana akım kabulün yavaş ilerlemesi büyümeyi sınırlayabilir

USDC Regülasyon Riskleri

- Uyumsuzluk belirsizliği: Değişen düzenleyici yapılar USDC'nin operasyonlarını etkileyebilir

- Banka ilişkileri: Bankacılık partnerlerinin kaybı hizmet kesintisine neden olabilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyonlar USDC'nin küresel kullanımını engelleyebilir

USDC Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda potansiyel açıklar istismara yol açabilir

- Blokzincir tıkanıklığı: Ağ yoğunluğu işlem gecikmesi veya yüksek ücret riskini artırabilir

- Merkezileşme riski: İhraç ve yönetimde Circle ve Coinbase'e bağımlılık

VI. Sonuç ve Öneriler

USDC Yatırım Değeri Değerlendirmesi

USDC, ABD dolarına sabitlenmiş, görece istikrarlı bir dijital varlık sunarak geleneksel finans istikrarı ile kripto ekosistemindeki faydayı bir arada bulundurur. Volatilitesi diğer kripto varlıklara göre düşük olsa da, yatırımcılar regülasyon ve teknik risklerin bilincinde olmalıdır.

USDC Yatırım Önerileri

✅ Yeni başlayanlar: Stablecoin (stabil kripto para) ekosistemini kavramak için küçük miktarlarla deneyin ✅ Deneyimli yatırımcılar: Portföy stabilizasyonu ve işlem çiftlerinde USDC kullanımı ✅ Kurumsal yatırımcılar: Hazine yönetimi ve sınır ötesi işlemlerde USDC'yi değerlendirin

USDC'de Katılım Yöntemleri

- Doğrudan alım: USDC'yi Gate.com veya diğer düzenlenmiş borsalardan alın

- Getiri sağlama: USDC borç verme ya da likidite sunan DeFi protokollerini keşfedin

- Ödeme aracı olarak: Uygun olduğu durumlarda USDC ile uluslararası transferleri hızlı ve düşük maliyetli gerçekleştirin

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerini dikkate alarak temkinli hareket etmeli ve profesyonel finansal danışmanlardan görüş almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırım yapmayın.

Sıkça Sorulan Sorular

USDC iyi bir yatırım mı?

USDC, istikrarlı ve güvenilir bir yatırım seçeneği olarak öne çıkar. ABD dolarına endeksli, yüksek piyasa hacmine sahip olması sebebiyle düşük volatilite ve geniş kabul sunar.

USDC her zaman 1 dolar olacak mı?

USDC, rezerv destekli şekilde 1 dolar değerini koruma hedefindedir. Ancak bu istikrar, Circle'ın politikalarına ve piyasadaki genel koşullara bağlıdır.

USDC değer kaybedebilir mi?

Evet, USDC piyasa talebine bağlı olarak küçük fiyat dalgalanmalarına uğrayabilir, fakat genellikle ABD dolarına endeksini korur. Bu tür geçici sapmalar normaldir ve genellikle kısa sürer.

En yüksek fiyat tahminine sahip kripto para hangisi?

Bitcoin, 127.864 dolara ulaşabilen tahminlerle en yüksek fiyat öngörüsüne sahiptir. Chainlink ise 56,65 dolar ile ikinci sıradadır.

Worldwide USD (WUSD) iyi bir yatırım mı?: Bu Yeni Ortaya Çıkan Stablecoin’in Potansiyeli ve Riskleri Üzerine Analiz

Circle’ın USDC Büyümesi: Stabilcoinler Hisse Senetleri ve Kripto Para Piyasasında Dalgalanıyor

Fiat Paranın Değerinde Değişime Neler Sebep Olabilir? Kapsamlı Bir Analiz

XRP Altın ile Desteklenecek mi?

2025 USD1 Fiyat Tahmini: Dijital para birimlerinin değerini etkileyen temel piyasa unsurlarının ayrıntılı analizi ve gelecek öngörüsü

Falcon Finance (FF): Nedir ve Nasıl Çalışır

Ethereum, Tokenleştirilmiş Finans Zincir Üzerine Taşınırken Kurumsal Momentum Kazanıyor

Kripto Haberler Bugün: Piyasa Akışları, Ortaya Çıkan Trendler ve Dijital Varlıkları Şekillendiren Anahtar Sinyaller

0G (0G) yatırım için uygun mu?: Piyasa Potansiyeli, Riskler ve Gelecek Beklentilerinin Kapsamlı Analizi

Ultima (ULTIMA) güvenli bir yatırım mı?: 2024 yılı özelinde tokenomik yapısı, piyasa potansiyeli ve risk faktörlerine dair ayrıntılı değerlendirme

GUSD (GUSD) yatırım için uygun mu?: Gemini Dollar'ın Potansiyeli ve Risklerinin Detaylı Analizi