2025 TIA Fiyat Tahmini: Celestia Token’ın Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: TIA’nın Piyasa Konumu ve Yatırım Potansiyeli

Celestia (TIA), modüler mimaride tasarlanan ve tak-çalıştır veri erişilebilirlik katmanı çözümü sunan bir blokzincir ağı olarak kurulduğu günden bu yana sektörde önemli ilerlemeler kaydetti. 2025 yılı itibarıyla Celestia’nın piyasa değeri 1,41 milyar ABD dolarına ulaşırken, dolaşımdaki arz yaklaşık 778.332.411 TIA token’a çıktı ve birim fiyat 1,81 ABD doları civarında seyrediyor. “Veri erişilebilirliği yenilikçisi” unvanını taşıyan bu varlık, web3 geliştiricileri için ölçeklenebilirliğin ve verimliliğin artırılmasında gitgide daha merkezi bir rol üstleniyor.

Bu makalede, Celestia’nın 2025-2030 dönemi fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam ışığında kapsamlı biçimde ele alınacak; yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. TIA Fiyat Geçmişi ve Mevcut Piyasa Görünümü

TIA Fiyatının Tarihsel Seyri

- 2024: 10 Şubat’ta 21,129 ABD doları ile tüm zamanların zirvesine ulaşıldı

- 2025: Önemli bir düzeltme yaşandı, 22 Haziran’da 1,311 ABD doları ile taban fiyat görüldü

- 2025: Kademeli toparlanma evresine girildi, fiyatlar istikrar kazanıp üst banda yöneldi

TIA Güncel Piyasa Durumu

12 Eylül 2025 tarihi itibarıyla TIA 1,8076 ABD doları seviyesinden işlem görüyor ve küresel kripto para piyasasında 89. sırada yer alıyor. Son 24 saat içinde %2,05 artış sergileyen token’ın işlem hacmi 5.084.466,83 ABD doları. TIA’nın piyasa değeri 1.406.913.667 ABD dolarına ulaştı ve bu rakam kripto piyasasının toplam değerinin %0,048’ini oluşturuyor.

Mevcut seviye, tüm zamanların zirvesinin hayli altında; bu durum, piyasa koşullarının iyileşmesi halinde yukarı yönlü hareket potansiyeli taşıdığını gösteriyor. Buna karşın, yakın dönemde görülen en düşük fiyatın ise oldukça üzerinde seyretmesi, fiyat stabilitesinin ve yatırımcı güveninin kısmen korunduğuna işaret ediyor.

Kısa vadeli fiyat dinamikleri karmaşık bir görünüm sergiliyor:

- 1 saatlik değişim: +%0,19

- 24 saatlik değişim: +%2,05

- 7 günlük değişim: +%13,91

- 30 günlük değişim: -%4,26

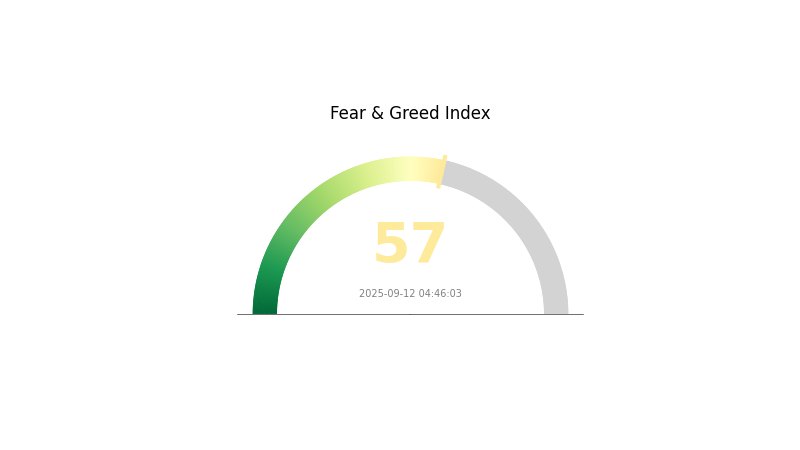

7 günlük pozitif performans, kısa vadede TIA’ya yönelik artan ilgiyi ortaya koyarken; 30 günlük negatif tablo, yatırımda dikkatli olunmasını gerektiriyor. Mevcut piyasa algısı “Açgözlülük” düzeyinde olup, VIX endeksi 57 değerinde; bu da yatırımcıların iyimser bir ruh haliyle hareket ettiğini gösteriyor.

Güncel TIA piyasa fiyatını görmek için tıklayın.

TIA Duyarlılık Göstergesi

12 Eylül 2025 Korku ve Açgözlülük Endeksi: 57 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın.

Kripto piyasasında önem kazanan Korku ve Açgözlülük Endeksi’nin 57 olması “Açgözlülük” seviyesinde bir yatırımcı duyarlılığına işaret ediyor. Bu da yatırımcı güveninin arttığını ve fiyatların potansiyel olarak yukarı yönlü hareket edebileceğini gösteriyor. Ancak aşırı iyimserlik fiyat balonları yaratabileceği için, yatırımcıların portföylerinde çeşitliliğe gitmeleri ve eldeki kârı korumak adına zararı durdur emirleri belirlemeleri önerilir. Kripto piyasasının yüksek oynaklığı göz önünde bulundurularak her yatırım öncesi detaylı analiz ve etkin risk yönetimi hayati önemdedir.

TIA Varlık Dağılımı

TIA için adres bazlı tutar ve dağılım verileri şu an erişilebilir değil, bu da yoğunlaşma analizinin kapsamını kısıtlıyor. Veri eksikliği; TIA’nın merkeziyet derecesini ve bunun piyasa yapısı ile fiyat oynaklığı üzerindeki olası etkilerini değerlendirmeye engel oluyor.

En büyük sahiplerin kimler olduğu ve dağılım oranları net olmadığı için token’ların çeşitli adreslere dağılımına dair net bir tablo çizilemiyor. Aynı şekilde verisizlik, olası piyasa manipülasyonunu ya da TIA’nın zincir üstü yapısal istikrarını analiz etmeyi de güçleştiriyor.

Söz konusu veriler bulunmadığından, yatırımcı ve analistler TIA’nın piyasa dinamikleri ve dağılımı konusunda daha güvenli bir perspektif elde edebilmek için ek kaynaklardan yararlanmalı ve temkinli yaklaşmalıdır.

Güncel TIA varlık dağılımı için tıklayın.

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. TIA’nın Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Kilit Açılması: Temmuz 2025’te Polychain Capital, elindeki toplam 62,5 milyon ABD doları değerindeki TIA’yı Celestia Foundation’a devretti.

- Tarihsel Eğilim: Geçmiş token kilit açılımları, fiyat üzerinde geçici satış baskısı oluşturdu.

- Mevcut Etki: Son büyük kilit açılımla birlikte arzda artış, kısa vadede TIA fiyatı üzerinde aşağı yönlü baskı yaratabilir.

Kurumsal ve Büyük Yatırımcı Etkisi

- Kurumsal Portföyler: Polychain Capital’dan gerçekleşen alım sonrasında Celestia Foundation, TIA token arzının önemli bölümünü kontrol etmeye başladı.

Makroekonomik Koşullar

- Enflasyon Korumalı Yatırım: TIA, bazı ekonomik ortamlarda enflasyona karşı korunma aracı olarak değerlendirilebilir.

Teknik Gelişim & Ekosistem Büyümesi

- Modüler Blokzincir Teknolojisi: Celestia’nın temel yaklaşımı, herkesin kendi zincirini kolayca başlatıp yönetmesini sağlamaktır.

- Ekosistem Uygulamaları: Geliştiriciler, TIA’yı gas token ve para birimi olarak kullanarak tıpkı Ethereum’un ETH’si gibi zincirlerini hızlıca ayağa kaldırabilirler.

- Yönetişim: TIA sahipleri, merkeziyetsiz yönetişime katılıp ağ parametrelerini değiştirme, ekosistem fonlamaları ve topluluk havuzu yönetimi gibi kararlarda rol alabilir.

III. TIA 2025-2030 Fiyat Tahmini

2025 Öngörüsü

- Ihtiyatlı senaryo: 1,08 - 1,50 ABD doları

- Tarafsız senaryo: 1,50 - 2,00 ABD doları

- İyimser senaryo: 2,00 - 2,43 ABD doları (olumlu piyasa algısı ve kayda değer proje gelişmeleri şartıyla)

2027 Orta Vadeli Görünüm

- Piyasa sürecinde: Artan benimsenmeyle birlikte büyüme aşaması potansiyeli

- Beklenen fiyat aralığı:

- 2026: 1,33 - 2,43 ABD doları

- 2027: 1,89 - 2,84 ABD doları

- Belirleyici faktörler: Ekosistemin genişlemesi, ileri teknoloji hamleleri ve piyasa trendleri

2030 Uzun Vadeli Öngörü

- Taban senaryo: 2,35 - 2,94 ABD doları (istikrarlı piyasa büyümesi ve düzenli proje ilerleyişi varsayımıyla)

- İyimser senaryo: 2,94 - 3,09 ABD doları (güçlü performans, yaygın benimsenme varsayımıyla)

- Dönüştürücü senaryo: 3,09 - 3,50 ABD doları (çığır açıcı inovasyon ve ana akıma entegrasyon durumunda)

- 31 Aralık 2030: TIA için 3,09 ABD doları (iyimser tahmine göre potansiyel tepe seviye)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 2,43162 | 1,8012 | 1,08072 | 0 |

| 2026 | 2,43387 | 2,11641 | 1,33334 | 17 |

| 2027 | 2,84393 | 2,27514 | 1,88837 | 25 |

| 2028 | 3,14823 | 2,55953 | 2,38037 | 41 |

| 2029 | 3,02511 | 2,85388 | 2,48288 | 57 |

| 2030 | 3,08647 | 2,9395 | 2,3516 | 62 |

IV. TIA İçin Profesyonel Yatırım Stratejisi ve Risk Yönetimi

TIA Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeye odaklanan yatırımcılar ve modüler blokzincir teknolojisine inananlar

- Uygulama önerileri:

- Piyasa düşüşlerinde TIA biriktirin

- Kısmi kar realizasyonu için hedef fiyatlar belirleyin

- Varlıklarınızı güvenli, saklama anahtarı sizde olan cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Kullanılabilecek teknik analiz araçları:

- Hareketli Ortalamalar: Trend tespitinde ve direnç/destek seviyelerinde yararlanın

- RSI (Relatif Güç Endeksi): Aşırı alım ve satım noktalarını belirlemek için kullanın

- Dalgalı al-sat için önemli noktalar:

- Celestia ağı güncellemeleri ve yeni iş birliklerini takip edin

- Kripto piyasasının genel duyarlılığını izleyin

TIA İçin Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10 arası

- Profesyonel yatırımcılar: Azami %15

(2) Riskten Koruma Seçenekleri

- Portföy çeşitliliği: Farklı blokzincir projelerine yayılmış yatırımlar

- Zararı durdur emirleri: Olası kayıpları sınırlandırmak için uygun seviyeler belirleyin

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi Celestia cüzdanı (varsa)

- Ek güvenlik: İki faktörlü kimlik doğrulama kullanın, kurtarma kelimelerini güvenli bir yerde saklayın

V. TIA’da Potansiyel Riskler ve Zorluklar

TIA Piyasa Riskleri

- Yüksek volatilite: TIA fiyatında sert dalgalanmalar görülebilir

- Rekabet: Diğer modüler blokzincir projeleri pazarda pay kazanabilir

- Benimsenme riski: Celestia teknolojisinin geliştirici ve kullanıcılarca yavaş adapte edilmesi

TIA Regülasyon Riskleri

- Bilinmeyen yasal ortam: Temel pazarlarda olumsuz regülasyon ihtimali

- Sınıflandırma sorunları: TIA bazı ülkelerde menkul kıymet olarak kabul edilebilir

- Uyum maliyetleri: Artan mevzuat, geliştirme sürecine ek maliyet getirebilir

TIA Teknik Riskleri

- Akıllı sözleşme açıkları: Celestia ağında olası saldırı riskleri

- Ölçeklenebilirlik sorunları: Ağ yükü arttıkça beklenmedik darboğazlar yaşayabilir

- İşlevsellik sorunları: Diğer blokzincir ekosistemleriyle entegrasyonda zorluklar yaşanabilir

VI. Sonuç ve Eylem Önerileri

TIA Yatırım Değeri Analizi

TIA, modüler blokzincir alanında uzun vadeli potansiyeli yüksek umut vadeden bir yatırım imkanı sunar. Ancak kısa vadeli sert fiyat dalgalanmaları ve regülasyon belirsizlikleri önemli risk oluşturuyor.

TIA İçin Yatırım Tavsiyeleri

✅ Yeni yatırımcılar: Küçük pozisyonlarla başlayıp, önce teknolojiyi anlamaya odaklanmalı ✅ Deneyimli yatırımcılar: Kendi risk toleranslarına göre portföyünün bir kısmını ayırabilir ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapmalı ve stratejik ortaklıkları göz önünde bulundurmalı

TIA İşlem Katılım Alternatifleri

- Spot alım-satım: TIA’yı Gate.com gibi güvenilir borsalarda satın alıp bekletme

- Staking: Ağa doğrulama desteği verip ödül kazanma (uygulanabiliyorsa)

- DeFi entegrasyonu: TIA ile merkeziyetsiz finans platformlarında işlem yapma fırsatları (erişilmeye başlandığında)

Kripto para yatırımları çok yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alamayacağınız parayla yatırım yapmayınız.

Sıkça Sorulan Sorular

TIA Coin’in Geleceği Var mı?

TIA Coin’in kayda değer bir potansiyeli bulunuyor. Son tahminler, önümüzdeki bir ay içinde 1,12 ABD doları seviyesinde işlem görebileceğini ve piyasa ilgisinin sürdüğünü gösteriyor. Gelecekteki performansı, kripto piyasası trendleriyle Web3 teknolojik gelişimlerine bağlı olarak şekillenecektir.

Celestia için 2030 Fiyat Tahmini Nedir?

Kapsamlı piyasa analizine göre, 2030 yılı Temmuz ayı ortasında Celestia’nın fiyatı 3,9919 euro düzeyine ulaşabilir.

TIA Coin Neden Düşüşte?

TIA coin, sektör genelindeki ayı trendi ve makroekonomik etkenler nedeniyle değer kaybetmiştir. Bu gerileme, piyasa algısındaki olumsuzluğun yatırımcı davranışlarına yansımasıdır.

TIA Coin’in Şu Ana Kadarki En Yüksek Fiyatı Nedir?

Piyasa verilerine göre TIA, son 24 saatte en yüksek 2,281 ABD dolarına ulaşmıştır.

Hedera (HBAR) 2025 Fiyat Analizi ve Yatırım Olanakları

Sui Fiyat Pazar Analizi ve 2025'te Uzun Vadeli Yatırım Potansiyeli

Amerika Partisi: White Paper Mantığı ve Gelecek Etkisi Üzerine Temel Analiz

Lark Davis Vs ZachXBT

Elon Musk'ın Doğum Günü ve Astrolojisi

2025 RENDER Fiyat Tahmini: Merkeziyetsiz Bulut Bilişim Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Polygon NFT'lerini güvenli şekilde saklamak için en etkili çözümler

Token Yakma Sürecini ve Kripto Para Birimi Üzerindeki Etkilerini Anlamak

Cüzdanınızın özel anahtarını güvenle yönetmeye yönelik stratejiler

DeFi'nin Kilidini Açmak: Flash Loan Arbitraj Fırsatlarına Kapsamlı Bir Rehber

Kripto para piyasalarında marjin işlemlerinde uzmanlaşmak