2025 SUPER Fiyat Tahmini: Dijital Varlık Ekosisteminde Piyasa Trendleri ve Yatırım Potansiyelinin Analizi

Giriş: SUPER’in Piyasa Konumu ve Yatırım Değeri

SuperFarm (SUPER), NFT çiftlikleriyle herhangi bir tokene fayda sunmak üzere tasarlanan zincirler arası bir DeFi protokolü olarak 2021’den bu yana önemli mesafe kat etti. 2025 itibarıyla SUPER’in piyasa değeri 339.657.022 $’ya ulaşırken, yaklaşık 628.412.622 adet dolaşımdaki token bulunuyor ve fiyatı 0,5405 $ seviyelerinde dalgalanıyor. “NFT Farming’in Öncüsü” olarak anılan bu varlık, DeFi ve NFT altyapısı alanında giderek daha önemli bir rol üstleniyor.

Bu makalede, SUPER’in 2025-2030 dönemindeki fiyat eğilimleri; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte detaylıca analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ile pratik yatırım stratejileri sunulacaktır.

I. SUPER Fiyat Geçmişi ve Güncel Piyasa Durumu

SUPER'in Tarihsel Fiyat Gelişimi

- 2021: 31 Mart’ta 4,72 $ ile tüm zamanların en yüksek seviyesi, belirgin fiyat artışı

- 2023: Piyasa düşüşü, 19 Ekim’de 0,07 $ ile dip seviye

- 2025: Kademeli toparlanma, fiyat 0,54 $ civarında dengelendi

SUPER Piyasa Durumu

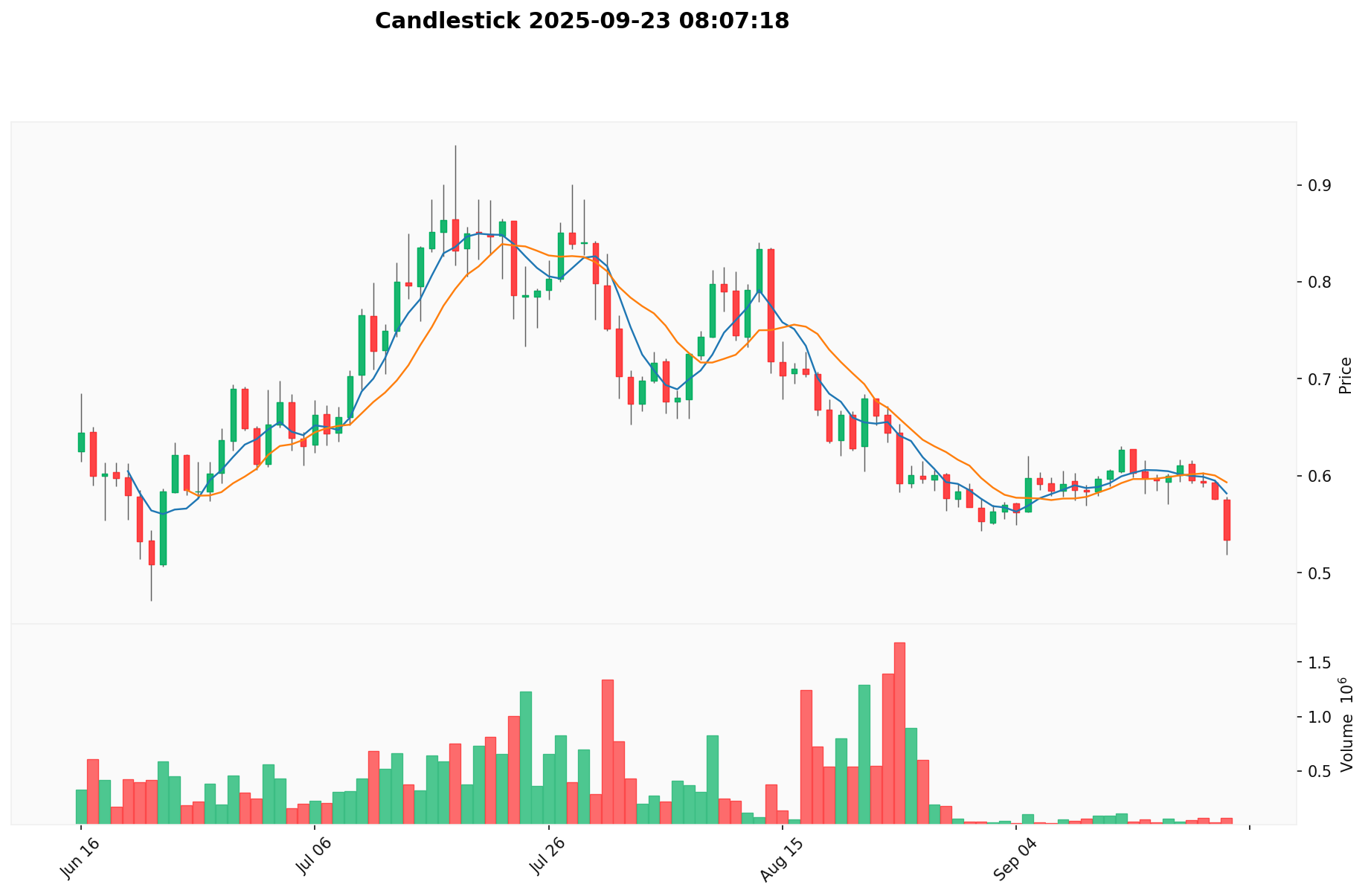

23 Eylül 2025 itibarıyla SUPER, 0,5405 $ seviyesinden işlem görüyor. Son 24 saatte %0,85 oranında sınırlı bir toparlanma gösterdi. Ancak, haftalık bazda %9,22 ve aylık bazda %16,56 düşüş yaşandı. Güncel piyasa değeri 339.657.022 $ ile SUPER, küresel kripto piyasasında 222. sıradadır. 24 saatlik işlem hacmi ise 20.637 $ seviyesindedir; bu da orta düzeyde bir piyasa aktivitesine işaret eder. Kısa vadeli kazançlara rağmen, SUPER bir yıl öncesine göre %41,81 geride olup piyasadaki genel düşüş eğilimini yansıtmaktadır.

Güncel SUPER piyasa fiyatını görüntülemek için tıklayın

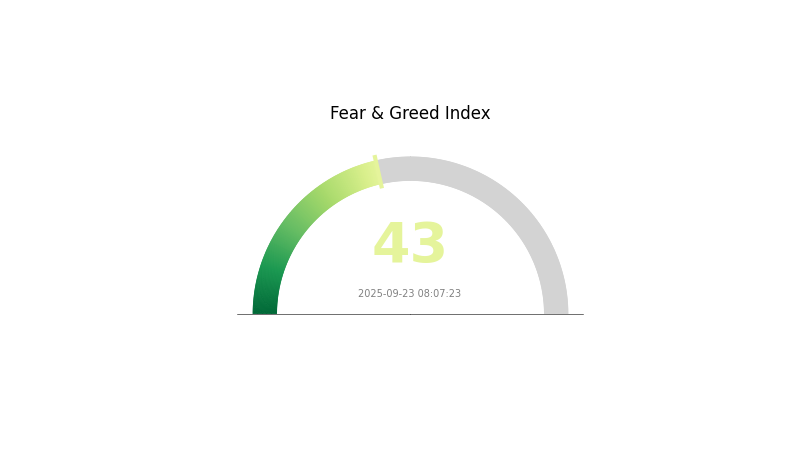

SUPER Piyasa Duyarlılığı Göstergesi

23 Eylül 2025 Korku ve Açgözlülük Endeksi: 43 (Korku)

Güncel Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasası duyarlılığı, 43 puandaki Korku ve Açgözlülük Endeksi ile temkinli kalmaktadır ve piyasada “korku” öne çıkmaktadır. Bu, yatırımcıların çekingen davrandığını ve büyük hareketler yapma konusunda isteksiz olabildiğini gösteriyor. Böyle dönemlerde, yatırımcıların güncel kalması ve fevri kararlar vermekten kaçınması büyük önem taşır. Unutmayın, “korku”nün hakim olduğu piyasalarda uzun vadeli bakış açısına sahip olanlar için fırsatlar doğabilir. Temel göstergeleri takip ederek yatırım kararlarınızı finansal danışmanlarla birlikte vermeniz önerilir.

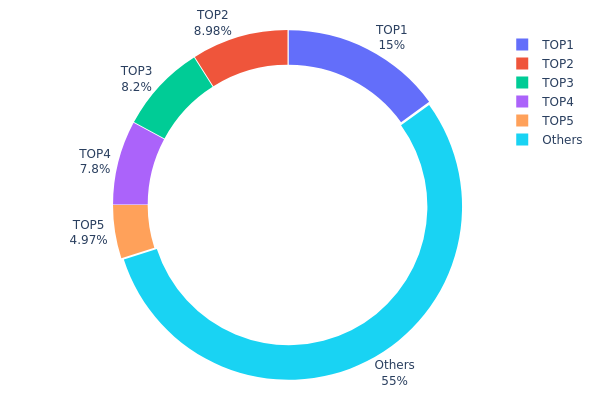

SUPER Token Varlık Dağılımı

SUPER’in adres bazlı varlık dağılımı, tokenların büyük kısmının az sayıda üst düzey adreste toplandığını göstermektedir. En büyük adres arzın %15,02’sini elinde bulundururken, ilk beş adres birlikte toplamda %44,96’lık paya sahiptir. Bu yüksek yoğunlaşma, SUPER ekosistemi içinde merkezileşme riskine işaret etmektedir.

Bu derecede yoğunlaşmış varlık dağılımı, piyasada belirgin dalgalanmalara yol açabilir. Özellikle büyük adreslerin satış veya transfer yapması, fiyatların ani dalgalanmasına neden olabilir. Ayrıca bu yoğunlaşma, büyük yatırımcıların piyasayı manipüle edebilme riskini de artırmaktadır.

Genel çerçevede, bu dağılım modeli; tokenin merkeziyetsizliği konusunda zayıf bir profil ortaya koymaktadır. Tokenların %55,04’ü ilk beş adres dışında tutulsa da, az sayıdaki adresin yüksek payı, tokenin yönetimi ve ekosistem istikrarını bu büyük yatırımcıların hareketlerine karşı savunmasız bırakmaktadır.

Güncel SUPER Varlık Dağılımını görüntüleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7226...250cb1 | 150.257,48K | 15,02% |

| 2 | 0x8c96...d0b887 | 89.797,14K | 8,97% |

| 3 | 0xbda1...3a4700 | 82.000,00K | 8,20% |

| 4 | 0xf6e4...2e14ca | 78.020,00K | 7,80% |

| 5 | 0x7080...ac3f2c | 49.720,80K | 4,97% |

| - | Diğerleri | 550.202,65K | 55,04% |

II. SUPER’in Gelecekteki Fiyatını Etkileyen Ana Faktörler

Arz Mekanizması

- Token Yakımı: SUPER, toplam arzı zamanla azaltmak için token yakma mekanizması uygular.

- Tarihsel Eğilim: Geçmiş token yakımları, dolaşımdaki arzı azalttığı için SUPER fiyatı üzerinde pozitif etki yaratmıştır.

- Güncel Etki: Devam eden token yakımının, talep sabit veya artarsa, SUPER fiyatında yukarı yönlü baskı oluşturmaya devam etmesi bekleniyor.

Teknolojik Gelişim ve Ekosistem İnşası

- Platform Güncellemeleri: SuperFarm, NFT oluşturma ve farming platformunda kullanıcı deneyimi ve işlevselliği artırmaya yönelik iyileştirmeler yapıyor.

- Ekosistem Uygulamaları: SuperFarm ekosistemi; NFT pazar yerleri, getiri farming ve zincirler arası NFT köprüleri içeriyor ve bu uygulamalar SUPER’in faydasını ve potansiyel değerini artırıyor.

III. 2025-2030 SUPER Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,39493 $ - 0,541 $

- Tarafsız tahmin: 0,541 $ - 0,57887 $

- İyimser tahmin: 0,57887 $ - 0,80631 $ (güçlü piyasa ivmesi ve artan benimseme varsayımıyla)

2027-2028 Görünümü

- Piyasanın büyüme aşamasına geçişiyle birlikte yüksek dalgalanma bekleniyor

- Fiyat tahmini:

- 2027: 0,62164 $ - 0,87439 $

- 2028: 0,75539 $ - 0,87221 $

- Başlıca tetikleyiciler: Teknolojik ilerleme, piyasa benimsenmesinde artış ve olası yeni iş ortaklıkları

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,82548 $ - 1,02773 $ (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 1,02773 $ - 1,22997 $ (hızlanan benimseme ve olumlu piyasa ortamında)

- Dönüştürücü senaryo: 1,22997 $ - 1,50 $ (çığır açıcı inovasyon ve yaygın entegrasyonla)

- 31 Aralık 2030: SUPER muhtemel zirve fiyatı 1,21272 $

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,57887 | 0,541 | 0,39493 | 0 |

| 2026 | 0,80631 | 0,55994 | 0,36396 | 3 |

| 2027 | 0,87439 | 0,68312 | 0,62164 | 26 |

| 2028 | 0,87221 | 0,77876 | 0,75539 | 44 |

| 2029 | 1,22997 | 0,82548 | 0,69341 | 52 |

| 2030 | 1,21272 | 1,02773 | 0,99689 | 90 |

IV. SUPER için Profesyonel Yatırım Stratejisi ve Risk Yönetimi

SUPER Yatırım Stratejileri

(1) Uzun vadeli tutma stratejisi

- Hedef yatırımcı: Uzun vadeli değer odaklılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde SUPER biriktirin

- 1-2 yıl boyunca dalgalanmayı göğüsleyerek bekleyin

- Tokenlarınızı donanım cüzdanında güvenle saklayın

(2) Aktif al-sat stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük MAlarla trend belirleyin

- RSI göstergesiyle aşırı alım/satım koşullarını takip edin

- Swing trade için anahtar noktalar:

- Kayıpları sınırlamak için stop-loss kullanın

- Belirlenmiş kar hedeflerinde satış yapın

SUPER Risk Yönetimi Çerçevesi

(1) Varlık dağılımı ilkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Atağı yüksek yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten korunma çözümleri

- Çeşitlendirme ile yatırımlarınızı farklı kripto varlıklara dağıtın

- Otomatik stop-loss ile potansiyel kayıpları sınırlayın

(3) Güvenli saklama yöntemleri

- Donanım cüzdanı: Gate Web3 Wallet önerilir

- Uzun vade için soğuk depolama: Kağıt cüzdan çözümü

- Güvenlik tedbirleri: 2FA aktif edin, özel anahtarları çevrimdışı saklayın ve phishing saldırılarına dikkat edin

V. SUPER için Potansiyel Riskler ve Zorluklar

Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasasına özgü keskin fiyat hareketleri

- Rekabet: Yeni NFT ve DeFi projeleri pazar payını etkileyebilir

- Likitide riski: Yetersiz hacim fiyat istikrarını bozabilir

Regülasyonel Riskler

- Belirsiz düzenleyici ortam: Kripto mevzuatındaki değişimler SUPER’in işleyişini etkileyebilir

- Uluslararası uyum: Farklı ülkelerin kuralları zorluk çıkarabilir

- Vergilendirme: Kripto varlıklara dair vergi politikalarının değişmesi

Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya siber saldırı olasılığı

- Ölçeklenebilirlik sorunları: Yoğun dönemlerde ağ tıkanıklığı

- Birlikte çalışabilirlik: Diğer blokzincirlerle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

SUPER'in Yatırım Değeri Değerlendirmesi

SUPER, NFT ve DeFi alanında uzun vadeli potansiyel sunsa da, kısa vadeli dalgalanma ve rakiplerle karşılaşabilir. Yatırımcılar, risk profillerini dikkatle gözden geçirmeli.

SUPER Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın; eğitime ve araştırmaya öncelik verin

✅ Deneyimli yatırımcılar: Dengeli portföy yaklaşımı ve düzenli DCA uygulayın

✅ Kurumsal yatırımcılar: Derinlemesine analiz yapın, stratejik işbirliklerini araştırın

SUPER'e Yatırım Yapma Yöntemleri

- Spot işlem: Gate.com üzerinden SUPER alım-satımı ve elde tutma

- Staking: SUPER staking programları ile pasif getiri elde etme

- NFT farming: SUPER NFT ekosisteminde ek fırsatları değerlendirme

Kripto para yatırımları çok yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Kendi risk seviyenizi göz önünde bulundurun ve profesyonel finansal danışmanlara başvurarak karar verin. Kaybetmeyi göze alabileceğinizden fazlasını kesinlikle yatırmayın.

Sıkça Sorulan Sorular

SuperRare coinleri yükselecek mi?

Evet, SuperRare coinlerinin değerinin artması muhtemeldir. NFT piyasasının büyümesiyle birlikte SuperRare’in dijital sanat pazarındaki özel konumu talep ve değeri artırabilir.

2030 yılı için XRP fiyat tahmini nedir?

Mevcut piyasa eğilimleri ve analizlere göre, artan benimseme ve finans sektöründeki ortaklıklar sayesinde XRP’nin fiyatı 2030’da 10-15 $ aralığına ulaşabilir.

SuperVerse’in riskleri nedir?

Büyük riskler; piyasa oynaklığı, regülasyonlarda değişim, akıllı sözleşme açıkları ve proje başarısızlığıdır. Yatırım öncesinde detaylı araştırma şarttır.

Siacoin'in geleceği için tahmin nedir?

Siacoin’in, merkeziyetsiz depolama çözümleri ve blockchain teknolojisinde ilerlemelerle birlikte 2026 yılına kadar 0,05-0,10 $ aralığına ulaşarak istikrarlı şekilde büyümesi beklenmektedir.

Dego Finance (DEGO) Yatırıma Değer mi?: NFT Oyun Ekosisteminde Olası Getiri ve Risklerin Değerlendirilmesi

Zora (ZORA) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyeli ve riskleri üzerine analiz

Story Network (IP) iyi bir yatırım mı?: Bu gelişmekte olan içerik platformunun potansiyelini analiz ediyoruz

MUSE ve LINK: Yaratıcı yazarlık alanında iki yenilikçi yapay zeka dil modelinin karşılaştırılması

NEXO ve FLOW: Dijital varlık yönetiminde iki yenilikçi blockchain platformunun karşılaştırılması

ThetaDrop (TDROP) iyi bir yatırım mı?: Bu NFT Platformu Tokeninin potansiyelini ve risklerini analiz etmek

Web3 ve dijital varlıklar alanında teknik bir platform

B2 Squared Network'i Keşfetmek: Blockchain Teknolojisine Kapsamlı Bir Rehber

2026 Altcoin Sezonu: Alım Satım Fırsatları ve Kâr Stratejileri

DApp'ler için etkili gelir stratejilerini keşfetmek