2025 SPX Fiyat Tahmini: S&P 500’ü Yeni Zirvelere Taşıyabilecek Temel Faktörler

Giriş: SPX'nin Piyasadaki Konumu ve Yatırım Değeri

SPX6900 (SPX), geleneksel finansı hicveden bir mizahi kripto para token’ı olarak piyasaya sürüldüğünden bu yana dikkat çekici bir gelişim sergilemiştir. 2025 yılı itibarıyla, SPX’nin piyasa değeri 1,32 milyar dolara ulaşmış, yaklaşık 931 milyon adet dolaşımdaki token’la fiyatı 1,41 dolar civarında seyretmektedir. “S&P 500'ün mizahi versiyonu” olarak anılan bu varlık, finansal nihilizme meydan okumak ve alternatif ekonomik modellere yönelik inancı teşvik etmek bakımından artan öneme sahip olmuştur.

Bu makalede, 2025-2030 dönemine ait SPX fiyat trendleri kapsamlı biçimde analiz edilerek; tarihsel eğilimler, piyasadaki arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önünde bulundurularak yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. SPX Fiyat Geçmişi ve Mevcut Piyasa Durumu

SPX Tarihsel Fiyat Gelişimi

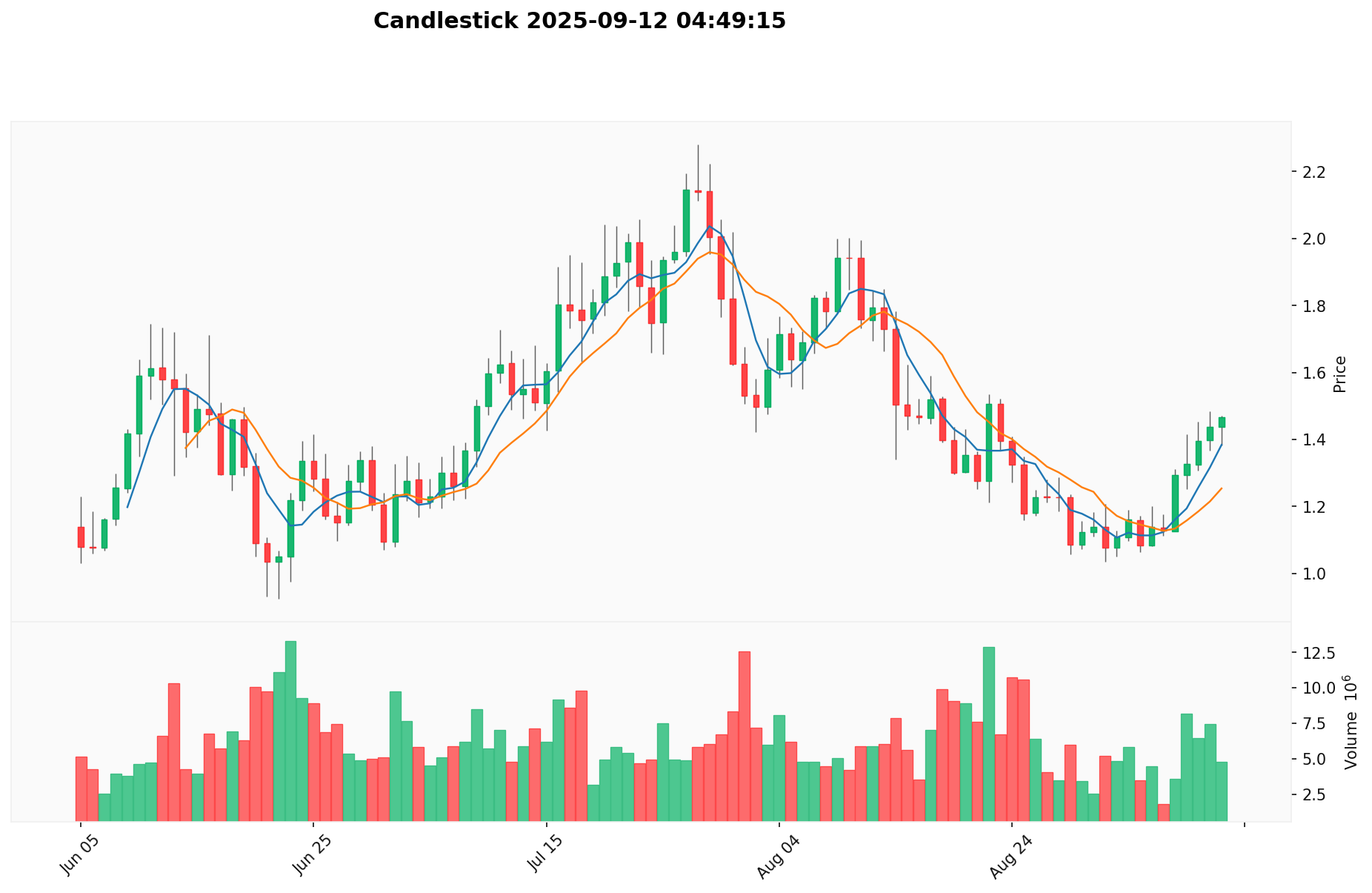

- Mart 2025: SPX, 0,2531 dolar ile tüm zamanların en düşük seviyesini görerek piyasaya giriş yaptı

- Temmuz 2025: SPX, kısa sürede önemli bir büyüme kaydederek 2,2811 dolar ile tarihi zirvesine ulaştı

- Eylül 2025: SPX, destek ve direnç seviyeleri arasında dalgalanarak konsolidasyon sürecine girdi

SPX Güncel Piyasa Durumu

12 Eylül 2025 itibarıyla SPX, 1,4127 dolardan alınıp satılmaktadır. Son 24 saatte %1,02’lik bir düşüş yaşayan token’ın işlem hacmi 6.780.673 dolar seviyesindedir. SPX’nin piyasa değeri 1.315.213.932 dolar olup, küresel kripto piyasasında 97. sıradadır. Mevcut fiyatı, tarihi zirvesine göre %38 düşüşte olmasına karşın, en düşük seviyesinin %458 üzerinde bulunuyor. Dolaşımdaki SPX miktarı ise 930.993.085 olup, bu rakam toplam arzın %93,1’ini oluşturmaktadır (toplam arz: 1 milyar token).

Kısa vadede SPX dalgalı bir seyir izlemektedir. Son bir saatte %0,27’lik hafif bir yükseliş yaşanırken, geçen hafta boyunca %27,93 artış görülmüştür. Ancak son 30 günün performansı %21,11’lik bir geri çekilme ile son dönem piyasadaki volatilitenin altını çizmiştir.

Uzun dönemde ise SPX, geçtiğimiz yıl içinde %12.401,96 gibi olağanüstü bir değer artışıyla yatırımcıların ve piyasanın büyük ilgisini çekmiştir.

Güncel SPX piyasa fiyatını görüntüleyin

SPX Piyasa Duyarlılık Göstergesi

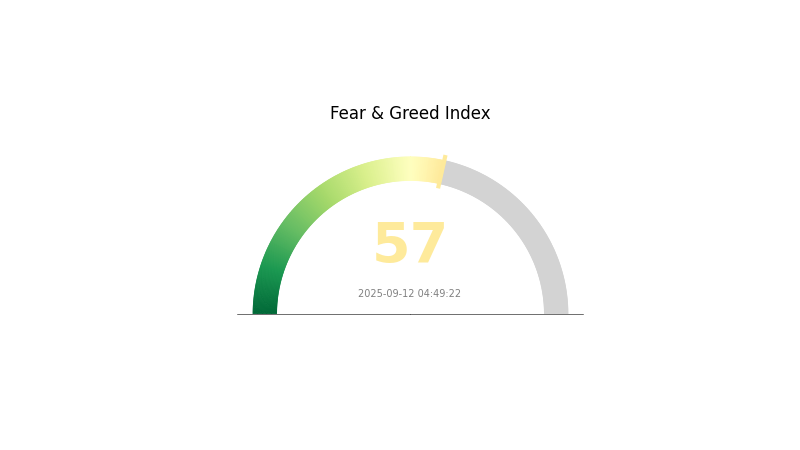

12 Eylül 2025 Korku ve Hırs Endeksi: 57 (Hırs)

Güncel Korku & Hırs Endeksi’ni görüntüleyin

Kripto piyasasının mevcut duyarlılığı hırs yönünde; Korku ve Hırs Endeksi 57 seviyesinde bulunuyor. Yatırımcı iyimserliğinin güçlenmesi fiyatlarda yükselişi tetikleyebilir. Bununla birlikte, aşırı hırs piyasa düzeltmelerine yol açabileceğinden dikkatli olmak önemlidir. Yatırımcılar portföylerini çeşitlendirerek ve zarar durdur emirleri belirleyerek kazançlarını koruyabilirler. Piyasa duyarlılığının hızla değişebileceğini unutmadan düzenli güncellemeleri takip etmek ve stratejiyi duruma göre revize etmek gereklidir.

SPX Varlık Dağılımı

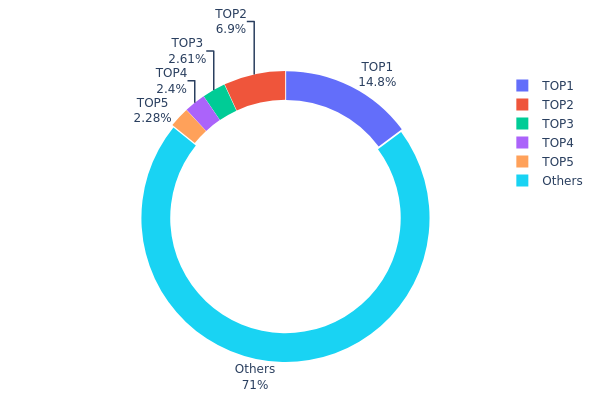

Adres varlık dağılımı verileri, SPX tokenlarının farklı cüzdan adreslerindeki yoğunlaşma düzeyini anlamaya yardımcı olur. Akıllı kontrat ve zincir verilerine bakıldığında, dağılımın görece orta derecede yoğunlaştığı görülüyor. En büyük adres toplam arzın %14,83’ünü elinde bulundururken, ilk beş adres toplamda %29’una hakimdir. Bu oran dikkat çekici olsa da aşırı merkeziyetçiliğe işaret etmez.

%71 oranındaki “Diğerleri” kategorisi, tokenların büyük çoğunluğunun daha küçük yatırımcılar arasında paylaşıldığına işaret etmektedir. Bu dağılım, piyasa stabilitesine olumlu yansıyabilirken, üst adreslerdeki yoğunluk yine de büyük işlemlerde fiyat volatilitesine yol açabilir.

Sonuç olarak, güncel SPX token yapısı, büyük paydaşlarla yaygın bir küçük yatırımcı kitlesi arasında dengeyi yansıtmaktadır. Bu yapı, piyasa manipülasyonuna karşı orta düzeyde direnç gösterirken, hacimli işlemler karşısında fiyat hassasiyetini tamamen ortadan kaldırmaz.

Güncel SPX Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x3ee1...8fa585 | 148.329,20K | 14,83% |

| 2 | 0x0000...00dead | 69.006,91K | 6,90% |

| 3 | 0xc06f...0b3370 | 26.090,05K | 2,60% |

| 4 | 0xf8f0...fc4002 | 24.000,01K | 2,40% |

| 5 | 0x07fd...45b557 | 22.763,28K | 2,27% |

| - | Diğerleri | 709.810,56K | 71% |

II. Gelecekteki SPX Fiyatlarını Etkileyen Temel Unsurlar

Arz Mekanizması

- Tarihsel Eğilim: Geçmişteki arz değişimleri fiyat hareketleri üzerinde kayda değer etkiler yaratmıştır

- Güncel Etki: Yakın dönemdeki arz değişimleri, fiyat trendlerini etkileyebilir

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Portföyler: Büyük kurumlar SPX’te güçlü pozisyonlar taşımaktadır

- Kurumsal Benimseme: Önde gelen şirketler SPX bağlantılı stratejilere ilgi göstermektedir

- Devlet Politikaları: SPX’i etkileyen ulusal düzeyde politika girişimleri gündemdedir

Makroekonomik Ortam

- Para Politikası Etkisi: Başlıca merkez bankalarının politikalarına yönelik beklentiler SPX’in görünümünü etkilemektedir

- Enflasyon Korumalı Özellikler: SPX, yüksek enflasyon ortamına karşı kısmen dayanıklılık göstermiştir

- Jeopolitik Gelişmeler: Uluslararası gelişmeler SPX piyasası üzerinde etkili olmaktadır

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zeka ve Yarı İletkenlerde İlerleme: AI ve çip teknolojilerindeki gelişmeler piyasa büyümesini desteklemektedir

- Ekosistem Uygulamaları: Öncü DApp’ler ve projeler SPX ekosisteminin olgunlaşmasına katkı sağlamaktadır

III. 2025-2030 SPX Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 1,0569 – 1,4092 dolar

- Nötr tahmin: 1,4092 – 1,45148 dolar

- İyimser tahmin: 1,45148 – 1,97387 dolar (güçlü piyasa desteği gerektirir)

2027-2028 Beklentisi

- Piyasa döngüsü: Potansiyel büyüme evresi

- Fiyat tahmini:

- 2027: 1,36168 – 2,24677 dolar

- 2028: 1,61904 – 2,626 dolar

- Kilit katalizörler: Yükselen benimseme ve teknolojik yenilikler

2030 Uzun Vadeli Beklenti

- Temel senaryo: 2,25399 – 2,74876 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 2,74876 – 3,82078 dolar (olumlu piyasa koşullarında)

- Dönüştürücü senaryo: 3,82078 doların üzerinde (aşırı olumlu piyasa gelişmeleri durumunda)

- 31 Aralık 2030: SPX 3,82078 dolar (olası tepe noktası)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Yıllık Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 1,45148 | 1,4092 | 1,0569 | 0 |

| 2026 | 1,97387 | 1,43034 | 1,05845 | 1 |

| 2027 | 2,24677 | 1,7021 | 1,36168 | 20 |

| 2028 | 2,626 | 1,97444 | 1,61904 | 39 |

| 2029 | 3,19731 | 2,30022 | 1,61015 | 62 |

| 2030 | 3,82078 | 2,74876 | 2,25399 | 94 |

IV. SPX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SPX Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Yüksek risk ve volatiliteye toleransı olan yatırımcılar için

- Öneriler:

- Piyasa düşüşlerinde SPX biriktirin

- Uzun vadeli fiyat hedefinizi belirleyin ve bu hedefe sadık kalın

- Token’ları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Göreli Güç Endeksi (RSI): Aşırı alım/satım noktalarını tespit edin

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış seviyelerini belirleyin

- Swing trade için kritik noktalar:

- Sosyal medya duyarlılığını yakından takip edin; mizahi token fiyatları üzerinde ciddi etkisi olabilir

- Zarar durdur emirlerini kesinlikle uygulayarak aşağı yönlü riskleri kontrol altında tutun

SPX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Tutucu yatırımcılar: Kripto portföyünün %1-2’si

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Risk profiline göre %15’e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Put opsiyonu kullanımı: Düşüş riskine karşı koruma sağlayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı: Güvenilir çoklu imzalı cüzdanları tercih edin

- Güvenlik adımları: İki faktörlü doğrulama, benzersiz şifreler ve özel anahtarların paylaşılmaması

V. SPX’e Yönelik Potansiyel Riskler ve Zorluklar

SPX Piyasa Riskleri

- Yoğun volatilite: Mizahi tokenlar keskin fiyat dalgalanmalarına açıktır

- Likidite riski: Stres dönemlerinde pozisyon kapatmak güçleşebilir

- Piyasa manipülasyonu: Pump-and-dump gibi spekülatif uygulamalara açık yapı

SPX Regülasyon Riskleri

- Bilinmez regülasyonlar: Ani yasal müdahaleler olasılığı

- Vergi yükümlülükleri: Değişen vergi mevzuatı kârlılığa etki edebilir

- Hukuki risk: Mizahi tokenlara karşı açılabilecek davalar

SPX Teknik Riskleri

- Akıllı sözleşme açıkları: Saldırı ve istismar riski

- Ağ yoğunluğu: Zirve dönemlerde yüksek ücretler ve yavaş işlemler

- Teknolojik geride kalma: Yenilikçi projeler karşısında değer kaybı riski

VI. Sonuç ve Eylem Önerileri

SPX Yatırım Değeri Değerlendirmesi

SPX6900; yüksek riskli, spekülatif bir varlıktır ve ciddi kazanç ihtimalinin yanında büyük kayıplara da yol açabilir. Uzun vadeli değer önerisi tartışmalı olup, kısa vadede mizahi yapısı ve piyasa oynaklığı nedeniyle önemli riskler barındırır.

SPX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyde çok düşük pay ile sınırlayın ya da uzak durun (en fazla %1)

✅ Tecrübeli yatırımcılar: Kısa vadeli al-sat fırsatları için düşük miktarlarda değerlendirin

✅ Kurumsal yatırımcılar: Sadece portföyde yüksek riskli kısım için ve aşırı temkinle yaklaşılmalıdır

SPX İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden SPX token alım-satımı

- Türevler: Vadeli sözleşmelerle kaldıraç kullanarak pozisyon açma (ileri düzey yatırımcılar için)

- Staking (kilitleme, likidite sağlama): Uygun ise likidite sağlama; fakat kalıcı kayıp riskini göz önünde bulundurun

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre hareket etmeli ve profesyonel finansal danışmanlık almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

SPX fiyat tahmini nedir?

Uzman analizlerine göre, SPX 2030 yılına kadar 0,07159284 dolara ve 2033’te 0,1373 dolara ulaşabilir. Güncel tahminler olumlu yöndedir.

2025 için SPX tahmini nedir?

Goldman Sachs, istikrarlı kar büyümesi ve ekonomik genişleme sayesinde SPX’in 2025’te 6.500 seviyesine çıkacağını öngörüyor.

SPX kripto para iyi bir yatırım mı?

SPX kripto para, blockchain yapısı sayesinde güvenliğe öncelik verir. Bu nedenle birçok yatırımcı tarafından güvenilir bulunur. Ancak yatırımın uygunluğu, yatırımcının risk toleransına bağlıdır.

2035’te SPX6900’ın fiyat tahmini nedir?

Yıllık %5 büyüme varsayımıyla, 2035’te SPX6900'ın öngörülen fiyatı 1,82 dolardır.

2025 PUFF Fiyat Tahmini: Kripto Para Yatırımcılarına Yönelik Stratejik Piyasa Analizi ve Öngörü

2025 GOHOME Fiyat Tahmini: Küresel Gayrimenkul Yatırım Trendlerine Yönelik Piyasa Analizi ve Gelecek Öngörüsü

2025 GIGGLE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 REKTCOIN Fiyat Tahmini: Kripto Vahşi Batısı’nda Dalgalanmayı Yönetmek

2025 HAPPY Fiyat Tahmini: Dijital Varlık Piyasa Trendlerinin ve Gelecek Perspektiflerinin Analizi

2025 SPX Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? Uzmanlar S&P 500'ün Geleceğine Dair Görüşlerini Paylaşıyor

LTC Nedir: Litecoin’in Teknolojisi, Kullanım Alanları ve Yatırım Potansiyeline Kapsamlı Bir Rehber

ZEC Nedir: Zcash ve Gizlilik Özelliklerinin Ayrıntılı İncelemesi

XLM nedir: Stellar Lumens ve sınır ötesi ödemelerdeki rolüne dair kapsamlı bir rehber

2025 HYPE Fiyat Tahmini: Uzman Analizi ve Bir Sonraki Boğa Koşusuna Yönelik Piyasa Öngörüsü

2025 WEETH Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yılın Piyasa Beklentileri