2025 SFP Price Prediction: Analyzing Market Trends, Ecosystem Growth and Investment Potential in the Evolving DeFi Landscape

Introduction: SFP's Market Position and Investment Value

SafePal (SFP), as a digital currency wallet designed for secure and user-friendly crypto asset management, has made significant strides since its inception in 2021. As of 2025, SafePal's market capitalization has reached $225,400,000, with a circulating supply of approximately 500,000,000 tokens, and a price hovering around $0.4508. This asset, often referred to as the "secure crypto management solution," is playing an increasingly crucial role in the fields of digital asset storage, management, and trading.

This article will provide a comprehensive analysis of SafePal's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SFP Price History Review and Current Market Status

SFP Historical Price Evolution Trajectory

- 2021: Initial launch, price reached all-time high of $4.19 on February 10

- 2022: Market downturn, price dropped to all-time low of $0.269235 on June 14

- 2025: Gradual recovery, price currently at $0.4508

SFP Current Market Situation

As of September 24, 2025, SFP is trading at $0.4508, with a 24-hour trading volume of $12,901.18. The token has shown a 1.64% increase in the last 24 hours. SFP's market cap stands at $225,400,000, ranking it 273rd in the overall cryptocurrency market. The circulating supply is 500,000,000 SFP, which is also the total and maximum supply. The token's price is currently 89.24% below its all-time high and 67.43% above its all-time low. In the past year, SFP has experienced a significant decline of 40.33%, reflecting the broader market trends and challenges faced by the crypto industry.

Click to view the current SFP market price

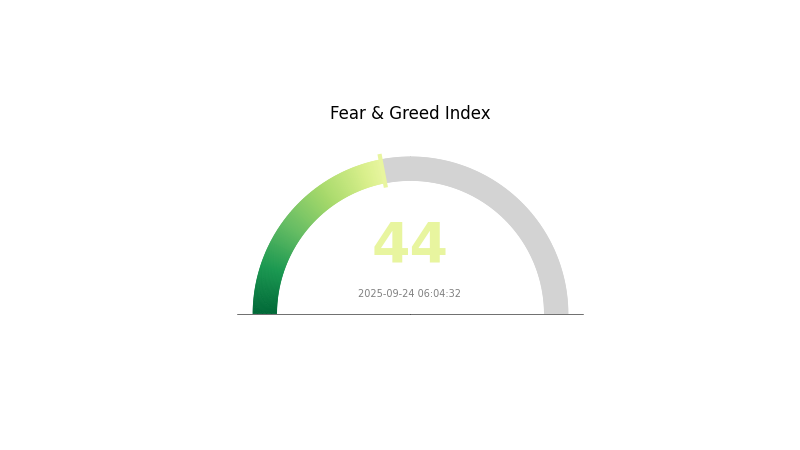

SFP Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 44, indicating a fearful outlook. This suggests investors are hesitant and risk-averse, potentially leading to selling pressure. However, contrarian investors might view this as a buying opportunity, following the adage "be greedy when others are fearful." Traders should exercise caution and conduct thorough research before making any decisions in this uncertain climate.

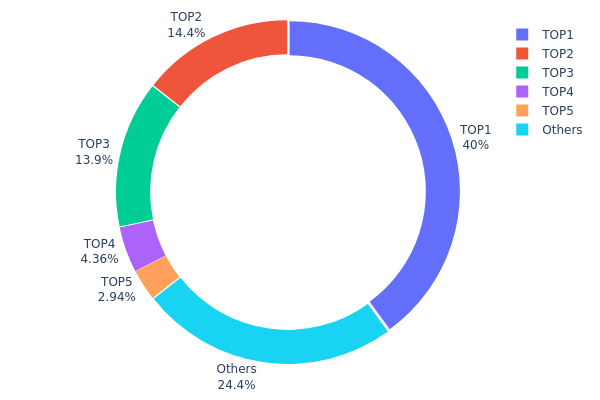

SFP Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of SFP tokens across various wallet addresses. Analysis of this data reveals a highly centralized distribution pattern for SFP. The top address, likely a burn or contract address (0x0000...00dead), holds 40% of the total supply, effectively removing a significant portion from circulation. The next four largest addresses collectively control 35.55% of the supply, with the second and third largest holders each possessing over 13% of tokens.

This concentration raises concerns about market stability and potential price manipulation. With approximately 75.55% of SFP tokens held by just five addresses, the market is susceptible to large price swings should any of these major holders decide to sell or transfer their holdings. Such a centralized distribution also impacts the token's decentralization ethos, as a small number of entities have significant influence over the SFP ecosystem.

The current distribution structure suggests a relatively immature market for SFP, with limited widespread adoption among retail investors. This concentration could lead to increased volatility and susceptibility to whale movements, potentially deterring new investors concerned about market fairness and stability.

Click to view the current SFP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 200000.00K | 40.00% |

| 2 | 0x5a52...70efcb | 71948.23K | 14.38% |

| 3 | 0xf977...41acec | 69445.30K | 13.88% |

| 4 | 0x4928...33ccfc | 21780.74K | 4.35% |

| 5 | 0x9182...176ba8 | 14700.73K | 2.94% |

| - | Others | 122124.99K | 24.45% |

II. Key Factors Affecting SFP's Future Price

Supply Mechanism

- Scarcity: SFP's total supply and issuance mechanism ensure its scarcity, which is a crucial factor influencing its value.

- Historical Patterns: Scarcity has historically helped maintain SFP's market value.

- Current Impact: The limited supply is expected to continue supporting SFP's price in the future.

Technical Development and Ecosystem Building

- Ecosystem Applications: SFP is associated with SafePal, a hardware wallet provider, which contributes to its ecosystem development.

III. SFP Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.34 - $0.40

- Neutral forecast: $0.40 - $0.48

- Optimistic forecast: $0.48 - $0.52 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.30 - $0.66

- 2028: $0.54 - $0.83

- Key catalysts: Broader crypto market recovery, increased adoption of SFP technology

2029-2030 Long-term Outlook

- Base scenario: $0.70 - $0.80 (assuming steady market growth)

- Optimistic scenario: $0.80 - $0.85 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.85 - $0.90 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: SFP $0.7893 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.52003 | 0.4522 | 0.34367 | 0 |

| 2026 | 0.6757 | 0.48612 | 0.45209 | 7 |

| 2027 | 0.66223 | 0.58091 | 0.30788 | 28 |

| 2028 | 0.82669 | 0.62157 | 0.54698 | 37 |

| 2029 | 0.85447 | 0.72413 | 0.70241 | 60 |

| 2030 | 0.85245 | 0.7893 | 0.51305 | 75 |

IV. Professional Investment Strategies and Risk Management for SFP

SFP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the SafePal ecosystem

- Operation suggestions:

- Accumulate SFP tokens during market dips

- Stake SFP tokens to earn rewards through SafePal Earn program

- Store tokens securely in hardware wallets or reputable software wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor SafePal ecosystem developments for potential price catalysts

SFP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: SafePal S1 hardware wallet

- Software wallet option: SafePal mobile app

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for SFP

SFP Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price swings

- Competition: Increasing competition in the hardware and software wallet space

- Market sentiment: Broader crypto market trends can impact SFP's price

SFP Regulatory Risks

- Regulatory uncertainty: Changing regulations may affect SafePal's operations or SFP's utility

- Compliance requirements: Potential need for additional compliance measures in different jurisdictions

- Cross-border restrictions: Possible limitations on international transactions or token transfers

SFP Technical Risks

- Smart contract vulnerabilities: Potential exploits in the SFP token contract

- Blockchain scalability: Limitations of the underlying blockchain could affect transaction speeds

- Cybersecurity threats: Potential hacks or security breaches of the SafePal ecosystem

VI. Conclusion and Action Recommendations

SFP Investment Value Assessment

SFP presents a unique investment opportunity in the crypto wallet and asset management sector. Long-term value is supported by SafePal's growing ecosystem and partnerships, while short-term risks include market volatility and regulatory uncertainties.

SFP Investment Recommendations

✅ Beginners: Start with a small position, focus on learning about the SafePal ecosystem

✅ Experienced investors: Consider a moderate allocation, actively participate in staking and governance

✅ Institutional investors: Evaluate SFP as part of a diversified crypto portfolio, monitor ecosystem growth

SFP Trading Participation Methods

- Spot trading: Buy and sell SFP tokens on Gate.com

- Staking: Participate in SafePal Earn program for additional rewards

- Governance: Engage in community proposals and voting to shape SafePal's future

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for SFP?

The prediction for SFP is $0.4599 for tomorrow, with a short-term forecast ranging between $0.4591 and $0.4691 as of 2025-09-24.

What is the price target for SFP?

Based on recent market analysis, the price target for SFP is $0.4612 as of 2025-09-24.

What is the price prediction for crypto in 2025?

Based on analyst forecasts, Bitcoin's price in 2025 is expected to range from $117,000 to $124,500, with a potential ROI of 10.2%.

What is the price prediction for tensor crypto in 2030?

Based on current trends, Tensor crypto is predicted to reach around $1.05 by early 2030, with potential fluctuations between $1.02 and $1.05 throughout the year.

Share

Content