2025 QTUM Price Prediction: Analyzing Growth Potential and Market Factors for the Smart Contract Platform

Introduction: QTUM's Market Position and Investment Value

Qtum (QTUM), as a blockchain platform combining Bitcoin's security and Ethereum's flexibility, has made significant strides since its inception in 2017. As of 2025, Qtum's market capitalization has reached $228,574,941.12, with a circulating supply of approximately 105,821,732 coins, and a price hovering around $2.16. This asset, often referred to as the "bridge between Bitcoin and Ethereum," is playing an increasingly crucial role in decentralized application development and enterprise blockchain solutions.

This article will provide a comprehensive analysis of Qtum's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. QTUM Price History Review and Current Market Status

QTUM Historical Price Evolution

- 2017: QTUM launched, price surged from $0.2941 to over $10

- 2018: Bull market peak, QTUM reached all-time high of $100.22 on January 6

- 2020: Market downturn, price dropped to all-time low of $0.783142 on March 13

- 2021: Recovery period, QTUM price rebounded significantly

- 2022-2025: Price fluctuations amid broader crypto market cycles

QTUM Current Market Situation

As of September 24, 2025, QTUM is trading at $2.16. The token has experienced a slight decline of 0.36% in the past 24 hours, with a trading volume of $27,367.32. QTUM's market capitalization stands at $228,574,941.12, ranking it 271st in the global cryptocurrency market.

The current price represents a significant drop from its all-time high, with QTUM currently trading at about 2.15% of its peak value. However, it remains well above its all-time low, showing a 175.81% increase from that point.

Short-term price trends show mixed signals. While QTUM has gained 0.61% in the last hour, it has declined by 10.52% over the past week and 32.9% over the last month. The year-to-date performance shows a 14.79% decrease.

QTUM's circulating supply is 105,821,732 tokens, which is 98.14% of its total supply of 107,822,406 QTUM. This high circulation ratio indicates that most of the tokens are already in the market.

Click to view the current QTUM market price

Here's the formatted output based on your request:

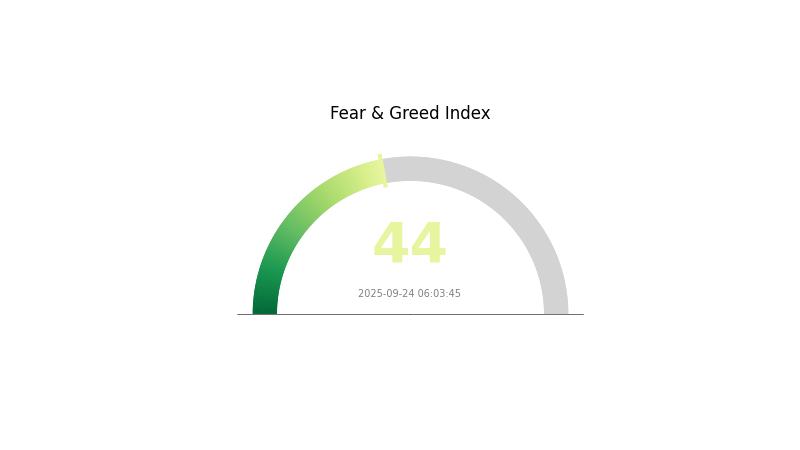

QTUM Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a state of fear, with the Fear and Greed Index at 44. This sentiment often indicates that investors are cautious and may be looking for buying opportunities. QTUM traders should remain vigilant, as fear can lead to overselling, potentially creating favorable entry points. However, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions. Stay informed and monitor market trends closely on Gate.com for the latest QTUM updates and trading opportunities.

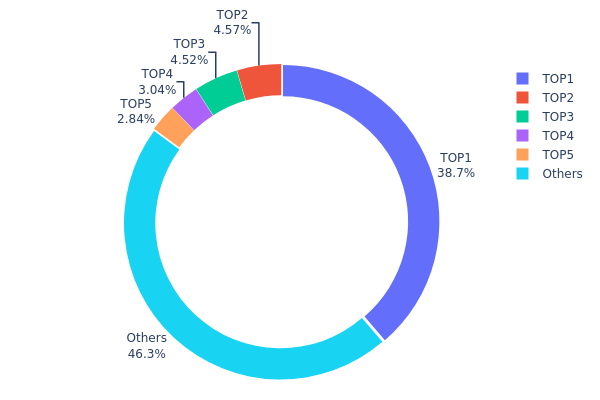

QTUM Holdings Distribution

The address holdings distribution data for QTUM reveals a significant concentration of tokens in a few top addresses. The top address holds 38.70% of the total supply, with 40,960,780 QTUM tokens. The subsequent four largest addresses collectively hold 14.95% of the supply. This high concentration suggests potential centralization risks within the QTUM network.

Such a distribution pattern raises concerns about market stability and vulnerability to large-scale movements. The dominant position of the top address could potentially influence market dynamics and price volatility. However, it's worth noting that 46.35% of the tokens are distributed among numerous smaller holders, which provides some level of decentralization and may help mitigate risks associated with excessive concentration.

This current distribution reflects a mixed market structure for QTUM, with elements of both centralization and wider distribution. While the high concentration in top addresses may pose challenges to overall network resilience, the substantial portion held by smaller addresses suggests an active and diverse user base, which is crucial for long-term ecosystem health and adoption.

Click to view the current QTUM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | QcUXa8...Z7ra3q | 40960.78K | 38.70% |

| 2 | MUi5ZH...ACyyfU | 4831.93K | 4.56% |

| 3 | QMzeaq...NuhT6r | 4786.77K | 4.52% |

| 4 | qc1qx2...p7e7hn | 3220.38K | 3.04% |

| 5 | Qe8gvA...ybB6VH | 3001.49K | 2.83% |

| - | Others | 49019.97K | 46.35% |

II. Key Factors Affecting QTUM's Future Price

Supply Mechanism

- Proof-of-Stake (PoS): QTUM uses a custom PoS variant with "offline staking" feature, allowing non-custodial addresses to be delegated to online "super stakers".

- Current Impact: The PoS mechanism ensures fair distribution of block rewards and low inflation, potentially supporting long-term price stability.

Institutional and Whale Dynamics

- Enterprise Adoption: QTUM has established partnerships with popular Chinese video portal websites, expanding its reach and scale.

Macroeconomic Environment

- Hedge Against Inflation: As a cryptocurrency, QTUM may be viewed as a potential hedge against inflation in traditional financial markets.

Technological Development and Ecosystem Building

- Account Abstraction Layer: QTUM combines Ethereum's smart contract functionality with Bitcoin's UTXO accounting system through this innovative technology.

- Improved PoS: QTUM has implemented PoS 3.0, which allows for even small stakeholders to participate in consensus.

- Ecosystem Applications: QTUM supports highly secure decentralized applications (DApps) and has interesting projects, including a blockchain-based satellite system launched in collaboration with Space Chain.

III. QTUM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.66 - $2.00

- Neutral prediction: $2.00 - $2.16

- Optimistic prediction: $2.16 - $2.23 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $1.83 - $3.28

- 2028: $1.45 - $3.99

- Key catalysts: Technological advancements, wider adoption, and overall crypto market trends

2030 Long-term Outlook

- Base scenario: $3.93 - $4.22 (assuming steady growth and adoption)

- Optimistic scenario: $4.22 - $5.92 (assuming strong market performance and QTUM ecosystem expansion)

- Transformative scenario: $5.92+ (extreme favorable conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: QTUM $4.22 (95% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.23098 | 2.166 | 1.66782 | 0 |

| 2026 | 2.63819 | 2.19849 | 1.86872 | 1 |

| 2027 | 3.28894 | 2.41834 | 1.83794 | 11 |

| 2028 | 3.9951 | 2.85364 | 1.45536 | 32 |

| 2029 | 5.03382 | 3.42437 | 1.91765 | 58 |

| 2030 | 5.92073 | 4.22909 | 3.93306 | 95 |

IV. QTUM Professional Investment Strategies and Risk Management

QTUM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in QTUM technology

- Operation suggestions:

- Accumulate QTUM during market dips

- Stay informed about project developments and technological upgrades

- Store QTUM in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Helps in identifying overbought and oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage risk

QTUM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Official QTUM wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for QTUM

QTUM Market Risks

- Volatility: Cryptocurrency markets are known for high price fluctuations

- Competition: Other smart contract platforms may outperform QTUM

- Liquidity: Lower trading volumes compared to top cryptocurrencies

QTUM Regulatory Risks

- Global regulatory uncertainty: Changing regulations may impact QTUM's adoption

- Compliance challenges: Potential difficulties in adhering to evolving regulatory requirements

- Legal status: Risk of being classified as a security in some jurisdictions

QTUM Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the code

- Scalability issues: Challenges in handling increased transaction volumes

- Consensus mechanism failures: Potential issues with the proof-of-stake system

VI. Conclusion and Action Recommendations

QTUM Investment Value Assessment

QTUM presents a unique value proposition by combining Bitcoin's UTXO model with Ethereum's smart contract functionality. While it offers long-term potential in the blockchain space, investors should be aware of short-term volatility and competition from other smart contract platforms.

QTUM Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading

✅ Institutional investors: Evaluate QTUM as part of a diversified crypto portfolio, focusing on its technological advancements

QTUM Trading Participation Methods

- Spot trading: Buy and sell QTUM on Gate.com

- Staking: Participate in QTUM's proof-of-stake system for passive income

- DApp interaction: Engage with QTUM-based decentralized applications to understand the ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will QTUM stock go?

QTUM is projected to reach up to $244.70 by 2045, with analysts forecasting a potential 165.82% increase from its current price.

Does QTUM have a future?

Yes, QTUM has a promising future. Forecasts predict a 4.6% value increase, reaching $2.28 by September 2025, indicating potential for growth and continued relevance in the crypto market.

Is QTUM ETF a good buy?

QTUM ETF shows positive buy signals from short and long-term averages, suggesting a favorable short-term outlook. With a price of $94.08 as of August 2025, it appears to be a promising investment opportunity.

What is the price prediction for quantum coin in 2025?

Based on technical analysis, QuantumCoin is predicted to reach a minimum price of $0.0000012422656 in 2025.

Share

Content