2025 PYUSDPrice Prediction: Market Trends and Future Outlook for PayPal's Stablecoin

Introduction: PYUSD's Market Position and Investment Value

PayPal USD (PYUSD) as a stablecoin designed for payment opportunities, has made significant contributions to the digital payments landscape since its launch. As of 2025, PYUSD's market capitalization has reached $1.35 billion, with a circulating supply of approximately 1.35 billion tokens, maintaining a price close to $0.9995. This asset, known as the "PayPal-backed stablecoin," is playing an increasingly crucial role in facilitating digital transactions and providing a stable store of value in the cryptocurrency ecosystem.

This article will provide a comprehensive analysis of PYUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PYUSD Price History Review and Current Market Status

PYUSD Historical Price Evolution

- 2023: PYUSD launched, price initially fluctuated between $0.833 and $1.2

- 2024: Steady growth in adoption, price stabilized around $1

- 2025: Increased market acceptance, price maintained close to $1 peg

PYUSD Current Market Situation

As of September 12, 2025, PYUSD is trading at $0.9995, maintaining its peg to the US dollar with minimal deviation. The 24-hour trading volume stands at $644.34, indicating moderate liquidity for a stablecoin. PYUSD's market capitalization is $1,347,984,805, ranking it 94th among all cryptocurrencies.

The coin's all-time high of $1.2 was reached on September 12, 2023, while its all-time low of $0.833 occurred on August 22, 2023. Over the past year, PYUSD has shown remarkable stability, with a slight positive price change of 0.069%.

The circulating supply of 1,348,659,134.84973 PYUSD tokens represents 139.38% of the total supply, which is unusual for a stablecoin and may warrant further investigation. The fully diluted market cap is $967,131,057.56750, indicating potential for further growth.

Click to view the current PYUSD market price

PYUSD Market Sentiment Indicator

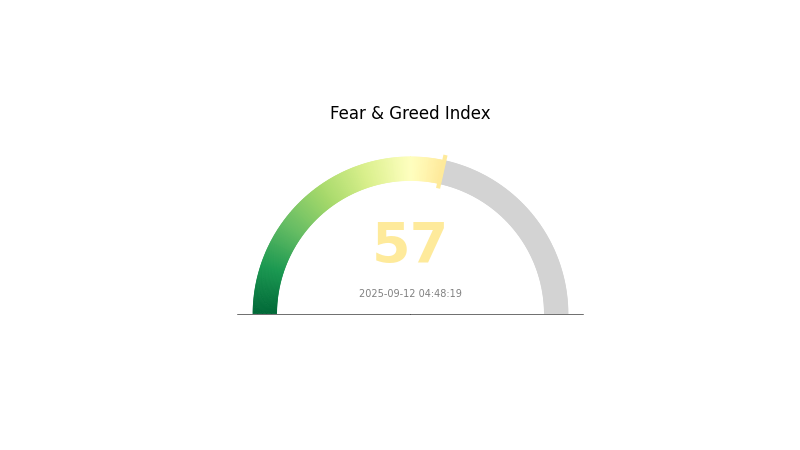

2025-09-12 Fear and Greed Index: 57 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of optimism as the Fear and Greed Index reaches 57, indicating a sentiment of greed. This suggests that investors are becoming more confident and potentially seeking higher-risk opportunities. However, it's crucial to remain cautious and avoid making impulsive decisions based solely on market sentiment. As always, thorough research and risk management are essential when navigating the volatile crypto landscape. Keep an eye on key indicators and stay informed about market trends to make well-informed investment choices.

PYUSD Holdings Distribution

The address holdings distribution data for PYUSD reveals a significant concentration among top holders. The top address holds 24.02% of the total supply, while the top 5 addresses collectively control 55.09% of PYUSD tokens. This high concentration suggests a relatively centralized distribution, which could potentially impact market dynamics.

Such a concentrated distribution may lead to increased volatility and susceptibility to price manipulation. Large holders, often referred to as "whales," have the capacity to influence market movements through significant buy or sell orders. However, it's worth noting that 44.91% of PYUSD tokens are distributed among other addresses, indicating some level of wider adoption and circulation.

This current distribution pattern reflects a market structure that is still maturing. While the high concentration in top addresses may raise concerns about market stability, the presence of a substantial "Others" category suggests an ongoing process of decentralization. As the token ecosystem evolves, monitoring changes in this distribution will be crucial for assessing PYUSD's long-term sustainability and market health.

Click to view the current PYUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 65049.43K | 24.02% |

| 2 | 5stwKM...vudFde | 24971.00K | 9.22% |

| 3 | HwDX5e...4cEMGE | 20000.00K | 7.38% |

| 4 | HgTWrW...3tCx6Q | 20000.00K | 7.38% |

| 5 | 22Wnk8...h7zkBa | 19220.51K | 7.09% |

| - | Others | 121533.04K | 44.91% |

II. Key Factors Affecting PYUSD's Future Price

Supply Mechanism

- Fiat-backed reserves: PYUSD is backed by cash equivalents and short-term U.S. Treasury bills

- Historical patterns: Stable supply due to 1:1 USD backing

- Current impact: Consistent supply maintains price stability around $1

Institutional and Whale Activities

- Institutional holdings: PayPal holds significant reserves to back PYUSD

- Corporate adoption: Gucci accepts PYUSD payments in select stores since 2022

- Government policies: U.S. Congress considering GENIUS Act for stablecoin regulation

Macroeconomic Environment

- Monetary policy impact: Federal Reserve policies on interest rates affect PYUSD demand

- Inflation hedge properties: PYUSD serves as a dollar-pegged inflation hedge in emerging markets

- Geopolitical factors: International sanctions drive PYUSD adoption for cross-border payments

Technological Development and Ecosystem Building

- Stellar blockchain integration: Enhances cross-border payment capabilities and reduces transaction costs

- Integration with PayPal's Xoom: Improves international remittance services

- Ecosystem applications: Implemented in PayPal and Venmo P2P transfers and third-party wallet payments

III. PYUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.86957 - $0.9995

- Neutral forecast: $0.9995 - $1.1045

- Optimistic forecast: $1.1045 - $1.2094 (requires increased adoption and market stability)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $1.08899 - $1.42209

- 2028: $0.85152 - $1.93282

- Key catalysts: Wider institutional adoption, regulatory clarity, and technological advancements in the stablecoin sector

2029-2030 Long-term Outlook

- Base scenario: $1.64222 - $1.93782 (assuming steady market growth and adoption)

- Optimistic scenario: $1.93782 - $2.23342 (assuming favorable regulatory environment and increased global usage)

- Transformative scenario: $2.23342 - $2.48041 (assuming revolutionary developments in the stablecoin ecosystem)

- 2030-12-31: PYUSD $1.93782 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.2094 | 0.9995 | 0.86957 | 0 |

| 2026 | 1.45787 | 1.10445 | 1.06027 | 10 |

| 2027 | 1.42209 | 1.28116 | 1.08899 | 28 |

| 2028 | 1.93282 | 1.35162 | 0.85152 | 35 |

| 2029 | 2.23342 | 1.64222 | 1.14956 | 64 |

| 2030 | 2.48041 | 1.93782 | 1.08518 | 93 |

IV. PYUSD Professional Investment Strategies and Risk Management

PYUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Gradually accumulate PYUSD during market dips

- Set up automatic monthly purchases to average out costs

- Store in secure wallets with multi-factor authentication

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- Relative Strength Index (RSI): Use for overbought/oversold conditions

- Key points for swing trading:

- Monitor PYUSD/USD peg stability

- Track overall stablecoin market trends

PYUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Aggressive investors: 15-20% of portfolio

- Professional investors: Up to 30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Balance PYUSD with other stablecoins and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable multi-signature wallets

- Security precautions: Enable 2FA, use unique passwords, and regularly update software

V. PYUSD Potential Risks and Challenges

PYUSD Market Risks

- Peg stability: Fluctuations in the 1:1 USD peg

- Liquidity risk: Potential difficulties in large-scale redemptions

- Competition: Pressure from other established stablecoins

PYUSD Regulatory Risks

- Changing stablecoin regulations: Potential impact on operations

- Cross-border transaction limitations: Possible restrictions in certain jurisdictions

- Compliance requirements: Evolving KYC/AML standards

PYUSD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Centralization concerns: Reliance on PayPal and Paxos infrastructure

- Blockchain network issues: Scalability and transaction speed limitations

VI. Conclusion and Action Recommendations

PYUSD Investment Value Assessment

PYUSD offers a stable digital asset backed by a major financial institution, providing potential for widespread adoption in digital payments. However, investors should remain cautious due to regulatory uncertainties and the evolving stablecoin landscape.

PYUSD Investment Recommendations

✅ Beginners: Start with small allocations and focus on learning about stablecoin mechanics

✅ Experienced investors: Consider PYUSD for portfolio diversification and as a hedge against crypto volatility

✅ Institutional investors: Explore PYUSD for treasury management and as a potential bridge to traditional finance

PYUSD Trading Participation Methods

- Spot trading: Buy and sell PYUSD on Gate.com

- DeFi integration: Utilize PYUSD in decentralized finance protocols (when available)

- Payment usage: Adopt PYUSD for digital transactions within supported ecosystems

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is pyusd a good investment?

PYUSD shows promise as an investment. By 2025, it's projected to reach an average price of $0.99986353, indicating potential growth. The stable value and backing by PayPal make it an attractive option for investors seeking reliability in the crypto market.

Will PayPal USD go up in value?

Yes, PayPal USD is expected to slightly increase in value. By the end of 2025, it's projected to reach $0.9995, representing a 0.04% rise.

How much is Pyusd worth today?

As of 2025-09-12, Pyusd is worth $1.00. The price has remained stable, maintaining its peg to the US dollar.

What will PayPal be worth in 2030?

PayPal is projected to be worth $20.89 on average in 2030, with potential highs of $41.74 and lows of $0.0403, based on current market trends and forecasts.

Share

Content