2025 OP Fiyat Tahmini: Optimism’in Layer 2 (Katman 2) Ölçekleme Çözümlerindeki Uzun Vadeli Değer Potansiyelinin Analizi

Giriş: OP'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Optimism (OP), Ethereum Layer 2 blokzincir çözümleri arasında düşük maliyet ve yüksek hız avantajıyla öne çıkıyor. 2021 yılında piyasaya sürülmesinden bu yana önemli aşamalar kaydeden Optimism, 2025 itibarıyla 1,39 milyar dolar piyasa değerine ulaştı; dolaşımdaki OP token miktarı ise yaklaşık 1,78 milyar. Token fiyatı şu anda 0,7825 dolar civarında seyrediyor. "Ethereum Ölçeklendirme Çözümü" olarak bilinen OP, Ethereum’un ölçeklenebilirliğini artırmada ve işlem maliyetlerini azaltmada kilit rol oynuyor.

Bu makalede, Optimism’in 2025-2030 dönemi fiyat hareketleri; geçmiş veriler, arz-talep dinamikleri, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde analiz edilecek. Yatırımcılara profesyonel fiyat öngörüleri ile etkin yatırım stratejileri sunulacak.

I. OP Fiyat Geçmişi ve Mevcut Piyasa Durumu

OP Fiyatının Tarihsel Evrimi

- 2022: Piyasaya giriş yılı, 19 Haziran'da 0,402159 dolar ile tüm zamanların en düşük fiyatı

- 2024: Kritik dönüm noktası, 6 Mart'ta 4,84 dolar ile zirve fiyat

- 2025: Piyasa döngüsü, fiyat tepe noktasından mevcut seviyesine geriledi

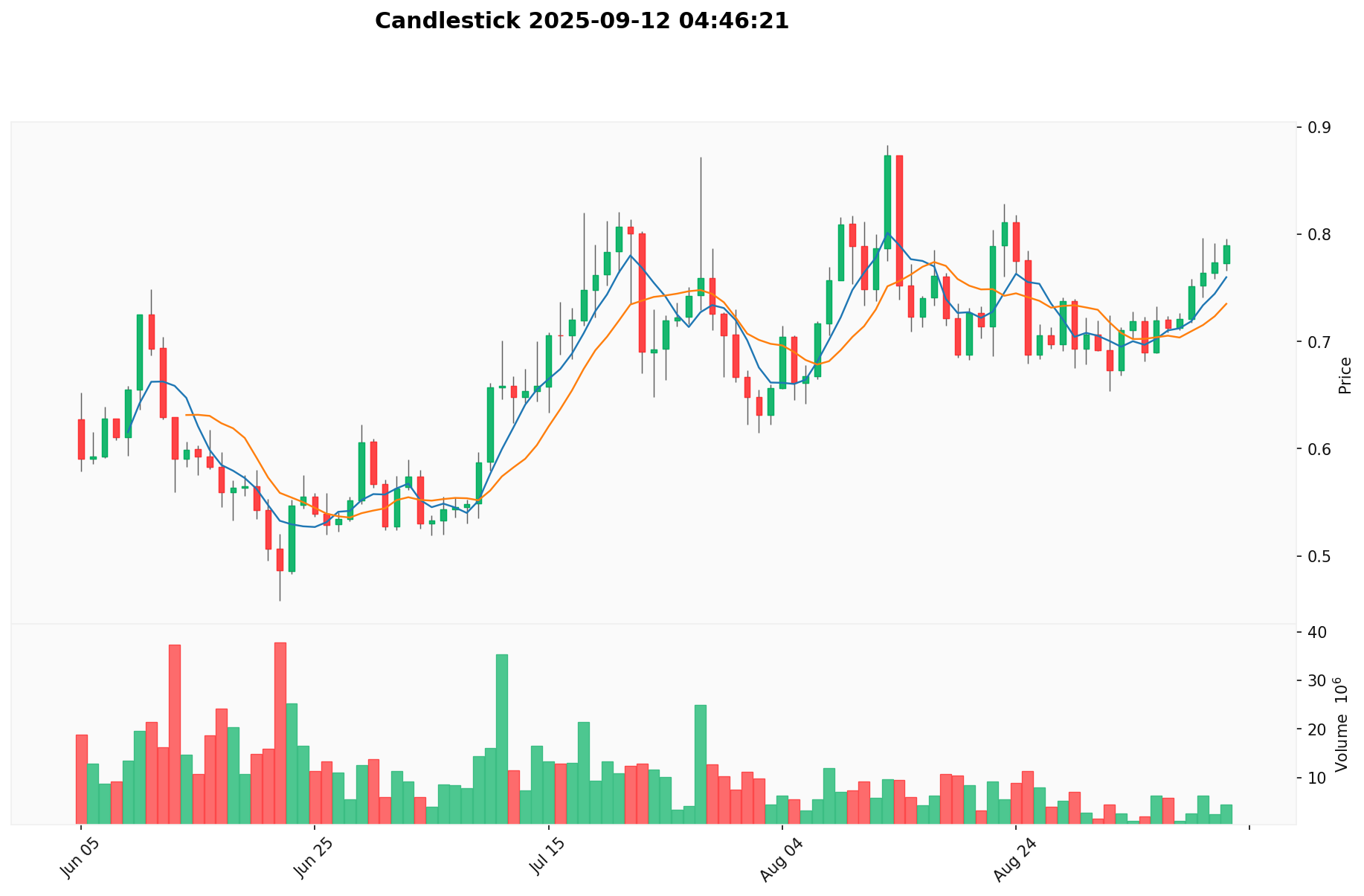

OP Güncel Piyasa Görünümü

12 Eylül 2025 tarihinde, OP 0,7825 dolardan alınıp satılıyor ve son 24 saatte %1,32 düşüş yaşadı. Token’in piyasa değeri 1.391.781.410 dolar ile küresel kripto sıralamasında 91. konumda. Son 24 saatteki işlem hacmi 2.695.259 dolar düzeyinde; bu da piyasanın orta düzeyde aktif olduğunu gösteriyor. Fiyat, bir yıl öncesine göre %49,35 gerilemiş olsa da, son bir haftada %12 yükselerek kısa vadede olumlu bir momentum yakaladı. OP, tüm zamanların zirvesinin %83,83 altında ve en düşük seviyesinin %94,58 üzerinde yer alıyor. Bu dalgalı performans, güçlü bir toparlanma potansiyeline işaret ediyor.

Güncel OP piyasa fiyatını görmek için tıklayın piyasa fiyatı

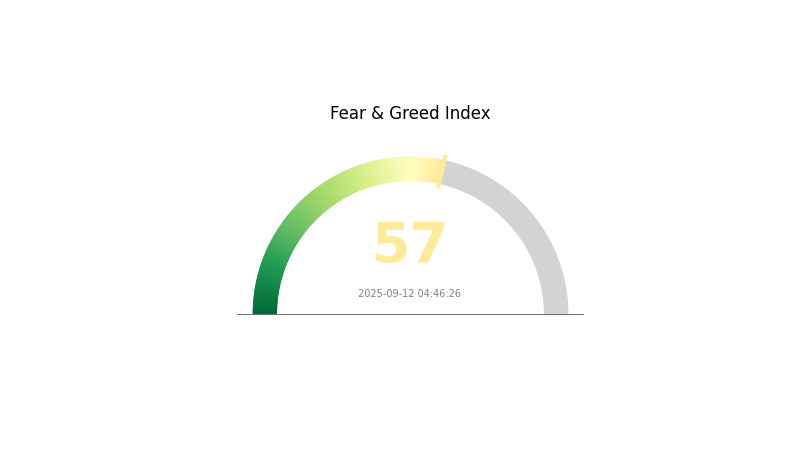

OP Piyasa Duyarlılığı Göstergesi

12 Eylül 2025 Korku & Açgözlülük Endeksi: 57 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında Korku & Açgözlülük Endeksi 57 seviyesinde ve "Açgözlülük" durumunu gösteriyor. Bu, yatırımcıların daha özgüvenli ve yükseliş odaklı hareket ettiğine işaret ediyor. Yine de aşırı iyimserliğe kapılmadan dikkatli olmak gerekiyor. Pozitif piyasa duyarlılığı fiyatları destekleyebilir, ancak yatırım kararları öncesinde detaylı analiz ve risklerin değerlendirilmesi şarttır. Gate.com, mevcut koşullarda yatırımcılara yol gösterici araçlar ve uzman analizler sunar.

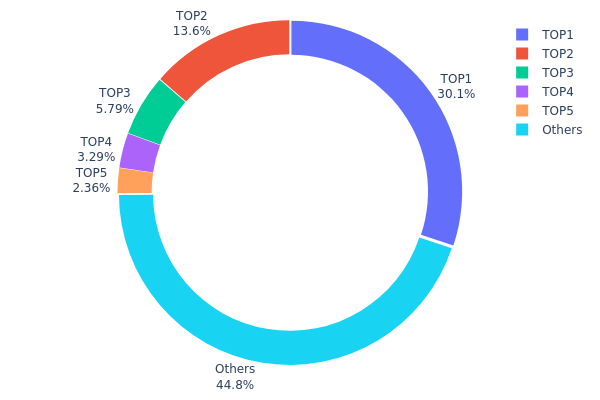

OP Token Dağılımı

Adres dağılımı verileri, OP token’larının büyük bölümünün az sayıda adreste yoğunlaştığını gösteriyor. En büyük adres arzın %30,12’sini elinde bulundururken, ilk 5 adres birlikte toplam arzın %55,18’ini kontrol ediyor. Bu konsantrasyon, piyasa manipülasyonu ve merkezileşme riskleri açısından belirgin bir tehdit oluşturuyor.

Büyük token sahipleri, işlem hacmiyle fiyatları dalgalandırabiliyor ve bu durum merkeziyetsizlik anlayışına zarar verebiliyor. Yönetişim kararları ile ağın genel istikrarı da bu yoğunlaşmadan etkilenebilir.

Yine de, tokenların %44,82’sinin "Diğerleri" arasında dağıldığı görülüyor; bu, bir ölçüde daha dengeli bir dağılıma işaret ediyor. Mevcut varlık yapısı ise OP token piyasasında balina etkisine karşı daha fazla çeşitlendirme ihtiyacını vurguluyor.

Güncel OP varlık dağılımına göz atın

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x2a82...663a26 | 1.294.044,37K | 30,12% |

| 2 | 0x2501...a8b3f0 | 585.251,18K | 13,62% |

| 3 | 0xf977...41acec | 248.814,11K | 5,79% |

| 4 | 0x641f...35ec6e | 141.320,03K | 3,29% |

| 5 | 0x6ba2...ff7c9f | 101.494,92K | 2,36% |

| - | Diğerleri | 1.924.038,68K | 44,82% |

II. OP Fiyatını Belirleyecek Temel Faktörler

Arz Mekanizması

- Token kilit açılımları: Geçmiş açılışlarda talep dengesi OP fiyatında belirgin değişikliğe yol açmadı.

- Güncel Durum: Son olarak 40 milyon dolarlık token kilit açılması satış baskısı yaratabilir.

Kurumsal ve Balina Hareketleri

- Kurumsal Benimsenme: Optimism Layer 2 teknolojisi, Ethereum ağının ölçeklenebilirliği için kritik ve daha fazla kurumsal yatırımcı çekiyor.

Makroekonomik Ortam

- Enflasyon Koruma Özellikleri: OP’nin enflasyonist koşullardaki performansı henüz tam test edilmedi; yeni bir varlık olduğundan izlenmektedir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: Optimism ekosisteminde yeni DApp ve projeler, OP token talebini gelecekte artırabilir.

III. 2025-2030 OP Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,6557 - 0,7806 dolar

- Taraflı tahmin: 0,7806 - 0,84305 dolar

- İyimser tahmin: 0,84305 - 0,89301 dolar (olumlu piyasa koşullarında)

2027-2028 Görünümü

- Büyüme fazı bekleniyor

- Fiyat aralığı tahmini:

- 2027: 0,63079 - 1,17633 dolar

- 2028: 0,69992 - 1,32883 dolar

- Tetikleyici faktörler: Layer 2 çözümlerinin yaygınlaşması ve kripto piyasasında genel iyileşme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,1716 - 1,33563 dolar (piyasa büyümesiyle)

- İyimser senaryo: 1,49965 - 1,72296 dolar (ekosistemin güçlü genişlemesiyle)

- Radikal senaryo: 1,72296+ dolar (kripto ve Layer 2 çözümlerinde aşırı olumlu ortamda)

- 2030-31 Aralık: OP 1,72296 dolar (iyimser projeksiyon zirvesi)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,84305 | 0,7806 | 0,6557 | 0 |

| 2026 | 0,89301 | 0,81182 | 0,69005 | 3 |

| 2027 | 1,17633 | 0,85242 | 0,63079 | 8 |

| 2028 | 1,32883 | 1,01437 | 0,69992 | 29 |

| 2029 | 1,49965 | 1,1716 | 1,08959 | 49 |

| 2030 | 1,72296 | 1,33563 | 1,24213 | 70 |

IV. OP Yatırım Stratejileri ve Risk Yönetimi

OP Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Ethereum ölçeklendirme çözümlerini uzun vadeli benimseyen yatırımcılar

- Önerilen uygulama:

- Piyasa düşüşlerinde OP biriktirin

- Stake işlemi yoluyla yönetim ve ödül fırsatlarından yararlanın

- Token’ları güvenli, şahsi saklama cüzdanlarında tutun

(2) Aktif İşlem Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama (MA): 50 ve 200 günlük MA ile trend takibi

- Göreceli Güç Endeksi (RSI): Aşırı alım ve satım noktalarını izleyin

- Kısa vadeli dalgalanma işlemleri için dikkat edilmesi gerekenler:

- Ethereum ağındaki güncellemelerin Layer 2 çözümlerine etkisini izleyin

- Optimism ekosistemindeki büyüme göstergelerini takip edin

OP Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Daha agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla Layer 2 çözümüne dağıtın

- Put opsiyonu stratejileri: Put opsiyonu ile riskleri sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Cüzdan

- Donanım cüzdanı ile soğuk saklama: Uzun vadeli güvenli muhafaza

- Güvenlik: İki faktörlü doğrulama ve güçlü şifre kullanımı ile riski azaltın

V. OP İçin Riskler ve Zorluklar

OP Piyasa Riskleri

- Yüksek volatilite: OP fiyatı kısa sürede sert hareketler gösterebilir

- Rekabet: Diğer Layer 2 çözümleri pazar payı alabilir

- Ethereum güncellemeleri: Ethereum değişiklikleri OP’nin değer önerisini etkileyebilir

OP Düzenleyici Riskler

- Belirsiz regülasyonlar: Layer 2 çözümleri için net mevzuat eksikliği

- Menkul kıymet sınıflandırma riski: OP token’ı menkul kıymet olarak tanımlanabilir

- Uluslararası kısıtlamalar: Düzenleyici işlemler OP’nin küresel erişimini sınırlandırabilir

OP Teknik Riskler

- Akıllı sözleşme açıklıkları: Yazılım hataları risk barındırabilir

- Ölçeklenebilirlik sorunları: Yüksek işlem hacmi yönetiminde beklenmedik zorluklar

- Ethereum bağımlılığı: Ethereum’daki büyük değişiklikler OP operasyonlarını aksatabilir

VI. Sonuç ve Öneriler

OP Yatırım Potansiyeli Değerlendirmesi

Optimism (OP), Ethereum Layer 2 ölçeklendirme çözümleri arasında uzun vadeli değer sunan lider adaylardan biri. Ancak kısa vadede volatilite ve rekabet, riskleri artırıyor.

OP Yatırım Önerileri

✅ Yeni başlayanlar: Düşük tutarlı düzenli alımlarla portföy oluşturun

✅ Deneyimli yatırımcılar: Tutma ve aktif işlem kombinasyonunu değerlendirin

✅ Kurumsal yatırımcılar: OP’yi Layer 2 çeşitlendirme stratejisine dahil edin

OP İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden OP alım-satımı

- Stake işlemi: Optimism yönetimine katılım ve ödül kazanımı

- DeFi entegrasyonu: OP’yi Optimism ekosistemindeki DeFi çözümlerinde kullanma

Kripto para yatırımı son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar risk toleranslarına göre karar vermeli ve profesyonel finansal danışmana başvurmalıdır. Kaybetmeyi göze aldığınızdan fazla yatırım yapmayın.

Sıkça Sorulan Sorular

OP kripto paranın geleceği var mı?

Evet, OP kripto para geleceğe yönelik umut vadediyor. Geleceği piyasa dinamikleri ve benimseme oranlarına bağlı, fakat analistler uzun vadeli değer ve büyüme potansiyeli konusunda olumlu görüşe sahip.

OP yatırım için iyi bir alternatif mi?

Evet, OP güçlü bir potansiyel sergiliyor. Yenilikçi altyapısı ve Web3’te artan kullanımı ile uzun vadeli yatırım için cazip bir seçenek sunuyor.

OP coin’in en yüksek fiyatı nedir?

OP coin’in tüm zamanların en yüksek fiyatı 4,84 dolar olup, mevcut piyasadan oldukça yukarıdadır.

Optimism coin (OP) ne işe yarar?

Optimism coin (OP), Ethereum’un Optimism Layer 2 ağında protokol yönetimi ve finansman fonksiyonları için kullanılmaktadır. Token sahipleri protokol yönetimine katılabilir ve ağın ölçeklendirme çözümlerini destekler.

2025 POL Fiyat Tahmini: Polygon’un Yerel Token’ı İçin Potansiyel Büyüme Dinamikleri ve Piyasa Eğilimlerinin Analizi

2025 LINEA Fiyat Tahmini: Layer 2 Çözümüne Yönelik Piyasa Trendleri, Teknik Gelişmeler ve Benimsenme Unsurlarının Analizi

LightLink (LL) iyi bir yatırım mı?: Bu yükselen blockchain platformunun DeFi ekosistemindeki potansiyelini analiz ediyoruz

CORE ve ETH: DeFi Ekosistemlerinde Ölçeklenebilirlik Çözümlerinin Karşılaştırılması

YFII ve OP: DeFi Ekosisteminde Getiri Farming Protokollerinin Rekabeti

Arbitrum (ARB) iyi bir yatırım mı?: Gelişen kripto ekosisteminde bu Layer 2 ölçeklendirme çözümünün potansiyelini değerlendirmek

2025 VR Fiyat Tahmini: Uzmanların Sanal Gerçeklik Donanım Maliyetleri ve Pazar Trendleri Üzerine Analizi

2025 ICNT Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıla Yönelik Piyasa Tahmini

2025 ELF Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıla Yönelik Piyasa Beklentisi

2025 PROVE Fiyat Tahmini: Uzman Analizleri ve Gelecek Yıla Yönelik Piyasa Beklentileri

Yooldo Games (ESPORTS) iyi bir yatırım mı?: Rekabetçi oyun sektöründe şirketin finansal performansına, pazar konumuna ve büyüme potansiyeline dair kapsamlı bir analiz