2025 INJ Fiyat Tahmini: Injective Protocol’un Piyasa Trendleri ve Büyüme Potansiyelinin Kapsamlı Analizi

Giriş: INJ'nin Piyasa Konumu ve Yatırım Değeri

Injective (INJ), üst seviye Web3 finans uygulamalarının inşasına yönelik optimize edilmiş, son derece hızlı ve zincirler arası uyumlu bir birinci katman blokzinciri olarak, 2020’deki lansmanından bu yana önemli ilerlemeler kaydetti. 2025 itibarıyla Injective’in piyasa değeri 1,39 milyar dolara ulaşırken, yaklaşık 97.727.220 adet dolaşımdaki arzı ve 14,226 dolar seviyesinde seyreden fiyatıyla öne çıkıyor. “DeFi’nin güç merkezi” olarak bilinen bu varlık, merkeziyetsiz finans ve Web3 uygulamalarında giderek daha önemli bir rol üstleniyor.

Bu makale, Injective’in 2025-2030 dönemi fiyat eğilimlerini; tarihsel örüntüler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı şekilde analiz ederek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. INJ Fiyat Geçmişi ve Güncel Piyasa Durumu

INJ Tarihsel Fiyat Seyri

- 2020: INJ, 0,657401 dolar fiyatla kripto para piyasasına giriş yaptı

- 2021: Boğa piyasası döneminde, 14 Mart 2024’te 52,62 dolarla tüm zamanların zirvesini gördü

- 2025: Piyasa konsolidasyonu sürecinde, son 24 saatte fiyat 13,851 ila 14,41 dolar arasında dalgalandı

INJ Güncel Piyasa Tablosu

12 Eylül 2025 itibarıyla INJ, 14,226 dolar seviyesinden işlem görüyor; son 24 saatteki işlem hacmi 3.066.738,94 dolar. Günlük yüzde 0,38’lik hafif bir yükseliş yaşandı. INJ’nin piyasa değeri 1.390.267.436 dolar olup, genel kripto para piyasasında 92. sıradadır.

Bu fiyat, INJ’nin tüm zamanların en düşük seviyesinden güçlü bir toparlanmaya işaret etmekle birlikte, zirve fiyatının yüzde 72,96 altında bulunuyor. INJ son bir haftada yüzde 13,07 artış göstererek kısa vadede pozitif bir ivme yakalasa da; son 30 günde yüzde 5,04, son bir yılda ise yüzde 24,12 düşüşle, uzun vadede volatilite barındırıyor.

Dolaşımdaki INJ miktarı 97.727.220,33 token olup, bu rakam toplam 100.000.000 token arzının yüzde 97,73’üne karşılık geliyor. Tam seyreltilmiş piyasa değeri 1.422.600.000 dolar ile güncel piyasa değerine oldukça yakın; bu, tokenlerin büyük bölümünün dolaşımda olduğunu gösteriyor.

Piyasa duyarlılığı INJ için temkinli bir iyimserlik sunuyor; son fiyat artışı ve güçlü haftalık performans, yatırımcı ilgisini artırabilir. Ancak, uzun vadeli değer kaybı yatırımcıların hem piyasa eğilimlerini hem de projenin temellerini dikkatle değerlendirmesi gerektiğine işaret ediyor.

Güncel INJ piyasa fiyatını görüntüleyin

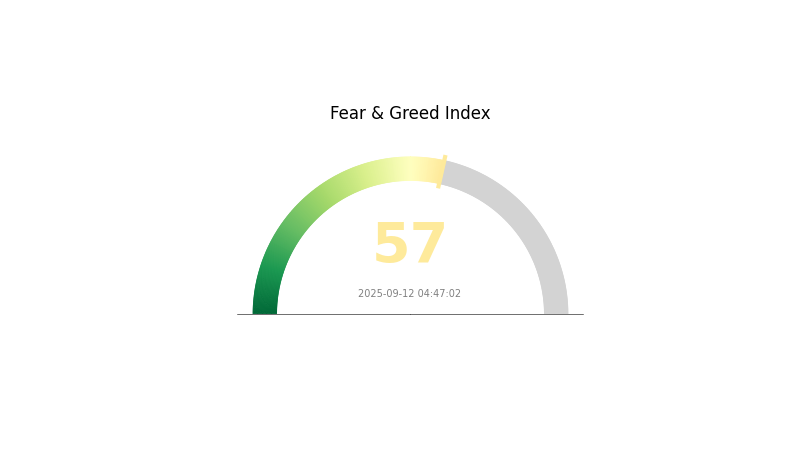

INJ Piyasa Duyarlılığı Göstergesi

12 Eylül 2025 Korku ve Açgözlülük Endeksi: 57 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Şu anda kripto para piyasası açgözlülük seviyesinde; Korku ve Açgözlülük Endeksi 57 değerinde. Bu, yatırımcıların INJ’nin potansiyeline dair daha iyimser olduklarını gösteriyor. Ancak, yüksek açgözlülük seviyeleri genellikle piyasa düzeltmelerinin öncüsü olabileceğinden dikkatli olunmalı. Yatırımcılar portföylerini çeşitlendirmeli ve riskleri yönetmek için stop-loss emirleri kullanmalı. Her zaman olduğu gibi, detaylı araştırma yapmalı ve risk toleransınıza ile yatırım hedeflerinize uygun kararlar alınmalıdır.

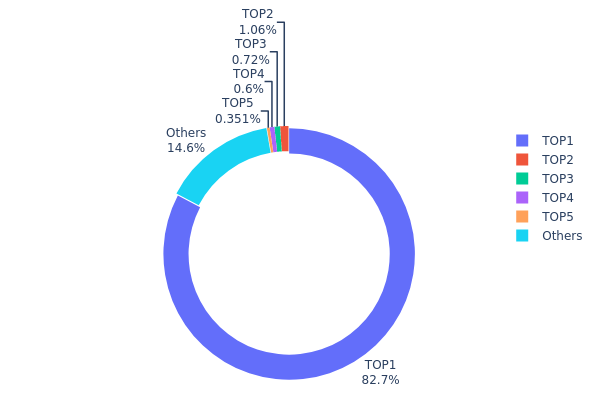

INJ Varlık Dağılımı

INJ adres bazında varlık dağılımı, son derece yoğun bir sahiplik tablosu ortaya koyuyor. En büyük cüzdan, toplam arzın yüzde 82,70’ini oluşturan 82.700,24K INJ’yi elinde tutuyor. Bu düzeyde bir yoğunlaşma, merkezyetsizlik ve piyasa dinamikleri açısından önemli soru işaretleri doğuruyor.

İkinci en büyük sahip yalnızca yüzde 1,05’lik bir paya sahip, diğer büyük adreslerde ise bu oran daha da düşük. İlk 5 adres INJ tokenlarının yüzde 85,41’ini kontrol ederken, kalan tüm adresler toplam yüzde 14,59’a sahip. Bu dengesiz dağılmış yapı, büyük sahiplerin hareketlerinin fiyat üzerinde ciddi dalgalanmalara yol açabileceğini ve potansiyel piyasa manipülasyonu riskini gösteriyor.

Böyle bir yoğun sahiplik yapısı, projenin istikrarına ve merkezsizleşme vizyonuna zarar verebilir. Bu durum, piyasa bütünlüğünü zedelerken, merkeziyet endişeleri nedeniyle daha geniş kitlelerin benimsemesini de engelleyebilir. Yatırımcılar ve paydaşlar, bu dağılımdaki olası değişiklikleri yakından takip etmeli; en büyük sahiplerdeki pozisyon değişimleri INJ’nin piyasa hareketleri ve ekosistem sağlığı üzerinde orantısız etkiye neden olabilir.

Güncel INJ Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf955...bad6f3 | 82.700,24K | 82,70% |

| 2 | 0xf89d...5eaa40 | 1.059,54K | 1,05% |

| 3 | 0x5ff1...89634b | 719,73K | 0,71% |

| 4 | 0xafcd...45c5da | 600,00K | 0,60% |

| 5 | 0x77fb...94df0e | 350,54K | 0,35% |

| - | Diğerleri | 14.569,95K | 14,59% |

II. INJ’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Yakımı: Haftalık yakım açık artırmaları INJ için sürekli bir deflasyonist mekanizma oluşturuyor

- Tarihsel Eğilim: Geçmişteki arz düşüşleri genellikle fiyat artışını destekledi

- Güncel Etki: Süregelen yakımların, INJ fiyatında yukarı yönlü baskı oluşturmaya devam etmesi bekleniyor

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Yatırımlar: DeFi altyapısında öne çıkan INJ’ye kurumsal ilgi artıyor

- Kurumsal Katılım: Injective Protocol üzerinde artan proje sayısı, INJ’ye olan talebi büyütüyor

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası kararları ve faiz oranları, INJ gibi kripto varlıklara duyulan risk iştahını belirleyecek

- Enflasyona Karşı Koruma: INJ, belirsiz ekonomik ortamda enflasyona karşı korunma amacıyla yatırımcı ilgisi çekebilir

Teknik Gelişim ve Ekosistem Büyümesi

- Çapraz Zincir Uyumluluğu: Diğer blokzincirlere erişimi genişleterek platformun etki alanını artırıyor

- Performans Güncellemeleri: İşlem hızı ve ölçeklenebilirlikteki süreklilik, rekabet avantajının korunmasını sağlıyor

- Ekosistem Uygulamaları: Injective üzerinde artan DApp, DEX ve DeFi protokolü sayısı, INJ’nin kullanım alanını ve talebini artırıyor

III. 2025-2030 Dönemi INJ Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 12,50 – 14,20 dolar

- Tarafsız tahmin: 14,20 – 15,20 dolar

- İyimser tahmin: 15,20 – 16,20 dolar (güçlü piyasa ivmesi gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Boğa piyasasının devamı olasılığı

- Fiyat aralığı projeksiyonu:

- 2027: 15,33 – 24,12 dolar

- 2028: 19,91 – 22,91 dolar

- Ana itici güçler: INJ’nin DeFi uygulamalarında artan kullanımı, ekosistemin büyümesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 22,15 – 24,04 dolar (istikrarlı piyasa büyümesi)

- İyimser senaryo: 24,04 – 25,73 dolar (yaygın blokzincir adaptasyonu ile)

- Dönüştürücü senaryo: 25,73 dolar ve üzeri (INJ’nin lider bir DeFi platformu olması halinde)

- 31 Aralık 2030: INJ 24,04 dolar (2025 seviyesine göre yüzde 69 artış)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 16,19712 | 14,208 | 12,50304 | 0 |

| 2026 | 22,19574 | 15,20256 | 13,0742 | 6 |

| 2027 | 24,1219 | 18,69915 | 15,3333 | 31 |

| 2028 | 22,90926 | 21,41053 | 19,91179 | 50 |

| 2029 | 25,92708 | 22,15989 | 19,72231 | 55 |

| 2030 | 25,72653 | 24,04348 | 17,79218 | 69 |

IV. INJ Profesyonel Yatırım Stratejileri ve Risk Yönetimi

INJ Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Temel öneriler:

- Piyasa düzeltmelerinde INJ biriktirmek

- INJ’yi stake ederek pasif gelir elde etmek

- Varlıkları güvenli bir donanım cüzdanında muhafaza etmek

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trend izleme

- RSI: Aşırı alım/satım koşullarını belirleme

- Swing trade için önemli noktalar:

- Zarar durdur (stop-loss) emirleriyle potansiyel kayıpları sınırlamak

- Önceden belirlenmiş fiyat hedeflerinde kâr almak

INJ Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Portföyün %1-3’ü

- Atağı yatırımcı: Portföyün %5-10’u

- Profesyonel yatırımcı: Portföyün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto paralara yaymak

- Zarar durdur kullanımı: İşlemlerde potansiyel kayıpları sınırlandırmak

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Ek güvenlik: İki faktörlü kimlik doğrulama, güçlü şifre

V. INJ’ye Yönelik Potansiyel Riskler ve Zorluklar

INJ Piyasa Riskleri

- Yüksek volatilite: Sert fiyat dalgalanmaları, büyük kayıplara neden olabilir

- Rakipler: Diğer Layer 1 blokzincirlerinin pazar payını artırması

- Piyasa duyarlılığı: Olumsuz haber akışı INJ fiyatını olumsuz etkileyebilir

INJ Düzenleyici Riskler

- Mevzuat belirsizliği: Düzenleyici çerçevede yaşanacak değişimler, INJ’nin kullanımını ve benimsenmesini etkileyebilir

- Uyum maliyetleri: Artan denetimler, ek maliyetlere yol açabilir

- Uluslararası kısıtlamalar: Farklı coğrafyalardaki mevzuat, INJ’nin küresel büyümesini sınırlandırabilir

INJ Teknik Riskler

- Akıllı sözleşme açıkları: Protokol kodunda potansiyel güvenlik sorunları

- Ağ yoğunluğu: Yüksek işlem hacminde işlem onaylarının gecikmesi

- Ölçeklenebilirlik sıkıntıları: Ağ faaliyetinde artış yaşandığında olası darboğazlar

VI. Sonuç ve Eylem Önerileri

INJ’nin Yatırım Değeri Değerlendirmesi

Injective (INJ), DeFi uygulamalarına optimize edilen birlikte çalışabilir bir birinci katman blokzinciri olarak uzun vadede cazip bir değer sunmaktadır. Ancak kısa vadeli volatilite ve mevzuat kaynaklı riskler de göz ardı edilmemelidir.

INJ Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düşük tutarlı ve düzenli yatırımlarla deneyim kazanın ✅ Tecrübeli yatırımcılar: Uzun vadeli tutma ve aktif alım-satımı dengeleyerek ilerleyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yaparak INJ’yi çeşitlendirilmiş bir kripto portföyünün parçası olarak değerlendirin

INJ İşlem Katılım Yöntemleri

- Spot alım-satım: INJ satın almak ve satmak için Gate.com gibi güvenilir borsaları kullanın

- Staking: INJ token’larını stake ederek pasif gelir elde edin

- DeFi uygulamaları: Injective’in merkeziyetsiz finans ekosistemindeki farklı uygulamaları keşfedin

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatlice vermeli, gerekirse profesyonel finansal danışmanlardan görüş almalısınız. Asla kaybetmeyi göze alabileceğinizden fazla para yatırmayın.

Sıkça Sorulan Sorular

INJ kripto paranın geleceği var mı?

INJ, kurumsal düzeyde altyapısı ve gerçek dünya adaptasyonuyla, lider DeFi token’ları arasında parlak bir gelecek vaat ediyor. Uzmanlar, 100 kata kadar değerlenme potansiyeliyle kayda değer bir büyüme öngörüyor.

Injective 100 dolara ulaşabilir mi?

Evet, Injective elverişli piyasa koşullarında, özellikle ABD seçimleri sonrasında, 2025’e kadar 100 dolara ulaşabilir. Bu senaryo, olumlu piyasa trendleri ve dinamiklerine bağlıdır.

Injective için 2025 fiyat tahmini nedir?

Mevcut piyasa trendlerine göre Injective’in Aralık 2025’te 15,19 – 17,17 dolar aralığında işlem görmesi beklenmektedir.

Injective uzun vadeli yatırıma uygun mu?

Evet, Injective uzun vadede güçlü bir potansiyel sergiliyor. Kurumsal altyapısı ve DeFi alanında artan kullanım oranı, gelecekte önemli değer artışının önünü açıyor. Özellikle Injective’in, küresel türev piyasasından küçük bir pay alması hâlinde, fiyatın 100 kat ve üzerinde artabileceği tahmin ediliyor.

2025 MNT Fiyat Tahmini: Mantle Network Token'a Yönelik Piyasa Analizi ve Olası Büyüme Dinamikleri

2025 NEAR Fiyat Tahmini: NEAR Protocol Ekosisteminde Bir Sonraki Boğa Koşusunu Belirleyecek Faktörlerin Kapsamlı Analizi

2025 AURORA Fiyat Tahmini: Layer-2 Çözümü İçin Gelecek Trendler ve Piyasa Potansiyeli Analizi

2025 CELR Fiyat Tahmini: Celer Network Token’ının Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

Celestia (TIA) iyi bir yatırım mı?: Bu layer-1 blockchain projesinin potansiyeli ve riskleri üzerine analiz

Aptos (APT) iyi bir yatırım mı?: Bu gelişmekte olan blockchain platformunun potansiyelini ve risklerini değerlendirmek

WLFI ve USD1: 2025'te DeFi'yi Şekillendiren Trump Ailesi ile Bağlantılı Kripto Projesi

# Kripto Para Piyasalarında Rekabetçi Ürün Kıyaslama Analizi Nedir ve Pazar Payı Değişimlerini Nasıl Tetikler?

2025 yılında Dogecoin, Bitcoin ve Ethereum ile karşılaştırıldığında performansı, pazar payı ve rekabet avantajları bakımından nasıl konumlanıyor?

USDP ve HBAR: Stablecoin ile Kurumsal Blockchain Çözümlerinin Ayrıntılı Karşılaştırması

Dogecoin'un temel analizi nedir: white paper mantığı, kullanım alanları ve 2025 yılı ekip geçmişi?