2025 GMX Fiyat Tahmini: DeFi Alım-Satım Protokolünün Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

Giriş: GMX’in Piyasa Konumu ve Yatırım Değeri

GMX (GMX), merkeziyetsiz sürekli işlem borsası olarak faaliyete geçtiği ilk günden itibaren önemli başarılara imza atmıştır. 2025 yılı itibarıyla GMX’in piyasa değeri 175.344.893 ABD doları seviyesine ulaşırken, dolaşımdaki token sayısı yaklaşık 10.302.285 adet ve token fiyatı da 17,02 dolar civarındadır. “DeFi işlem devi” olarak adlandırılan bu varlık, merkeziyetsiz finans ve kripto para alım satım sektörlerinde gitgide daha stratejik bir rol üstlenmektedir.

Bu makalede, GMX’in 2025-2030 yılları arasındaki fiyat trendleri, tarihsel veri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkiler ışığında kapsamlı bir şekilde analiz edilecek; yatırımcılara profesyonel fiyat öngörüleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. GMX Fiyat Geçmişi Analizi ve Güncel Piyasa Durumu

GMX Tarihsel Fiyat Gelişimi

- 2023: 18 Nisan tarihinde 91,07 dolar ile tüm zamanların en yüksek seviyesine ulaşıldı

- 2025: 7 Nisan’da 9,61 dolarla tarihi en düşük fiyata gerileyerek anlamlı bir düzeltme gerçekleşti

GMX Güncel Piyasa Görünümü

24 Eylül 2025 itibarıyla GMX, 17,02 dolar seviyesinden işlem görmektedir. Son 24 saatte %17,58’lik, son bir haftada ise %12,69’luk bir yükselişle kısa vadede güçlü bir performans sergilemiş olup; 30 günlük süreçte de %11,95’lik pozitif bir artış yaşanmıştır. Ancak, uzun vadeli trend hâlâ zayıf; GMX son 1 yılda %31,97 düşüş göstermiştir.

GMX’in şu anki piyasa değeri 175.344.893 ABD dolarıdır ve bu, kripto para sıralamasında 320. sırada olduğunu göstermektedir. 10.302.285 adetlik dolaşımdaki token, toplam arzın %77,75’ine denk gelmekte; projenin tam seyreltilmiş piyasa değeri ise 225.515.000 ABD dolarına ulaşmıştır.

Son 24 saatteki işlem hacmi 1.261.182 dolar olup, bu durum orta seviyede piyasa hareketliliğine işaret etmektedir. GMX, hâlen tüm zamanların en yüksek seviyesinin çok altında işlem görmektedir; bu da, piyasa şartlarının iyileşmesi halinde varlık için yükseliş potansiyelinin korunduğuna işaret etmektedir.

Güncel GMX piyasa fiyatını görmek için tıklayın

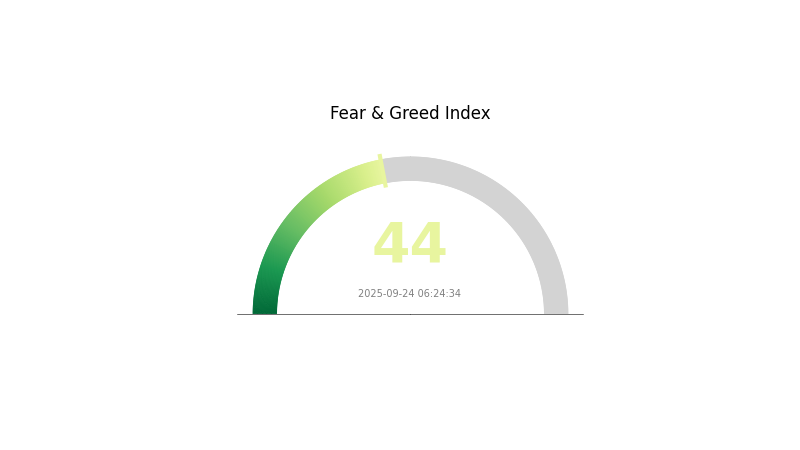

GMX Piyasa Duyarlılık Endeksi

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku & Açgözlülük Endeksini incelemek için tıklayın

Kripto piyasasında temkinli bir hava hâkim. Korku ve Açgözlülük Endeksi’nin 44 seviyesinde “Korku” sinyali vermesi, yatırımcıların riskten kaçındığını ve yüksek riskli işlemlere karşı daha temkinli yaklaştıklarını göstermektedir. Bu tür zamanlarda dikkatli hareket etmek ve yatırım öncesinde detaylı araştırma yapmak kritik önemdedir. Bazı yatırımcılar, “herkes korkarken açgözlü olun” yaklaşımıyla bu ortamı alım fırsatı olarak görebilir. Ancak, her zaman bütçeniz doğrultusunda ve sorumluluk bilinciyle yatırım yapmanız gerektiğini unutmayın.

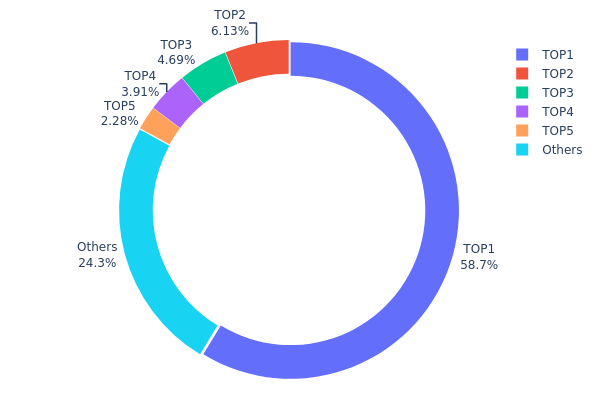

GMX Varlık Dağılımı

GMX’in adres bazlı tutucu dağılımı, token sahipliğinin oldukça yüksek bir oranda merkezi bir adreste toplandığını gösteriyor. En büyük adres, toplam arzın %58,67’sine karşılık gelen 6.258.200 GMX token saklamakta. Bu derecede konsantrasyon, merkeziyetsizlik ilkesiyle çelişen ve potansiyel olarak riskli bir tablo ortaya koymaktadır. Sonraki en büyük dört adresin ise sahipliği %6,13 ile %2,28 aralığında değişiyor ve toplamda arzın %17,01’ini oluşturuyor.

Token’ların tek bir adreste bu denli yoğunlaşması, GMX piyasasında yüksek fiyat oynaklığı riskine yol açabilir. En büyük sahibin satış yapması ciddi fiyat dalgalanması yaratabilir. Ayrıca, bu durum, projede yönetim kararlarının tek bir aktörün elinde toplanmasına ve merkeziyetsizlik ilkesinin zedelenmesine yol açmaktadır. Kalan %24,32’lik dağılım ise, tokenların toplum genelinde sınırlı ölçüde yayıldığını ve bunun likidite ile piyasa katılımını sınırlandırabileceğini göstermektedir.

Bu dağılım yapısı, şu an GMX için merkeziyetsizlik açısından zayıf bir profil sunmaktadır. Diğer büyük tutucu adreslerin varlığı nispi denge sağlasa da, en büyük adresin ağırlığı projenin ve varlık fiyatının istikrarı açısından yakından izlenmelidir.

Güncel GMX Varlık Dağılımı için tıklayın

| En Büyük | Adres | Token Miktarı | Oran (%) |

|---|---|---|---|

| 1 | 0x908c...c59dd4 | 6.258,20K | 58,67% |

| 2 | 0x6f4e...dc19c9 | 653,83K | 6,13% |

| 3 | 0x80a9...42158e | 500,37K | 4,69% |

| 4 | 0xb38e...82891d | 417,45K | 3,91% |

| 5 | 0x5a52...70efcb | 243,33K | 2,28% |

| - | Diğerleri | 2.592,42K | 24,32% |

II. GMX’in Gelecekteki Fiyatını Belirleyen Temel Faktörler

Token Arzı ve Mekanizması

- Token Kullanımı ve Stake: GMX ekosistemi içinde token’ın yönetişim ve staking ödüllerindeki işlevselliği fiyatı etkileyen başlıca unsurdur.

- Mevcut Durum: GMX’in token modeli ve ürün inovasyonundaki başarısı, fiyat performansında kilit rol oynamaktadır.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Benimseme: GMX, merkeziyetsiz türev piyasasında Layer 2 çözümlerinde ciddi oranda TVL ile öne çıkmaktadır.

Makroekonomik Faktörler

- Jeopolitik Dinamikler: Uluslararası gelişmeler ve düzenleyici ortam, GMX gibi merkeziyetsiz türev protokollerinin büyümesini etkileyebilir.

Teknolojik Gelişmeler ve Ekosistem İnşası

- GMX V2 Güncellemesi: 4 Ağustos 2023’te devreye alınan bu güncelleme, protokol işleyişi ile kullanıcı deneyiminde önemli değişiklikler sağlamıştır.

- Fiyat Etkisi Ücreti: GMX V2 ile hayat geçirilen “fiyat etkisi ücreti”, pozisyon büyüklüğü ve long/short dengesizliğine göre artmakta, emir defteri davranışını simüle etmektedir.

- Ekosistem Uygulamaları: GMX, yatırımcılara minimum spread ve sıfıra yakın fiyat etkisiyle pozisyon açma/kapatma imkanı tanır; bu sayede bazı emir defteri temelli borsalardan daha avantajlı fiyat sunabilir.

III. 2025-2030 Dönemi GMX Fiyat Tahminleri

2025 Tahminleri

- Temkinli öngörü: 16,32 - 16,83 ABD doları

- Tarafsız öngörü: 16,83 - 20,00 ABD doları

- İyimser öngörü: 20,00 - 23,06 ABD doları (olumlu piyasa koşulları ve artan DeFi adaptasyonu ile)

2027-2028 Tahminleri

- Piyasa döngüsü beklentisi: Yüksek volatiliteyle birlikte potansiyel bir boğa piyasası

- Fiyat tahmini aralığı:

- 2027: 16,44 - 34,08 ABD doları

- 2028: 17,37 - 29,83 ABD doları

- Kilit katalizörler: DeFi büyümesi, GMX platform geliştirmeleri ve genel piyasa trendleri

2029-2030 Uzun Vadeli Tahminleri

- Temel senaryo: 24,69 - 29,83 ABD doları (istikrarlı DeFi ve GMX büyümesi varsayımıyla)

- Olumlu senaryo: 29,83 - 32,52 ABD doları (hızlı DeFi adaptasyonu, artan GMX pazar payı ile)

- Dönüştürücü senaryo: 32,52 - 35,00 ABD doları (GMX’in ana akım kabul gören DeFi platformu olması halinde)

- 31 Aralık 2030: GMX 29,83 ABD doları (büyüme evresi sonrası olası stabilizasyon)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 23,0571 | 16,83 | 16,3251 | -1 |

| 2026 | 27,72153 | 19,94355 | 13,96049 | 16 |

| 2027 | 34,08054 | 23,83254 | 16,44445 | 39 |

| 2028 | 29,82523 | 28,95654 | 17,37392 | 69 |

| 2029 | 30,27261 | 29,39089 | 24,68835 | 71 |

| 2030 | 32,51661 | 29,83175 | 16,10915 | 74 |

IV. GMX’te Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GMX Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Merkeziyetsiz finans piyasasına temkinli şekilde girmek isteyen yatırımcılar

- Önerilen uygulamalar:

- Ortalama maliyetle (DCA) kademeli GMX birikimi

- Token’ları güvenli cüzdanda tutmak ve yönetişimde oy kullanmak

- Pasif getiri elde etmek amacıyla staking programlarına katılım

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirlemede kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım bölgelerini tespit etmek için kullanılabilir

- Swing trade için dikkat edilmesi gerekenler:

- Fiyat hareketlerinin teyidi için işlem hacmini gözlemlemek

- Zarar risklerini sınırlamak için katı stop-loss emirleri kullanmak

GMX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Portföyün %1-3’ü GMX’te

- Orta riskli yatırımcılar: Portföyün %3-5’i GMX’te

- Agresif yatırımcılar: Portföyün %5-10’u GMX’te

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Varlıkları birden fazla DeFi projesine yaymak

- Opsiyonlar: GMX fiyatındaki oynaklığa karşı koruma için opsiyon kullanmayı değerlendirmek

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Aktif ticaret için Gate Web3 Cüzdanı tercih edilebilir

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik için: 2FA etkinleştirilmesi, güçlü şifre kullanımı

V. GMX’in Karşılaşabileceği Riskler ve Zorluklar

GMX Piyasa Riskleri

- Fiyat oynaklığı: Kripto piyasasında sık görülen sert fiyat hareketleri

- Likidite riski: Büyük işlemlerde çıkış zorlukları

- Rekabet: Yeni DeFi projeleri GMX’in pazar payını azaltabilir

GMX Regülasyon Riskleri

- Düzenleme belirsizliği: Değişen küresel regülasyonlar GMX’i etkileyebilir

- Uyumluluk sıkıntıları: Farklı ülke mevzuatlarına uyum sağlama ihtiyacı

- Olası kısıtlamalar: Devlet müdahaleleriyle GMX’e erişimin sınırlandırılması

GMX Teknik Riskleri

- Akıllı kontrat açıkları: Protokol kodunda güvenlik zafiyeti riski

- Ölçeklenebilirlik sorunları: Yüksek işlem hacmi karşısında sistem darboğazı

- Ağ tıkanıklığı: Ethereum’daki yüksek gas ücretleri kullanıcılar açısından olumsuzluk yaratabilir

VI. Sonuç ve Eylem Önerileri

GMX Yatırım Değeri Değerlendirmesi

GMX, merkeziyetsiz sürekli işlem borsa tokenı olarak uzun vadede önemli bir değer vaat ederken, piyasa oynaklığı ve regülasyon belirsizliği gibi kısa vadeli risklerle karşı karşıyadır.

GMX Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, DeFi ekosistemini öğrenmeye öncelik verin ✅ Deneyimli yatırımcılar: Tutma ve aktif işlem stratejileriyle dengeli bir portföy oluşturun ✅ Kurumsal yatırımcılar: GMX’i çeşitlendirilmiş bir DeFi portföyünün parçası olarak değerlendirin ve kapsamlı analiz yapın

GMX’e Katılım Yolları

- Spot alım-satım: GMX token’ı Gate.com üzerinden satın alabilirsiniz

- Staking: GMX staking programına katılarak pasif getiri elde edebilirsiniz

- Yönetişim: Token oyları ile protokol karar mekanizmasında yer alabilirsiniz

Kripto para yatırımları yüksek risk içerir ve bu makale bir yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre verin ve mümkünse profesyonel finansal danışman desteği alın. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

GMX alınır mı?

GMX, olumlu fiyat projeksiyonuyla yatırımcılara umut vadediyor. 2025 yılında 27,33 ABD doları fiyatı ve 258,9 milyon ABD doları piyasa değeriyle büyüme potansiyeli taşıyan cazip bir yatırım seçeneğidir.

2030 için en güçlü token fiyat tahmini nedir?

Mevcut piyasa analizlerine göre GMX’in 2030 yılı için en iddialı fiyat tahmini 500 ABD dolarıdır. Bu tahmin, GMX’in önümüzdeki birkaç yılda önemli bir büyüme sergileme potansiyeline işaret etmektedir.

2025 için önde gelen kripto fiyat tahmini nedir?

Bitcoin’in (BTC) 2025’te 200.000 ABD dolarına, Ethereum’un (ETH) ise 10.000 ABD dolarına çıkacağı öngörülmektedir. Bu tahminler, 2025 yılı için öne çıkan kripto fiyat öngörüleridir.

2030’da XRP fiyatı ne olur?

Analistlere göre XRP, 2030’da benimsenme oranı ve regülasyonlara bağlı olarak 4,67 – 26,97 ABD doları aralığında fiyatlanabilir. Güçlü piyasa koşullarında 10 ABD doları seviyesinin görülmesi mümkündür.

2025 JOE Fiyat Tahmini: Trader Joe’nun Yerel Token’ı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Aark (AARK) iyi bir yatırım mı?: Bu Yükselen Kripto Paranın Potansiyelini ve Risklerini Değerlendirmek

BLZ vs GMX: İki Önde Gelen Bulut Servis Sağlayıcısının Kapsamlı Analizi

DIAM ve GMX: Likiditeyi ve işlem verimliliğini artırmaya yönelik iki önde gelen merkeziyetsiz borsa protokolünün karşılaştırılması

ASK ve GMX: İş İletişimi İçin İki Lider E-posta Sağlayıcısının Karşılaştırılması

ASTER'ın sermaye akışı, 2025 yılında piyasa eğilimini nasıl yansıtıyor?

İzlenmesi Gereken En İyi ERC20 Token'lar: 2025 Pazar Manzarası ve Yatırım Mantığı

En İyi ETH Cüzdanları Derinlemesine Analiz: Kendinize Ait Cüzdanlardan Web3 Ekosistem Cüzdanlarının Evrimine

Tron Ağı Derinlemesine İnceleme: TRX Piyasa Performansı ve Stablecoin Dominansı Altında Gelecek Fırsatları

RSI Tuzağı ve Kripto Ticaretinde Optimizasyon

2025 yılında kripto para sektöründe öne çıkan güvenlik ve risk olayları nelerdir?