2025 FIL Fiyat Tahmini: Filecoin’in Piyasa Trendleri, Ağ Benimsenme Süreci ve Potansiyel Büyüme Faktörlerine Yönelik Profesyonel Analiz

Giriş: FIL’in Piyasa Konumu ve Yatırım Değeri

Filecoin (FIL), merkeziyetsiz depolama alanında faaliyet gösteren bir ağ olarak 2020’deki çıkışından bu yana önemli bir gelişme göstermiştir. 2025 itibarıyla Filecoin’in piyasa değeri 1.740.159.095 ABD dolarına ulaşırken, dolaşımdaki token miktarı yaklaşık 687.538.165 adet ve fiyatı da 2,531 ABD doları seviyesinde seyrediyor. “Merkeziyetsiz depolamanın geleceği” olarak konumlandırılan bu varlık, dağıtık dosya depolama ve içerik hizmetlerinde giderek daha kritik bir yere sahip olmaktadır.

Bu makalede, 2025-2030 yılları arasında Filecoin’in fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte kapsamlı biçimde ele alınacak ve yatırımcılara hem profesyonel fiyat öngörüleri hem de uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. FIL Fiyat Geçmişi ve Mevcut Piyasa Durumu

FIL Tarihi Fiyat Gelişimi

- 2020: Filecoin ana ağı Ekim’de başlatıldı, fiyat yaklaşık 30 ABD doları seviyesinden işleme açıldı

- 2021: Boğa piyasası zirvesinde, FIL 1 Nisan’da tüm zamanların en yüksek seviyesi olan 236,84 ABD dolarını gördü

- 2022-2023: Kripto kışı döneminde fiyat, zirve değerlerden sert şekilde düştü

- 2025: Fiyat istikrar kazandı ve toparlanma sinyalleri verdi

FIL Mevcut Piyasa Görünümü

12 Eylül 2025 itibarıyla FIL, 2,531 ABD doları fiyatından işlem görmektedir. 24 saatlik işlem hacmi 4.065.692 ABD doları, piyasa değeri ise 1,74 milyar ABD dolarıdır. FIL son 24 saatte %0,91, son bir haftada ise %10,77 oranında değer kazanmıştır. Son 30 günde %4,6 düşüş yaşanırken, son 1 yılda ise %29,82 oranında belirgin bir kayıp olmuştur.

Mevcut fiyat hâlâ 1 Nisan 2021’de görülen 236,84 ABD doları zirvesinin çok altındadır. Dolaşımdaki FIL miktarı 687.538.165 olarak, toplam 1.959.091.063’lük arzın yaklaşık %35,09’unu oluşturmaktadır.

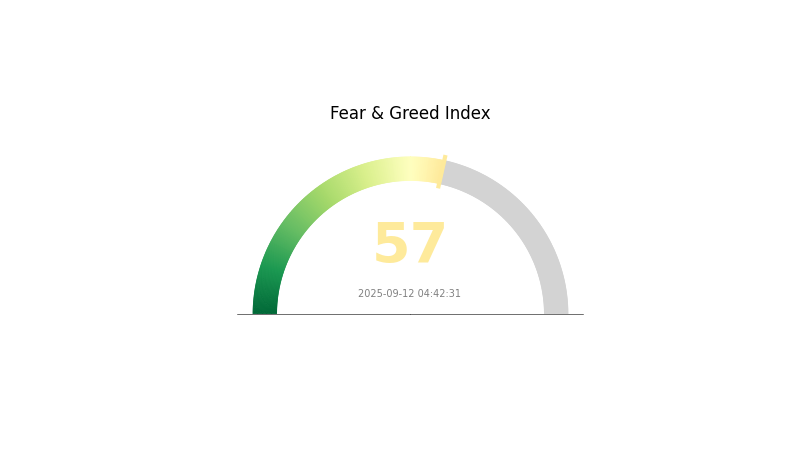

Kısa vadeli kazançlara rağmen, FIL tarihi zirvelere göre hâlen uzun vadeli bir düşüş trendindedir. VIX endeksinin 57 seviyesinde olması, piyasanın şu anda “Açgözlülük” evresinde olduğunu göstermekte; bu da gelecekteki fiyat hareketlerinde etkili olabilecek bir unsur teşkil etmektedir.

Güncel FIL piyasa fiyatını görüntülemek için tıklayın

FIL Piyasa Duyarlılığı Göstergesi

2025-09-12 Korku ve Açgözlülük Endeksi: 57 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında Korku ve Açgözlülük Endeksi’nin 57 olarak ölçülmesi, yatırımcıların FIL’in geleceği konusunda iyimserleştiğini gösteriyor. Ancak, aşırı açgözlülük durumu genellikle fiyatlarda aşırı alım sinyali verebileceğinden dikkatli olunmalı. Yatırımcılar, kâr alma veya pozisyonlarını hedge etme stratejilerini değerlendirmelidir. Olası trend dönüşlerine karşı, ana direnç seviyeleri ve piyasa hacmi yakından takip edilmelidir. Her koşulda, çeşitlendirme ve etkin risk yönetimi dalgalı piyasalarda hayati önem taşır. Sürekli güncel kalarak Gate.com’da bilinçli ve sorumlu şekilde işlem yapmanızı öneririz.

FIL Varlık Dağılımı

FIL’in adres bazlı varlık dağılımı grafiği, mülkiyetin oldukça merkeziyetsiz bir yapıda olduğunu göstermektedir. Bu veri, FIL tokenlarının farklı cüzdan adreslerinde nasıl dağıldığına dair içgörü sunarak, Filecoin ekosisteminde servetin dağılımı ve piyasa etkisi hakkında önemli bilgiler sağlar.

Mevcut dağılım, herhangi bir adresin toplam arzın üzerinde baskın bir paya sahip olmadığını, dolayısıyla orta seviyede bir merkeziyetsizlik olduğunu göstermektedir. Bu tablo, herhangi bir büyük oyuncunun piyasayı manipüle etme riskini azaltır. Ancak, büyük sahipler arasında belirli bir yoğunlaşmanın, sektör genelinde olduğu gibi, Filecoin’de de kısmen mevcut olduğu unutulmamalıdır.

Bu adres dağılımı, FIL’in piyasa yapısına daha fazla istikrar kazandırabilir ve varlığın fiyatında yoğun sahiplikten kaynaklanabilecek aşırı oynaklığı azaltabilir. Ayrıca dengeli dağılım, genellikle uzun vadeli sürdürülebilirlik ve ağın büyümesi için olumlu sinyaller veren, çeşitli katılımcılara sahip bir ekosisteme işaret etmektedir.

Güncel FIL Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. FIL’in Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Günlük Arz: Günlük 280.000 yeni FIL token ihraç edilmekte ve bu arz-talep dinamiklerini etkileyebilir.

- Tarihsel Eğilim: Sürekli artan arz, geçmişte FIL fiyatı üzerinde aşağı yönlü baskı oluşturdu.

- Mevcut Etki: Devam eden token ihraçlarının fiyat hareketi üzerindeki etkisi muhtemelen sürecek ve yükseliş ivmesini sınırlayabilir.

Kurumsal ve Balina Faaliyetleri

- Kurumsal Benimseme: Filecoin’in dağıtık depolama teknolojisinin kurumsal düzeyde yaygınlaşması, FIL talebini artırabilir.

Makroekonomik Ortam

- Enflasyon Korumalı Özellik: FIL, dijital bir varlık olarak belirli ekonomik ortamlarda enflasyona karşı bir koruma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Küresel piyasa algısı ve düzenleyici gelişmeler, FIL fiyatında hareketlilik yaratabilir.

Teknik Gelişim ve Ekosistem İnşası

- Dağıtık Depolama Teknolojisi: IPFS protokolündeki ilerlemeler ve dağıtık depolama kapasitesindeki gelişmeler, ilgi ve benimsemeyi hızlandırabilir.

- Ekosistem Uygulamaları: Filecoin üzerinde geliştirilen DApp’ler ve projelerin çoğalması, FIL’in kullanım alanını ve talebini büyütebilir.

III. 2025-2030 FIL Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 1,69 – 2,00 ABD doları

- Nötr tahmin: 2,00 – 2,53 ABD doları

- İyimser tahmin: 2,53 – 3,49 ABD doları (güçlü piyasa toparlanması ve artan benimseme gerektirir)

2027-2028 Görünümü

- Piyasa aşaması: Artan dalgalanmayla birlikte olası büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 2,86 – 4,22 ABD doları

- 2028: 2,61 – 4,06 ABD doları

- Temel itici güçler: Teknolojik ilerlemeler, yeni kullanım senaryoları ve genel kripto piyasası eğilimleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 3,69 – 4,91 ABD doları (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: 4,91 – 6,83 ABD doları (hızlı benimseme ve olumlu piyasa ortamı ile)

- Dönüştürücü senaryo: 6,83 ABD doları üzeri (Filecoin ekosistemi ve genel kripto sektörü için çok olumlu gelişmelerde)

- 31 Aralık 2030: FIL 4,91 ABD doları (2025’e göre %94 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Yüzdesi |

|---|---|---|---|---|

| 2025 | 3,48726 | 2,527 | 1,69309 | 0 |

| 2026 | 4,14984 | 3,00713 | 2,88684 | 18 |

| 2027 | 4,22261 | 3,57848 | 2,86279 | 41 |

| 2028 | 4,05657 | 3,90055 | 2,61337 | 54 |

| 2029 | 5,84848 | 3,97856 | 3,06349 | 57 |

| 2030 | 6,82979 | 4,91352 | 3,68514 | 94 |

IV. Uzman FIL Yatırım Stratejileri ve Risk Yönetimi

FIL Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olduğu profil: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Öneriler:

- Fiyat düşüşlerinde FIL biriktirin

- En az 3-5 yıl boyunca tutun

- Güvenli bir donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendi tespit etmek için 50 ve 200 günlük hareketli ortalamaları takip edin

- RSI: Aşırı alım/aşırı satım bölgelerini izleyin

- Swing trade için dikkat edilmesi gerekenler:

- Sıkı zarar-kes seviyeleri belirleyin

- Önceden belirlenmiş fiyatlarda kâr alın

FIL Risk Yönetimi Çerçevesi

(1) Varlık Tahsisi İlkeleri

- Koruyucu yatırımcılar: %1-3 arası

- Daha agresif yatırımcılar: %5-10 arası

- Uzman yatırımcılar: Maksimum %15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto paralara dağıtın

- Zarar-kes emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Soğuk saklama: Gizli anahtarların çevrimdışı ortamlarda tutulması

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. FIL için Potansiyel Riskler ve Zorluklar

FIL Piyasa Riskleri

- Yüksek volatilite: Sert fiyat dalgalanmaları

- Rekabet: Yeni ortaya çıkan depolama çözümleri benimsenmeyi olumsuz etkileyebilir

- Piyasa algısı: Genel kripto piyasasının dinamiklerinden etkilenir

FIL Regülasyon Riskleri

- Belirsiz düzenlemeler: Daha sıkı kamu denetimi ihtimali

- Sınır-ötesi uyumluluk: Farklı ülkelerde değişen yasal çerçeveler

- Vergilendirme: Kripto paralar için gelişen vergi politikaları

FIL Teknik Riskler

- Ağ ölçeklenebilirliği: Artan talebe yanıt verme zorlukları

- Güvenlik zafiyetleri: Akıllı sözleşme açıkları riski

- Teknolojik eskime: Depolama teknolojisinin hızlı ilerlemesi

VI. Sonuç ve Eylem Önerileri

FIL Yatırım Değeri Değerlendirmesi

Filecoin, merkeziyetsiz depolama ekosisteminde özgün bir değer sunarken, kısa vadede ciddi volatilite ve rekabet baskılarıyla karşı karşıyadır. Uzun vadeli potansiyeli ise geniş ölçekli benimseme ve teknolojik gelişmelere bağlı olarak güçlüdür.

FIL Yatırım Tavsiyeleri

✅Yeni yatırımcılar: Piyasa dinamiklerini kavramak için küçük ve düzenli alımlarla başlayın

✅Tecrübeli yatırımcılar: Stratejik giriş-çıkış noktaları ile dengeli yaklaşım uygulayın

✅Kurumsal yatırımcılar: FIL’i, uzun vadeli potansiyele odaklanarak çeşitlendirilmiş bir portföye dahil edin

FIL İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com’da doğrudan FIL alım-satımı

- Vadeli işlemler: Gate.com üzerinden deneyimli yatırımcılara kaldıraçlı işlem fırsatları

- Staking: Pasif gelir elde etmek için FIL ağında doğrulama faaliyetlerine katılım

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre karar vermeli ve profesyonel finansal danışmanlardan görüş almalılardır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

Filecoin 100 ABD dolarına ulaşır mı?

Evet. Uzman tahminlerine göre Filecoin’in 2025 sonunda 100 ABD dolarına çıkması bekleniyor. Bu, mevcut fiyat düzeyine göre çok büyük bir artışa işaret etmektedir.

Filecoin’in geleceği var mı?

Evet, Filecoin’in geleceği umut vericidir. 2025’te 5,20 ABD dolarına ulaşabileceği ve merkeziyetsiz depolamanın yaygınlaşmasıyla daha da büyüyebileceği öngörülüyor. Başarıda, piyasa eğilimleri ve teknolojik gelişmeler belirleyici rol oynayacaktır.

Filecoin 500 ABD dolarına ulaşabilir mi?

Şu an fiyatı oldukça düşük olsa da, piyasa koşullarındaki belirgin iyileşme ve yoğun benimseme ile Filecoin’in 500 ABD dolarına ulaşması mümkün olabilir.

FIL tokeni için 2025 fiyat tahmini nedir?

FIL’in 2025’te 2,63 ile 2,94 ABD doları arasında işlem göreceği, ortalama fiyatın ise 2,71 ABD doları olacağı tahmin ediliyor. Bu öngörü, piyasa talebi ve Web3 gelişmelerine bağlıdır.

2025 AKT Fiyat Tahmini: Olgunlaşan Web3 Ekosisteminde Akash Network Token’ının Gelecekteki Gelişim Yollarının Değerlendirilmesi

2025 AIOZ Fiyat Tahmini: Piyasa Trendleri, Teknolojik Gelişmeler ve Yatırım Potansiyeli Analizi

IAG nedir: Insurance Australia Group'u Anlamak ve Finansal Piyasa Üzerindeki Etkisi

GEOD nedir: Küresel Yeryüzü Gözlem Veritabanı ve Çevre Araştırmalarına Etkisi

2025 POKT Fiyat Tahmini: Pocket Network’in Yerel Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 XL1 Fiyat Tahmini: Yeni Nesil Elektrikli Araç İçin Piyasa Trendleri ve Potansiyel Büyümenin Analizi

Do Kwon'un Hapis Cezası, Terra ve LUNA'nın Mirası İçin Yeni Bir Bölümü İşaret Ediyor

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak