2025 FET Fiyat Tahmini: Fetch.ai’nin Yerel Token’ı FET İçin Piyasa Eğilimleri ve Gelecek Potansiyeli Analizi

Giriş: FET'nin Piyasa Konumu ve Yatırım Değeri

Fetch.AI (FET), yapay zeka tabanlı merkeziyetsiz ağlar alanında öncü bir girişim olarak, 2019'daki çıkışından bu yana önemli mesafe katetti. 2025 yılı itibarıyla Fetch.AI'nin piyasa değeri 1,59 milyar ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 2,37 milyar adet ve fiyatı da 0,67 dolar seviyesinde seyrediyor. "Yapay Zeka Destekli Blokzincir Devrimi" unvanı ile anılan bu varlık, otonom ekonomik sistemler ve merkeziyetsiz makine öğrenimi gibi alanlarda giderek artan bir öneme sahip hale geliyor.

Bu yazıda, Fetch.AI'nin 2025–2030 dönemindeki fiyat eğilimi; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik dinamiklerle birlikte ele alınarak, yatırımcılara yönelik profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulmaktadır.

I. FET Fiyat Geçmişinin Analizi ve Güncel Piyasa Durumu

FET Fiyat Geçmişinin Gelişim Seyri

- 2019: FET piyasaya çıktı, fiyatı 0,08 dolar civarında dalgalı seyretti

- 2021: Boğa piyasası zirvesinde fiyat tüm zamanların en yükseği olan 3,47 dolara ulaştı

- 2022-2023: Kripto kışıyla fiyat yaklaşık 0,20 dolara geriledi

FET Güncel Piyasa Görünümü

12 Eylül 2025 itibarıyla FET, 0,6726 ABD doları seviyesinden işlem görüyor ve piyasa değeri sıralamasında 85. sırada yer alıyor. 24 saatlik işlem hacmi 2.539.473,76 dolar olarak kaydedildi. FET son 24 saatte %1,58, son bir haftada ise %11,86 oranında değer kazandı. Ancak son 30 günde %7,93 düşüş, son bir yılda ise %50,29’luk kayda değer bir gerileme söz konusu. Güncel fiyat, 29 Mart 2024 tarihinde kaydedilen 3,47 dolarlık tarihi zirvenin hâlâ %80,64 altında. Piyasa değeri 1.596.027.481 dolar ve dolaşımdaki FET token adedi 2.372.922.214.

Güncel FET piyasa fiyatını görüntüleyin

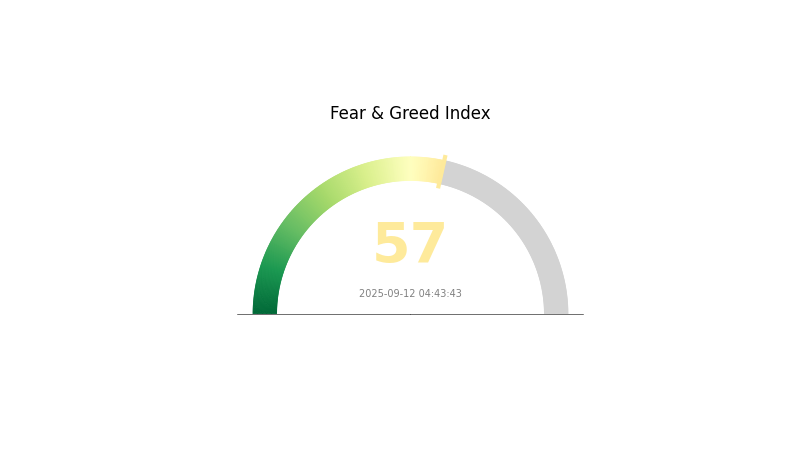

FET Piyasa Duyarlılık Göstergesi

12 Eylül 2025 Korku ve Açgözlülük Endeksi: 57 (Açgözlülük)

Kripto para piyasası, şu anda 57 seviyesinde ölçülen Korku ve Açgözlülük Endeksi ile belirgin bir açgözlülük eğilimi sergiliyor. Bu, yatırımcıların geleceğe dair iyimserliğinin arttığını ortaya koyuyor. Duyarlılıktaki bu artış fiyatları yukarı taşıyabilir; ancak ihtiyat elden bırakılmamalı. Çünkü açgözlülük genellikle piyasa düzeltmelerinin öncüsüdür. Bu nedenle yatırımcılar portföylerini dengelemeli, FOMO’dan kaçınmalı ve kapsamlı analiz ile etkin risk yönetimini elden bırakmamalıdır.

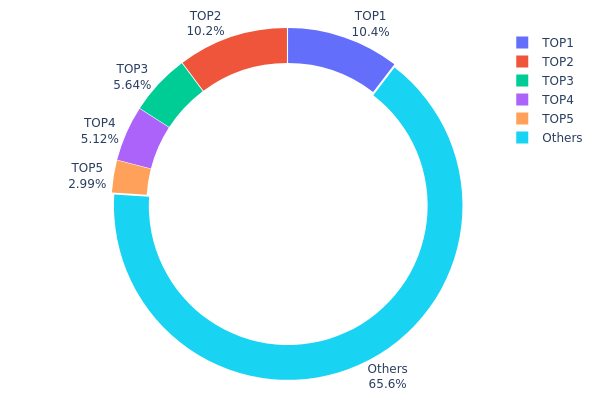

FET Arz Dağılımı

FET’ye ilişkin adres bazlı sahiplik dağılımı, sahiplikte orta seviyede bir yoğunlaşmaya işaret etmektedir. En büyük beş cüzdan, toplam FET arzının %34,4’üne sahip; en büyük iki cüzdan ise %10’dan fazla pay bulunduruyor. Bu seviye, büyük yatırımcıların FET ekosistemi üzerinde önemli bir etkiye sahip olabileceğini gösteriyor.

Söz konusu dağılım, belirli ölçüde merkezileşmeye işaret etse de, aşırı seviyede değildir. FET tokenlerinin %65,6’sı ilk beş cüzdan dışında yer alan adreslerde tutulduğundan, küçük yatırımcıların da ekosistemde kayda değer bir yer tuttuğu anlaşılıyor. Büyük ve küçük yatırımcılar arasındaki denge, genel piyasa istikrarına katkıda bulunabilir. Ancak, büyük yatırımcıların ciddi hareketleri fiyat oynaklığı yaratabilir.

Bu dağılım yapısı, FET için makul ölçüde bir merkeziyetsizlik sağlamaktadır. Büyük yatırımcıların varlığı piyasa hareketlerini etkileyebilecek olsa dahi, küçük adreslerin oluşturduğu geniş taban, ekosistemin çeşitliliği ve direncini artırır. Bu denge, piyasa manipülasyonuna karşı direnç sunabilir; fakat büyük adreslerin etkisine karşı dikkatli yaklaşmak gerekir.

| En Büyük | Adres | Miktar | Oran (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 283.507,32K | 10,44% |

| 2 | 0xf58d...b645dc | 277.549,57K | 10,22% |

| 3 | 0x9478...b626cc | 153.048,92K | 5,63% |

| 4 | 0x3378...e9e863 | 139.117,63K | 5,12% |

| 5 | 0x5a8d...66166a | 81.214,82K | 2,99% |

| - | Diğerleri | 1.780.055,64K | 65,6% |

II. FET'nin Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Maksimum Arz: 2.719.493.897 FET

- Tarihsel Eğilim: Geçmişteki arz değişimleri, fiyat oynaklığına neden oldu

- Güncel Etki: Sınırlı arz, talep arttıkça kıtlık oluşturabilir

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Şirketler, Fetch.ai’yi yapay zeka ve blok zincir çözümlerinde kullanmaya başladı

Makroekonomik Ortam

- Enflasyona Karşı Koruma: FET, belirsiz makroekonomik koşullarda enflasyona karşı bir koruma aracı olarak görülebilir

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zeka Entegrasyonu: Yapay zeka ve blok zincir teknolojilerinin entegrasyonunda sürekli gelişmeler

- Ekosistem Uygulamaları: Fetch.ai’nin teknolojisini kullanan merkeziyetsiz uygulamaların (DApp) geliştirilmesi

III. 2025-2030 FET Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,45024 - 0,60 ABD doları

- Nötr tahmin: 0,60 - 0,80 ABD doları

- İyimser tahmin: 0,80 - 1,00128 ABD doları (güçlü piyasa toparlanması ve yaygın benimseme halinde)

2027-2028 Görünümü

- Piyasa dönemi beklentisi: Artan volatilite ile büyüme fazı

- Fiyat aralığı tahmini:

- 2027: 0,61292 - 1,14226 ABD doları

- 2028: 0,69376 - 1,26327 ABD doları

- Kilit faktörler: Teknolojik ilerleme, yeni kullanım alanları ve genel piyasa duyarlılığı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,06891 - 1,33327 ABD doları (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 1,33327 - 1,75026 ABD doları (hızlı benimseme ve olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 1,75026 ABD doları ve üzeri (çığır açıcı uygulamalar ve kitlesel benimseme durumunda)

- 2030-12-31: FET 1,24132 ABD doları (muhtemel yıl sonu ortalama fiyatı)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Yıllık Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,00128 | 0,672 | 0,45024 | 0 |

| 2026 | 1,0207 | 0,83664 | 0,47688 | 24 |

| 2027 | 1,14226 | 0,92867 | 0,61292 | 38 |

| 2028 | 1,26327 | 1,03547 | 0,69376 | 53 |

| 2029 | 1,33327 | 1,14937 | 1,06891 | 70 |

| 2030 | 1,75026 | 1,24132 | 0,98064 | 84 |

IV. FET İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

FET Yatırım Stratejileri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip, uzun vadeli yatırımcılar

- Önerilen adımlar:

- Piyasa düşüşlerinde FET biriktirmek

- Piyasa dalgalanmalarına karşı en az 2-3 yıl elde tutmak

- Token’ları güvenli donanım cüzdanında saklamak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz yöntemleri:

- Hareketli Ortalama (MA): 50 ve 200 günlük MA ile trend takibi

- RSI: Aşırı alım/satım seviyelerinin izlenmesi

- Dalgalı işlem için önemli noktalar:

- Destek/direnç seviyelerine göre net giriş-çıkış noktası belirlemek

- Olası kayıpları sınırlamak için stop-loss kullanmak

FET Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10

- Profesyoneller: %15’e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Varlıkları farklı kriptolar arasında dağıtmak

- Opsiyon kullanımı: Düşüşe karşı satış (put) opsiyonu ile koruma

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadede kağıt cüzdan kullanımı

- Güvenlik: İki aşamalı doğrulama ve güçlü şifreler

V. FET İçin Olası Riskler ve Zorluklar

FET Piyasa Riskleri

- Yüksek volatilite: Kripto piyasasında ani fiyat dalgalanmaları

- Likidite riski: Yüklü alım-satımda piyasadan çıkış zorluğu

- Rekabet: Diğer yapay zeka odaklı blok zincir projelerinin öne çıkma olasılığı

FET Regülasyon Riskleri

- Belirsiz/Değişken regülasyonlar: Devlet politikalarındaki değişiklikler benimsemeyi etkileyebilir

- Menkul kıymet olarak sınıflandırma potansiyeli: Düzenleyicilerden ek inceleme riski

- Ülkeler arası kısıtlamalar: Farklı mevzuatlar nedeniyle bölgesel erişim sorunları

FET Teknik Riskler

- Akıllı kontrat açıkları: Ağ kodundaki zafiyetlerden doğan riskler

- Ölçeklenebilirlik sorunları: Kullanım arttıkça ağda tıkanıklık meydana gelmesi

- Birlikte çalışabilirlik sıkıntıları: Diğer blok zincirlerle uyum sorunları

VI. Sonuç ve Eylem Önerileri

FET Yatırım Değeri Analizi

FET, yapay zeka ve blok zincir kesişiminde yüksek risk-yüksek getiri potansiyeline sahip bir varlık olarak öne çıkıyor. Uzun vadede ciddi büyüme potansiyeli sunarken, kısa vade için yüksek oynaklık ve düzenleyici belirsizlikler önemli riskler oluşturuyor.

FET Yatırım Önerileri

✅ Yeni başlayanlara: Düzenli ve küçük ölçekli yatırımlarla adım adım pozisyon oluşturun ✅ Deneyimli yatırımcılara: Aktif risk yönetimiyle orta ölçekli portföy tahsisi yapılabilir ✅ Kurumsal yatırımcılara: Stratejik ortaklık ve büyük ölçekli entegrasyonları değerlendirin

FET Alım-Satım Yöntemleri

- Spot işlem: Güvenilir borsalarda FET al-sat ve elde tutma

- Staking: Ağ doğrulamaya katılarak pasif gelir elde etme

- DeFi entegrasyonu: FET ile getiri çiftçiliği olanakları

Kripto para yatırımları aşırı derecede risklidir; bu içerik yatırım tavsiyesi değildir. Yatırım kararınızı kendi risk profilinize göre alın ve bir finansal danışmana başvurun. Kaldıramayacağınızdan fazla yatırım yapmayın.

Sık Sorulan Sorular

Fetch.ai 100 dolara ulaşır mı?

Mevcut öngörülere göre Fetch.ai’nin 100 ABD dolarına ulaşması beklenmemektedir. 2025 için tahmin edilen en yüksek değer yaklaşık 24,47 ABD dolarıdır.

FET 2025’te ne kadar yükselebilir?

Güncel tahminlere göre FET’nin 2025’teki maksimum fiyatı 0,9999 ABD doları; ortalama fiyat ise 0,84–1 dolar arasında bekleniyor.

FET 10 doları görebilir mi?

Bunun teorik olarak mümkün olmasına rağmen, FET’nin yakın vadede 10 ABD dolarına ulaşması beklenmemektedir. Mevcut piyasa durumu ve projeksiyonlar, daha muhafazakâr bir fiyat aralığını öngörmekte; piyasa değerinin 8 milyar ABD dolarının altında kalacağı öngörülmektedir.

FET’nin kripto piyasasında geleceği var mı?

FET kripto parası, önümüzdeki yıl için 0,72 ile 1,77 ABD doları arasında değişen fiyat tahminleriyle büyüme potansiyeline sahip. Başarısı, piyasadaki genel eğilimler ile yapay zeka ve blok zincir teknolojilerindeki ilerlemeye bağlıdır.

2025 TRACAI Fiyat Tahmini: Yükselen Blockchain Teknolojisi için Gelecek Değerleme Analizi ve Piyasa Potansiyeli

2025 CAMP Fiyat Tahmini: Blockchain oyun varlıklarının piyasa trendleri ve büyüme potansiyeli üzerine analiz

2025 NC Fiyat Tahmini: Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

2025 AITECH Fiyat Tahmini: Piyasa Trendleri, Ekonomik Gelişmeler ve Yapay Zeka Sektöründe Yatırım Olanakları

2025 REX Fiyat Tahmini: Benimsenme ve kullanımın büyümeyi tetiklemesiyle yükseliş yönlü görünüm

2025 MIRA Fiyat Tahmini: Gelecek Trendler ve Potansiyel Büyüme Faktörlerinin Analizi

NFT Nadirliğini Etkili Şekilde Değerlendirme Yöntemlerini Keşfedin

Threshold (T) iyi bir yatırım mı? Blockchain altyapı sektöründe tokenomik, piyasa performansı ve gelecekteki potansiyeline dair kapsamlı bir analiz

AWE Network (AWE) yatırım için uygun mu?: Kripto para piyasasında performans, risk faktörleri ve gelecek potansiyeline dair kapsamlı bir analiz

Unibase (UB) iyi bir yatırım mı?: Piyasa potansiyeli, risk faktörleri ve gelecek beklentilerinin ayrıntılı analizi

Mina (MINA) iyi bir yatırım mı?: Fiyat Potansiyeli, Teknoloji ve Piyasa Görünümüne Dair Kapsamlı Bir Analiz