2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

Giriş: EUL'un Piyasadaki Konumu ve Yatırım Potansiyeli

Euler (EUL), Ethereum üzerindeki merkeziyetsiz borç verme protokolü olarak, 2021'deki çıkışından bu yana önemli bir gelişim gösterdi. 2025 itibarıyla Euler’in piyasa değeri 172.579.561 dolar seviyesine ulaştı; yaklaşık 18.685.530 token dolaşımda bulunuyor ve fiyatı ortalama 9,236 dolar civarında. “İzin gerektirmeyen borç verme çözümü” olarak bilinen bu varlık, DeFi kredi piyasasında giderek daha merkezi bir rol üstleniyor.

Bu analizde, Euler’in 2025-2030 dönemindeki fiyat trendleri tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı bir şekilde değerlendirilecek. Ayrıca yatırımcılara profesyonel fiyat tahminleri ile uygulamaya dönük stratejiler sunulacak.

I. EUL Fiyat Geçmişi ve Güncel Piyasa Durumu

EUL Tarihsel Fiyat Hareketleri

- 2023: Proje başlatıldı, fiyat 16 Haziran'da tüm zamanların en düşük seviyesi olan 1,44 dolara indi

- 2024: Piyasa toparlanma dönemiydi, fiyat kademeli olarak yükseldi

- 2025: Boğa piyasasında, fiyat 11 Temmuz’da tüm zamanların en yüksek seviyesi olan 15,81 dolara ulaştı

EUL Güncel Piyasa Görünümü

24 Eylül 2025 tarihi itibarıyla EUL, 9,236 dolar seviyesinden işlem görüyor ve son 24 saatte %1,92 düşüş yaşadı. Token’ın toplam piyasa değeri 172.579.561 dolar ve küresel kripto para piyasasında 325. sırada bulunuyor. Son bir yılda EUL %93,33 oranında değer kazandı. Fakat son dönemde dalgalanma yaşandı; son 7 günde %15,09 ve son 30 günde %11,44 oranında değer kaybı var. Mevcut fiyat, zirve değerine göre %41,58’lik düşüş gösterse de, en düşük seviyesinin %541,39 üzerinde seyrediyor. Bu da projenin başlangıcından bu yana güçlü bir performans sergilediğini gösteriyor.

Güncel EUL piyasa fiyatını görüntüleyin

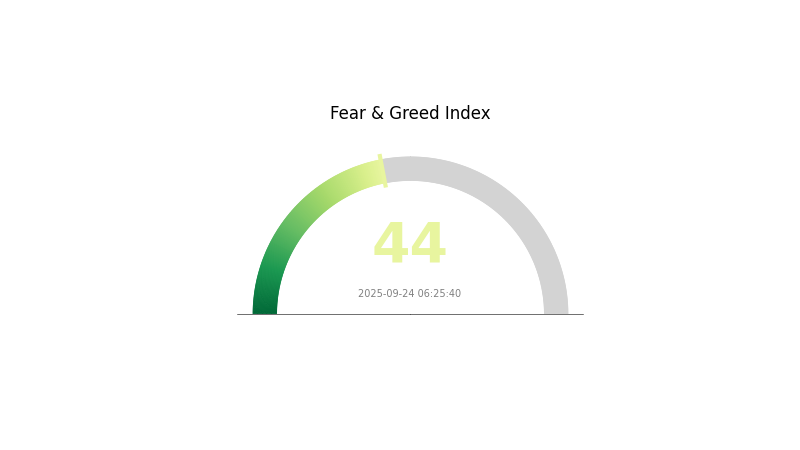

EUL Piyasa Duyarlılık Göstergesi

24 Eylül 2025 Korku ve Açgözlülük Endeksi: 44 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık, Korku ve Açgözlülük Endeksi'nin 44 seviyesinde kalmasıyla temkinli ve “korkulu” olarak öne çıkıyor. Yatırımcılar bu dönemde tedbirli davranıyor ve büyük işlemlerden kaçınıyor. Bu dönemlerde güncel bilgileri takip etmek ve ani karar almaktan uzak durmak önemlidir. Piyasa döngüleri doğaldır ve korkunun hâkim olduğu zamanlar, uzun vadeli düşünen yatırımcılar için fırsat sunabilir. Yatırım kararı vermeden önce kapsamlı analiz yapılmalı ve risk profili değerlendirilmelidir.

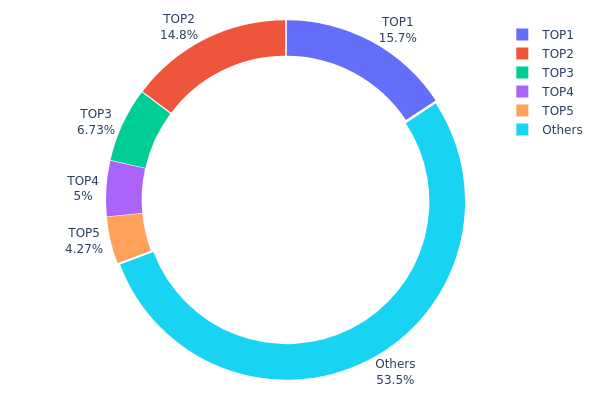

EUL Varlık Dağılımı

Adres varlık dağılımı verileri, EUL tokenlarının belli cüzdanlarda yoğunlaştığını gösteriyor. Detaylı analiz, başlıca beş adresin toplam EUL arzının %46,43’üne sahip olduğunu, iki büyük adresin ise tokenların her birinin %14’ünden fazlasını elinde bulundurduğunu ortaya koyuyor.

Böyle bir yoğunlaşma, olası piyasa manipülasyonu ve yüksek fiyat dalgalanması riskini artırıyor. Tokenların yaklaşık yarısının az sayıda adreste toplanması, bu adreslerin büyük ölçekli işlemlerinin piyasa dengelerinde ciddi etkiye sahip olabileceği anlamına gelir. Konsantrasyonun yüksek olması da merkeziyetsizliğin zayıfladığını ve EUL ekosisteminin istikrarı ile adil yapısını etkileyebileceğini gösteriyor.

Diğer taraftan, EUL tokenlarının %53,57’si farklı cüzdanlar arasında dağılmış durumda. Bu model merkezi kontrol ile yaygın katılım arasında bir denge kurarken, üst düzey sahiplerin piyasa üzerindeki etkisi hâlâ büyük kalıyor.

Güncel EUL Varlık Dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xcad0...fb1dce | 4.275,72K | 15,72% |

| 2 | 0x7597...b33a95 | 4.009,47K | 14,74% |

| 3 | 0x25aa...126992 | 1.828,27K | 6,72% |

| 4 | 0x7ba1...76eaa4 | 1.359,14K | 4,99% |

| 5 | 0xfb91...444bd5 | 1.160,22K | 4,26% |

| - | Diğerleri | 14.550,01K | 53,57% |

II. EUL'un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Borsa Listelenmeleri: Bithumb gibi yeni piyasalarda KRW eşleşmesi dahil EUL'un işlem görmesi fiyat ve likidite üzerinde doğrudan etkiye sahiptir.

Makroekonomik Konjonktür

- Enflasyon Koruma Özelliği: Ticaret savaşları ve resesyon endişesiyle altının yükselmesi, EUL gibi kripto varlıkların alternatif bir değer saklama aracı olma potansiyelini gösteriyor.

Teknik Gelişim ve Ekosistem Genişlemesi

- Piyasa Duyarlılığı: Yatırımcı eğilimi, EUL fiyat hareketlerinde ana belirleyici. Son günlerde %3,04’lük fiyat düşüşü, piyasa algısının zayıfladığını gösteriyor.

- Fiyat Farklılıkları: EUL fiyatının yerli ve yabancı borsalarda farklılık göstermesi hem arbitraj fırsatı hem de tutarlı fiyat bilgisine ulaşmak isteyen yatırımcılar için zorluk oluşturur.

III. 2025-2030 EUL Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: 7,91 - 8,55 dolar

- Tarafsız tahmin: 8,55 - 9,20 dolar

- İyimser tahmin: 9,20 - 9,84 dolar (uygun piyasa koşulları gerektirir)

2027-2028 Öngörüsü

- Piyasa aşaması: Olası büyüme dönemi

- Öngörülen fiyat aralığı:

- 2027: 8,79 - 11,94 dolar

- 2028: 7,39 - 13,89 dolar

- Temel tetikleyiciler: Artan benimseme, teknolojik ilerleme

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 12,55 - 15,18 dolar (istikrarlı piyasa büyümesi)

- İyimser senaryo: 15,18 - 17,82 dolar (güçlü boğa piyasası)

- Dönüştürücü senaryo: 17,82 - 21,71 dolar (teknolojik atılımlar ve kitlesel benimseme)

- 2030-12-31: EUL 21,71 dolar (muhtemel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 9,83972 | 9,196 | 7,90856 | 0 |

| 2026 | 11,42143 | 9,51786 | 7,32875 | 3 |

| 2027 | 11,9354 | 10,46965 | 8,7945 | 13 |

| 2028 | 13,89113 | 11,20252 | 7,39366 | 21 |

| 2029 | 17,81649 | 12,54682 | 9,15918 | 35 |

| 2030 | 21,70977 | 15,18166 | 11,08261 | 64 |

IV. EUL Yatırım Stratejisi ve Risk Yönetimi

EUL Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli ve risk toleransı yüksek olan yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde EUL biriktirin

- Önemli hareketler için fiyat alarmı kurun

- Token’ları güvenli, saklama hizmeti olmayan cüzdanda tutun

(2) Aktif Al-Sat Stratejisi

- Kullanılacak teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını saptamak için kullanılır.

- RSI: Aşırı alım veya aşırı satım noktalarını belirlemede yardımcı olur.

- Kısa vadeli işlemler için temel noktalar:

- Euler protokol güncellemeleri ve yönetişim değişikliklerini takip edin

- DeFi piyasası trendlerini ve rakip projeleri izleyin

EUL Risk Yönetimi Yaklaşımı

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföylerinde %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: En fazla %15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı DeFi projelerinde pozisyon alın

- Stop-loss emri: Kaybı sınırlamak için önceden çıkış noktası belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Cüzdan

- Soğuk cüzdan tercih edin: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü parola ve düzenli yazılım güncellemesi

V. EUL'a Yönelik Potansiyel Riskler ve Zorluklar

EUL Piyasa Riskleri

- Volatilite: DeFi token’larında yüksek fiyat dalgalanması riski

- Rekabet: Yeni borç verme protokollerinin yükselişi Euler'ın pazar payını azaltabilir

- Likidite: Piyasa düşüşlerinde likiditenin azalması mümkün

EUL Düzenleyici Riskler

- Düzenleyici belirsizlik: DeFi düzenlemelerinin gelişmesi Euler'ın operasyonlarını etkileyebilir

- Uyum zorunlulukları: İleride KYC/AML gerekliliği söz konusu olabilir

- Sınır ötesi kısıtlamalar: Ülkeler arasında farklı yaklaşım

EUL Teknik Riskler

- Akıllı kontrat açıkları: Protokolde zafiyet veya hata oluşma riski

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık deneyimi olumsuz etkileyebilir

- Oracle hataları: Yanlış fiyat verisi sistemde istikrarı bozabilir

VI. Sonuç ve Eylem Önerileri

EUL Yatırım Değeri Analizi

Euler (EUL), DeFi borç verme piyasasında yenilikçi özellikleri ve güçlü yönetişim yapısıyla uzun vadede cazip bir yatırım seçeneği sunuyor. Kısa vadede ise piyasa oynaklığı ve düzenleyici belirsizlikler risk oluşturmaktadır.

EUL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlar ile yatırım yapın ve DeFi borç protokollerini öğrenmeye odaklanın

✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif al-satı dengeleyin

✅ Kurumsal yatırımcılar: Detaylı inceleme yapın ve EUL’u çeşitli DeFi portföylerine dahil edin

EUL Alım-Satım Yöntemleri

- Spot işlem: Gate.com spot piyasasında EUL alıp satın

- Staking: Euler protokolünde EUL token’larını stake ederek yönetişime katılın

- Likidite sağlama: Euler ekosistemindeki likidite fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk içerir. Bu metin yatırım tavsiyesi değildir. Yatırımcılar kendi risk profilini dikkate almalı ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alamayacağınız tutarda yatırım yapmayın.

SSS

2030’da XRP için fiyat tahmini nedir?

Uzmanlara göre XRP, 2030’da benimsenme düzeyi ve düzenleyici faktörlere bağlı olarak 4,67 - 26,97 dolar aralığında hareket edebilir. Güçlü piyasa koşullarında ise 10 dolar seviyesine ulaşması olasıdır.

2025’te AI gold için fiyat tahmini nedir?

AI gold’un 2025’te yaklaşık 3.500 dolar seviyesine ulaşması ve istikrarlı görünümde rekorunu yeniden test etmesi bekleniyor.

En yüksek fiyat tahmine sahip kripto para hangisi?

2025 için en yüksek fiyat tahmini Bitcoin (BTC) ve hemen ardından Ethereum (ETH) içindir. Bu tahminler güncel piyasa trendleri ve uzman analizlerine dayalıdır.

2030’da Shib fiyatı ne kadar olabilir?

Mevcut tahminlere göre, 2030’da Shib fiyatı 0,0000489951 ile 0,000059994 dolar arasında seyredebilir.

2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 ASTER Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 OMG Fiyat Tahmini: Gelişen Kripto Ekosisteminde Token'ın Piyasa Trendleri ve Gelecek Potansiyelinin Değerlendirilmesi

2025 MORPHO Fiyat Tahmini: DeFi Tokenı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 TOKEN Fiyat Tahmini: Piyasa Eğilimleri ve Yaklaşan Boğa Sezonunda Büyüme Potansiyelinin İncelenmesi

Kripto Para Piyasasında Short Squeeze: İşleyişi Nasıl Gerçekleşir Açıklandı

Short Squeeze Fenomenini Anlamak: Kapsamlı Bir Açıklama