2025 ETH Fiyat Tahmini: Piyasa Trendleri ve Kurumsal Benimseme Faktörlerinin Analizi

Giriş: ETH'nin Piyasa Konumu ve Yatırım Potansiyeli

Ethereum (ETH), merkeziyetsiz uygulamalar ve akıllı sözleşmelerin öncüsü olarak 2015 yılındaki çıkışından bu yana sektörde pek çok önemli gelişmeye imza atmıştır. 2025 yılı itibarıyla Ethereum’un piyasa değeri 528,61 milyar ABD doları seviyesine ulaşmıştır, dolaşımdaki toplam arzı yaklaşık 120.705.000 adet olup, fiyatı da 4.379,39 dolar civarında seyretmektedir. Sıklıkla “Dünya Bilgisayarı” olarak tanımlanan bu dijital varlık, merkeziyetsiz finans (DeFi), benzersiz dijital varlıklar (NFT) ve blokzincir tabanlı uygulamalarda giderek daha kritik bir konuma sahip.

Bu makalede Ethereum’un 2025-2030 dönemindeki fiyat seyri; tarihsel eğilimler, arz-talep dengesi, ekosistem büyümesi ve genel ekonomik ortam değerlendirilerek profesyonel fiyat öngörüleri ve yatırımcılar için uygulanabilir stratejiler sunulacaktır.

I. ETH Fiyat Geçmişi ve Güncel Durum

ETH Fiyatında Tarihsel Gelişim

- 2015: Ethereum piyasaya sürüldü, başlangıç fiyatı 0,432979 ABD doları

- 2017: ICO dönemi, fiyat 1.400 ABD dolarının üzerine çıktı

- 2018-2019: Kripto kışı, fiyat yaklaşık 100 dolara geriledi

- 2021: Boğa piyasası, tüm zamanların zirvesi 4.946,05 ABD doları

- 2022-2023: Piyasa düzeltmesi, fiyat 1.000-2.000 ABD doları arasında dalgalandı

- 2025: Toparlanma dönemi, fiyat 4.379,39 ABD dolara yükseldi

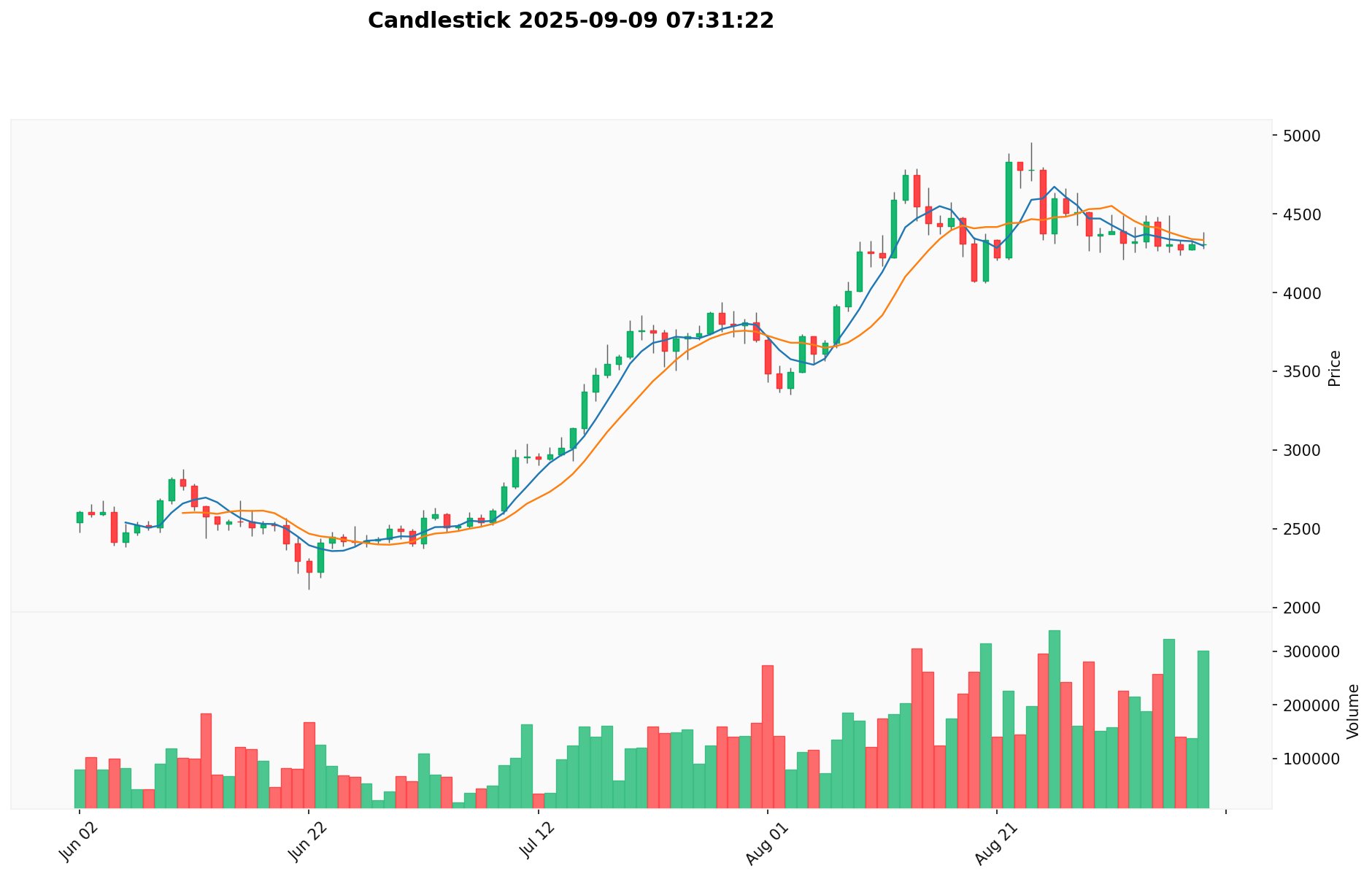

ETH Güncel Piyasa Durumu

9 Eylül 2025 tarihinde Ethereum (ETH) 4.379,39 ABD doları fiyatla işlem görmekte, son 24 saatteki işlem hacmi 1.439.596.524 ABD dolarıdır. Mevcut piyasa değeri 528.614.271.986 ABD doları olup, ETH en yüksek piyasa değerine sahip ikinci kripto para konumundadır. Son 24 saatte ETH fiyatı %1,59 artış göstermiştir. 7 günlük performansta %0,98 oranında hafif düşüş gözlenirken, 30 gün ve 1 yıllık süreçte sırasıyla %3,40 ve %90,27 yükseliş kaydedilmiştir. Mevcut fiyat, 25 Ağustos 2025’te kaydedilen 4.946,05 dolarlık tüm zamanların zirvesine yaklaşmaktadır. Bu durum Ethereum’un uzun vadeli potansiyeline yönelik güçlü piyasa güvenini yansıtmaktadır.

Güncel ETH piyasa fiyatını görüntüleyin

Talep ettiğiniz İngilizce içerik şu şekildedir:

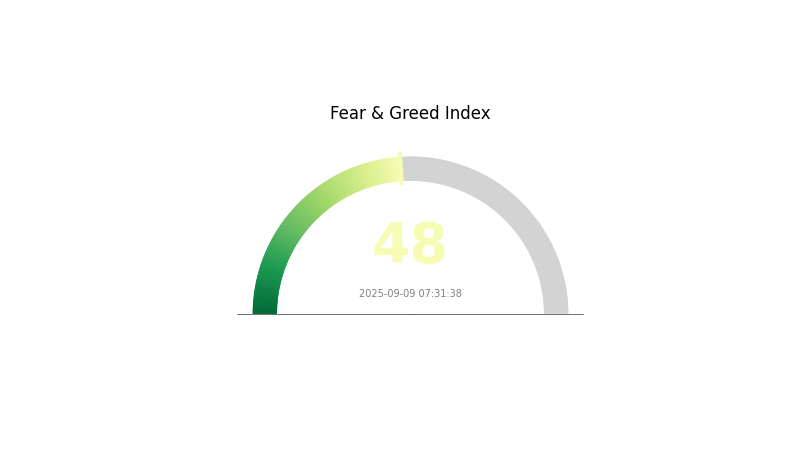

ETH Piyasa Duyarlılık Göstergesi

09 Eylül 2025 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Ethereum için piyasa duyarlılığı dengeli seyrediyor. Korku ve Açgözlülük Endeksi 48 ile nötr düzeydedir. Bu durum, yatırımcıların ne aşırı kaygılı ne de aşırı iyimser olduğunu gösterir. Özellikle strateji revizyonu ve ortalama maliyetle alım için uygun bir dönemdir. Piyasa duyarlılığının hızla değişebildiği unutulmamalıdır, yatırımcılar piyasayı yakından takip etmeli ve risklerini etkin şekilde yönetmelidir. Gate.com, sunduğu gelişmiş araçlarla bu zorlu piyasa koşullarında verimli işlem yapmanızı destekler.

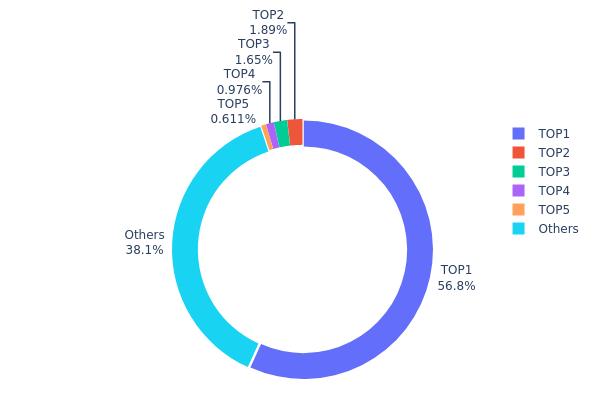

ETH Varlık Dağılımı

Adres bazında varlık dağılımı verileri, Ethereum sahipliğinin yüksek oranda yoğunlaşmış olduğunu gösteriyor. En büyük adres, toplam ETH arzının %56,78’ini elinde bulundurmakta ve bu durum ciddi merkezileşme riskine işaret etmektedir. Bu yoğunlaşma, piyasa manipülasyonu ve dalgalanma risklerini artırmaktadır. İlk 5 adres, toplam arzın %61’inden fazlasını kontrol ederek dağılımdaki dengesizliği iyice güçlendirmektedir.

Bu denli büyük varlık sahipliği (“balina” olarak bilinen adresler) önemli alım veya satış emirleriyle fiyatları ciddi şekilde etkileyebilir ve piyasa dinamiklerini değiştirebilir. Merkeziyet, Ethereum’un merkeziyetsizlik hedeflerine doğrudan rakip bir unsur olarak da karşımıza çıkmaktadır. Az sayıdaki aktörün ağ üzerinde orantısız kontrole sahip olması sistemde risk teşkil etmektedir.

Öte yandan, ETH arzının %38,09’u diğer adresler arasında dağılmıştır; bu, daha yaygın katılım ve dağılımın varlığını gösterir. Dağılımın bu yapısı, merkezi etki ile geniş katılım arasındaki dengeyi oluşturur ve bu denge Ethereum’un uzun vadeli istikrarı ile büyüme potansiyelini belirleyebilir.

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...7705fa | 68.534,08K | 56,78% |

| 2 | 0xc02a...756cc2 | 2.277,15K | 1,89% |

| 3 | 0xbe0e...4d33e8 | 1.996,01K | 1,65% |

| 4 | 0x40b3...18e489 | 1.177,79K | 0,98% |

| 5 | 0x4904...74e97e | 737,33K | 0,61% |

| - | Diğerleri | 45.982,71K | 38,09% |

II. ETH'nin Gelecekteki Fiyatını Belirleyen Temel Unsurlar

Arz Mekanizması

- EIP-1559: Bu sistem, işlem ücretlerinin bir kısmını yakarak zaman içinde ETH'nin deflasyonist bir yapıya bürünmesine yol açabilir.

- Tarihsel Seyir: Önceki arz değişiklikleri, dolaşımdaki arzın azalmasıyla fiyatlarda genel artışa neden olmuştur.

- Mevcut Etki: Süregelen ücret yakma mekanizması, toplam arzı azaltıp ETH fiyatını desteklemeye devam etmektedir.

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: BlackRock gibi önde gelen kurumlar, ETF başvuruları ile ETH’ye olan ilgilerini artırıyor.

- Kurumsal Benimseme: Bit Digital ve Bitmine Immersion Technologies gibi firmalar ETH varlığını ciddi şekilde artırdı.

- Devlet Politikaları: 401(k) emeklilik planlarında kripto para kullanımının gündeme gelmesi, kurumsal ETH talebini güçlendirebilir.

Makroekonomik Koşullar

- Para Politikası Etkisi: Özellikle ABD Merkez Bankası politikaları, kripto piyasası duyarlılığını doğrudan etkiliyor.

- Enflasyon Kalkanı Özelliği: ETH, Bitcoin gibi enflasyona karşı koruma aracı olarak giderek daha fazla kullanılmaktadır.

- Jeopolitik Unsurlar: Küresel belirsizlikler ve siyasi gerilimler, yatırımcıların ETH gibi varlıklara yönelmesini sağlayabilir.

Teknolojik Gelişmeler ve Ekosistem Büyümesi

- Ethereum 2.0: Proof of Stake algoritmasına geçiş, ölçeklenebilirlik ve enerji verimliliğine büyük katkı sağlayacak.

- Layer 2 Çözümleri: Katman 2 teknolojileriyle Ethereum’un işlem kapasitesi artıyor, işlem ücretleri düşüyor.

- Ekosistem Uygulamaları: Merkeziyetsiz Finans (DeFi) ve NFT’ler, Ethereum ağının kullanımını ve benimsenmesini derinleştiriyor.

III. 2025-2030 ETH Fiyat Tahminleri

2025 Beklentisi

- Temkinli tahmin: 3.580 – 4.000 ABD doları

- Nötr tahmin: 4.000 – 4.700 ABD doları

- İyimser tahmin: 4.700 – 5.327 ABD doları (Ethereum ağ güncellemeleri ve benimsenmenin sürmesi halinde)

2027-2028 Beklentisi

- Piyasa döngüsü: Olası boğa dönemi

- Fiyat aralıkları:

- 2027: 3.292 – 7.041 ABD doları

- 2028: 4.661 – 8.716 ABD doları

- Temel katalizörler: Ethereum 2.0’ın tamamlanması, DeFi ve NFT kullanımının artması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 7.000 – 8.000 ABD doları (ağda istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: 8.000 – 9.000 ABD doları (kurumsal benimseme hızlanırsa)

- Oyun değiştirici senaryo: 9.000 – 9.491 ABD doları (Ethereum’un finans ve teknolojiye tam entegre olmasıyla)

- 31 Aralık 2030: ETH’nin 7.975 ABD doları ile yeni zirve görme potansiyeli

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 5.327,73 | 4.366,99 | 3.580,93 | 0 |

| 2026 | 5.283,62 | 4.847,36 | 4.556,52 | 10 |

| 2027 | 7.041,03 | 5.065,49 | 3.292,57 | 15 |

| 2028 | 8.716,70 | 6.053,26 | 4.661,01 | 38 |

| 2029 | 8.566,57 | 7.384,98 | 4.874,09 | 68 |

| 2030 | 9.491,17 | 7.975,78 | 4.944,98 | 82 |

IV. Profesyonel ETH Yatırım Stratejileri ve Risk Yönetimi

ETH Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Ethereum’un teknolojisini ve uzun vadeli vizyonunu benimseyen yatırımcılar

- Öneriler:

- Piyasa geri çekilmelerinde ETH biriktirin

- ETH’de staking yaparak pasif gelir elde edin

- Varlıklarınızı güvenli ve şahsi cüzdanlarda muhafaza edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası yön değişimlerini belirleyin

- RSI: Aşırı alım/satım sinyallerini takip edin

- Swing trade işlemlerinde dikkat edilmesi gerekenler:

- Kritik destek ve direnç seviyelerini izleyin

- Ethereum ağına dair güncellemeleri ve gelişmeleri takip ederek pozisyonunuzu yönetin

ETH Risk Yönetimi Modeli

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-5’i

- Orta düzey yatırımcılar: Portföyün %5-15’i

- Agresif yatırımcılar: Portföyün %15-30’u

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Kripto ve geleneksel varlıklar arasında yatırımınızı dağıtın

- Stop-loss (zarar-durdur) emirleri: Olası kayıpları otomatik satış ile sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Yüksek miktarlı varlıklar için donanım cüzdanları

- Güvenlik önlemleri: İki aşamalı doğrulama, özel anahtarların güvenli yedeklenmesi

V. ETH İçin Olası Riskler ve Zorluklar

ETH Piyasa Riskleri

- Yüksek fiyat oynaklığı: ETH’nin fiyatı kısa sürede ciddi dalgalanmalar gösterebilir

- Rekabet: Diğer akıllı sözleşme platformları pazar payı elde edebilir

- Makroekonomik riskler: Küresel ekonomi kripto piyasalarını etkileyebilir

ETH Düzenleyici Riskler

- Belirsiz regülasyon ortamı: Farklı ülkelerde daha sıkı yasal düzenlemeler gündeme gelebilir

- SEC sınıflandırması: ETH’nin menkul kıymet olup olmadığına dair tartışmalar devam ediyor

- Vergi mevzuatı: Değişen vergi yasaları ETH yatırımlarının getirisini etkileyebilir

ETH Teknik Riskleri

- Ağ sıkışıklığı: Yoğun dönemlerde yüksek işlem ücretleri

- Akıllı sözleşme açıkları: Ethereum tabanlı uygulamalarda çeşitli güvenlik riskleri bulunabilir

- Ölçeklenebilirlik sorunları: Ağ kapasitesinin gelişimi için sürekli yenilik gereklidir

VI. Sonuç ve Eylem Önerileri

ETH Yatırım Değeri Analizi

Ethereum, akıllı sözleşme ve DeFi ekosisteminin merkezi konumuyla güçlü bir uzun vadeli büyüme potansiyeli taşımaktadır. Buna karşın, kısa vadeli oynaklık ve teknik zorluklar önemli riskler barındırır.

ETH Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düzenli ve küçük yatırımlarla uzun vadede pozisyon oluşturun ✅ Deneyimli yatırımcılar: Piyasa durumu doğrultusunda uzun vadeli tutma ve aktif ticaret stratejilerini harmanlayın ✅ Kurumsal yatırımcılar: ETH’yi çeşitlendirilmiş kripto portföylerinde değerlendirin, staking fırsatlarını inceleyin

ETH İşlem Katılım Seçenekleri

- Spot işlemler: Gate.com üzerinden doğrudan ETH alım-satımı

- Vadeli işlemler: Kaldıraçlı işlem veya riskten korunma için ETH vadeli kontratları

- Staking: Gate.com’un Ethereum 2.0 staking hizmetlerine katılın

Kripto para yatırımları yüksek derecede risk içerir, bu içerik yatırım tavsiyesi olarak değerlendirilmemelidir. Her yatırımcı risklerini dikkate alıp kendi kararlarını vermeli ve gerekiyorsa profesyonel finansal danışmanlardan görüş almalıdır. Asla kaybedebileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular (FAQ)

2025’te 1 Ethereum’un değeri ne kadar olacak?

Mevcut öngörülere göre, 2025 yılında 1 Ethereum’un değeri 6.200 ila 9.345 ABD doları arasında, ortalama fiyat ise 4.567 ABD doları seviyesinde beklenmektedir.

2030 için ETH fiyat tahmini nedir?

ETH'nin 2030’da güçlü piyasa konumu ve sürekli teknolojik ilerleme sayesinde 10.000 ABD doları seviyesine ulaşması beklenmektedir.

Ethereum 10.000 ABD dolarını görecek mi?

Evet, ağda artan benimseme, teknik güncellemeler ve piyasa büyümesiyle Ethereum 2025’te 10.000 ABD dolarına ulaşabilir.

Ethereum 50.000 ABD dolarını görebilir mi?

Evet, Ethereum uzun vadede artan benimseme, teknolojik gelişmeler ve Ethereum 2.0’ın tam olarak hayata geçmesiyle 50.000 ABD dolarına ulaşabilir.

Ethereum Fiyatı (CAD): 2025 Güncellemesi Kanadalı Yatırımcılar için

Ethereum Fiyatı Kanada'da: Temmuz 2025 için Analiz ve Alım Rehberi

Özbekistan Para Birimi ve Kripto

Kripto Çöküşü mü Yoksa Sadece Düzeltme mi?

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

Kripto Neden Çöküyor ve Yeniden Yükselir Mi? Tam Piyasa Analizi

CELO nedir: Mobil öncelikli blockchain platformu ve yerel kripto parası hakkında kapsamlı bir rehber

CELO nedir: Finansal Katılım İçin Mobil Öncelikli Blockchain Platformuna Kapsamlı Bir Rehber

Bilgisayar biliminde CFG: Bağlamdan Bağımsız Dilbilgilerine Kapsamlı Rehber

VTHO Nedir: VeChain’in Gas Token’ı ve Blockchain Ekosistemindeki Rolü Hakkında Kapsamlı Rehber

SUSHI nedir: Japonya'nın En İkonik Mutfak Geleneğine Kapsamlı Bir Rehber