2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Tokeni İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Giriş: BLUR’un Piyasa Konumu ve Yatırım Değeri

Blur (BLUR), merkeziyetsiz NFT pazarı ve NFT agregatörü olarak kurulduğu günden bu yana dikkat çekici bir gelişim gösterdi. 2025 yılı itibarıyla BLUR’un piyasa değeri 193.188.398 $’a ulaşırken, yaklaşık 2.526.329.262 dolaşımdaki token var ve fiyatı 0,07647 $ seviyesinde seyrediyor. “NFT ticaret devi” şeklinde tanımlanan bu varlık, NFT ve merkeziyetsiz finans sektörlerinde giderek kritik bir rol üstleniyor.

Bu makalede, BLUR’un 2025-2030 dönemindeki fiyat hareketleri; geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler doğrultusunda profesyonel fiyat öngörüleri ve pratik yatırım stratejileriyle kapsamlı biçimde ele alınacak.

I. BLUR Fiyat Geçmişi ve Mevcut Piyasa Durumu

BLUR Geçmiş Fiyat Yolculuğu

- 2023: BLUR piyasaya sürüldü, 14 Şubat’ta 5,4146 $ ile zirve yaptı.

- 2024: Piyasa dalgalanmaları sürdü, BLUR yüksek volatilite yaşadı.

- 2025: Ayı trendiyle fiyat 22 Haziran’da 0,06129 $’a kadar geriledi.

BLUR Güncel Piyasa Durumu

24 Eylül 2025 itibarıyla BLUR 0,07647 $’dan işlem görmekte ve son 24 saatte %2,68 yükselmiştir. Güncel piyasa değeri 193.188.398 $ olup, BLUR kripto para piyasasında 303’üncü sırada yer almaktadır. 24 saatlik işlem hacmi 377.036 $ ile orta düzeyde piyasa aktivitesi görülmektedir.

BLUR’un kısa vadeli performansı karışık: Son 1 saatte %1,27 artış, son 7 günde %9,17 düşüş yaşanmıştır. 30 günlük değişimde %1,85’lik hafif bir gerileme vardır. Uzun vadeli trend ise hâlâ düşüşte. Son bir yılda %65,08 oranında değer kaybı yaşanmıştır.

Dolaşımdaki token miktarı 2.526.329.262 BLUR ile toplam arzın %84,21’ini oluşturuyor (toplam arz: 3.000.000.000 BLUR). Tam seyreltilmiş piyasa değeri 229.410.000 $’dır.

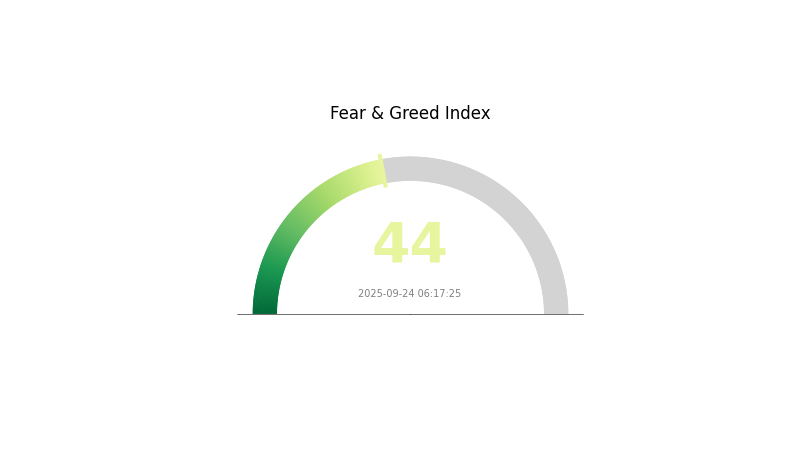

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 44 ile “Korku” seviyesinde bulunuyor.

Mevcut BLUR piyasa fiyatını görmek için tıklayın

BLUR Piyasa Duyarlılık Göstergesi

2025-09-24 Korku ve Açgözlülük Endeksi: 44 (Korku)

BLUR için kripto piyasasında duyarlılık korku düzeyinde; Korku ve Açgözlülük Endeksi 44 olarak ölçülüyor. Bu durum, yatırımcılar arasında temkinli bir ortam oluşmasına neden oluyor ve uzun vadeli BLUR potansiyeline inananlar için alım fırsatları sunabiliyor. Ancak, piyasa duyarlılığı hızla değişebilir. Yatırım kararı öncesi detaylı analiz yapmalı ve risk toleransınızı dikkate almalısınız. Gate.com belirsiz piyasalarda kapsamlı veriyle sizi güncel tutar.

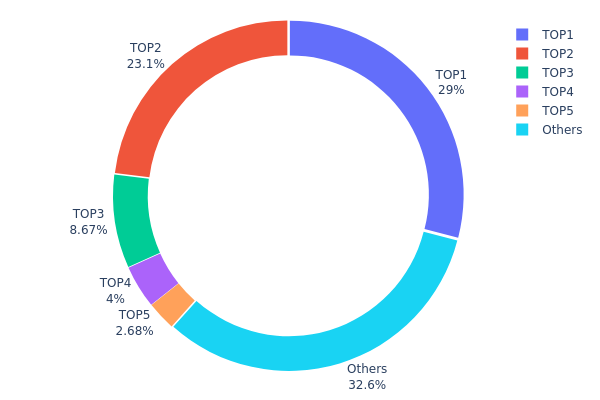

BLUR Varlık Dağılımı

BLUR adres varlık dağılımı oldukça yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. İlk 5 adres, toplam BLUR arzının %67,39’unu elinde bulundururken, en büyük adres tek başına %29 paya sahip. Bu yoğunlaşma, BLUR ekosisteminde olası piyasa manipülasyonu ve merkeziyetçiliğe dair endişeleri artırıyor.

Yoğun varlık dağılımı, büyük holder’ların satışa gitmesi halinde fiyat hareketlerinde ciddi oynaklık ve ani düşüşler yaratabilir. Ayrıca, ekosistemde az sayıda adresin dolaşımdaki arz üzerinde büyük etki sahibi olması, merkeziyetsizliğin zayıflamasına ve yönetişim kararlarının az sayıda paydaşın inisiyatifine kalmasına neden olabilir. Bu durum, BLUR yatırımlarında ve ekosisteminde dikkatle izlenmelidir.

Güncel BLUR Varlık Dağılımı için tıklayın

| İlk Sıra | Adres | Varlık Adedi | Pay (%) |

|---|---|---|---|

| 1 | 0x581e...f3fb26 | 870.000,00K | 29,00% |

| 2 | 0x04b5...aeed1c | 691.696,83K | 23,05% |

| 3 | 0x3f1b...7db647 | 260.037,96K | 8,66% |

| 4 | 0xf977...41acec | 120.000,00K | 4,00% |

| 5 | 0x6522...837e90 | 80.543,56K | 2,68% |

| - | Diğerleri | 977.721,64K | 32,61% |

II. BLUR’un Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Token Dağıtımı: BLUR token’ları airdrop ve piyasa katılımıyla dağıtılır.

- Mevcut Etki: Son airdrop’lar, mavi çip NFT’lere talebi artırarak BLUR fiyatını etkileyebilir.

Kurumsal ve Balina Etkileri

- Kurumsal Benimseme: Blur, profesyonel yatırımcılar ve NFT koleksiyonerlerinden yoğun ilgi görmektedir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Dijital varlık olan BLUR, enflasyon riskine karşı koruma aracı olarak görülebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Platform Güncellemeleri: Blur, gelişmiş filtreleme ve analitik özelliklerle NFT platformunu sürekli iyileştiriyor.

- Ekosistem Uygulamaları: Blur, toplu listeleme ve toplu satın alma fonksiyonlarıyla kapsamlı NFT ticareti deneyimi sağlar.

III. 2025-2030 BLUR Fiyat Öngörüsü

2025 Görünümü

- Temkinli tahmin: 0,04524 $ - 0,07667 $

- Tarafsız tahmin: 0,07667 $ - 0,09200 $

- İyimser tahmin: 0,09200 $ - 0,10734 $ (olumlu piyasa koşulları ve yüksek benimseme ile)

2027-2028 Görünümü

- Piyasa fazı bekleniyor: Yükselen volatilite ile büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,07839 $ - 0,1166 $

- 2028: 0,06008 $ - 0,13412 $

- Başlıca katalizörler: Teknolojik yenilikler, yaygın piyasa kabulleri ve olası stratejik iş birlikleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,11761 $ - 0,12251 $ (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,12251 $ - 0,13232 $ (piyasanın güçlü performansı ve artan kullanım ile)

- Yüksek potansiyel senaryo: 0,13232 $ - 0,15000 $ (çığır açıcı yenilikler ve ana akım benimseme ile)

- 2030-12-31: BLUR 0,13232 $ (mevcut projeksiyonlara göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,10734 | 0,07667 | 0,04524 | 0 |

| 2026 | 0,10396 | 0,092 | 0,08004 | 20 |

| 2027 | 0,1166 | 0,09798 | 0,07839 | 28 |

| 2028 | 0,13412 | 0,10729 | 0,06008 | 40 |

| 2029 | 0,12433 | 0,1207 | 0,06156 | 57 |

| 2030 | 0,13232 | 0,12251 | 0,11761 | 60 |

IV. BLUR Yatırımı için Profesyonel Stratejiler ve Risk Yönetimi

BLUR Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Risk toleransı yüksek ve uzun vadeli vizyona sahip olanlar

- Operasyon önerileri:

- Fiyat düşüşlerinde BLUR biriktirin

- Piyasa oynaklığından etkilenmemek için en az 2-3 yıl tutun

- Token’ları donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar (EMA/SMA): 50 ve 200 günlük hareketli ortalamalar ile trend takibi yapın

- RSI: Aşırı alım ve aşırı satım noktalarını tespit edin

- Swing trade için ipuçları:

- Teknik göstergelere göre açılış ve kapanış noktalarını belirleyin

- Stop-loss (zarar durdur) emirleriyle potansiyel riskleri sınırlandırın

BLUR Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Aggresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Araçları

- Diversifikasyon: Farklı kripto varlıklara yatırım yapın

- Stop-loss (zarar durdur) emirleriyle kayıpları sınırlandırın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdanı

- Soğuk cüzdan kullanımı: Varlıkların büyük bölümünü çevrimdışı güvenli şekilde tutun

- Güvenlik önlemleri: İki aşamalı doğrulama ve anahtar yedekleme kullanın

V. BLUR için Olası Riskler ve Zorluklar

BLUR Piyasa Riskleri

- Yüksek volatilite: BLUR fiyatı ani dalgalanmalara açık

- Rekabet: Diğer NFT platformları pazar payı kazanabilir

- Piyasa duyarlılığı: NFT trendleri BLUR’un değerini etkiler

BLUR Regülasyon Riskleri

- Belirsiz regülasyonlar: NFT ve kripto regülasyonları değişebilir

- Vergisel belirsizlik: NFT işlemlerinde net olmayan vergilendirme

- Sınır ötesi kısıtlamalar: Uluslararası düzenlemeler benimsemeyi sınırlayabilir

BLUR Teknik Riskler

- Akıllı kontrat açıkları: Olası hata ve saldırı riskleri

- Ölçeklenebilirlik: Yoğun dönemlerde yüksek gas ücretleri

- Platform bağımlılığı: Ethereum ağ performansına olan bağlılık

VI. Sonuç ve Eylem Önerileri

BLUR Yatırım Değeri Analizi

BLUR, NFT piyasasında yüksek riskli ve yüksek potansiyelli bir yatırım imkanı sunar. Uzun vadeli değer, NFT ekosisteminin yaygınlaşması ve platform gelişimine bağlıyken, kısa vadede volatilite ve regülasyon belirsizliği ön plana çıkar.

BLUR Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla giriş yapın, bilgi kazanın

✅ Deneyimli yatırımcılar: Ortalama maliyetle alım ve net çıkış stratejisi uygulayın

✅ Kurumsal yatırımcılar: Derin analiz yapın, OTC işlemleri değerlendirin

BLUR Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com’da BLUR alın ve tutun

- Staking: Varsa BLUR staking programlarına katılım

- NFT ticareti: Blur platformunda NFT işlemleri için BLUR kullanımı

Kripto para yatırımı son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli hareket etmeli ve profesyonel danışmanlar ile görüşmelidir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Blur iyi bir yatırım mı?

Evet, Blur iyi bir yatırım fırsatı olarak öne çıkıyor. Güncel verilerde son bir ayda %60 oranında “yeşil gün” yaşandı, fiyat istikrarlı seyretti. Tahminler alım yönünde destek oluşturmaktadır.

BLUR neden düşüyor?

BLUR fiyatının düşüş sebebi, yaklaşan airdrop nedeniyle mevcut token değerlerinin seyrelmesidir. Yeni token dağıtımı fiyatta düşüşe yol açıyor.

Blur kripto ne işe yarar?

Blur, merkeziyetsiz NFT pazarı olarak ücretsiz işlem ve NFT destekli borçlanma imkanı sunar.

2025 kripto fiyat tahmini nedir?

Analist öngörüsüne göre, 2025’te Bitcoin fiyatı 117.000 $ ile 124.500 $ arasında olacak ve beklenen getiri oranı %10,2 olacaktır.

2025 AURA Fiyat Tahmini: Bu DeFi Token Boğa Piyasasında Yeni Zirvelere Çıkabilir mi?

2025 BLUR Fiyat Tahmini: NFT Pazar Yeri Token’ı Yeni Zirvelere Yükselecek mi?

ARTEM ve KAVA: DeFi ile zincirler arası çözümler sunan iki yenilikçi blockchain platformunun karşılaştırılması

ZORA ve LINK: Dijital İçeriğin Geleceğinde Blockchain Protokollerinin Rekabeti

FLOW ve ZIL: dApp Geliştirme Amaçlı İki Lider Blockchain Platformunun Karşılaştırmalı Analizi

2025 SUPER Fiyat Tahmini: Kripto Para Birimi İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Infrared Finance LSD: IR Token'un DeFi getiri çiftçiliği ve likit staking süreçlerinde işleyişi

Solana’da Ondo Finance ETF’leri ile Tokenize ABD Hisselerine Yatırım Yapma Rehberi

Theoriq (THQ): Web3’e Yönelik Yapay Zeka Tabanlı DeFi Altyapısı

Bitwise 2026 Kripto Piyasa Tahmini: Dört Yıllık Döngünün Sonu

RedotPay Seri B Yatırım Turu: Stablecoin ödeme çözümüne 107 milyon dolar yatırım alındı