2025 ATOM Fiyat Tahmini: Cosmos Ekosisteminin Büyüme Potansiyeli ve Piyasa Dinamiklerinde Yol Haritası

Giriş: ATOM’un Piyasadaki Konumu ve Yatırım Potansiyeli

Cosmos (ATOM), blokzincirler arası birlikte çalışabilirlik alanında öncü bir proje olarak 2014’te kurulduğundan bu yana ciddi ilerleme kaydetmiştir. 2025 itibarıyla Cosmos’un piyasa değeri 2.161.884.845 $’a yükselmiş, dolaşımdaki arzı yaklaşık 467.730.910 adet token seviyesine ulaşmış ve fiyatı da 4,622 $ civarında seyretmektedir. “Blokzincirlerin İnterneti” olarak bilinen bu varlık, zincirler arası iletişim ve birlikte çalışabilirliğin gelişiminde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Cosmos’un 2025 ile 2030 arasındaki fiyat trendleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önüne alınarak profesyonel fiyat tahminleri ve yatırımcılara yönelik uygulanabilir stratejilerle kapsamlı olarak incelenecektir.

I. ATOM Fiyat Geçmişi ve Güncel Piyasa Durumu

ATOM Fiyatının Tarihsel Gelişimi

- 2019: İlk çıkış, fiyat 0,1 $’dan başladı

- 2021: Boğa sezonu zirvesi, 17 Ocak 2022’de tüm zamanların en yüksek seviyesi olan 44,45 $’a ulaştı

- 2022-2023: Kripto kışı, fiyat yaklaşık 5-6 $ bandına geriledi

ATOM’un Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla ATOM, 4,622 $ seviyesinden işlem görüyor. 24 saatlik işlem hacmi 669.796,95732 $’dır. ATOM’un piyasa değeri 2.161.852.268 $ olup, toplam kripto varlıklar arasında 60. sırada yer almaktadır. Dolaşımdaki arz ise 467.730.910,57809 ATOM’dur.

Son 24 saatte fiyat %0,3 oranında gerilemiştir. Ancak daha uzun vadede pozitif bir seyir izleyerek son 7 günde %3,91 ve geçen yıl %12,87 artış sağlamıştır. 30 günlük performansta ise %0,84’lük hafif bir azalma mevcuttur.

ATOM, halen 44,45 $’lık tüm zamanların zirvesinin oldukça gerisinde seyrederken, 1,16 $’lık taban seviyesine kıyasla ise güçlü bir yükseliştedir. Güncel fiyat, zirveden %89,6 oranında düşük, dipten ise %298 oranında yüksek seviyededir.

Piyasa duyarlılığı ATOM için genel olarak nötr düzeydedir; fiyat, dalgalı piyasa koşullarına rağmen dirençli kalmıştır. Son haftalık ve yıllık pozitif performanslar, Cosmos ekosistemine ve birlikte çalışabilirlik projelerine yönelik ilginin arttığını göstermektedir.

Güncel ATOM piyasa fiyatını görüntülemek için tıklayın

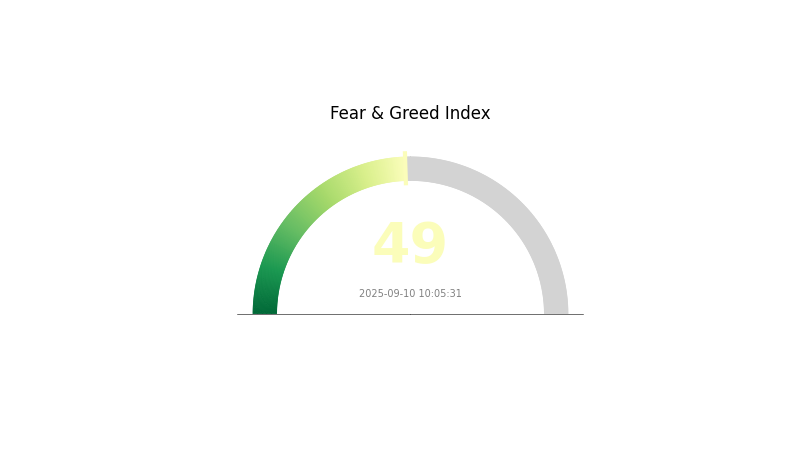

ATOM Piyasa Duyarlılık Göstergesi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

ATOM piyasasındaki duyarlılık dengeli seyretmektedir; Korku ve Açgözlülük Endeksi’nin 49 seviyesinde olması, yatırımcıların genel olarak nötr olduğu anlamına gelir. Bu durum, piyasanın ani bir yön değişimi öncesinde bekle-gör modunda olduğunu gösterir. Gate.com’da işlem yapanlara, bu denge durumunda dikkatli hareket etmesi ve portföylerini çeşitlendirmesi tavsiye edilir. Gelişmeleri yakından takip ederek yatırım stratejinizi buna göre şekillendirin.

ATOM Varlık Dağılımı

ATOM’un adres bazlı varlık dağılımına ilişkin güncel veri bulunmadığından, konsantrasyon ve merkezileşme analizleri yapılamamaktadır. Bu eksiklik, ATOM arzının piyasa üzerindeki olası etkilerinin ve fiyat istikrarının net şekilde değerlendirilmesine engel teşkil etmektedir.

Büyük cüzdanların ve dağılımın detayları olmadan, zincir üstü yapının ve varlık istikrarının mevcut durumu hakkında kesin bir yorum yapmak zordur. Bu durum, kapsamlı piyasa analizleri için şeffaf blokzincir verisinin kritik önemini gösteriyor.

Detaylı varlık dağılımı verisi olmadığı için yatırımcılar ve analistler, ATOM’un piyasa dinamikleri ve riskleri konusunda diğer göstergelerden ve metriklerden yararlanmalıdır. Ekosistemin genel sağlığını ve istikrarını değerlendirirken çok yönlü faktörler göz önünde bulundurulmalıdır.

Güncel ATOM Varlık Dağılımını incelemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. ATOM’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Güncel Arz: Toplam ATOM arzı 467.520.740 token’dır

- Tarihsel Gözlemler: ATOM fiyatı tarihte arz değişimleriyle doğrudan etkilenmiştir

- Güncel Etki: Sonsuz arz modeli uzun vadeli fiyat dengesi üzerinde baskı oluşturabilir

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Cosmos teknolojisinin blokzincir projelerinde yaygınlaşması, ATOM talebini artırabilir

Makroekonomik Ortam

- Enflasyona Karşı Koruma: ATOM’un enflasyonist ortamlardaki performansı, değer saklama aracı olarak cazibesini etkileyebilir

Teknolojik Gelişmeler ve Ekosistem Oluşumu

- Birlikte çalışabilirlik geliştirmeleri: Zincirler arası iletişimdeki iyileşmeler ATOM’un kullanım alanını ve değerini artırabilir

- Ölçeklenebilirlik iyileştirmeleri: Ağ kapasitesindeki artış, fiyat üzerinde olumlu etki yapabilir

- Ekosistem Uygulamaları: Cosmos üzerinde büyüyen DApp’ler ve projeler, ATOM’a olan talebi tetikleyebilir

III. 2025-2030 ATOM Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 2,96 - 4,00 $

- Nötr tahmin: 4,00 - 5,00 $

- İyimser tahmin: 5,00 - 6,11 $ (güçlü ekosistem ve artan adaptasyon senaryosu ile)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Muhtemel bir boğa dönemi

- Fiyat tahmini aralığı:

- 2027: 4,11 - 8,23 $

- 2028: 4,33 - 9,29 $

- Temel tetikleyiciler: Teknolojik yükseltmeler, yeni kullanım alanları, genel kripto piyasası toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 7,86 - 9,47 $ (istikrarlı ekosistem gelişimiyle)

- İyimser senaryo: 9,47 - 11,50 $ (hızlı benimseme ve olumlu piyasa koşulları ile)

- Dönüşümsel senaryo: 11,50 - 13,25 $ (öncü yenilikler ve küresel yaygınlık ile)

- 31 Aralık 2030: ATOM için öngörülen ortalama fiyat 9,47 $

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 6,11556 | 4,633 | 2,96512 | 0 |

| 2026 | 6,55662 | 5,37428 | 3,762 | 16 |

| 2027 | 8,23232 | 5,96545 | 4,11616 | 29 |

| 2028 | 9,29954 | 7,09889 | 4,33032 | 53 |

| 2029 | 10,74097 | 8,19921 | 6,88734 | 77 |

| 2030 | 13,25813 | 9,47009 | 7,86018 | 104 |

IV. ATOM İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ATOM Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli yatırımcılar ve Cosmos ekosistemine güvenenler

- Uygulama önerileri:

- Piyasa düşüşlerinde kademeli alım yaparak 3-5 yıl boyunca ATOM elde tutun

- Staking ile pasif gelir elde edin

- Token’ları güvenliği yüksek saklayıcı olmayan cüzdanlarda depolayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend takip edin

- RSI: Fiyatın aşırı alım/aşırı satım bölgelerini izleyin

- Dalgalı al-sat tüyoları:

- Teknik göstergelerle net alım ve çıkış noktaları belirleyin

- Zararı durdur emirleriyle riskinizi sınırlandırın

ATOM Risk Yönetim Çerçevesi

(1) Varlık Dağılım İlkeleri

- Konservatif yatırımcı: Portföyün %1-3’ü

- Agresif yatırımcı: Portföyün %5-10’u

- Profesyonel yatırımcı: Portföyün %10-15’i

(2) Riski Azaltma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto paraya dağıtın

- Zararı durdur: Kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı: Gate Web3 Wallet önerilir

- Yazılım cüzdanı: Cosmos’un resmi cüzdanı alternatif olarak kullanılabilir

- Güvenlik: İki faktörlü kimlik doğrulama açın, güçlü şifreler kullanın

V. ATOM’da Potansiyel Riskler ve Zorluklar

ATOM Piyasa Riskleri

- Yüksek dalgalanma: Fiyat hareketleri oldukça sert olabilir

- Rekabet: Diğer blokzincir birlikte çalışabilirlik projeleri pazar payı alabilir

- Piyasa hissiyatı: Genel kripto trendlerinden etkilenir

ATOM Regülasyon Riskleri

- Bilinmez düzenlemeler: Daha sıkı kripto para düzenlemeleri ihtimali

- Sınır aşan uyumluluk: Farklı ülkelerde değişken yasal uygulamalar

- Staking için regülasyon: Bazı bölgelerde menkul kıymet olarak değerlendirilme riski

ATOM Teknik Riskleri

- Akıllı kontrat açıkları: Cosmos ekosisteminde güvenlik zaafiyeti ihtimali

- Ağ tıkanıklığı: Yüksek yoğunluk dönemlerinde ölçeklenebilirlik problemleri

- Biyletişim sorunları: Zincirler arası veri transferinde oluşabilecek teknik engeller

VI. Sonuç ve Eylem Önerileri

ATOM Yatırım Değeri Analizi

ATOM, blokzincirler arası birlikte çalışabilirlikte önemli bir konumda olup uzun vadede potansiyel sunmakla birlikte, kısa vadede yüksek dalgalanma ve rekabet baskılarıyla karşı karşıyadır.

ATOM Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, önceliğinizi eğitim ve Cosmos ekosistemini anlamaya verin ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif işlem stratejilerini dengeleyin ✅ Kurumsal yatırımcılar: Staking fırsatlarını ve DeFi entegrasyonunu değerlendirin

ATOM İşlem Yöntemleri

- Spot alım-satım: Gate.com’da doğrudan ATOM alıp satabilirsiniz

- Staking: Ağ doğrulamasına katılarak pasif gelir elde etme

- DeFi entegrasyonu: Cosmos tabanlı DeFi protokolleriyle getiri fırsatlarını keşfetme

Kripto para yatırımları yüksek düzeyde risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk iştahlarına uygun kararları dikkatle almalı ve profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayınız.

SSS

ATOM 100 $’ı görebilir mi?

Evet, tahminlere göre ATOM 2025 yılına kadar 100 $’ı aşabilir. Öngörüler, minimum 101,08 $ ve muhtemel tepe noktası olarak 122,11 $ seviyelerini, ortalama olarak ise 104,76 $ civarını işaret ediyor.

ATOM 500 $’a ulaşabilir mi?

Böyle bir hedef iddialı olsa da, yakın vadede ATOM’un 500 $’a ulaşması gerçekçi görünmüyor. Bunun gerçekleşmesi için yaklaşık 195 milyar $’lık bir piyasa değerine ulaşması gerekir ki, bu da mevcut kripto piyasa seviyelerinin oldukça üzerindedir.

2030’da ATOM’un değeri ne olur?

Mevcut tahminler, ATOM’un 2030 yılında yaklaşık 6,23 $ değerine ulaşabileceğini ve uzun vadede büyüme potansiyeli taşıdığını göstermektedir.

ATOM hâlâ iyi bir yatırım mı?

Evet, ATOM 2025’te de güçlü bir yatırım olarak öne çıkıyor. Ticaret botları için gelişmiş API özellikleri ve Cosmos ekosistemindeki rolünün büyümesi, hem otomatik alım-satım hem de uzun vadeli büyüme için cazip olmasını sağlıyor.

TRON Fiyat Analizi: 2025 TRX Pazar Eğilimleri ve Yatırım Beklentileri

Avalanche (AVAX) 2025 Fiyat Analizi ve Piyasa Trendleri

Web3 Alfa Kripto: 2025 için En İyi Yatırım Stratejileri

2025'te BDT'nin CAD'ye dönüşüm oranı ve Web3 ticaret seçenekleri

2025 Web3 Rezerv Fonu Mekanizması: Proje Yönetimi ve Risk Kontrolü

Gate Web3 Alfa: 2025 Yılında Yatırım Fırsatları ve Gelişim Trendlerinin Analizi

Avalanche (AVAX) iyi bir yatırım mı?: Potansiyel getiriler ve piyasa beklentilerinin kapsamlı bir analizi

Hedera (HBAR) iyi bir yatırım mı?: Kripto para ekosisteminde teknolojisi, pazar konumu ve gelecek potansiyeline dair kapsamlı bir analiz

WEETH ve NEAR: Likit Staking ile Katman-1 Blockchain Çözümlerinin Ayrıntılı Karşılaştırması

HYPE nedir: Viral Trendlerin ve Sosyal Hareketlerin Temelindeki Psikolojiyi Anlamak

LEO nedir: Alçak Dünya Yörüngesi Uyduları ve Kullanım Alanları Üzerine Kapsamlı Bir Rehber