2025 ARB Fiyat Tahmini: Arbitrum'un Yerel Token'ı İçin Gelecek Trendler, Piyasa Dinamikleri ve Büyüme Potansiyeli Analizi

Giriş: ARB'nin Piyasa Konumu ve Yatırım Değeri

Arbitrum (ARB), Ethereum ölçeklendirme çözümleri arasında lider konumda olup, 2023'teki lansmanından bu yana büyük başarılara imza atmıştır. 2025 itibarıyla Arbitrum'un piyasa değeri 2,67 milyar ABD doları seviyesine ulaşmış, yaklaşık 5.3 milyar token dolaşımdadır ve fiyatı 0,5047 ABD doları civarında seyretmektedir. "Katman 2 Verimlilik Katalizörü" olarak anılan ARB, Ethereum'un ölçeklenebilirliğini artırma ve işlem maliyetlerini azaltma konusunda giderek daha önemli bir rol üstlenmektedir.

Bu makale, 2025-2030 dönemindeki Arbitrum fiyat eğilimlerini kapsamlı bir şekilde analiz edecek; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etmenler göz önünde bulundurularak profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler sunacaktır.

I. ARB Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

ARB Tarihsel Fiyat Gelişimi

- 2023: ARB token piyasaya sürüldü, 23 Mart’ta 4,00 ABD doları ile rekor seviyeye ulaştı

- 2024: Piyasada konsolidasyon; fiyat 0,50-1,50 ABD doları aralığında dalgalandı

- 2025: Ayı piyasası, 7 Nisan’da 0,2422 ABD doları ile en düşük seviyeyi gördü

ARB Güncel Piyasa Durumu

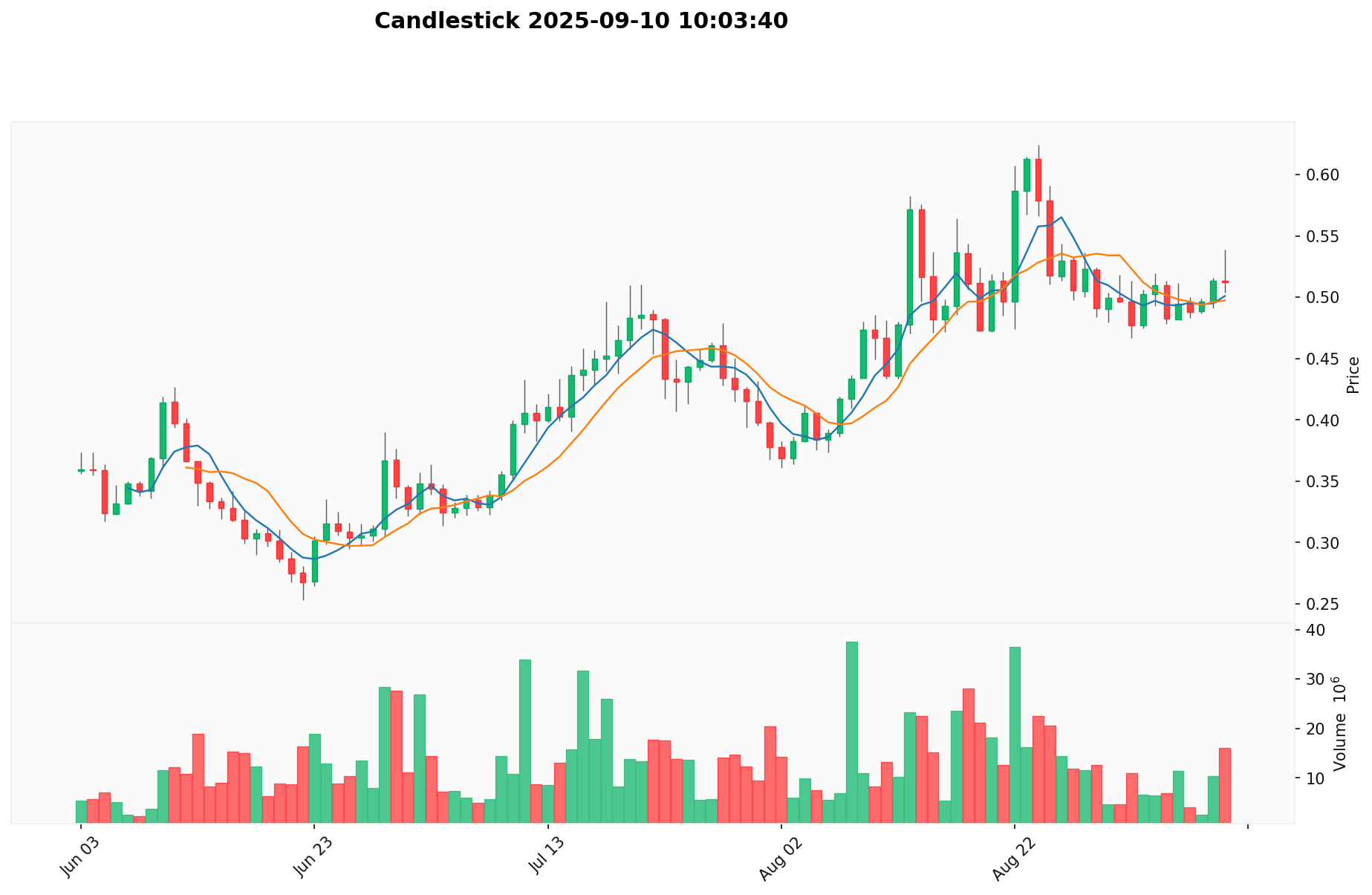

10 Eylül 2025 itibarıyla ARB, 0,5047 ABD doları fiyatından işlem görüyor ve 24 saatlik işlem hacmi 7.413.038 ABD dolarına ulaştı. Son 24 saatte token %5,78 oranında değer kaybetti. ARB'nin piyasa değeri 2.672.780.194 ABD doları olup, tüm kripto para piyasasında 56. sıradadır. Dolaşımdaki token miktarı 5.295.780.056 ARB iken toplam arz 10.000.000.000 ARB olarak kaydedildi. Son fiyat düşüşüne rağmen ARB, son 30 günde %9,4 artış göstermiştir. Ancak bir yıl öncesine göre fiyatı hâlâ %3,55 daha düşüktür. Piyasa hissiyatı şu an için nötr; token yakın zamandaki en düşük seviyenin üzerinde işlem görse de, zirve fiyatının oldukça gerisindedir.

Güncel ARB piyasa fiyatını görüntülemek için tıklayın

ARB Piyasa Hissiyatı Endeksi

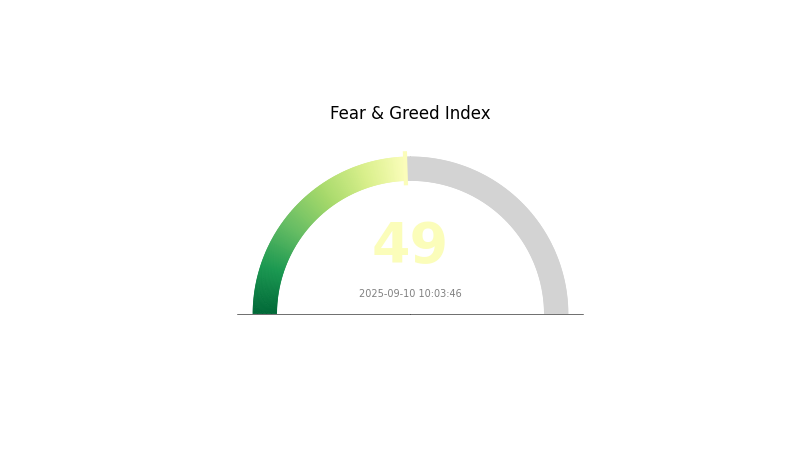

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında bugün hissiyat dengede; Korku ve Açgözlülük Endeksi 49 ile nötr seyrediyor. Bu, yatırımcıların aşırı iyimser veya kötümser olmadıklarını gösteriyor. İşlem yapanların hem potansiyel risk hem de fırsatları göz önünde bulundurmaları gerekir. Kripto piyasasının volatilitesi nedeniyle yatırım kararı öncesi kapsamlı araştırma yapmak ve riskleri doğru yönetmek önemlidir.

ARB Varlık Dağılımı

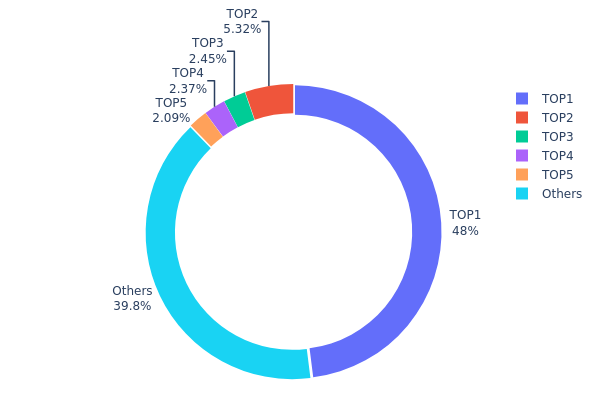

Adres dağılım verileri, ARB tokenlarının ciddi şekilde tek elde toplandığını gösteriyor. En büyük adres, toplam arzın %48,01’ini yani 94.264,43 bin tokeni elinde bulunduruyor. Bu yüksek tedarik yoğunluğu, piyasa hareketliliğini etkileyebilir. Sonraki en büyük dört adres, arzın %12,2’sini daha elinde tutuyor ve bireysel payları %2,08 ile %5,31 arasında değişiyor.

Böyle bir dağılım, merkezileşme ve olası piyasa manipülasyonu risklerini gündeme getiriyor. En büyük adresin hakimiyeti, büyük hacimli işlemlerde volatilitenin artmasına neden olabilir. Ancak tokenlerin %39,79’u çok sayıda küçük yatırımcıya dağılmış durumda ve bu durum ekosisteme belli bir denge sağlar. Bu tablo, belirgin merkeziyetçi yapı ile birlikte, orta düzeyde bir merkezsizleşmeye işaret etmektedir ve piyasa katılımcıları tarafından dikkatle izlenmelidir.

| Sıra | Adres | Varlık (Bin) | Pay (%) |

|---|---|---|---|

| 1 | 0x611f...dfb09d | 94.264,43 | 48,01 |

| 2 | 0x91d4...c8debe | 10.440,53 | 5,31 |

| 3 | 0xb0a2...113d64 | 4.815,50 | 2,45 |

| 4 | 0x0529...c553b7 | 4.644,94 | 2,36 |

| 5 | 0xffa8...44cd54 | 4.096,00 | 2,08 |

| - | Diğerleri | 78.071,65 | 39,79 |

II. ARB'nin Gelecek Fiyatında Etkili Temel Faktörler

Arz Mekanizması

- Token Dağıtımı: Arbitrum'un toplam arzı 10 milyar ARB ve dolaşımda 5,29 milyar token bulunmaktadır.

- Tarihsel Seyir: Tokenların aşamalı olarak piyasaya sürülmesi geçmişte fiyat oynaklığına yol açmıştır.

- Güncel Etki: Kalan tokenların piyasaya girmesi satış baskısı oluşturabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Yatırımlar: Polychain Capital ve Pantera Capital gibi büyük fonlar Arbitrum'a yatırım yaptı.

- Kurumsal Benimseme: Arbitrum'un Katman 2 ölçeklendirme çözümü, çok sayıda DApp ve protokolün tercih ettiği bir platform haline geldi.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının politikaları ve faiz kararları kripto piyasası hissiyatını etkilemeye devam ediyor.

- Enflasyona Karşı Koruma: ARB'nin enflasyona karşı koruyucu işlevi henüz tam olarak kanıtlanmadı.

Teknik Gelişim ve Ekosistem Büyümesi

- Ethereum Entegrasyonu: Arbitrum'un önde gelen bir Ethereum Katman 2 çözümü olması değer potansiyelini belirliyor.

- Ekosistem Uygulamaları: Platformda özellikle DeFi ve oyun alanında hızla artan DApp sayısı dikkat çekiyor.

III. 2025-2030 ARB Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,48917 - 0,50430 ABD doları

- Nötr tahmin: 0,50430 - 0,56734 ABD doları

- İyimser tahmin: 0,56734 - 0,63038 ABD doları (olumlu piyasa ve artan Arbitrum benimsenmesiyle)

2027-2028 Görünümü

- Piyasa fazı: Konsolidasyondan sonra kademeli büyüme bekleniyor

- Fiyat tahmin aralığı:

- 2027: 0,45018 - 0,68506 ABD doları

- 2028: 0,40125 - 0,98975 ABD doları

- Başlıca katalizörler: Ekosistem büyümesi, Katman 2 teknolojilerinin yaygınlaşması ve iyileştirilmiş birlikte çalışabilirlik

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,82925 - 1,03241 ABD doları (DeFi ve Web3 uygulamalarında istikrarlı büyüme ile)

- İyimser senaryo: 1,03241 - 1,23558 ABD doları (Katman 2'nin yaygınlaşması ve kurumsal ilginin artmasıyla)

- Dönüştürücü senaryo: 1,23558 - 1,47635 ABD doları (teknolojik atılımlar ve ana akım benimsemeyle)

- 31 Aralık 2030: ARB 1,47635 ABD doları (iyimser projeksiyonlara göre muhtemel zirve)

| Yıl | Tahmini Maksimum | Tahmini Ortalama | Tahmini Minimum | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,63038 | 0,5043 | 0,48917 | 0 |

| 2026 | 0,73754 | 0,56734 | 0,4255 | 12 |

| 2027 | 0,68506 | 0,65244 | 0,45018 | 29 |

| 2028 | 0,98975 | 0,66875 | 0,40125 | 32 |

| 2029 | 1,23558 | 0,82925 | 0,57218 | 64 |

| 2030 | 1,47635 | 1,03241 | 0,79496 | 104 |

IV. Profesyonel ARB Yatırım Stratejileri ve Risk Yönetimi

ARB Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Ethereum ölçeklendirme teknolojilerine inanan uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde ARB biriktirin

- ARB tokenlarını stake ederek yönetime katılın ve ödül kazanın

- Tokenları güvenli, gözetimsiz cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için kullanın

- RSI: Aşırı alım/aşırı satım durumlarını izleyin

- Swing trade için ana noktalar:

- Giriş-çıkış noktalarını teknik göstergelere dayalı olarak belirleyin

- Ethereum ağ güncellemelerini ve Arbitrum'a etkisini takip edin

ARB Risk Yönetimi Yapısı

(1) Varlık Dağılımı İlkeleri

- İhtiyatlı yatırımcı: Kripto portföyünün %1-3’ü

- Aggresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı birden fazla Katman 2 çözümüne bölüştürün

- Zarar durdur emirleri: Olası kayıpları sınırlandırın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdanı

- Soğuk saklama: Donanım cüzdanları ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulamayı açın, karmaşık şifreler kullanın

V. ARB için Olası Riskler ve Zorluklar

ARB Piyasa Riskleri

- Yüksek fiyat volatilitesi

- Rakip Katman 2 çözümlerinin pazar payı kazanması

- Ethereum güncellemelerinin Arbitrum değerine etkisi

ARB Regülasyon Riskleri

- Belirsiz regülasyon ortamı; Katman 2 çözümlerinde olası denetim artışı

- Gelecek uyum gereksinimleri Arbitrum’un faaliyetlerini etkileyebilir

- Uluslararası regülasyon farklılıkları benimsenmeye engel olabilir

ARB Teknik Riskleri

- Akıllı sözleşme açıkları: Ağda olası suistimal riskleri

- Ölçeklenebilirlik problemleri: Yüksek işlem hacminde beklenmedik sorunlar

- Birlikte çalışabilirlik sorunları: Diğer blok zincirleriyle uyumsuzluk riski

VI. Sonuç ve Eylem Tavsiyeleri

ARB Yatırım Değeri Analizi

Arbitrum (ARB), Ethereum ölçeklendirme teknolojilerinde lider olarak uzun vadede oldukça cazip bir yatırım potansiyeline sahiptir. Ancak kısa vadeli dalgalanmalar ve Katman 2 rekabeti önemli riskler yaratmaktadır.

ARB Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Zamanla küçük ve düzenli alımlar yaparak pozisyon oluşturun ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif alım-satımı birleştiren dengeli yaklaşımı değerlendirin ✅ Kurumsal yatırımcılar: ARB’yi Katman 2 portföyünde çeşitlendirme aracı olarak uzun vadeli potansiyelle analiz edin

ARB Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında ARB alıp satın

- Stake: ARB stake programlarıyla yönetişim ve ödül hakkı kazanın

- DeFi entegrasyonu: ARB ile Arbitrum ekosistemindeki DeFi fırsatlarından yararlanın

Kripto para yatırımları çok yüksek risk içermektedir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınız tutarda yatırım yapmayın.

SSS

ARB 100 ABD dolarına ulaşabilir mi?

Uzun vadeli olarak mümkün olsa da ARB'nin yakın vadede 100 ABD dolarına çıkması pek olası değildir. Mevcut fiyat bu seviyenin çok altındadır; kısa vadede bu hedefe ulaşmak zor görünmektedir.

2030’da Arbitrum’un fiyatı ne olacak?

Mevcut piyasa eğilimleri ve yıllık yaklaşık %5 büyüme oranına göre, 2030’da Arbitrum’un fiyatının yaklaşık 0,66 ABD doları olacağı öngörülmektedir.

ARB, uzun vadeli yatırım için uygun mu?

ARB, uzun vadede büyüme potansiyeline sahip. Tahminler, 2028’de fiyatın 2,40 ABD dolarına kadar çıkabileceğini gösteriyor. Yatırım kararı verirken teknolojik yeniliklerini ve piyasadaki kabulünü değerlendirmek gerekir.

ARB’nin uzun vadeli potansiyel değeri nedir?

ARB’nin uzun vadeli değeri, Arbitrum’un modüler Katman 2 platformu, güçlü yönetişimi ve Ethereum entegrasyonu ile öne çıkmaktadır. Birden fazla rollup ve uygulama zincirini destekleyerek ölçeklenebilirliği yükseltiyor. 2 milyar ABD doları tutarındaki hazine ise finansal istikrar sağlamaktadır.

2025 ETH Fiyat Tahmini: Kurumsal Benimsenme ve Layer 2 Ölçeklendirme Çözümleri, Ethereum'un Yeni Zirvelere Ulaşmasını Sağlayabilir

2025 ARB Fiyat Tahmini: Arbitrum'un Yerel Token'ı İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

On-chain veri analizi, Ethereum’un piyasa eğilimlerini nasıl gözler önüne serer?

2025 BOBA Fiyat Tahmini: Layer-2 Ölçeklendirme Çözümü Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Değerlendirilmesi

On-Chain Veri Analizi, Kripto Piyasa Davranışındaki Eğilimleri Nasıl Açığa Çıkarır?

2025 OP Fiyat Tahmini: Yükseliş Trendleri ve Optimism'in Gelecekteki Değerini Etkileyen Temel Unsurlar

VTHO nedir: VeThor Token ve VeChainThor Blockchain Ekosistemindeki Rolü

SC nedir: Modern İş Dünyasında Tedarik Zinciri Yönetimine Kapsamlı Bir Rehber

VANA Nedir: Devrim Yaratan Merkeziyetsiz Yapay Zekâ Veri Ağına Kapsamlı Rehber

2025 SUSHI Fiyat Tahmini: Lider DeFi Token’a Yönelik Uzman Analizi ve Piyasa Tahmini

2025 ALEO Fiyat Tahmini: Uzman Analizi ve Gelecek Yıla Yönelik Piyasa Öngörüsü