2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

Giriş: AIC’nin Piyasadaki Konumu ve Yatırım Değeri

Kişiselleştirilmiş dijital arkadaşlık alanında öncü olan AI Companions (AIC), kuruluşundan bu yana sektörde önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla AIC’in piyasa değeri 252.580.000 $’a yükselmiş, yaklaşık 1.000.000.000 token dolaşımdadır ve fiyatı 0,25258 $ seviyelerinde seyretmektedir. “Yeni nesil sanal ilişki platformu” olarak bilinen bu varlık, yapay zekâ, sanal gerçeklik ve blokzincir teknolojisinin kesiştiği alanda giderek daha belirleyici bir rol üstlenmektedir.

Bu içerikte, AIC’in 2025-2030 yılları arasındaki fiyat eğilimleri detaylı şekilde incelenecek; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar bir arada değerlendirilerek yatırımcılara uzman fiyat tahminleri ve yatırım stratejileri sunulacaktır.

I. AIC Fiyat Geçmişi ve Güncel Piyasa Durumu

AIC Tarihsel Fiyat Seyri

- 2024: Proje başlatıldı, fiyat 0,005 $’dan işlem görmeye başladı

- Kasım 2024: AIC en düşük seviyesini 0,03598 $ ile gördü

- Şubat 2025: AIC tüm zamanların en yüksek seviyesi olan 0,5575 $’a ulaştı

AIC Güncel Piyasa Durumu

23 Eylül 2025 itibarıyla AIC, 0,25258 $ seviyesinden işlem görmektedir. Token, son 24 saatte %105,15 oranında sert bir yükseliş sergilemiştir. Bu yükselişle fiyatı zirveye yaklaşsa da, hâlâ en yüksek seviyesinin yaklaşık %54,69 uzağındadır.

AIC’in piyasa değeri 252.580.000 $ ile tüm kripto paralar arasında 257. sırada yer almaktadır. Son 24 saatlik işlem hacmi ise 959.566,65 $’dır ve bu, piyasada yüksek bir işlem trafiği anlamına gelir.

AIC, farklı zaman dilimlerinde güçlü performanslar göstermiştir. Son haftada %73, son 30 günde %57,42 ve 1 yılda %144,74 getiri sağlamıştır. Bu veriler, orta ve uzun vadede yükseliş eğiliminin sürdüğüne işaret etmektedir.

AIC’in dolaşımdaki arzı 1.000.000.000 adettir ve bu rakam aynı zamanda toplam ve maksimum arzı temsil etmektedir. Yani tüm token’lar dolaşımdadır, bu da ileride yeni token basımıyla oluşabilecek enflasyonun önüne geçer.

Güncel AIC piyasa fiyatını görmek için tıklayın

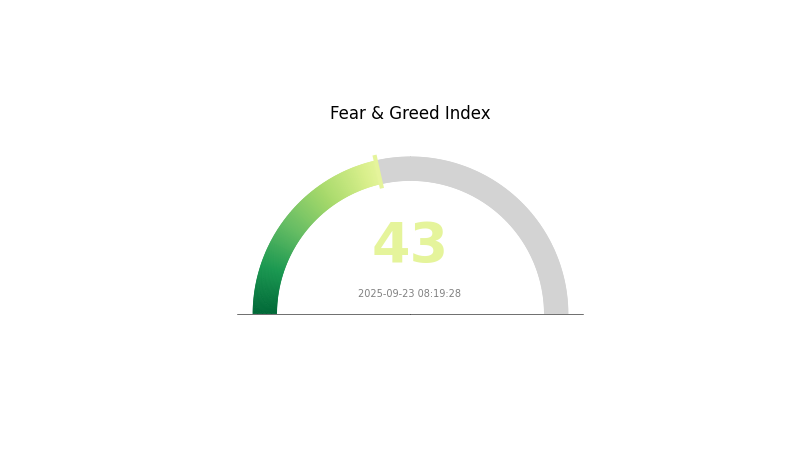

AIC Piyasa Duyarlılığı Göstergesi

23 Eylül 2025 Korku ve Açgözlülük Endeksi: 43 (Korku)

Kripto piyasasında duyarlılık temkinli bir düzeydedir; Endeks 43 seviyesinde seyrederek piyasanın korku evresinde olduğunu gösteriyor. Bu durum, yatırımcıların pazarda temkinli davrandığını ve zıt görüşlü yatırımcılar için alım fırsatı doğurabileceğini işaret eder. Ancak böyle bir ortamda yatırım kararları alırken kapsamlı araştırma yapmak ve risk yönetimine öncelik vermek gerekir. Unutmayın, piyasa duyarlılığı hızla değişebilir; bu nedenle güncel kalmak ve portföyü çeşitlendirmek önemlidir.

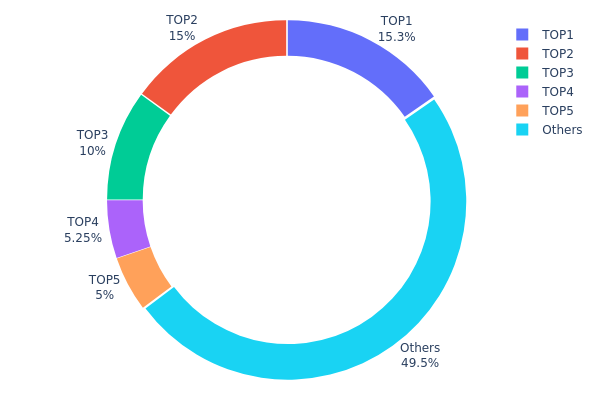

AIC Token Dağılımı

Adres bazında token dağılım grafiği, AIC’in sahiplik yapısındaki yoğunlaşmayı gösteriyor. Veriler, AIC token’larının büyük oranda merkezi birkaç adreste toplandığını ortaya koyuyor. En büyük beş adres, toplam token arzının %50,54’ünü elinde bulundururken, ilk iki adresin her biri sahipliğin %15’inden fazlasına hâkim durumda.

Bu derece yoğunlaşmanın, olası piyasa manipülasyonu ve fiyat dalgalanmalarına zemin hazırladığı değerlendirilmektedir. Beş cüzdanın elinde toplam arzın yarısı olduğunda, bu cüzdanlardan kaynaklanacak büyük işlemler AIC’in piyasa dinamiklerinde ciddi değişiklik yaratabilir. Merkezileşmenin fazla olması, token’ın dış etkilere karşı kırılganlığını da artırabilir.

Öte yandan, AIC token’larının %49,46’sı diğer adreslere dağılmış durumdadır; bu da sahiplikte belirli bir yaygınlık olduğunu gösterir. Ancak genel yapı merkezileşmeye yakın olduğundan, uzun vadede piyasa davranışı ve yönetişim süreçlerinde bu durumun etkili olabileceği unutulmamalıdır.

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xbe1e...9859f5 | 153.000,99K | 15,30% |

| 2 | 0x1cab...e08bb6 | 150.000,00K | 15,00% |

| 3 | 0x5fd9...b31173 | 100.000,00K | 10,00% |

| 4 | 0x0d07...b492fe | 52.485,34K | 5,24% |

| 5 | 0x643a...8e0087 | 50.000,10K | 5,00% |

| - | Diğerleri | 494.513,57K | 49,46% |

II. AIC’in Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Sabit Arz: AIC’in toplam arzı değişmemektedir. Bu kıtlık durumu, talebin artması halinde fiyatı destekleyebilir.

- Tarihsel Eğilim: Sınırlı arz politikası, benzer kripto varlıklarda değer artışını desteklemiştir.

- Mevcut Etki: Sabit arz, özellikle talep yükselirse AIC fiyatında yukarı yönlü baskı oluşturmaya devam edebilir.

Makroekonomik Ortam

- Enflasyondan Korunma: AIC, diğer dijital varlıklarda olduğu gibi enflasyona karşı bir koruma aracı olarak görülebilir.

- Jeopolitik Etkenler: Küresel ekonomik belirsizlikler ve siyasi riskler, yatırımcıların alternatif varlıklara yönelmesini tetikleyebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: AIC ağı üzerinde geliştirilen DApp’ler ve diğer projeler, kullanım alanını genişletip kullanıcı tabanını büyütürse fiyat üzerinde olumlu etki yaratabilir.

III. 2025-2030 Dönemi AIC Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 0,24874 $ - 0,2591 $

- Orta yol tahmini: 0,2591 $ - 0,32 $

- İyimser tahmin: 0,32 $ - 0,38088 $ (olumlu piyasa ortamı ve artan adaptasyon koşulu ile)

2027-2028 Beklentileri

- Piyasa evresi: Artan benimseme ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,2487 $ - 0,54936 $

- 2028: 0,44646 $ - 0,61676 $

- Kritik katalizörler: Teknolojik gelişmeler, piyasada yaygın kabul ve olası stratejik işbirlikleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,62296 $ - 0,64891 $ (istikrarlı büyüme ve kabul varsayımıyla)

- İyimser senaryo: 0,64891 $ - 0,80 $ (güçlü performans ve işlevsellik artışı ile)

- Dönüştürücü senaryo: 0,80 $ - 0,93444 $ (çığır açan gelişmeler ve yaygın adaptasyon koşulu ile)

- 31 Aralık 2030: AIC 0,93444 $ (iyimser projeksiyona göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,38088 | 0,2591 | 0,24874 | 2 |

| 2026 | 0,42238 | 0,31999 | 0,18879 | 26 |

| 2027 | 0,54936 | 0,37119 | 0,2487 | 46 |

| 2028 | 0,61676 | 0,46027 | 0,44646 | 82 |

| 2029 | 0,75931 | 0,53852 | 0,36081 | 113 |

| 2030 | 0,93444 | 0,64891 | 0,62296 | 156 |

IV. AIC İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AIC Yatırım Stratejisi

(1) Uzun Vadeli Tutma

- Profil: Yüksek risk iştahına sahip uzun vadeli yatırımcılar

- Öneriler:

- Düşüşlerde AIC token’ı kademeli olarak toplayın

- Projeden fayda görmek için token’ları en az 1-2 yıl elinizde bulundurun

- Token’larınızı donanım cüzdanı gibi güvenli ortamlarda saklayın

(2) Aktif Alım-Satım

- Kullanılacak teknik araçlar:

- Hareketli Ortalamalar (Moving Averages): Trendleri ve olası dönüş noktalarını tespit etmek için

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumlarını izlemek için

- Swing işlemlerinde dikkat edilmesi gerekenler:

- Teknik göstergelerle giriş-çıkış seviyelerini net belirleyin

- Riskten korunmak için zarar durdur emirleri uygulayın

AIC Risk Yönetim Çerçevesi

(1) Varlık Dağılımı

- Ihtiyatlı yatırımcı: %1-3

- Agresif yatırımcı: %5-10

- Uzman yatırımcı: %10-15

(2) Riskten Korunma

- Çeşitlendirme: Yatırımlarınızı hem farklı kripto paralara hem de geleneksel varlıklara dağıtın

- Zarar durdur kullanımı: Potansiyel kayıpları sınırlandırmak için zarar durdur uygulayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı: Gate Web3 Wallet önerilir

- Yazılım cüzdanı: Güvenilir, güçlü güvenlikli mobil veya masaüstü cüzdanlar tercih edin

- Ek güvenlik: İki faktörlü kimlik doğrulama kullanın, güçlü şifreler oluşturun, yazılımlarınızı sürekli güncel tutun

V. AIC’in Karşılaşabileceği Potansiyel Riskler ve Zorluklar

Piyasa Riskleri

- Yüksek oynaklık: AIC fiyatında önemli dalgalanmalar yaşanabilir

- Rekabet: Sektöre dahil olacak yeni AI ve VR projeleri güçlü rakipler oluşturabilir

- Piyasa duyarlılığı: Genel kripto piyasasındaki şartlar AIC’in performansını etkiler

Regülasyon Riskleri

- Yasal belirsizlikler: Gelecekteki devlet politikaları, AI ve VR projelerini etkileyebilir

- Veri gizliliği: Yapay zekâ ve kişisel verilere yönelik daha sıkı düzenlemeler projeyi etkileyebilir

- Uluslararası kısıtlamalar: Küresel düzenlemeler, AIC’in dünya çapındaki adaptasyonunu sınırlandırabilir

Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda oluşabilecek hata veya güvenlik açıkları

- Ölçeklenebilirlik sorunları: Hızla artan kullanıcı sayısı altyapıyı zorlayabilir

- Yapay zekâ geliştirme engelleri: Beklenmedik teknolojik zorluklar süreçleri yavaşlatabilir

VI. Sonuç ve Yatırımcıya Eylem Önerileri

AIC Yatırım Değeri Analizi

AI Companions (AIC), AI, VR ve blokzincir teknolojilerinin inovatif buluşma noktasında yer alarak hızla büyüyen dijital ilişki sektöründe uzun vadeli potansiyel sunar. Ancak yatırımcılar, kısa vadeli volatiliteye ve teknolojinin henüz yeni olmasına karşı temkinli olmalıdır.

AIC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve düzenli yatırımlarla pozisyonunuzu zamanla büyütün

✅ Tecrübeli yatırımcılar: Çeşitlendirilmiş kripto portföyünüzde makul bir oran ayırmayı değerlendirin

✅ Kurumsal yatırımcılar: Kapsamlı analiz sonrası stratejik ortaklıklar veya daha yüksek hacimli pozisyonlar düşünebilirsiniz

AIC Alım Satıma Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden AIC token alıp satabilirsiniz

- Staking: Proje tarafından sunuluyorsa staking programlarına katılın

- DeFi entegrasyonu: AIC ile bağlantılı merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımlarında risk seviyesi çok yüksektir; bu yazı yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk iştahınızı dikkate alarak alın ve profesyonel finansal danışmanlara başvurun. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

AIC Coin ne kadar?

Eylül 2025 itibarıyla, AIC Coin yaklaşık 0,85 $ seviyesinde ve kripto piyasasında istikrarlı bir büyüme trendi izliyor.

Cardano AI için fiyat beklentisi nedir?

Güncel piyasa trendleri ve yapay zekâ analizlerine göre Cardano AI’nin 2025 sonunda 0,15 $’a ulaşması, 2026’da ise daha fazla değer artışı yaşaması bekleniyor.

Hisse senedi fiyat tahmini için en başarılı AI hangisidir?

Hisse senedi fiyat tahminlerinde LSTM, transformer tabanlı modeller ve ensemble yöntemler, en yüksek başarı oranına sahip ileri seviye makine öğrenimi uygulamalarıdır.

2025’te en yüksek kripto para fiyat tahmini hangi coin için?

Bitcoin’in 2025 yılı sonunda 150.000 $ seviyesine ulaşacağı tahmin edilmekte; bu da yılın en iddialı kripto fiyat tahmini olarak öne çıkmaktadır.

2025 NETMIND Fiyat Tahmini: Gelişen yapay zekâ ekosisteminde piyasa trendleri, teknolojiye adaptasyon ve büyüme potansiyeli üzerine analiz

2025 OGPU Fiyat Tahmini: GPU Teknolojisindeki Piyasa Eğilimleri ve Teknolojik Gelişmelerin Analizi

2025 FAI Fiyat Tahmini: FAI Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 AGENT Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 ARC Fiyat Tahmini: Yükseliş Eğilimleri ve Algorand'ın Yönetim Token'ının Geleceğini Belirleyen Temel Etkenler

HBAR'ın AUD Fiyat Performansı

Web3 ekosisteminde Covalent Token'ların rolünü anlamak: Teknik bir rehber

Yakın dönemde öne çıkacak NFT projeleri arasında dikkatle izlenmesi gereken başlıca girişimler

Maksimum güvenlik sağlamak için en iyi kripto cüzdanı nasıl seçilir

Birleşik Krallık’ta Ethereum gas ücretlerinin düşük olduğu en uygun zamanlar

$MATIC'in Tarihî Zirvelerini Keşfedin: Fiyat Yolculuğuna Dair İçgörüler