Post content & earn content mining yield

placeholder

NineLivesNine

Why does it feel like the Shitcoin trend on the S chain is gradually returning to its peak?

View Original

- Reward

- like

- Comment

- Repost

- Share

MOMO

MOMO

Created By@gatefunuser_773c

Listing Progress

0.00%

MC:

$0.1

More Tokens

- Reward

- 1

- Comment

- Repost

- Share

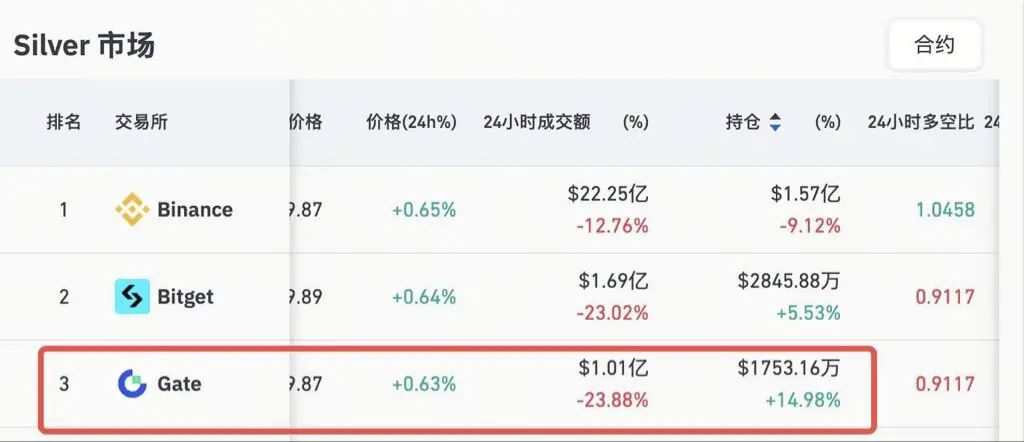

While most exchanges are still making high-profile moves into traditional financial markets, only a few have truly delivered results!

According to the latest data from CoinGlass, Gate XAG's 24-hour holdings have reached $17,531,600, ranking among the top three globally. The capital and trading activity are evident.

In terms of product structure, Gate was the first to build a complete multi-leverage system, integrating precious metals, stocks, foreign exchange, and indices from global financial markets into a one-stop platform, enabling 24/7 continuous trading. This truly breaks down the bounda

View OriginalAccording to the latest data from CoinGlass, Gate XAG's 24-hour holdings have reached $17,531,600, ranking among the top three globally. The capital and trading activity are evident.

In terms of product structure, Gate was the first to build a complete multi-leverage system, integrating precious metals, stocks, foreign exchange, and indices from global financial markets into a one-stop platform, enabling 24/7 continuous trading. This truly breaks down the bounda

- Reward

- like

- Comment

- Repost

- Share

Low-position acquisition of Dora drops below 1,000! Everything is under control!

Controlling the market sentiment is truly top-tier! Hesitation will lead to defeat

#当前行情抄底还是观望? #BTC能否重返7万美元? #深度创作营

View OriginalControlling the market sentiment is truly top-tier! Hesitation will lead to defeat

#当前行情抄底还是观望? #BTC能否重返7万美元? #深度创作营

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Crypto market analysis

- Reward

- like

- Comment

- Repost

- Share

🔹 Bitcoin returns to $70,000 is this a rebound or the start of a reversal?

- Reward

- like

- Comment

- Repost

- Share

Gm fam.

As you remember we made nice gains with $LOBSTAR recently.

At the moment it dipped again hugely.

What you think we will go lower from here or up?

As you remember we made nice gains with $LOBSTAR recently.

At the moment it dipped again hugely.

What you think we will go lower from here or up?

- Reward

- like

- Comment

- Repost

- Share

King Mitchy says she has been forgiven.

If it was a man would he have been forgiven too?

If it was a man would he have been forgiven too?

- Reward

- like

- Comment

- Repost

- Share

Silver, hurry up and go long.

After this wave of decline,

a very good rebound is coming soon, just like gold. It has been continuously converging above the trend, and with the previous secondary peak, the overall trend remains bullish. Now is the time to jump in.

Act quickly, it will be too late soon. The first wave targets around 95, and the second wave rebounds to around 100.

View OriginalAfter this wave of decline,

a very good rebound is coming soon, just like gold. It has been continuously converging above the trend, and with the previous secondary peak, the overall trend remains bullish. Now is the time to jump in.

Act quickly, it will be too late soon. The first wave targets around 95, and the second wave rebounds to around 100.

- Reward

- like

- Comment

- Repost

- Share

我的刀盾

我的刀盾

Created By@UnparalleledHandsomeGod

Subscription Progress

0.00%

MC:

$0

More Tokens

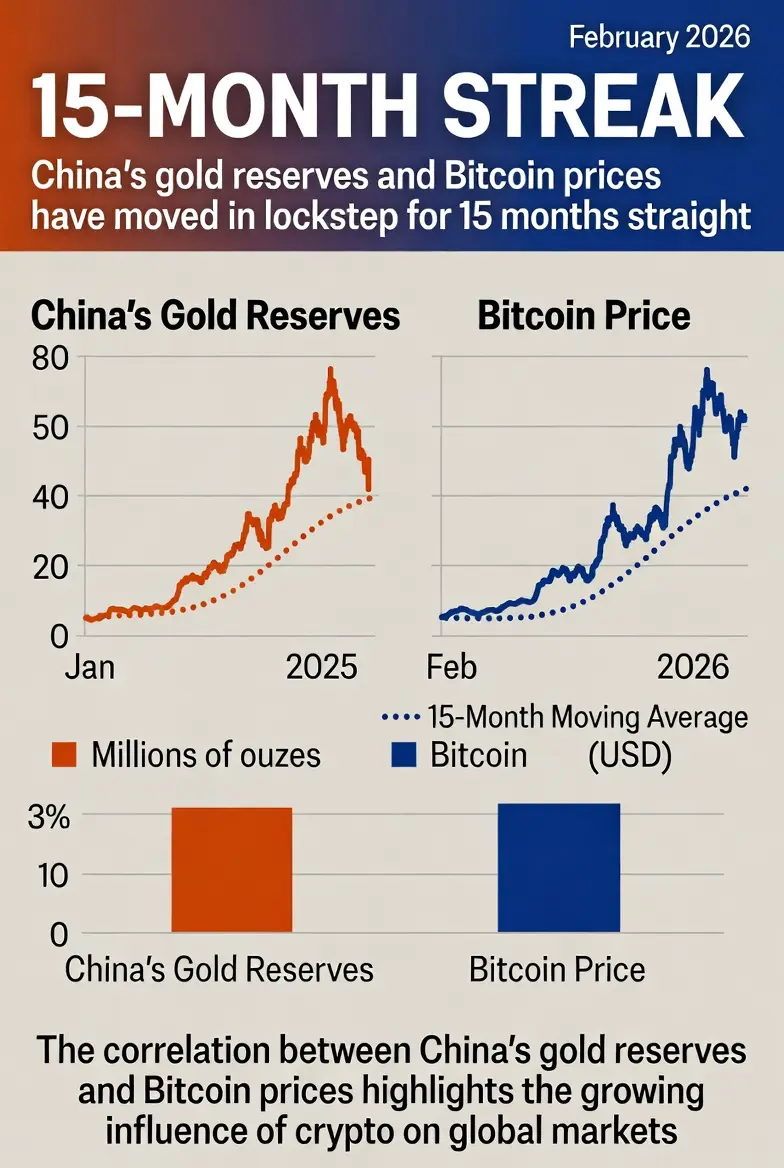

#China’sGoldReservesHit15-MonthHigh

China’s Gold Reserves Reach 15-Month Consecutive High: A Deep Macro & Crypto Market Impact Analysis (February 2026 Edition)

The People’s Bank of China (PBOC) has extended its gold accumulation streak to 15 consecutive months as of January 2026, pushing official holdings to 2,308 tonnes (approximately 74.19 million fine troy ounces). Valued at a record $369.58 billion (up sharply from $319.45 billion in December 2025), this marks China's highest reported gold reserve level in recent history and solidifies its position as the second-largest official gold hold

China’s Gold Reserves Reach 15-Month Consecutive High: A Deep Macro & Crypto Market Impact Analysis (February 2026 Edition)

The People’s Bank of China (PBOC) has extended its gold accumulation streak to 15 consecutive months as of January 2026, pushing official holdings to 2,308 tonnes (approximately 74.19 million fine troy ounces). Valued at a record $369.58 billion (up sharply from $319.45 billion in December 2025), this marks China's highest reported gold reserve level in recent history and solidifies its position as the second-largest official gold hold

- Reward

- 11

- 7

- Repost

- Share

BlackRiderCryptoLord :

:

thanks for the update information dear sir thank youView More

$DN 3 long green candlestics making bullish momentum.

Current Price Action

Price: $0.1524 (+2.56% 24h)

Timeframe: 15-minute candles

Range: 0.1435 – 0.1545

Candlestick Patterns Observed

Left Side (00:15 – 06:30) — Bullish Push then Reversal

Strong green marubozu candles early on → aggressive buying

Price hit 0.1545 resistance with a shooting star/doji top → rejection signal

Follow-through red candles confirmed bearish reversal

Mid Section (06:30 – 09:00) — Downtrend

Series of bearish engulfing candles

Wicks on top = sellers in control

Price dropped to 0.1440 support

Right Side (09:00 – 09:45

Current Price Action

Price: $0.1524 (+2.56% 24h)

Timeframe: 15-minute candles

Range: 0.1435 – 0.1545

Candlestick Patterns Observed

Left Side (00:15 – 06:30) — Bullish Push then Reversal

Strong green marubozu candles early on → aggressive buying

Price hit 0.1545 resistance with a shooting star/doji top → rejection signal

Follow-through red candles confirmed bearish reversal

Mid Section (06:30 – 09:00) — Downtrend

Series of bearish engulfing candles

Wicks on top = sellers in control

Price dropped to 0.1440 support

Right Side (09:00 – 09:45

DN1.41%

- Reward

- like

- 1

- Repost

- Share

Vortex_King :

:

To The Moon 🌕- Reward

- like

- 3

- Repost

- Share

MakeEnoughToStopAt10MillionU. :

:

HoldView More

#CRYPTOBURG $CRYPTOBURG Baby Odin in the Odin track is worth paying attention to!

The AVE of the Bitcoin ecosystem! Real applications, take profit and stop loss, analyze chips, send red envelopes, chain oil, etc. Welcome Odin partners to learn more.

The AVE of the Bitcoin ecosystem! Real applications, take profit and stop loss, analyze chips, send red envelopes, chain oil, etc. Welcome Odin partners to learn more.

CRYPTOBURG-15.43%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

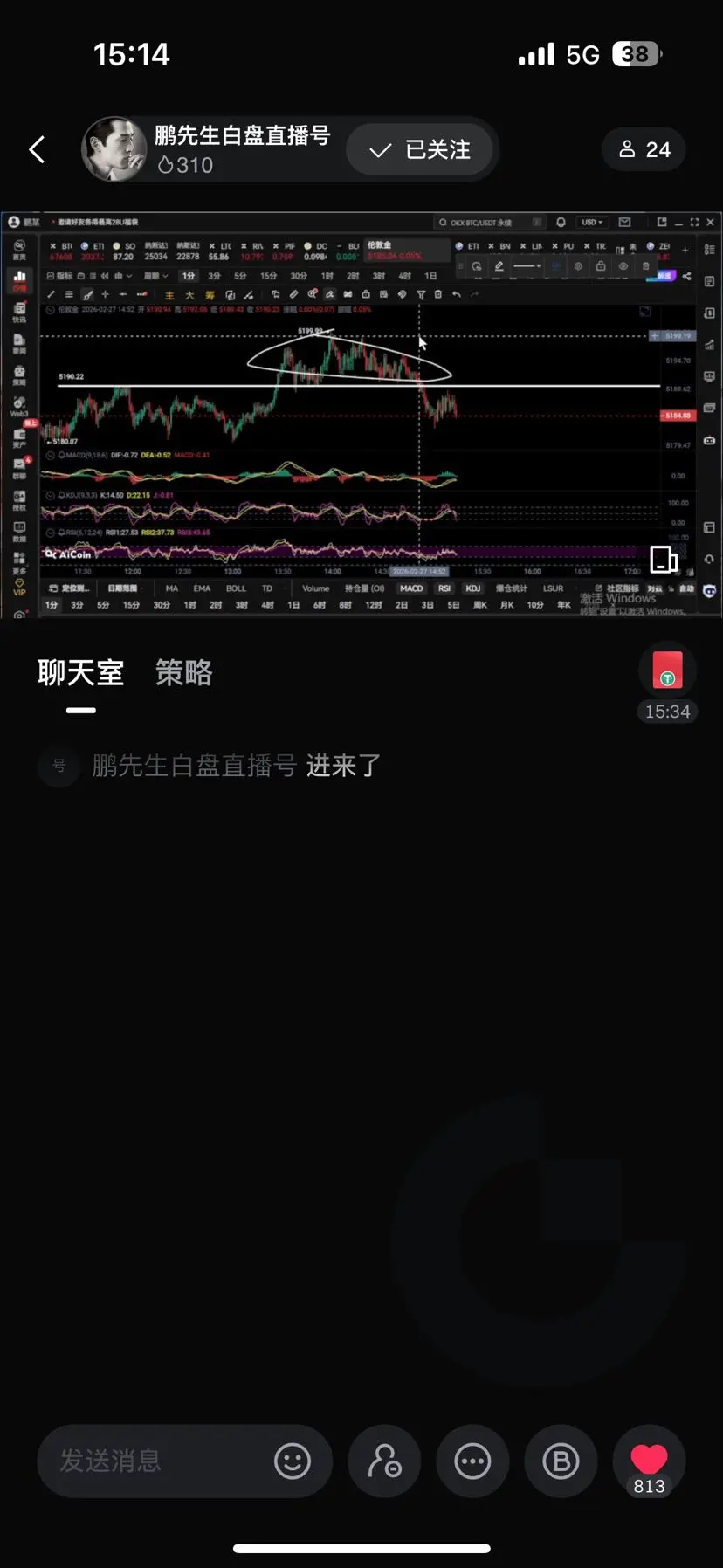

This morning, the cryptocurrency price quickly rebounded after hitting the bottom, then entered a phase of ongoing tug-of-war between bulls and bears, consolidating. Currently, the price continues to fluctuate around 6.75. This trend aligns perfectly with the retracement and buy-in strategy I shared with everyone this morning. Those who followed along should have once again accurately grasped the market trend and benefited from this wave. The short-term trading approach remains as precise as ever. Long-term followers should notice that bold traders have been consistently making profits, while

View Original

- Reward

- like

- Comment

- Repost

- Share

💰 #Gate Live Mining Bonus (Feb 16 -Feb 22)

$USDT rewards have been distributed on Feb 27 !

👉 Check yours now: Assets → Spot

Details: https://www.gate.com/social-mining-commission

About Live Mining: https://www.gate.com/announcements/article/49565

#GateLive #CryptoRewards #LiveMining

$USDT rewards have been distributed on Feb 27 !

👉 Check yours now: Assets → Spot

Details: https://www.gate.com/social-mining-commission

About Live Mining: https://www.gate.com/announcements/article/49565

#GateLive #CryptoRewards #LiveMining

- Reward

- 3

- 1

- Repost

- Share

Dipto123 :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More347.86K Popularity

10.31K Popularity

48.38K Popularity

10.07K Popularity

460.6K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.49KHolders:20.00%

- MC:$0.1Holders:10.00%

News

View MoreFeng Bo strongly supports Haseeb: he is the backbone of Dragonfly and the "brightest star" among the investors I know.

8 m

MYX (MYX Finance) increased by 27.58% in the last 24 hours

14 m

Cardone Capital aims to enter the tokenized real estate sector and is seeking the best Layer 2 partner

16 m

Gate Alpha Launches the 169th Issue of the Points Airdrop, Holders of the Corresponding Points Can Claim 0.5, 1.3, or 2.6 GT in Advance

24 m

VVV (Venice Token) increased by 20.86% in the past 24 hours

30 m

Pin