TAKD

現在、コンテンツはありません

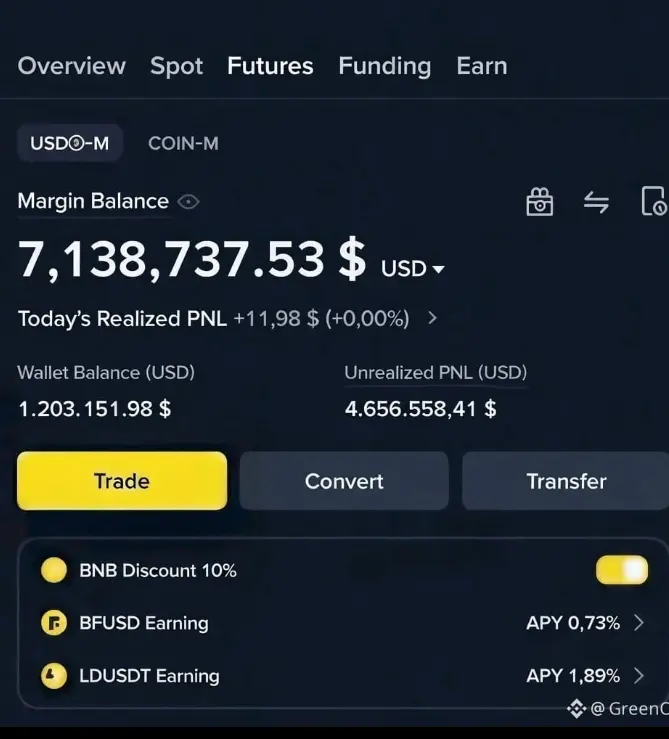

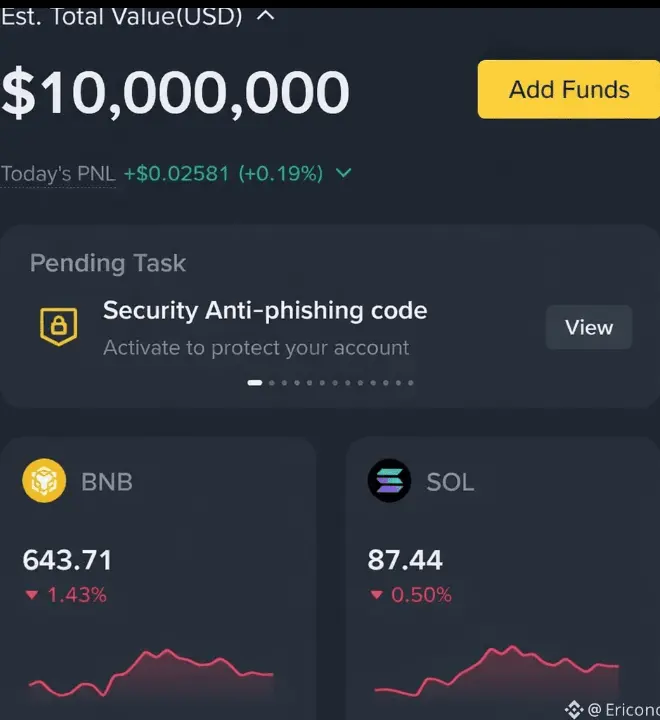

私のアカウントには$10M 以上の資金があり、最近は$SIREN、$RIVER、$BULLAをショートしてさらに$160K を引き出しました。賢い選択は常に報われる。#BuyTheDipOrWaitNow?

SIREN-1.49%

- 報酬

- 1

- コメント

- リポスト

- 共有

マイケル・セイラーは、ビットコインが70,000ドルを下回る中、未実現損失が44億ドルに達しています。

📉 マイクロストラテジーの平均購入価格は約76,000ドルであり、同社の巨大な保有量は現在大きく赤字です。

マイクロストラテジーは約713,000 BTCを保有しており、その下落はバランスシートに重くのしかかっています。

😐 皮肉なことに?セイラーは「絶対に売らない」というマントラを何年も推進してきました。

しかし、市場は今、難しい選択を迫るかもしれません:

損失の一部を実現する、

それとも、平均取得価格を下げるためにさらに借り入れ、投資家を安心させる。

🧠 小売トレーダーが$100 下落に神経質になる一方で、クジラは静かに損失を吸収しています。まるで小さな国の予算規模の損失を受け入れるかのように、パニックもドラマもありません。#BuyTheDipOrWaitNow? #GateJanTransparencyReport #BitcoinDropsBelow$65K #GlobalTechSell-OffHitsRiskAssets $BTC $ETH $GT

原文表示📉 マイクロストラテジーの平均購入価格は約76,000ドルであり、同社の巨大な保有量は現在大きく赤字です。

マイクロストラテジーは約713,000 BTCを保有しており、その下落はバランスシートに重くのしかかっています。

😐 皮肉なことに?セイラーは「絶対に売らない」というマントラを何年も推進してきました。

しかし、市場は今、難しい選択を迫るかもしれません:

損失の一部を実現する、

それとも、平均取得価格を下げるためにさらに借り入れ、投資家を安心させる。

🧠 小売トレーダーが$100 下落に神経質になる一方で、クジラは静かに損失を吸収しています。まるで小さな国の予算規模の損失を受け入れるかのように、パニックもドラマもありません。#BuyTheDipOrWaitNow? #GateJanTransparencyReport #BitcoinDropsBelow$65K #GlobalTechSell-OffHitsRiskAssets $BTC $ETH $GT

- 報酬

- いいね

- コメント

- リポスト

- 共有

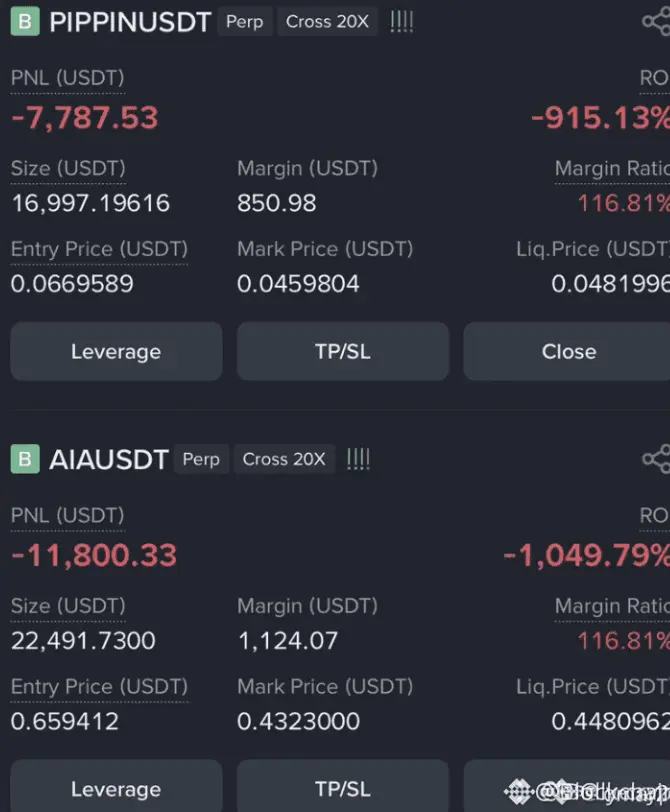

私はいわゆる「中国詐欺コイン」でショートポジションを開きましたが、その名前さえもよくわかりません。🤣#BuyTheDipOrWaitNow? #GateJanTransparencyReport #CryptoMarketPullback #BitcoinDropsBelow$65K

原文表示

- 報酬

- いいね

- コメント

- リポスト

- 共有

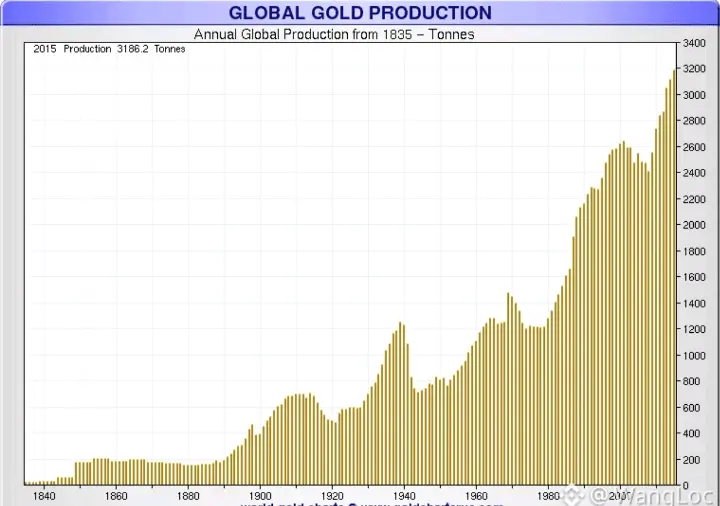

金の真実の物語は、昨日の9%の下落ではありません。それはノイズです。不快な真実ははるかに大きい:長い歴史の中で、金は実質的に99.987%も価値を失ってきました。

それは正しい視点から見れば不可能に思えるかもしれません。

もし人類が500年頃に金の採掘を止めていたとしたら、供給が本当に固定されていた場合、今日の1オンスの金の価値は数千ドルではなく、$40 百万ドル以上になっていたでしょう。需要が根本的に異なっていたからではなく、供給が絶対に上限に達していたからです。

しかし、金の供給は固定されていません。単に希少なだけです。毎年、より多くの金がゆっくりと、予測可能に、絶え間なく採掘され続けています。何世紀にもわたるその安定した拡大は複利のように積み重なります。そして、遠くから見ると、その結果が見えてきます:金は本当に固定された供給資産が達成できたであろう成果に比べて、圧倒的にパフォーマンスが劣っています。

だから、1日の9%の変動に焦点を当てることは、本当のポイントを見逃しています。本当の「クラッシュ」は何世紀もかけて起こったものであり、単一のセッションで起こったわけではありません。金は昨日突然価値を失ったのではなく、何千年にもわたって継続的な供給増加によって価値が漏れ続けてきたのです。

「希少」と「固定供給」の違いは些細なものではありません。それは10%でもなく、2倍でもなく、1

それは正しい視点から見れば不可能に思えるかもしれません。

もし人類が500年頃に金の採掘を止めていたとしたら、供給が本当に固定されていた場合、今日の1オンスの金の価値は数千ドルではなく、$40 百万ドル以上になっていたでしょう。需要が根本的に異なっていたからではなく、供給が絶対に上限に達していたからです。

しかし、金の供給は固定されていません。単に希少なだけです。毎年、より多くの金がゆっくりと、予測可能に、絶え間なく採掘され続けています。何世紀にもわたるその安定した拡大は複利のように積み重なります。そして、遠くから見ると、その結果が見えてきます:金は本当に固定された供給資産が達成できたであろう成果に比べて、圧倒的にパフォーマンスが劣っています。

だから、1日の9%の変動に焦点を当てることは、本当のポイントを見逃しています。本当の「クラッシュ」は何世紀もかけて起こったものであり、単一のセッションで起こったわけではありません。金は昨日突然価値を失ったのではなく、何千年にもわたって継続的な供給増加によって価値が漏れ続けてきたのです。

「希少」と「固定供給」の違いは些細なものではありません。それは10%でもなく、2倍でもなく、1

XAUT0.34%

- 報酬

- 1

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

シルバー ($XAG) は32%下落し、77ドルとなり、市場価値から約2.4兆ドルが消失しました。#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack $BTC $GT

原文表示

- 報酬

- いいね

- コメント

- リポスト

- 共有

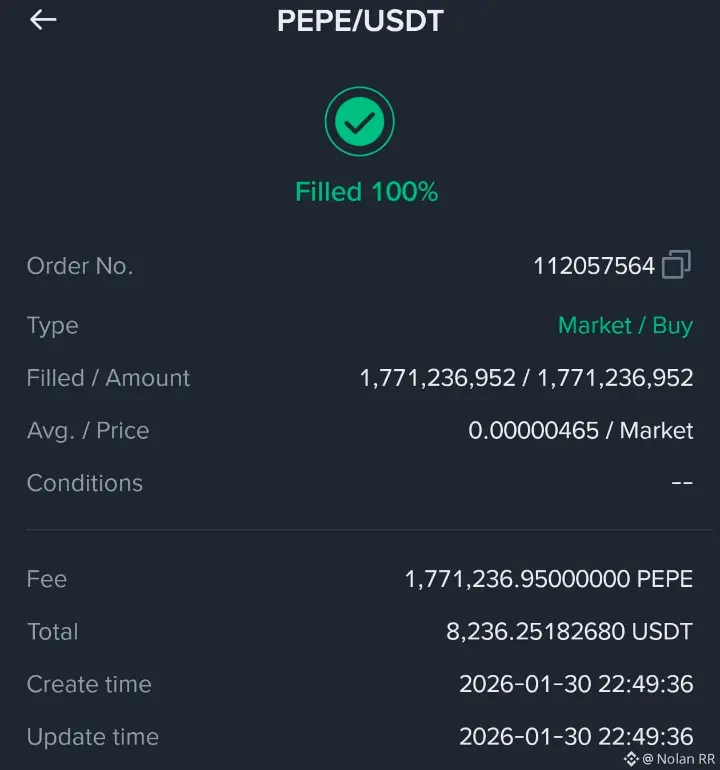

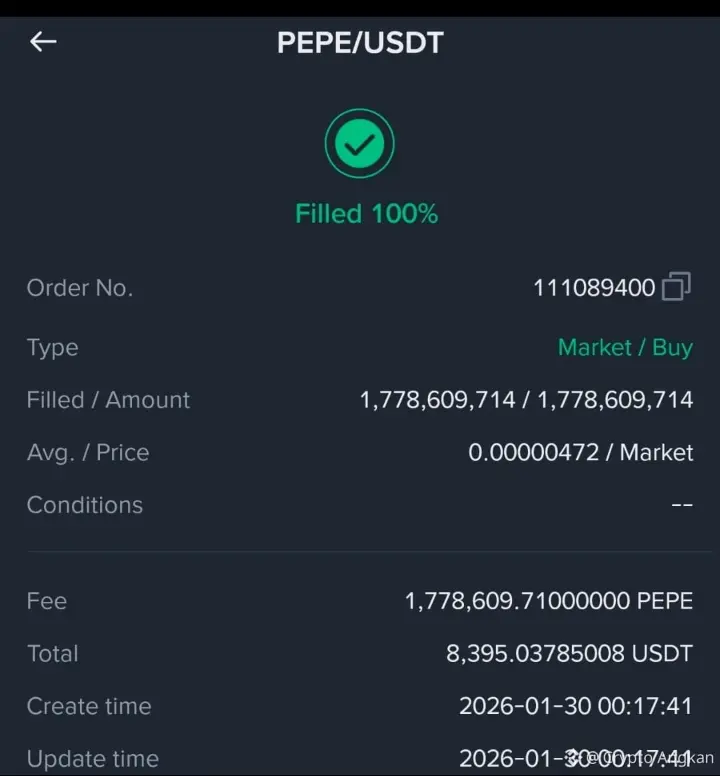

"もう一つの1.77B $PEPE ✅ 市場買いが完了 💪

大手プレイヤーが早期に動き出している…次の上昇局面は巨大になる可能性が高い 📈🐸

警戒を怠らないで $PEPE パンプシーズンはいつでも火がつく可能性がある!"

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack

$BTC $ETH $XRP

原文表示大手プレイヤーが早期に動き出している…次の上昇局面は巨大になる可能性が高い 📈🐸

警戒を怠らないで $PEPE パンプシーズンはいつでも火がつく可能性がある!"

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #PreciousMetalsPullBack

$BTC $ETH $XRP

- 報酬

- いいね

- コメント

- リポスト

- 共有

重要なポイント

ビットコインは、2019–2020年以来見られなかった連続6か月のゴールドに対するパフォーマンス不足の軌道に乗っています。ビットコインとゴールドの比率は、1BTCに相当する金の量を示すもので、過去24時間で金と銀がビットコインよりもより急落したため、一時15.5まで下落した後、約16.3に反発しました。比率の底値は必ずしもビットコインの強さを示すものではなく、むしろ金のビットコインに対する継続的なパフォーマンス不足を反映している可能性があります。

*ビットコインと金の比率の推移を示すチャート*

ビットコイン (BTC)は、投資家が経済的および地政学的な不確実性の中で、暗号通貨の「デジタルゴールド」ナarrティブよりも伝統的な安全資産としての金を好むため、1月もゴールドに対して6か月連続のパフォーマンス不足で終了しそうです。

この月、ビットコインと金の比率は23%下落し、現在の値は16.3です。過去6か月のパターンは、2019年に見られた傾向に似ており、その時は8月に類似の下落が始まり、翌年1月に底を打ち、その後ビットコインは5か月間ゴールドを上回るパフォーマンスを示しました。

反転の兆しが現れ始めている可能性もあります。比率は、木曜日の15.5までの急落の後、金曜

原文表示ビットコインは、2019–2020年以来見られなかった連続6か月のゴールドに対するパフォーマンス不足の軌道に乗っています。ビットコインとゴールドの比率は、1BTCに相当する金の量を示すもので、過去24時間で金と銀がビットコインよりもより急落したため、一時15.5まで下落した後、約16.3に反発しました。比率の底値は必ずしもビットコインの強さを示すものではなく、むしろ金のビットコインに対する継続的なパフォーマンス不足を反映している可能性があります。

*ビットコインと金の比率の推移を示すチャート*

ビットコイン (BTC)は、投資家が経済的および地政学的な不確実性の中で、暗号通貨の「デジタルゴールド」ナarrティブよりも伝統的な安全資産としての金を好むため、1月もゴールドに対して6か月連続のパフォーマンス不足で終了しそうです。

この月、ビットコインと金の比率は23%下落し、現在の値は16.3です。過去6か月のパターンは、2019年に見られた傾向に似ており、その時は8月に類似の下落が始まり、翌年1月に底を打ち、その後ビットコインは5か月間ゴールドを上回るパフォーマンスを示しました。

反転の兆しが現れ始めている可能性もあります。比率は、木曜日の15.5までの急落の後、金曜

時価総額:$3.2K保有者数:1

0.00%

- 報酬

- いいね

- コメント

- リポスト

- 共有

マーケット概要

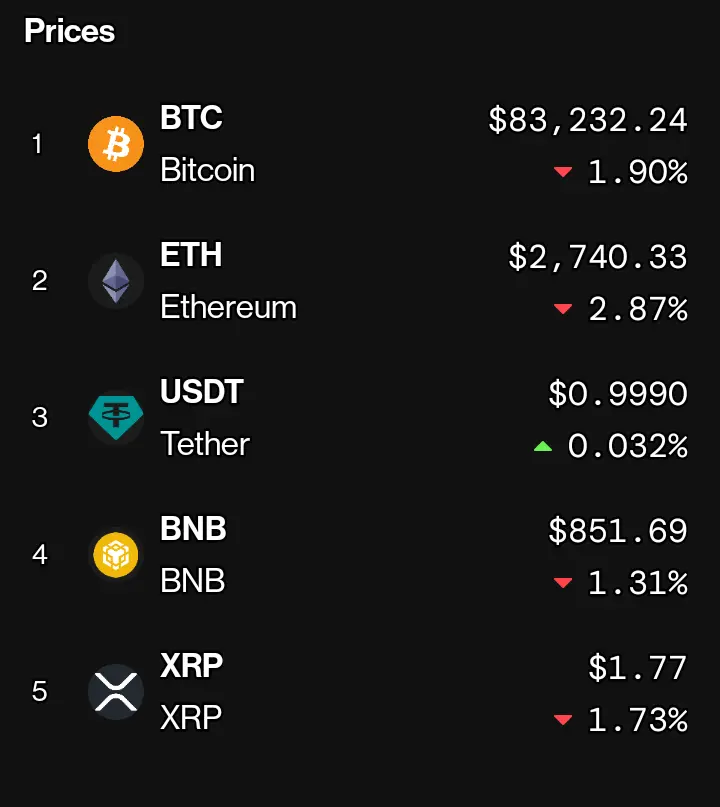

ビットコインとイーサリアムは、木曜日の急激な売り崩れに続き、最近の下落を拡大させました。銀や金を含む貴金属も下落し、市場全体の弱さに寄与しました。一方、米ドルは堅調に推移しました。

暗号資産の清算額は18億ドルに達し、投資家はリスクの高いアルトコインに回帰したため、ビットコインの支配率は低下しました。夜間、ビットコイン(BTC)は2.7%下落し、イーサリアム(ETH)は3.5%下落、木曜日の急落をさらに悪化させました。

銀は木曜日の史上最高値121ドルから20%下落し、現在約96ドルで取引されています。一方、金は水曜日のピーク5600ドルから11%下落し、5000ドルを下回りました。米国株価指数先物はわずかに下落し、ドル指数(DXY)は0.57%上昇、ケビン・ウォーシュ次期連邦準備制度理事会議長就任の見通しによって支えられました。

ビットコインは11月以来の最低水準に下落し、暗号市場で18億ドルの清算を引き起こしました。CoinDesk 20 Index(CD20)は年初来6.6%下落し、アルトコイン中心のCoinDesk 80 Index(CD80)は2.28%下落、ビットコインを上回るパフォーマンスを示しています。

デリバティブと取引活動

売り崩れにより、レバレッジをかけた暗号先物は24時間で18億ドルの清算を記録しました。ビットコインやイーサリアムなど主要暗号

原文表示ビットコインとイーサリアムは、木曜日の急激な売り崩れに続き、最近の下落を拡大させました。銀や金を含む貴金属も下落し、市場全体の弱さに寄与しました。一方、米ドルは堅調に推移しました。

暗号資産の清算額は18億ドルに達し、投資家はリスクの高いアルトコインに回帰したため、ビットコインの支配率は低下しました。夜間、ビットコイン(BTC)は2.7%下落し、イーサリアム(ETH)は3.5%下落、木曜日の急落をさらに悪化させました。

銀は木曜日の史上最高値121ドルから20%下落し、現在約96ドルで取引されています。一方、金は水曜日のピーク5600ドルから11%下落し、5000ドルを下回りました。米国株価指数先物はわずかに下落し、ドル指数(DXY)は0.57%上昇、ケビン・ウォーシュ次期連邦準備制度理事会議長就任の見通しによって支えられました。

ビットコインは11月以来の最低水準に下落し、暗号市場で18億ドルの清算を引き起こしました。CoinDesk 20 Index(CD20)は年初来6.6%下落し、アルトコイン中心のCoinDesk 80 Index(CD80)は2.28%下落、ビットコインを上回るパフォーマンスを示しています。

デリバティブと取引活動

売り崩れにより、レバレッジをかけた暗号先物は24時間で18億ドルの清算を記録しました。ビットコインやイーサリアムなど主要暗号

時価総額:$3.19K保有者数:1

0.00%

- 報酬

- いいね

- コメント

- リポスト

- 共有

金、銀、銅などの貴金属市場の大きな動き:金、銀、銅は大きな下落を見せ、ブロックチェーンを基盤とした金属トークンからの大規模な流出(エクソダス)を引き起こしています。

ビットコインは引き続き独立したリスク資産としての地位を強化していますが、従来の金属は逆風に直面しています。

この乖離は、デジタル資産と実物資産の価値保存手段の関係が進化していることを示しています。

### 2026年の金属と暗号通貨の展望

あなたは2026年において、金属と暗号通貨の関係についてどう考えますか?

**今後の市場動向に注目しましょう。**

ビットコインは引き続き独立したリスク資産としての地位を強化していますが、従来の金属は逆風に直面しています。

この乖離は、デジタル資産と実物資産の価値保存手段の関係が進化していることを示しています。

### 2026年の金属と暗号通貨の展望

あなたは2026年において、金属と暗号通貨の関係についてどう考えますか?

**今後の市場動向に注目しましょう。**

BTC-2.26%

- 報酬

- いいね

- コメント

- リポスト

- 共有

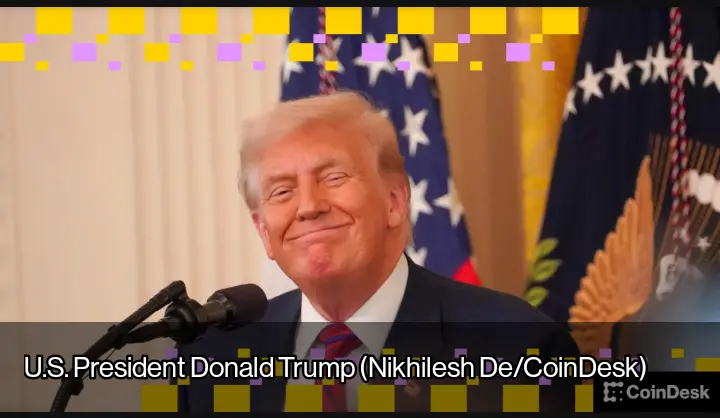

知っておくべきこと

ドナルド・トランプ大統領は、次期連邦準備制度理事会(FRB)議長にケビン・ウォーシュを指名し、金曜日に彼の選任を正式に承認しました。ウォーシュは、ジェローム・パウエルの任期満了(5月)に伴い、その後任となります。

ウォーシュは以前、2006年から2011年までFRB理事会に在籍し、その最年少の理事として知られています。彼はこの役職の有力候補と広く見なされており、この動きがビットコイン(BTC)が木曜日遅くに約81,000ドルまで下落した一因とも考えられます。これは、賭け市場が彼の指名の可能性を織り込んだためです。

ウォーシュは暗号通貨分野での経験も持ち、アルゴリズム安定コインプロジェクトBasisに投資したほか、暗号、ブロックチェーン、フィンテックに焦点を当てたベンチャーキャピタル企業Electric Capitalに助言を行ってきました。

彼の暗号通貨との関係にもかかわらず、一部のアナリストは、彼の金融規律を重視する姿勢が、実質金利の上昇を支える可能性があるため、ビットコインなどのリスク資産にとっては弱気材料となると見ています。トランプの発表後、ビットコインは最初に約0.7%上昇しましたが、その後すぐに約82,600ドルに戻ったとCoinDeskのデータは示しています。

更新 (2024年1月30日 12:25 UTC): 追加の背景情報と詳細を追記。

Jam

原文表示ドナルド・トランプ大統領は、次期連邦準備制度理事会(FRB)議長にケビン・ウォーシュを指名し、金曜日に彼の選任を正式に承認しました。ウォーシュは、ジェローム・パウエルの任期満了(5月)に伴い、その後任となります。

ウォーシュは以前、2006年から2011年までFRB理事会に在籍し、その最年少の理事として知られています。彼はこの役職の有力候補と広く見なされており、この動きがビットコイン(BTC)が木曜日遅くに約81,000ドルまで下落した一因とも考えられます。これは、賭け市場が彼の指名の可能性を織り込んだためです。

ウォーシュは暗号通貨分野での経験も持ち、アルゴリズム安定コインプロジェクトBasisに投資したほか、暗号、ブロックチェーン、フィンテックに焦点を当てたベンチャーキャピタル企業Electric Capitalに助言を行ってきました。

彼の暗号通貨との関係にもかかわらず、一部のアナリストは、彼の金融規律を重視する姿勢が、実質金利の上昇を支える可能性があるため、ビットコインなどのリスク資産にとっては弱気材料となると見ています。トランプの発表後、ビットコインは最初に約0.7%上昇しましたが、その後すぐに約82,600ドルに戻ったとCoinDeskのデータは示しています。

更新 (2024年1月30日 12:25 UTC): 追加の背景情報と詳細を追記。

Jam

- 報酬

- 1

- 1

- リポスト

- 共有

MrAltoid :

:

これは私たちトレーダーにとって素晴らしいニュースです。アップデートありがとうございます私は、Vitalik ButerinがEthereumの開発に$43 百万ドルを割り当てる予定であると報じる金融記事を見つけました。この記事では、Ethereumの共同創設者がこれらの資金を引き出し、「フルスタックのオープン性と検証性」を支援するために使用する予定であると述べており、Ethereum財団が支出の優先順位を見直していることに言及しています。

どのようなタイプの投稿を作成したいですか?例えば:

このニュースを共有するソーシャルメディアのアップデート

分析やコメント記事

特定のプラットフォーム向けに調整された投稿 (LinkedIn、X/Twitterなど)

その他の何か

スタイルとプラットフォームを教えてください。あなたのために作成をお手伝いします!#PreciousMetalsPullBack $ETH

どのようなタイプの投稿を作成したいですか?例えば:

このニュースを共有するソーシャルメディアのアップデート

分析やコメント記事

特定のプラットフォーム向けに調整された投稿 (LinkedIn、X/Twitterなど)

その他の何か

スタイルとプラットフォームを教えてください。あなたのために作成をお手伝いします!#PreciousMetalsPullBack $ETH

ETH-3.88%

- 報酬

- 1

- コメント

- リポスト

- 共有

17億ドルを購入 $PEPE

今、私はすぐに億万長者になると思っています😅

2030年までにビリオネアになるのか⁉️

$PIEVERSE $10 すぐに🚀#PreciousMetalsPullBack

今、私はすぐに億万長者になると思っています😅

2030年までにビリオネアになるのか⁉️

$PIEVERSE $10 すぐに🚀#PreciousMetalsPullBack

PEPE-3.47%

- 報酬

- 1

- コメント

- リポスト

- 共有

- 報酬

- 3

- コメント

- リポスト

- 共有