Gate Plaza | #MyWeekendTradingPlan

Weekend mode = defensive attack ⚔️🛡️

Volatility is still high, so plan > emotion.

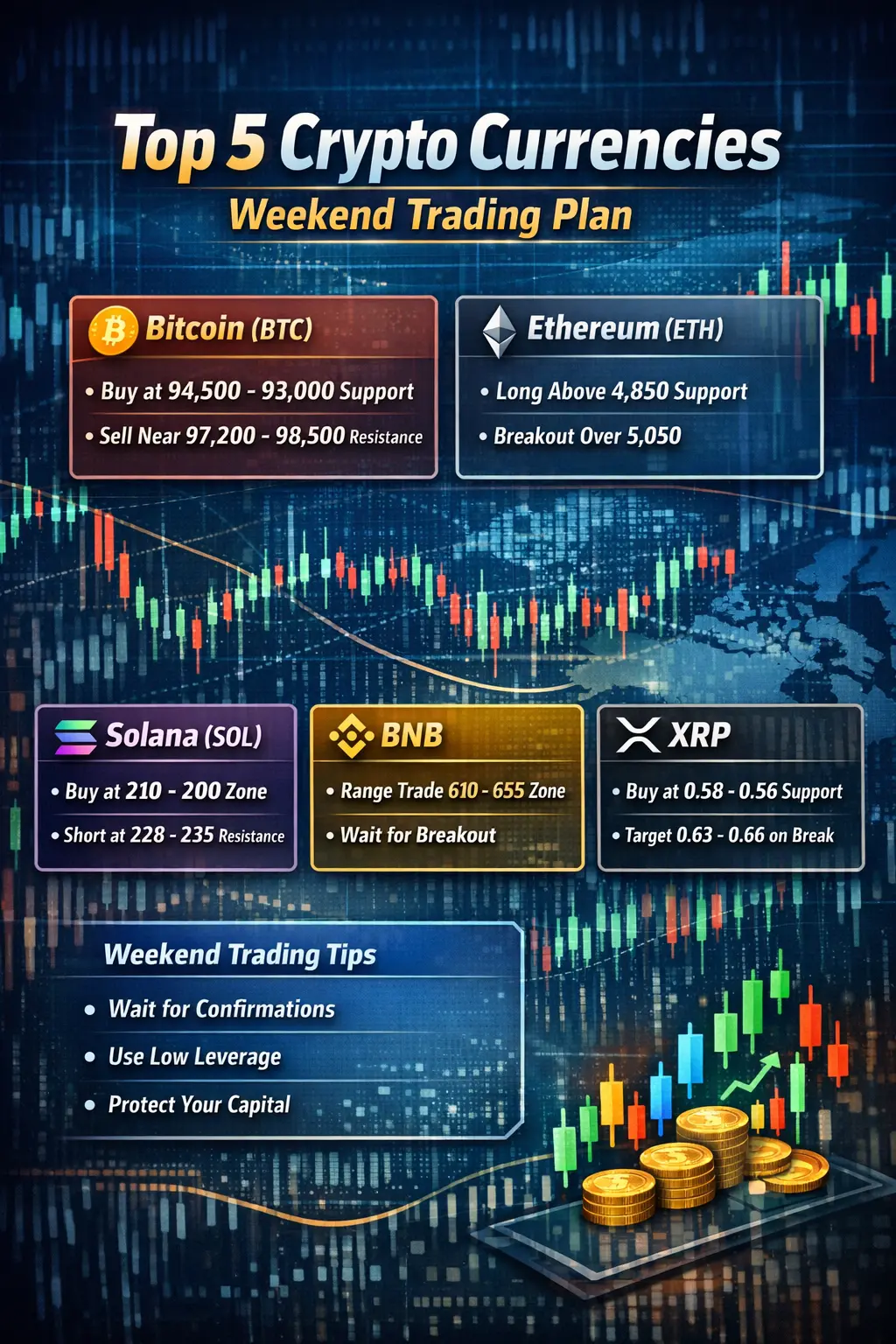

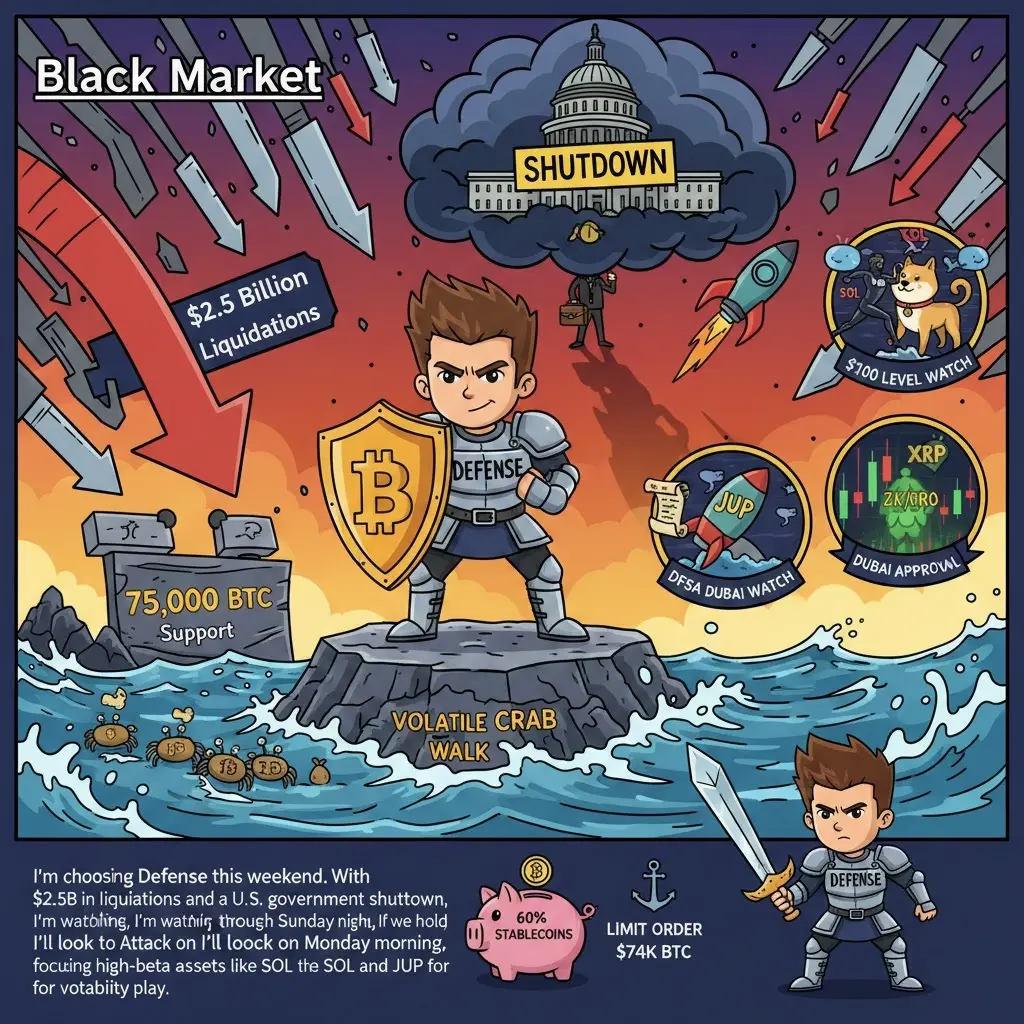

Market Bias (Weekend):

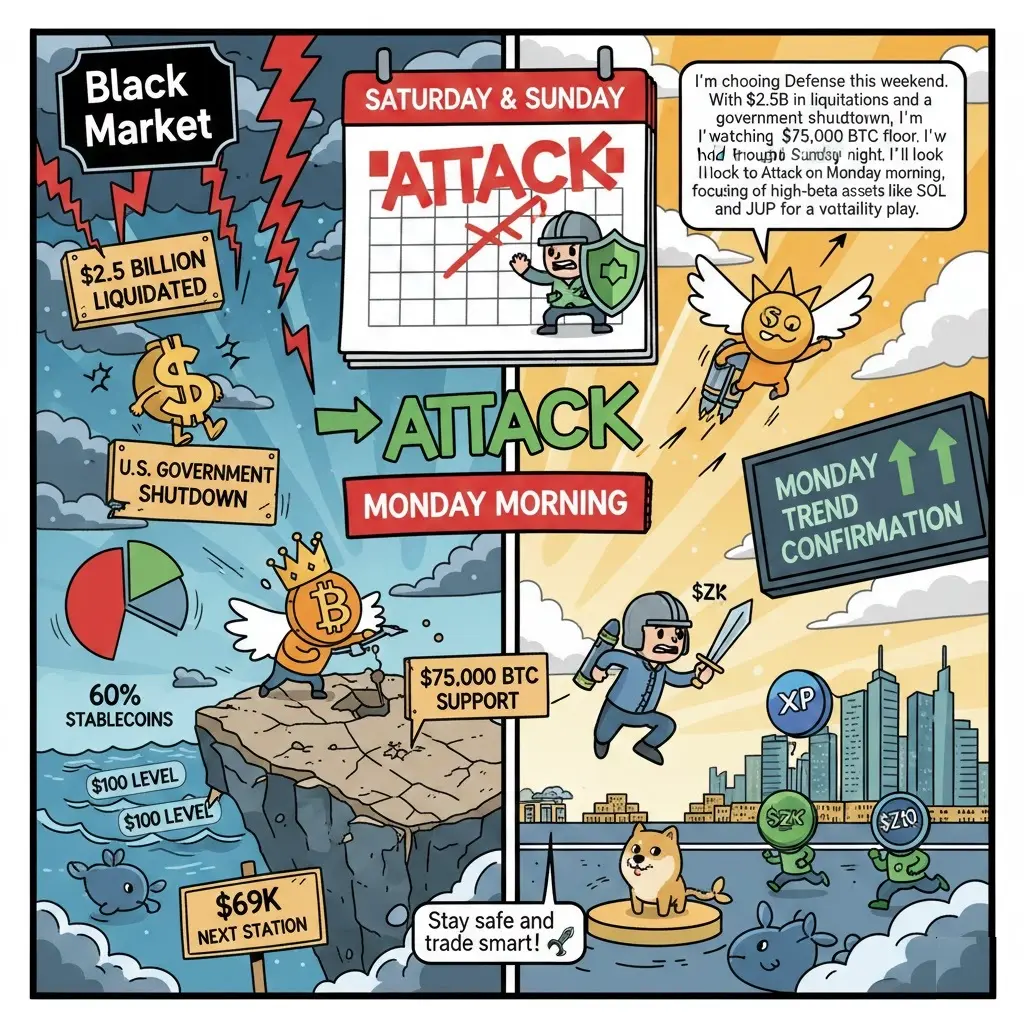

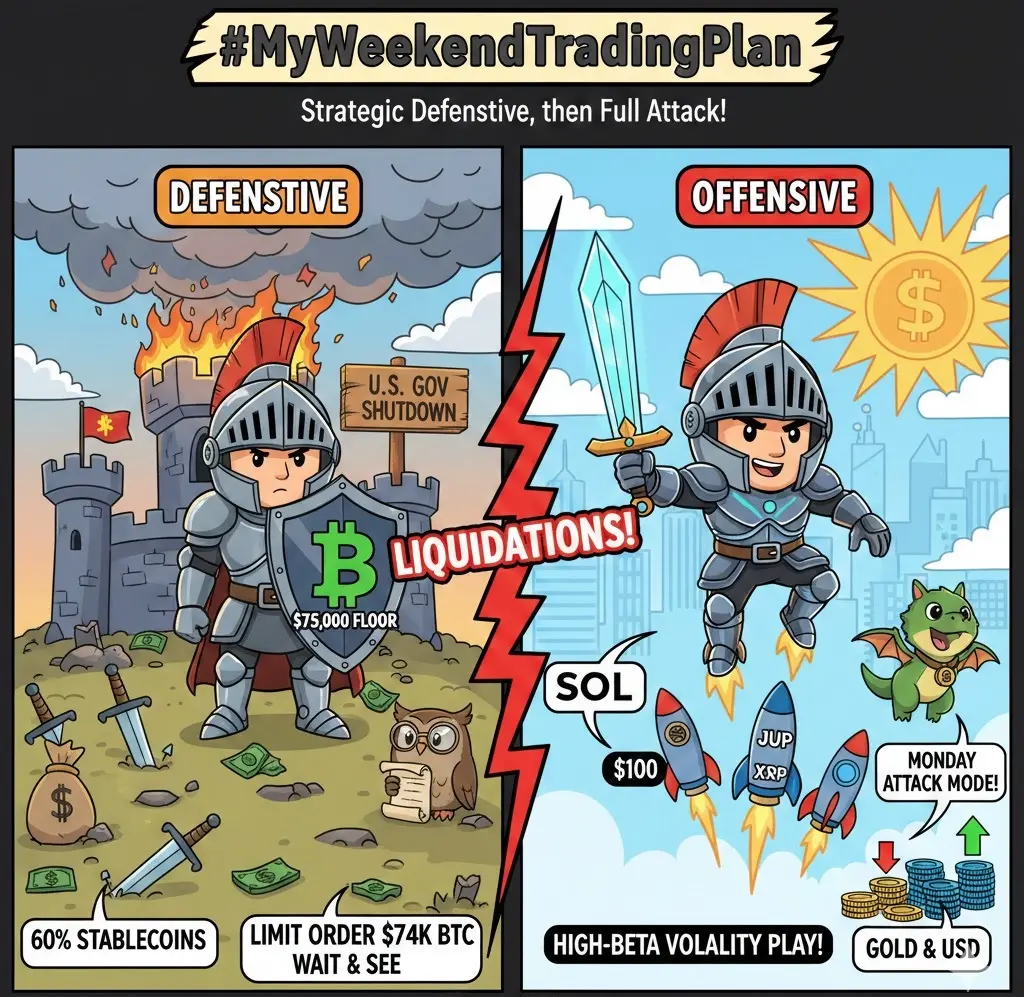

I’m expecting range → rebound attempt, not a straight dump. Liquidity usually thins on weekends; if support holds, a relief bounce is likely. If it breaks, I stay in defense and wait.

Key Levels I’m Watching:

BTC: holding higher-timeframe support → long scalp on confirmation; rejection at resistance → quick short, no overstay.

ETH: strength vs BTC matters; if ETH holds while BTC ranges, alts can breathe.

SOL / AI sector: momentum names only — trade reaction, not hope.

My Plan:

Trade confirmation only, small size

Take profits fast, no hero trades

If volatility spikes unexpectedly → stand aside

Weekend News Radar:

No major scheduled macro this weekend, so sudden liquidation cascades or whale moves matter more than headlines. Watching on-chain flow + funding shifts.

⚠️ Risk Warning: Crypto trading involves high risk. This is not financial advice. Trade responsibly.

Weekend mode = defensive attack ⚔️🛡️

Volatility is still high, so plan > emotion.

Market Bias (Weekend):

I’m expecting range → rebound attempt, not a straight dump. Liquidity usually thins on weekends; if support holds, a relief bounce is likely. If it breaks, I stay in defense and wait.

Key Levels I’m Watching:

BTC: holding higher-timeframe support → long scalp on confirmation; rejection at resistance → quick short, no overstay.

ETH: strength vs BTC matters; if ETH holds while BTC ranges, alts can breathe.

SOL / AI sector: momentum names only — trade reaction, not hope.

My Plan:

Trade confirmation only, small size

Take profits fast, no hero trades

If volatility spikes unexpectedly → stand aside

Weekend News Radar:

No major scheduled macro this weekend, so sudden liquidation cascades or whale moves matter more than headlines. Watching on-chain flow + funding shifts.

⚠️ Risk Warning: Crypto trading involves high risk. This is not financial advice. Trade responsibly.