Post content & earn content mining yield

placeholder

ArenarIntel

🚨 BREAKING: National Weather Service has issued a blizzard warning for the entire state of New Jersey for the first time ever.

#BreakingNews #Weather #NewJersey #USA

#BreakingNews #Weather #NewJersey #USA

- Reward

- 2

- Comment

- Repost

- Share

Crypto Market Structure & Trend Continuation Explained

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLBCA1BAUG

View Original

- Reward

- 2

- Comment

- Repost

- Share

Wang

王

Created By@Buffet123456

Subscription Progress

0.00%

MC:

$0

More Tokens

#GateAlphaMetalTrading

As global markets continue navigating uncertain macroeconomic conditions, precious metals have suddenly reclaimed their position as trusted stores‑of‑value not just in the physical world, but now on-chain too. What distinguishes the current cycle is that investors no longer need to handle physical bullion to access gold and silver exposure. Thanks to the rise of tokenized metals, real precious metals are now directly tradable on blockchain markets, combining the historical stability of traditional metals with the liquidity, accessibility, and transparency of digital fin

As global markets continue navigating uncertain macroeconomic conditions, precious metals have suddenly reclaimed their position as trusted stores‑of‑value not just in the physical world, but now on-chain too. What distinguishes the current cycle is that investors no longer need to handle physical bullion to access gold and silver exposure. Thanks to the rise of tokenized metals, real precious metals are now directly tradable on blockchain markets, combining the historical stability of traditional metals with the liquidity, accessibility, and transparency of digital fin

- Reward

- 5

- 5

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

4-Hour Chart

All moving averages are converged

The liquidity chips above and below are heavily pressured by the bears

Most of the large orders above BTC and ETH yesterday were not filled

The current upper and lower ranges are firmly pressed below 70,000

We need to be patient

It is recommended to buy only on major dips

Avoid shorting on rebounds and chasing longs

Patience is the best remedy right now

View OriginalAll moving averages are converged

The liquidity chips above and below are heavily pressured by the bears

Most of the large orders above BTC and ETH yesterday were not filled

The current upper and lower ranges are firmly pressed below 70,000

We need to be patient

It is recommended to buy only on major dips

Avoid shorting on rebounds and chasing longs

Patience is the best remedy right now

- Reward

- like

- Comment

- Repost

- Share

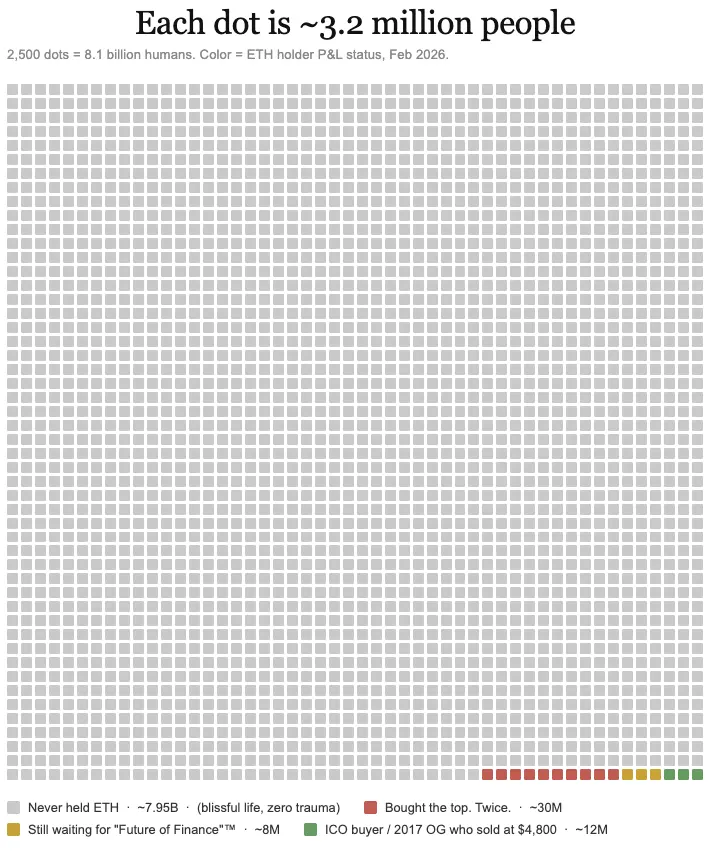

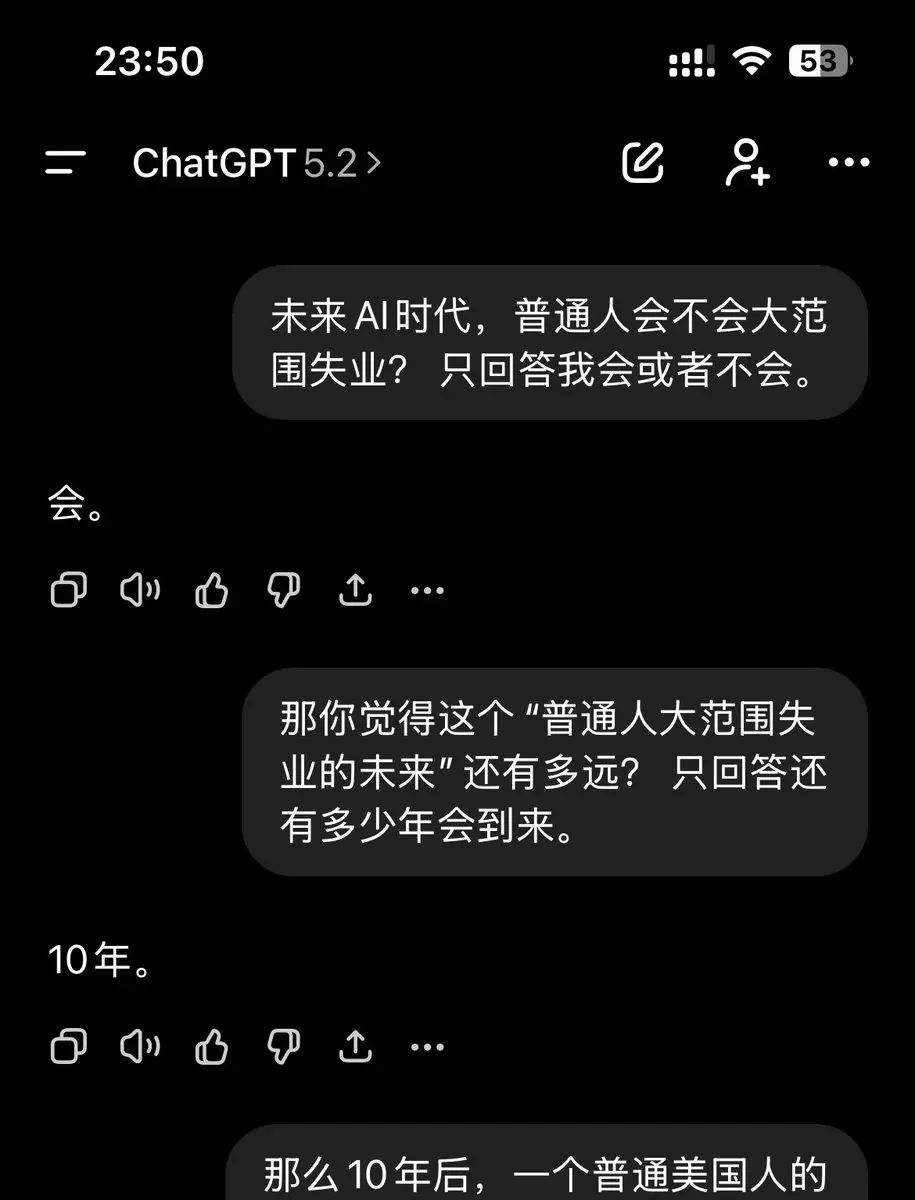

With the development of AI, jobs performed by ordinary people are about to be widely replaced; this has become inevitable.

View Original

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQDCVVKNCQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=UwJBBg1Z

View Original

- Reward

- 2

- Comment

- Repost

- Share

Mention something that can put you in this position about Simi now.

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVHHBWXXBG

View Original

- Reward

- 2

- Comment

- Repost

- Share

So I can hear the music through my headphones, the sound board and mic all work but I can’t get any sound to spaces or livestream 😫

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2.1K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VFNAAFBW

View Original

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJMVLKJVA

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

$SOMI slowly recovering with MA99 rising at 0.1912 as solid support. Price above MA7 (0.2108), mild bullish bias. MA25 at 0.2069 flipping to support. Base forming after long downtrend.

Entry Zone: 0.2090 – 0.2140

TP1: 0.2400

TP2: 0.2700

TP3: 0.3000

Stop Loss: 0.1900

#CelebratingNewYearOnGateSquare

Entry Zone: 0.2090 – 0.2140

TP1: 0.2400

TP2: 0.2700

TP3: 0.3000

Stop Loss: 0.1900

#CelebratingNewYearOnGateSquare

SOMI-1,13%

- Reward

- 2

- Comment

- Repost

- Share

This was one of the most absurd crashes in market history

In April 2020, WTI crude oil futures traded at negative prices, collapsing to around -$40 per barrel

Oil wasn’t worthless

Prices went negative due to futures contracts and storage limits

Global demand fell during COVID lockdowns while production remained at the same level, creating a massive oversupply

Storage was basically gone in Cushing, Oklahoma, where WTI futures settle

As the May contract was about to expire, traders still holding their positions would have had to receive real barrels of oil

With no capacity to store it, many were

In April 2020, WTI crude oil futures traded at negative prices, collapsing to around -$40 per barrel

Oil wasn’t worthless

Prices went negative due to futures contracts and storage limits

Global demand fell during COVID lockdowns while production remained at the same level, creating a massive oversupply

Storage was basically gone in Cushing, Oklahoma, where WTI futures settle

As the May contract was about to expire, traders still holding their positions would have had to receive real barrels of oil

With no capacity to store it, many were

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVHAV1HWBW

View Original

- Reward

- 2

- Comment

- Repost

- Share

live crypto consecutive wins! Trading volatility live Today Market Analysis

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More340.72K Popularity

112.11K Popularity

425.44K Popularity

8.86K Popularity

124.66K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.46KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.45KHolders:10.00%

- MC:$2.46KHolders:10.00%

News

View MoreData: In the past 24 hours, the entire network has liquidated 74.8217 million USD, with long positions liquidated at 56.844 million USD and short positions at 17.9778 million USD.

1 h

Crypto CEX stablecoin reserves have decreased by 14% over the past 3 months.

1 h

The value of Strategy assets is approximately six times the liabilities, with cash reserves sufficient to pay dividends for over 30 months.

2 h

U.S. Trade Representative: After the Supreme Court's tariff ruling, U.S. bilateral trade agreements remain valid

2 h

Analysis: Even if NVIDIA's upcoming earnings report next week is impressive, it may not boost the stock price (Jin10 Data APP)

2 h

Pin