When Ethereum pays interest to TradFi: staking rate hits a new high, is ETH approaching a structural inflection point?

5h ago

The whole world is celebrating, so why is only the crypto industry "wintering"?

5h ago

Trending Topics

View More52.02K Popularity

31.42K Popularity

25.34K Popularity

8.17K Popularity

19.71K Popularity

Hot Gate Fun

View More- MC:$3.69KHolders:21.00%

- MC:$3.77KHolders:21.27%

- MC:$3.41KHolders:10.00%

- MC:$3.46KHolders:20.05%

- MC:$3.41KHolders:10.00%

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889

The whole world is celebrating, so why is only the crypto industry "wintering"?

Article by: EeeVee

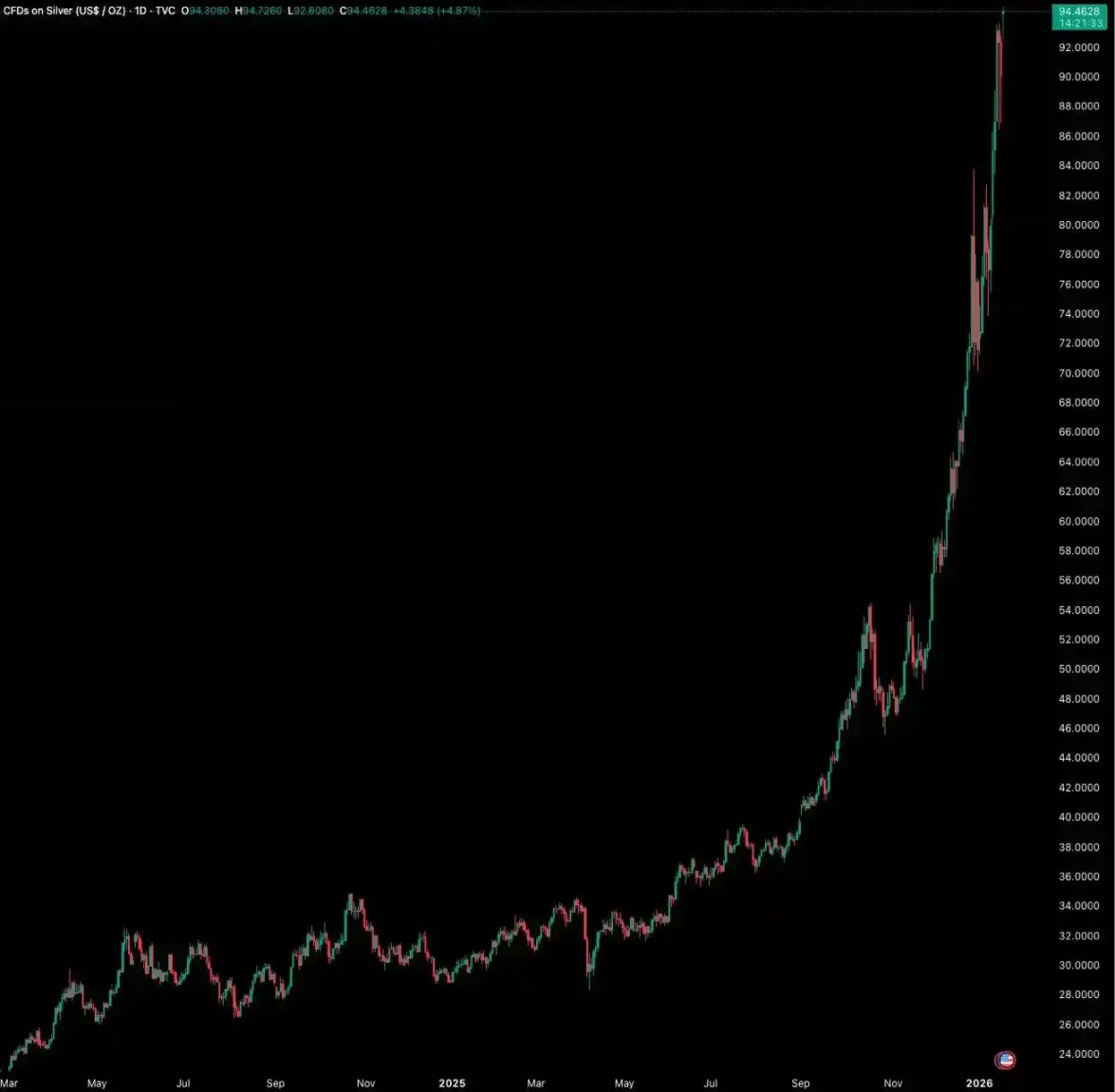

“As long as you don’t invest in cryptocurrencies, you can make money elsewhere.” Recently, the crypto world and other global markets seem to be experiencing two completely different realities. In 2025, gold rose over 60%, silver surged 210.9%, and the Russell 2000 index of US stocks increased by 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend. At the start of 2026, divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares gained over 15% in a single month. In contrast, Bitcoin closed January 21 with six consecutive declines, dropping from $98,000 to once again fall below $90,000 without looking back.

Silver’s performance over the past year

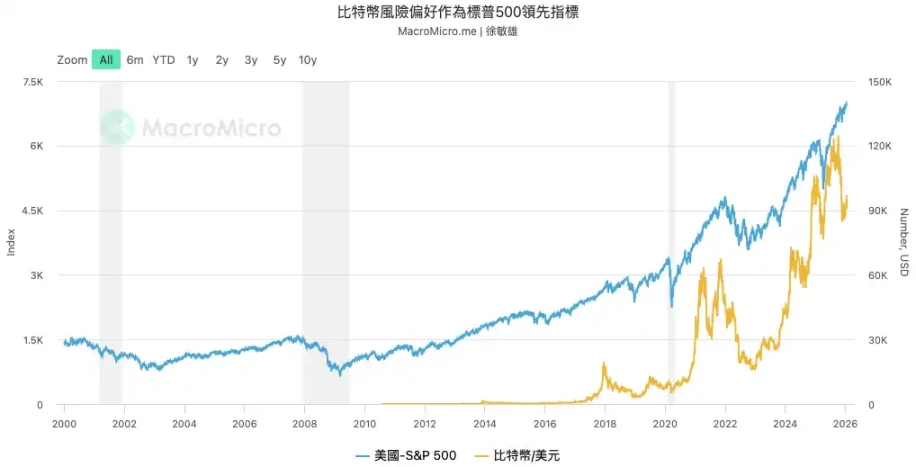

It seems that after 1011, capital has decisively left the crypto space. BTC has been oscillating below $100,000 for over three months, and the market has entered a period of “historically lowest volatility.” Disappointment is spreading among crypto investors. When asked about those who left cryptocurrencies and made money in other markets, they even shared a “secret” — “Anything But Crypto,” as long as they avoid investing in cryptocurrencies, they can profit elsewhere. The long-anticipated “Mass Adoption” now appears to be happening. But it’s not the widespread adoption of decentralized applications everyone hoped for; instead, it’s a fully asset-backed, Wall Street-led phenomenon. This cycle, the US establishment and Wall Street are embracing cryptocurrencies with unprecedented enthusiasm. The SEC approved a spot ETF; BlackRock and JPMorgan are allocating assets to Ethereum; the US has included Bitcoin in its national strategic reserves; several state pension funds have invested in Bitcoin; even the NYSE announced plans to launch a cryptocurrency trading platform. So, the question is: why, after Bitcoin received so much political and capital endorsement, has its price performance been so disappointing while precious metals and stocks are reaching new highs? Why is Bitcoin not rising along with these markets, which investors have become accustomed to watching before market moves? Why is Bitcoin so weak? Leading Indicators Bitcoin is considered a “leading indicator” of global risk assets. Raoul Pal, founder of Real Vision, has repeatedly mentioned this in many articles because Bitcoin’s price is driven purely by global liquidity, unaffected directly by any country’s financial reports or interest rates. Therefore, its volatility often leads that of mainstream risk assets like the Nasdaq. According to MacroMicro data, Bitcoin’s turning points in recent years have often led the S&P 500. Therefore, when Bitcoin, as a leading indicator, stalls and cannot reach new highs, it sends a strong warning signal that the upward momentum of other assets may also be nearing exhaustion.

Liquidity Tightening

Secondly, Bitcoin’s price, to this day, remains highly correlated with the net liquidity of the global US dollar. Although the Federal Reserve cut interest rates in 2024 and 2025, the quantitative tightening (QT) initiated in 2022 continues to drain liquidity from the market.

Bitcoin’s new highs in 2025 were more due to ETFs bringing in new funds, but this did not change the fundamental macro liquidity tightness. Bitcoin’s sideways movement is a direct response to this macro reality. In a liquidity-scarce environment, it’s difficult to initiate a super bull market.

Moreover, the world’s second-largest liquidity source—the Japanese yen—has also begun to tighten. In December 2025, the Bank of Japan raised its short-term policy rate to 0.75%, the highest in nearly 30 years. This directly impacts a major source of global risk asset funding: yen carry trades.

Historical data shows that since 2024, three rate hikes by the Bank of Japan have been accompanied by Bitcoin falling over 20%. The synchronized tightening by the Fed and BOJ worsens the global liquidity environment.

According to MacroMicro data, Bitcoin’s turning points in recent years have often led the S&P 500. Therefore, when Bitcoin, as a leading indicator, stalls and cannot reach new highs, it sends a strong warning signal that the upward momentum of other assets may also be nearing exhaustion.

Liquidity Tightening

Secondly, Bitcoin’s price, to this day, remains highly correlated with the net liquidity of the global US dollar. Although the Federal Reserve cut interest rates in 2024 and 2025, the quantitative tightening (QT) initiated in 2022 continues to drain liquidity from the market.

Bitcoin’s new highs in 2025 were more due to ETFs bringing in new funds, but this did not change the fundamental macro liquidity tightness. Bitcoin’s sideways movement is a direct response to this macro reality. In a liquidity-scarce environment, it’s difficult to initiate a super bull market.

Moreover, the world’s second-largest liquidity source—the Japanese yen—has also begun to tighten. In December 2025, the Bank of Japan raised its short-term policy rate to 0.75%, the highest in nearly 30 years. This directly impacts a major source of global risk asset funding: yen carry trades.

Historical data shows that since 2024, three rate hikes by the Bank of Japan have been accompanied by Bitcoin falling over 20%. The synchronized tightening by the Fed and BOJ worsens the global liquidity environment.

Bitcoin’s dips during each rate hike in Japan

Geopolitical Risks Finally, potential “black swan” events in geopolitics keep markets on edge, and Trump’s series of domestic and international actions in early 2026 have pushed this uncertainty to a new level. Internationally, Trump’s government actions are unpredictable. From military interventions in Venezuela and unprecedented arrests of its president, to the risk of war with Iran; from attempting to buy Greenland to issuing new tariffs against the EU. These aggressive unilateral moves are intensifying major power conflicts. Domestically, his actions have raised deep concerns about constitutional crises. He proposed renaming the Department of Defense to the “Department of War” and has ordered active-duty troops to prepare for potential domestic deployment. These moves, combined with hints that he regrets not using military force to intervene and his reluctance to accept midterm election defeat, are fueling fears: will he refuse to accept losing the midterms and use force to stay in power? Such speculation and high pressure are exacerbating internal conflicts in the US, with protests spreading across the country. Last week, Trump invoked the Insurrection Act and deployed troops to Minnesota to quell protests. The Pentagon has also ordered about 1,500 active-duty soldiers in Alaska to standby.

This normalization of conflict is dragging the world into a “gray zone” between localized wars and a new Cold War. Traditional full-scale hot war still has a relatively clear path and market expectations, sometimes even accompanied by monetary easing to “rescue the market.”

However, these localized conflicts are highly uncertain, full of “unknown unknowns.” For venture markets that rely heavily on stable expectations, this uncertainty can be fatal. When large capital cannot predict future trends, the most rational choice is to hold more cash and wait, rather than allocate funds into high-risk, highly volatile assets.

Why aren’t other assets falling?

Contrasting sharply with the silence in the crypto space, since 2025, markets like precious metals, US stocks, and A-shares have risen in turn. But these gains are not due to improved macro or liquidity fundamentals; instead, they are driven by structural trends under the influence of sovereign will and industrial policies amid great power rivalries.

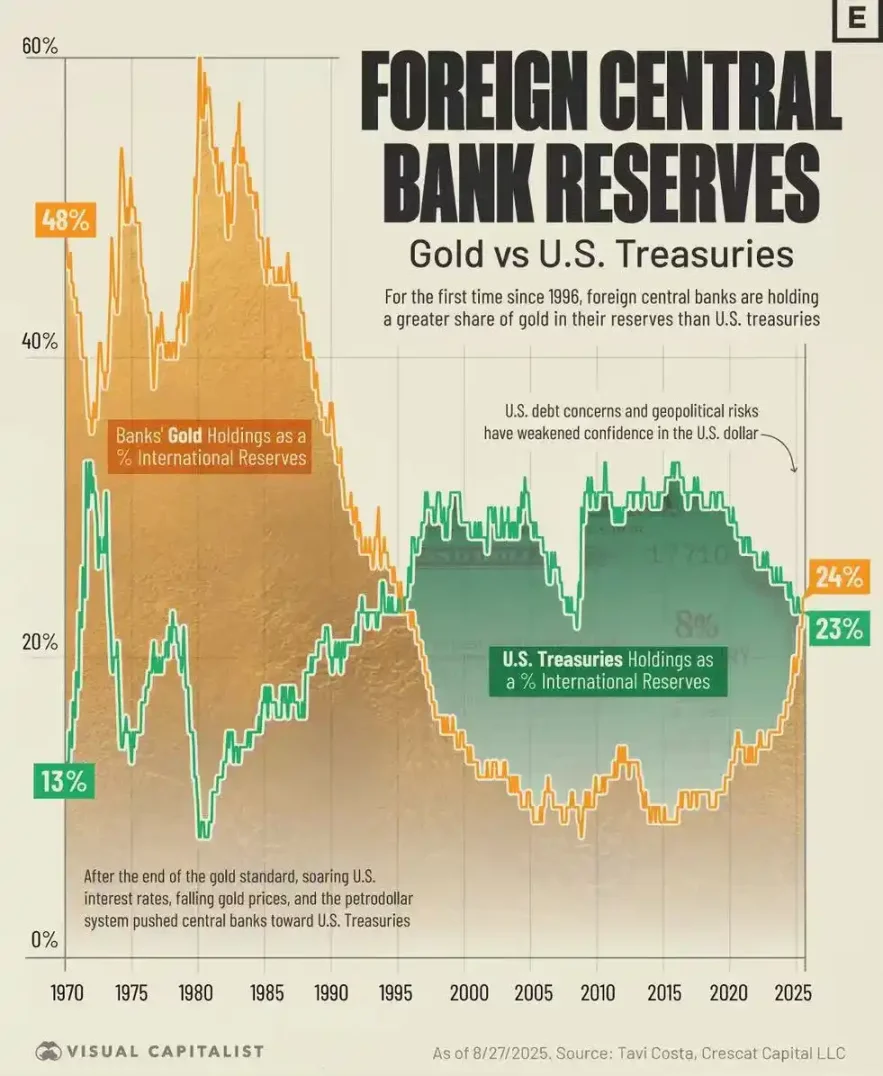

Gold’s rise is a response by sovereign nations to the existing international order, rooted in cracks in the dollar system’s credibility. The 2008 global financial crisis and the 2022 freezing of Russia’s foreign exchange reserves shattered the myth of the dollar and US Treasuries as risk-free, ultimate reserve assets. Against this backdrop, central banks worldwide have become “price-insensitive buyers.” They buy gold not for short-term profit but as an ultimate store of value independent of any sovereign credit.

Data from the World Gold Council shows that in 2022 and 2023, global central banks bought over 1,000 tons of gold for two consecutive years, setting a record. This gold rally is mainly driven by official sector activity, not market speculation.

Last week, Trump invoked the Insurrection Act and deployed troops to Minnesota to quell protests. The Pentagon has also ordered about 1,500 active-duty soldiers in Alaska to standby.

This normalization of conflict is dragging the world into a “gray zone” between localized wars and a new Cold War. Traditional full-scale hot war still has a relatively clear path and market expectations, sometimes even accompanied by monetary easing to “rescue the market.”

However, these localized conflicts are highly uncertain, full of “unknown unknowns.” For venture markets that rely heavily on stable expectations, this uncertainty can be fatal. When large capital cannot predict future trends, the most rational choice is to hold more cash and wait, rather than allocate funds into high-risk, highly volatile assets.

Why aren’t other assets falling?

Contrasting sharply with the silence in the crypto space, since 2025, markets like precious metals, US stocks, and A-shares have risen in turn. But these gains are not due to improved macro or liquidity fundamentals; instead, they are driven by structural trends under the influence of sovereign will and industrial policies amid great power rivalries.

Gold’s rise is a response by sovereign nations to the existing international order, rooted in cracks in the dollar system’s credibility. The 2008 global financial crisis and the 2022 freezing of Russia’s foreign exchange reserves shattered the myth of the dollar and US Treasuries as risk-free, ultimate reserve assets. Against this backdrop, central banks worldwide have become “price-insensitive buyers.” They buy gold not for short-term profit but as an ultimate store of value independent of any sovereign credit.

Data from the World Gold Council shows that in 2022 and 2023, global central banks bought over 1,000 tons of gold for two consecutive years, setting a record. This gold rally is mainly driven by official sector activity, not market speculation.

The proportion of gold and US Treasuries in sovereign reserves in 2025 shows that gold reserves have surpassed US Treasuries.

The rise in stock markets reflects national industrial policies. Whether it’s the US “AI National Strategy” or China’s “Industrial Autonomy” policy, these are signs of deep government intervention and control over capital flows.

In the US, the “Chips and Science Act” has elevated the AI industry to a strategic national security level. Capital is clearly shifting away from large tech stocks toward more growth-oriented, policy-aligned small and medium-sized stocks.

In China’s A-share market, funds are similarly concentrated in sectors like “Xinchuang” (core technologies) and “Defense and Military Industry,” closely related to national security and industrial upgrading. This government-led trend has a valuation logic fundamentally different from Bitcoin, which relies purely on market liquidity.

Will history repeat itself?

Historically, Bitcoin has not been the first asset to diverge from other assets’ performance. And every time, it has ended with a strong rebound.

The RSI (Relative Strength Index) of Bitcoin relative to gold has fallen below 30 in extreme oversold conditions four times: in 2015, 2018, 2022, and 2025.

Each time Bitcoin is extremely undervalued relative to gold, it signals a potential rebound in the exchange rate or Bitcoin’s price.

The proportion of gold and US Treasuries in sovereign reserves in 2025 shows that gold reserves have surpassed US Treasuries.

The rise in stock markets reflects national industrial policies. Whether it’s the US “AI National Strategy” or China’s “Industrial Autonomy” policy, these are signs of deep government intervention and control over capital flows.

In the US, the “Chips and Science Act” has elevated the AI industry to a strategic national security level. Capital is clearly shifting away from large tech stocks toward more growth-oriented, policy-aligned small and medium-sized stocks.

In China’s A-share market, funds are similarly concentrated in sectors like “Xinchuang” (core technologies) and “Defense and Military Industry,” closely related to national security and industrial upgrading. This government-led trend has a valuation logic fundamentally different from Bitcoin, which relies purely on market liquidity.

Will history repeat itself?

Historically, Bitcoin has not been the first asset to diverge from other assets’ performance. And every time, it has ended with a strong rebound.

The RSI (Relative Strength Index) of Bitcoin relative to gold has fallen below 30 in extreme oversold conditions four times: in 2015, 2018, 2022, and 2025.

Each time Bitcoin is extremely undervalued relative to gold, it signals a potential rebound in the exchange rate or Bitcoin’s price.

Historical trend of Bitcoin/Gold, with RSI indicator below

In 2015, during the end of a bear market, Bitcoin’s RSI relative to gold fell below 30, leading to a super bull run in 2016-2017. In 2018, during a bear market, Bitcoin dropped over 40%, while gold rose nearly 6%. After RSI fell below 30, Bitcoin rebounded from its 2020 lows by over 770%. In 2022, during a bear market, Bitcoin fell nearly 60%. After RSI dropped below 30, Bitcoin rebounded again, outperforming gold. Since late 2025, we are witnessing the fourth occurrence of this historic oversold signal. Gold surged 64% in 2025, and Bitcoin’s RSI relative to gold again entered the oversold zone. Can you still chase other assets higher now? Amid the “ABC” hype, selling off crypto assets easily to chase gains in seemingly more prosperous markets could be a risky decision. When small-cap US stocks start leading the rally, historically, it’s often the last exuberance before liquidity dries up at the end of a bull cycle. The Russell 2000 has gained over 45% since its 2025 lows, but most of its constituent stocks have weak profitability and are highly sensitive to interest rate changes. If the Fed’s monetary policy turns out to be less dovish than expected, these vulnerabilities will be exposed immediately. Second, the frenzy around AI is showing classic bubble characteristics. Whether it’s Deutsche Bank’s survey or Ray Dalio’s warnings, AI bubbles are listed as the biggest market risk for 2026. Valuations of star companies like Nvidia and Palantir have already hit historic highs, but whether their profit growth can support such valuations is increasingly questioned. Deeper risks include AI’s massive energy consumption potentially triggering a new round of inflation, forcing central banks to tighten monetary policy and bursting asset bubbles. According to a January survey by Bank of America fund managers, global investor optimism has hit a new high since July 2021, with growth expectations soaring. Cash holdings have fallen to a record low of 3.2%, and hedging measures against market corrections are at their lowest since January 2018. On one side, wildly rising sovereign assets and generally optimistic investor sentiment; on the other, escalating geopolitical conflicts. In this context, Bitcoin’s “stagnation” is not simply “underperforming the market.” It’s more like a clear signal—an early warning of larger risks ahead, and a buildup for a broader narrative shift. For true long-term believers, this is the moment to test their conviction, resist temptation, and prepare for upcoming crises and opportunities.