- Trending TopicsView More

22 Popularity

13.2K Popularity

25.5K Popularity

308.3K Popularity

164.6K Popularity

- Pin

- 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Explore Innovative Digital Asset Investment Opportunities

###Asset Management Growth in Digital Assets Sector

A prominent digital asset investment firm has reported significant growth in its assets under management (AUM). As of the latest update, the company's AUM reached $974 million, marking a 2.85% increase from the previous period. This upward trend indicates robust investor confidence and suggests potential for continued inflows into the digital asset space.

###Increasing Inflows and Product Performance

Since the beginning of the year, the firm's exchange-traded products (ETPs) have attracted substantial investor interest, with net inflows totaling $91.7 million. The month of August alone saw an additional $1.3 million in inflows, demonstrating ongoing momentum in the digital asset investment sector.

###Leading Products in the Portfolio

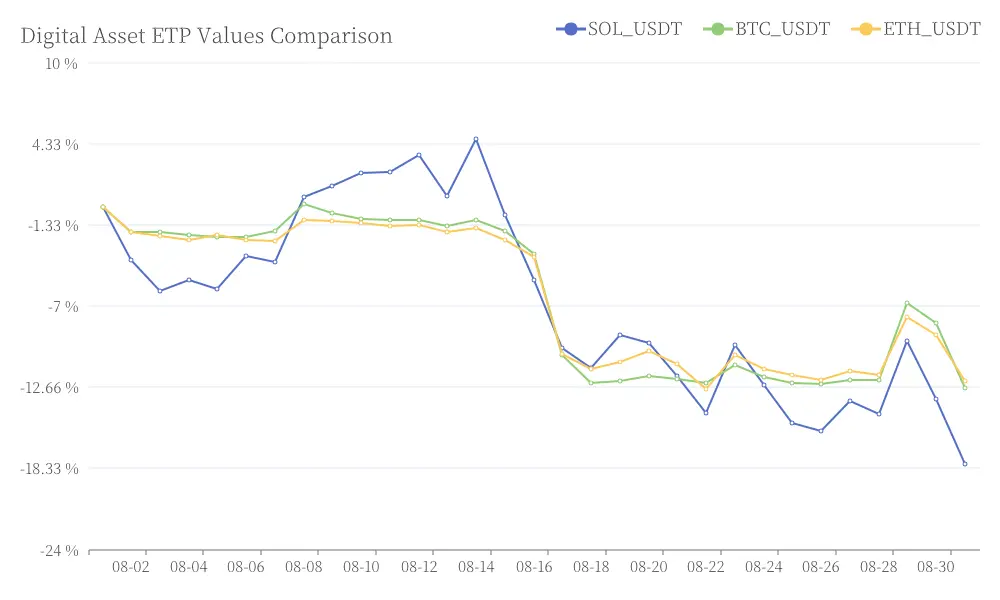

The company's product lineup showcases a diverse range of digital asset offerings, with the Solana ETP emerging as the frontrunner at $315 million in value. This is followed closely by the Bitcoin ETP at $269 million and the Ethereum ETP at $94.7 million, reflecting investor preferences across different blockchain ecosystems. Digital Asset ETP Values Comparison

Digital Asset ETP Values Comparison

###Broader Market Context

As the digital asset market continues to evolve, the total market capitalization has surpassed $3 trillion. This growth underscores the increasing mainstream acceptance and integration of blockchain technologies across various industries. Innovative investment strategies and platforms are emerging to capitalize on these trends, offering investors new opportunities to participate in the digital economy.

###Future Outlook

The sustained growth in AUM and consistent inflows suggest a positive outlook for the digital asset investment sector. As blockchain technologies continue to revolutionize business models and investment strategies, we can expect to see further innovation and expansion in this space. Investors and financial institutions alike are likely to closely monitor these developments as they seek to navigate the evolving landscape of digital asset investments.