- Trending TopicsView More

4.7M Popularity

13.4K Popularity

24.7K Popularity

308.6K Popularity

162.8K Popularity

- Pin

- 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Navigating Startup Phases in the Digital Asset Sector

###Adoption Trends Shape Bitcoin Market Cycles

Recent analysis suggests that Bitcoin's market cycles are not primarily driven by halving events, as commonly believed. Instead, other factors such as adoption trends and market structure play a more significant role in shaping bull and bear cycles. This perspective challenges the popular notion that Bitcoin's market cycles are tied to its halving events, which occur approximately every four years and reduce mining rewards.

###Identifying Key Transition Points

An analyst has identified three distinct cycles in Bitcoin's history, none of which are anchored around the halving events. The market's 2017 peak and 2022 bottom are highlighted as key transition points in these cycles. The first cycle from 2011 to 2018 represents an early adoption phase fueled by retail participation, followed by an adolescence cycle from 2018 to 2022 characterized by rapid growth and volatility. The current cycle beginning in 2022 marks Bitcoin's maturity with increased institutional involvement and greater stability.

###Challenging Traditional Perspectives

This analysis challenges the widespread belief that Bitcoin's market cycles are linked to halving events that create supply shocks by reducing block rewards. While bull market peaks have historically occurred in the year following halving events (2013, 2017, and 2021) with similar expectations for 2025, focusing solely on these patterns may cause observers to miss new signals in the evolving market landscape.

###Extended Bull Market Predictions

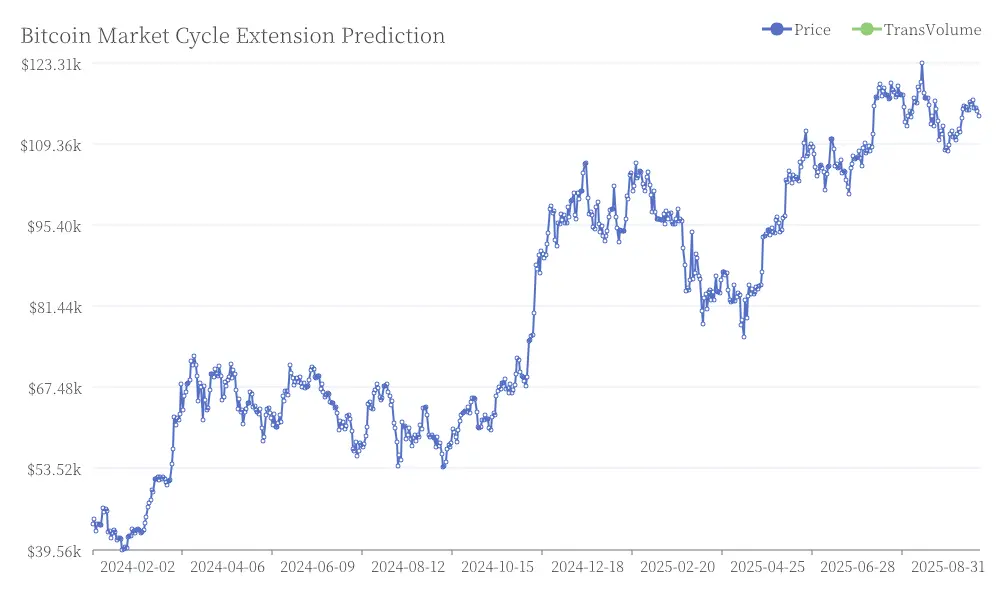

Recent predictions indicate the traditional four-year cycle may be ending, with the current bull market potentially extending into next year due to increased institutional participation. Some industry experts believe the cycle isn't complete until we see positive returns in 2026, though they acknowledge the four-year pattern is concluding. This extended bullish phase likely stems from macroeconomic factors including dollar liquidity and investment inflows. Bitcoin Market Cycle Extension Prediction

Bitcoin Market Cycle Extension Prediction

###Analyzing Market Dynamics

Understanding Bitcoin's market behavior requires comprehensive analysis of business cycle dynamics, examining the peaks and troughs of previous cycles. Recent observations suggest Bitcoin continues following traditional patterns, with current profit-taking and increased selling pressure indicating a late phase in the present cycle.

###Persistence of Bitcoin Cycles

Despite evolving conditions, some analysts maintain that Bitcoin cycles continue, driven by fundamental human behavior and market dynamics. The main difference lies in market impact intensity and recovery speed. This view emphasizes the ongoing relevance of cyclical patterns even as the cryptocurrency ecosystem matures and attracts diverse participants.

###Institutional Influence on Market Cycles

Increasing institutional involvement in Bitcoin may alter cycle dynamics. As established financial entities enter the market, their investment strategies and risk management approaches could lead to longer-term holdings and reduced volatility. This shift in market composition may result in extended cycles or modifications to the traditional patterns observed in Bitcoin's earlier years.