- Trending TopicsView More

5.9K Popularity

4.7M Popularity

120.9K Popularity

77.8K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Innovative Social Crypto Platform Transforming Digital Interactions

The Ethereum-Bitcoin Performance Dynamic

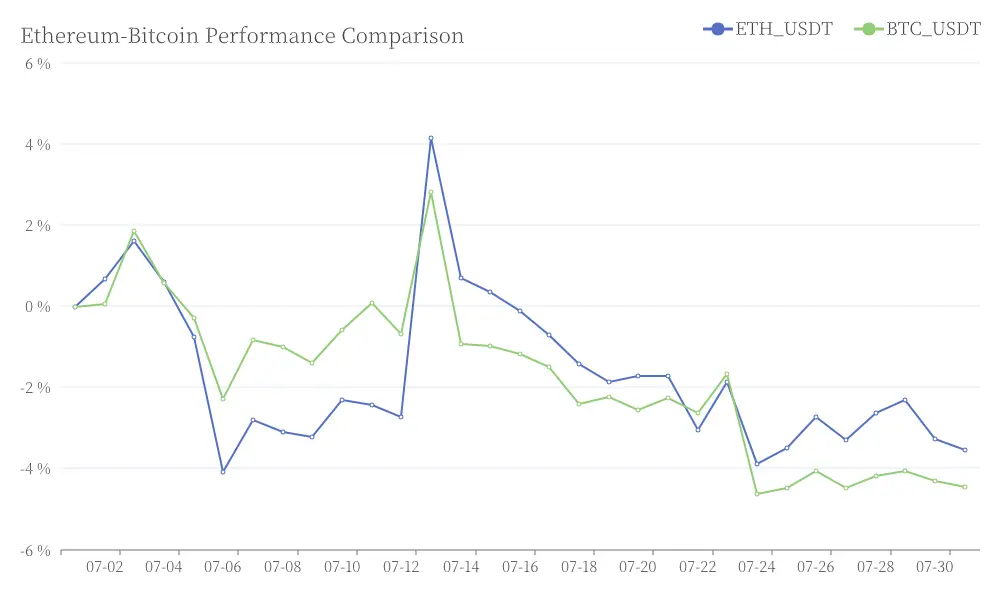

In the ever-evolving cryptocurrency landscape, a prominent analyst recently shared insights on the current trend of Ethereum outperforming Bitcoin. This phenomenon, while noteworthy, may be short-lived due to the intricate interplay of market narratives and timing. Ethereum-Bitcoin Performance Comparison

Ethereum-Bitcoin Performance Comparison

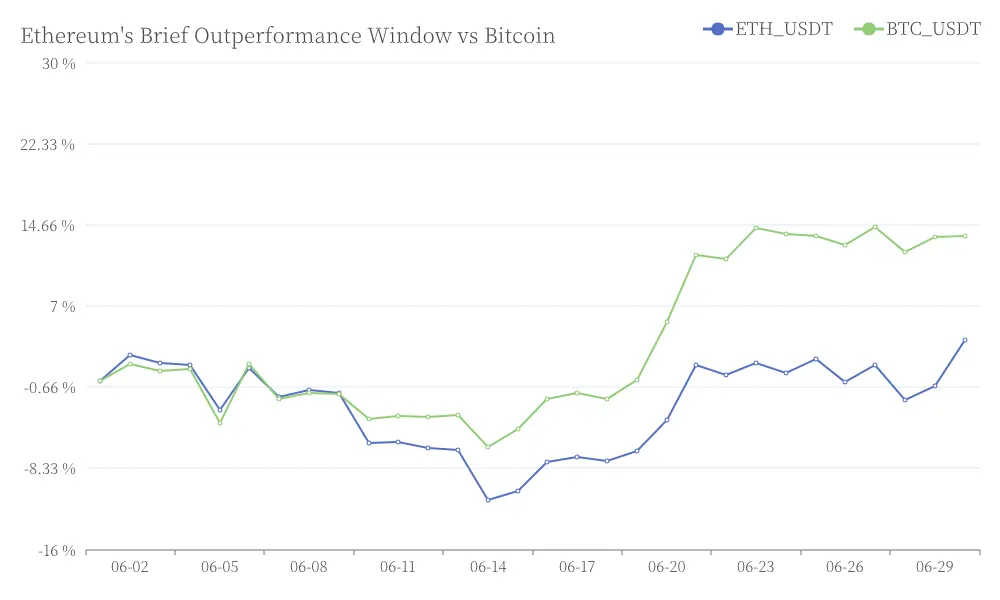

Market Dynamics and Investor Strategies

The analyst suggests that the window for Ethereum's outperformance could be brief, leaving investors with a limited timeframe to adjust their positions. This observation underscores the importance of staying agile in the fast-paced crypto market. Ethereum's Brief Outperformance Window vs Bitcoin

Ethereum's Brief Outperformance Window vs Bitcoin

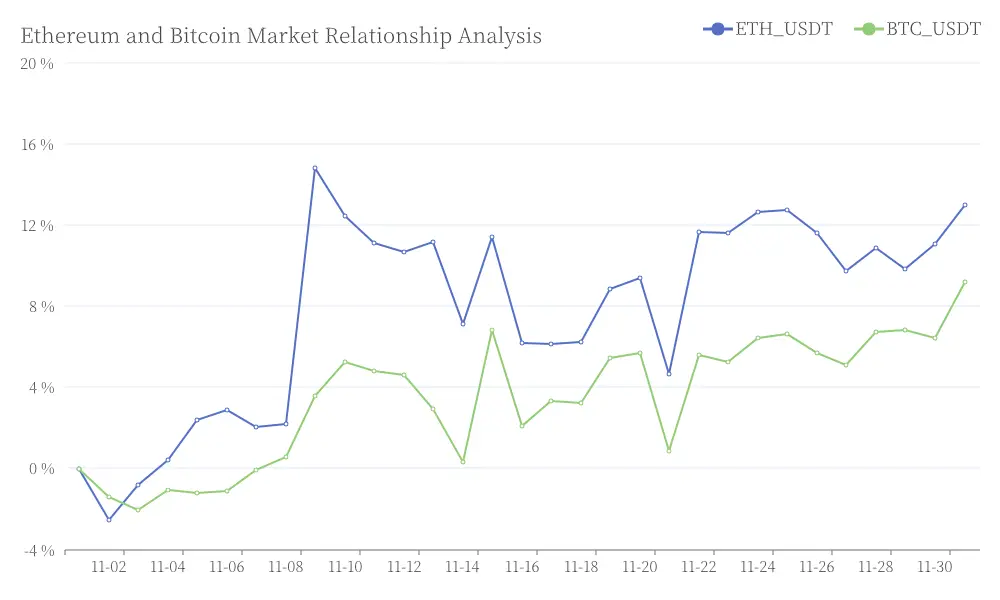

Long-term Perspectives on Major Cryptocurrencies

From a medium to long-term perspective, both Ethereum and Bitcoin draw from the same pool of macro funds, regulatory benefits, and market capitalization trends. Rather than viewing Ethereum as a substitute for Bitcoin, it's more accurate to consider it a beta amplifier for the leading cryptocurrency. Ethereum and Bitcoin Market Relationship Analysis

Ethereum and Bitcoin Market Relationship Analysis

Historical Patterns and Market Cycles

Historical data provides valuable context for understanding current trends. During significant market cycles, such as the ICO boom in 2017 and the DeFi surge in 2020, Ethereum's popularity actually enhanced Bitcoin's safe-haven premium. This pattern highlights the complex relationship between the two cryptocurrencies.

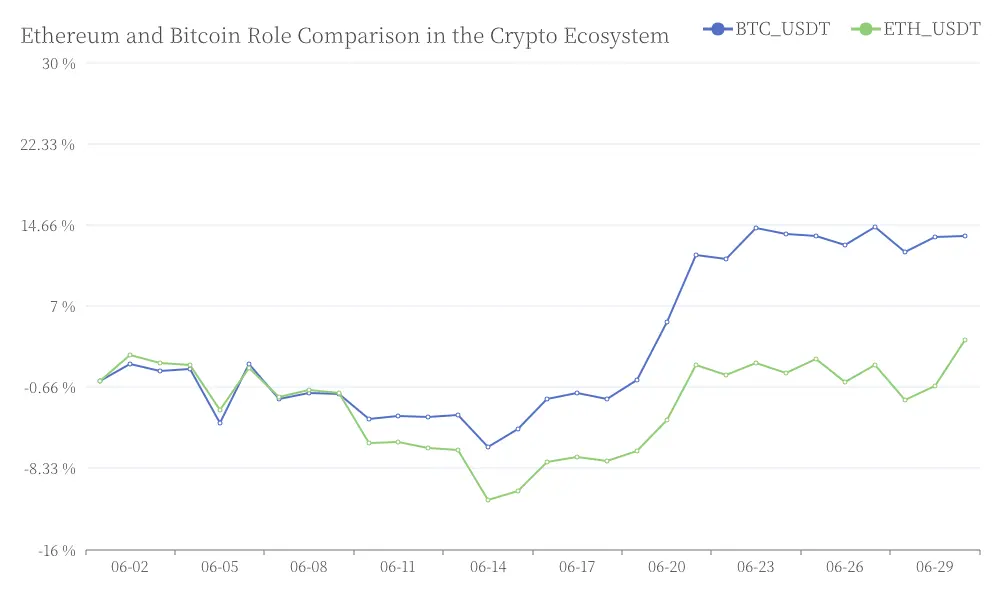

Roles in the Cryptocurrency Ecosystem

In the broader crypto ecosystem, Ethereum often acts as leverage, allowing for more speculative and potentially higher-reward investments. Bitcoin, on the other hand, serves as an anchor, providing relative stability in the volatile crypto market. This dynamic creates an interesting interplay between risk and security in investment strategies. Ethereum and Bitcoin Role Comparison in the Crypto Ecosystem

Ethereum and Bitcoin Role Comparison in the Crypto Ecosystem

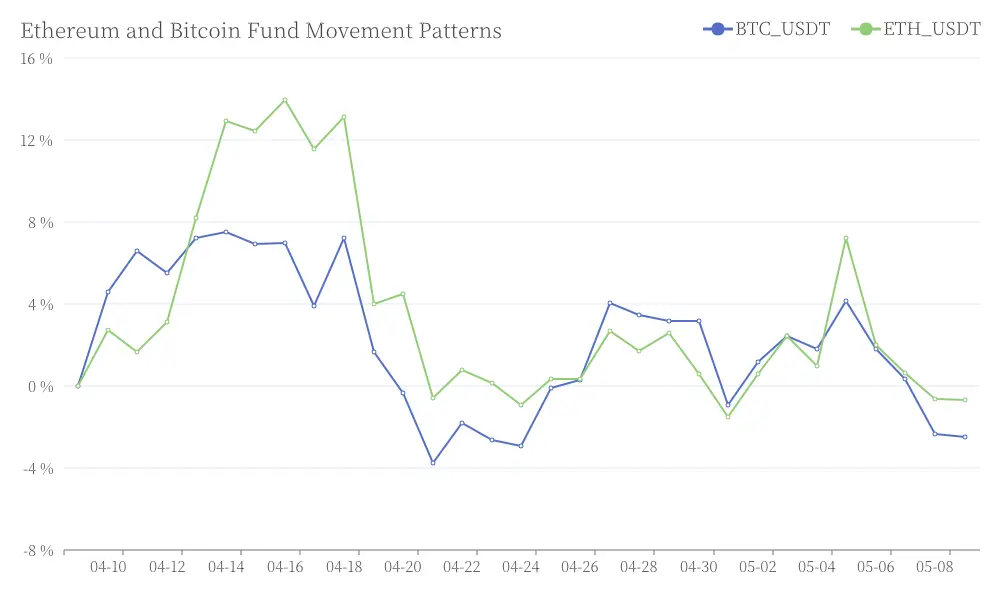

Fund Movement and Profit Realization

A notable trend observed in previous market cycles is the movement of large funds. After successful ventures in the Ethereum ecosystem or other altcoin markets, substantial capital often flows back to Bitcoin. This pattern suggests that many investors use Bitcoin as a means to realize and secure profits from more speculative investments. Ethereum and Bitcoin Fund Movement Patterns

Ethereum and Bitcoin Fund Movement Patterns

Implications for Cryptocurrency Investors

Understanding these market dynamics is crucial for cryptocurrency investors. While short-term trends may favor Ethereum or other altcoins, Bitcoin's role as a stable store of value remains significant. Investors should consider these factors when developing their long-term cryptocurrency investment strategies.