- Trending TopicsView More

12.2K Popularity

4.7M Popularity

123.3K Popularity

78.1K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Major Bitcoin Movement Detected Among Veteran Investors

Substantial Bitcoin Outflows from Long-Term Investors

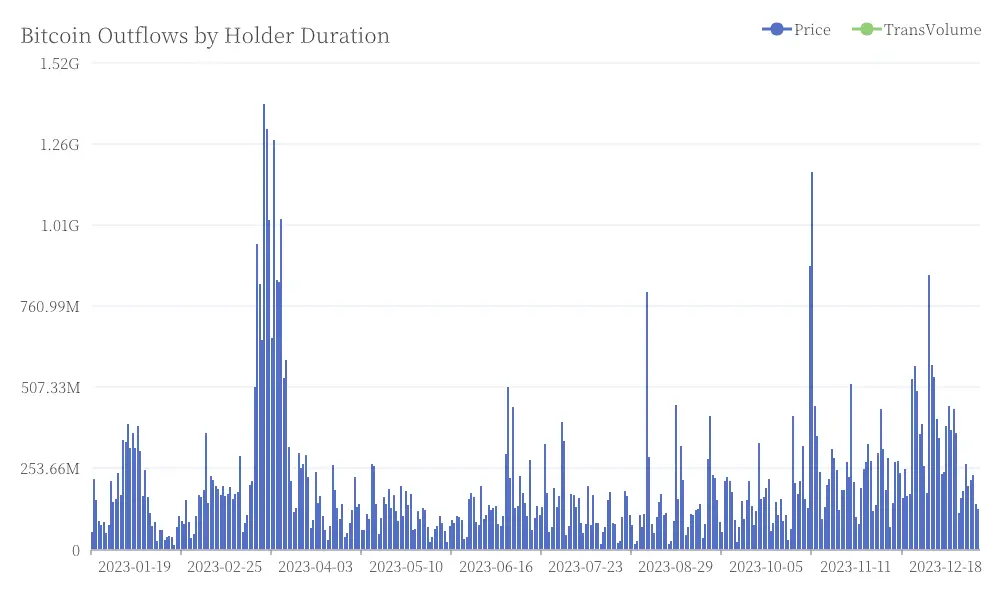

Recent data from blockchain analytics firm Glassnode reveals a significant sell-off by long-term Bitcoin holders. On a single day, approximately 97,000 bitcoins were moved by investors who had held their assets for extended periods.

Analysis of Bitcoin Selling Patterns

The outflows show distinct patterns across different holding durations. Investors who held Bitcoin for 1-2 years sold the most at 34,500 BTC, followed by those in the 6-12 month range who moved 16,600 BTC, while 3-5 year holders liquidated about 16,000 BTC. Together, these three investor categories represented approximately 70% of the total Bitcoin outflow from long-term holders. Bitcoin Outflows by Holder Duration

Bitcoin Outflows by Holder Duration

Market Implications of Long-Term Holder Behavior

The movement of such a substantial amount of Bitcoin by long-term investors could have significant implications for market dynamics. Typically, long-term holders are considered "strong hands" in the crypto market, and their actions often signal important shifts in sentiment or market conditions.

Potential Reasons for Bitcoin Liquidation

Several factors might explain this sell-off by long-term holders. Many investors appear to be taking profits following recent price increases, while others could be rebalancing their portfolios as part of broader investment strategies. Some may be responding to perceived risks or changing market conditions, prompting them to reduce their Bitcoin exposure.

Impact on Bitcoin's Price and Market Sentiment

The substantial outflow from long-term holders may create short-term selling pressure on Bitcoin's price. However, the ultimate impact will depend on various factors, including overall market conditions, institutional interest, and broader economic trends.

Long-Term Outlook for Bitcoin

Despite this significant movement by long-term holders, it's important to consider the broader context of Bitcoin's adoption and institutional interest. The cryptocurrency market continues to evolve, with increasing mainstream acceptance and integration into traditional financial systems.