- Trending TopicsView More

2.5K Popularity

4.7M Popularity

119.8K Popularity

77.5K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Exploring the Facets of Crypto Finance

###Ethereum's Decade-Long Journey: Unveiling the Potential of the Next Bull Run

As Ethereum approaches its tenth anniversary, the market is witnessing a significant surge in ETH prices, seemingly on the brink of reaching new all-time highs. This article delves into seven key financial dimensions that suggest the current Ethereum rally may be just the beginning of a more substantial bull run.

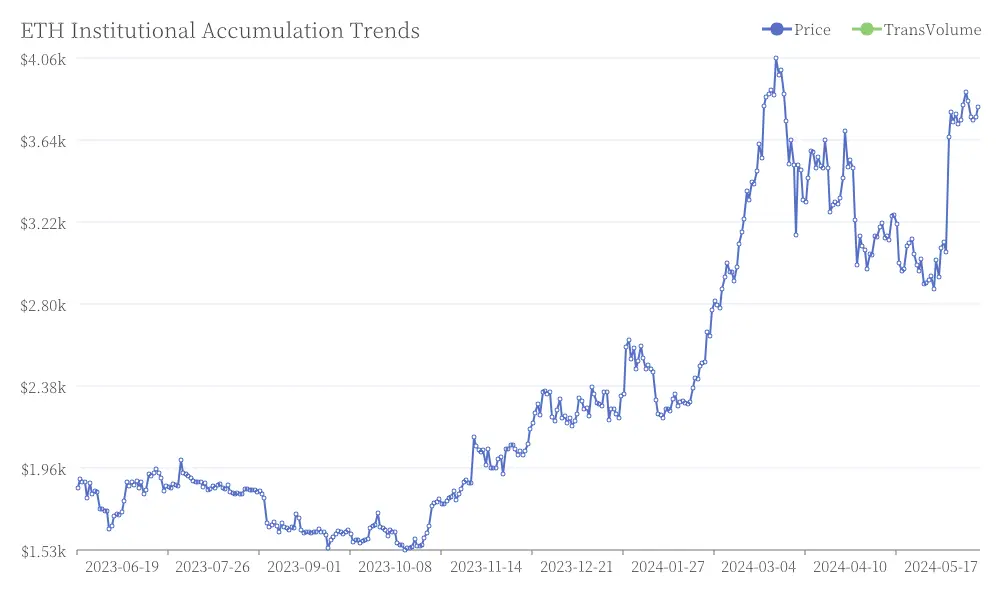

###Institutional Accumulation and Reserve Assets

Recent market trends reveal a strong buying momentum for ETH, with numerous publicly listed companies and asset management institutions actively increasing their holdings. Some have even integrated ETH into their financial strategies, marking a shift in institutional perception of Ethereum as a strategic reserve asset akin to Bitcoin.

This institutional embrace has been catalyzed by prominent figures in the financial sector. For instance, a well-known Wall Street strategist's high-profile bet on ETH led to the transformation of a former Bitcoin mining company into an Ethereum asset company, accumulating over 600,000 ETH valued at more than $3 billion. This move has sparked a wave of ETH purchases by several U.S. public companies as part of their asset allocation strategies. ETH Institutional Accumulation Trends

ETH Institutional Accumulation Trends

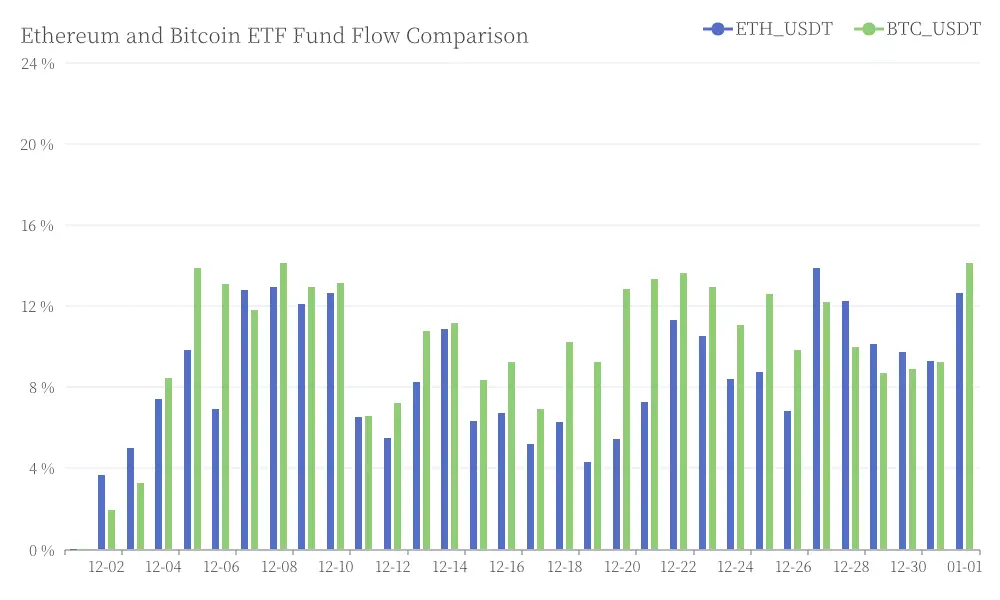

###The ETF Effect on Ethereum's Market Dynamics

The surge in ETH prices has been accompanied by a significant influx of funds into Ethereum ETFs. Data indicates that Ethereum spot ETFs have experienced consistent net inflows, with some ETFs setting records for single-day inflows. This trend contrasts with the cooling period observed in Bitcoin ETFs, suggesting a rebalancing of funds from BTC to ETH sectors. Ethereum and Bitcoin ETF Fund Flow Comparison

Ethereum and Bitcoin ETF Fund Flow Comparison

Looking ahead, the potential introduction of Ethereum staking yield ETFs could further enhance the attractiveness of ETH for institutional investors. These products are expected to offer annualized staking yields of 3-5% based on holding spot Ethereum, potentially making them more appealing to institutions seeking yield-generating assets.

###Evolution of the Ethereum Foundation

The Ethereum Foundation has undergone notable management adjustments, adopting a dual-director model to decentralize decision-making power and enhance efficiency. This restructuring aims to maintain the community-driven open-source spirit while strengthening external communication and strategic execution capabilities.

Furthermore, the integration of former Ethereum core team members into projects aimed at introducing ETH into mainstream financial systems marks a proactive step towards institutionalization, potentially shifting the valuation logic of ETH and enhancing its long-term price support.

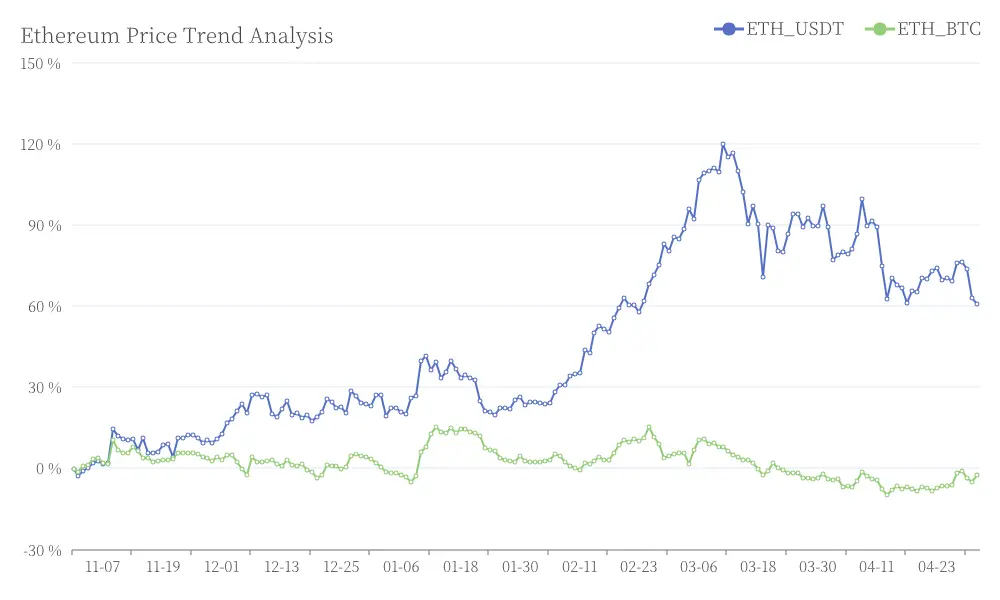

###Technical Indicators and Market Sentiment

Ethereum's recent price action has shown a strong upward trend, with ETH/BTC pair breaking out of a long-term consolidation phase. Technical indicators such as the Relative Strength Index (RSI) have signaled potential buying opportunities, with some analysts predicting significant upside potential for ETH prices in the coming months. Ethereum Price Trend Analysis

Ethereum Price Trend Analysis

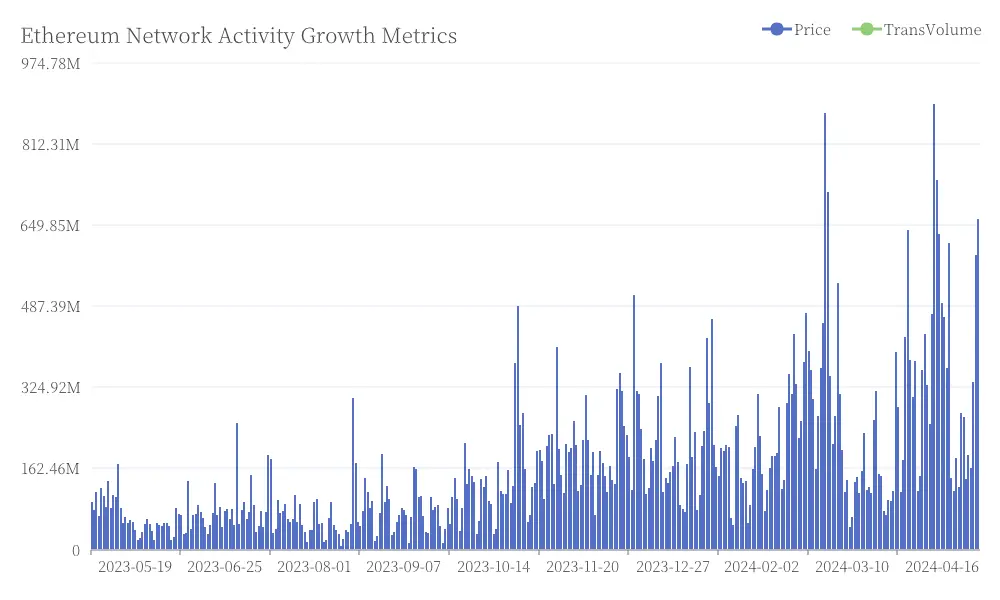

###On-Chain Metrics and Network Activity

On-chain data reveals a significant increase in Ethereum's network activity. Key metrics including daily transaction volumes, active addresses, and total value locked in DeFi protocols have shown substantial growth. Ethereum staking has also reached new heights with over 36 million ETH currently staked, effectively reducing circulating supply and potentially decreasing selling pressure. Ethereum Network Activity Growth Metrics

Ethereum Network Activity Growth Metrics

###The Rise of Real-World Assets and Stablecoins

Ethereum has established a dominant position in the markets for real-world assets and stablecoins. The platform hosts a significant portion of tokenized real-world assets and maintains its status as the primary on-chain dollar carrier. This trend is redefining ETH's investment value and positioning Ethereum as a potential global digital dollar settlement network.

###Technological Roadmap and Future Upgrades

Ethereum's continuous technological iterations and upgrades form a crucial internal driving force for bullish sentiment. Recent upgrades have enhanced scalability and user experience, while future improvements like sharding and Verkle trees are in development. This ongoing roadmap aims to further improve Ethereum's performance and strengthen its long-term value proposition.

As Ethereum enters its second decade, the convergence of improving core indicators, technological advancements, and external market factors suggests that the current rally may indeed be the beginning of a more substantial and sustained bull run. However, investors should remain aware of potential challenges from competing platforms and regulatory changes that could introduce market volatility.