- Trending TopicsView More

22 Popularity

12.9K Popularity

21.6K Popularity

307.2K Popularity

162.6K Popularity

- Pin

- 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Evaluating Luna Classic's Potential for Rebound

###Analyzing the Potential Recovery of Luna Classic

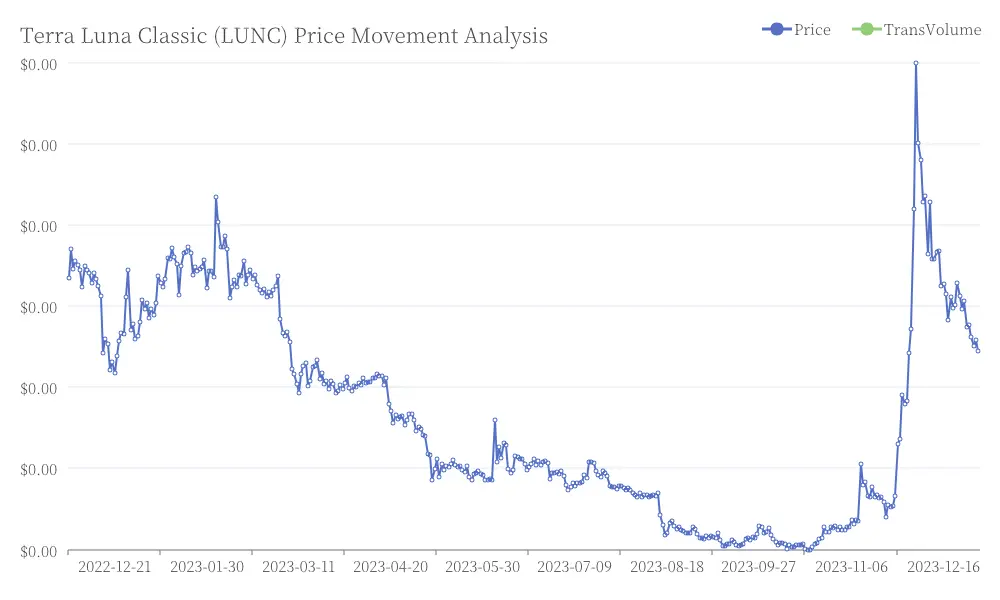

Terra Luna Classic (LUNC) has experienced significant price pressure, trading at approximately $0.00010, marking its lowest point since December 2022. This represents a steep 42% decline from its December peak of $0.0001790. Terra Luna Classic (LUNC) Price Movement Analysis

Despite this downtrend, several key factors are influencing the token's performance and potential for recovery.

Terra Luna Classic (LUNC) Price Movement Analysis

Despite this downtrend, several key factors are influencing the token's performance and potential for recovery.

###Impact of Token Burns on LUNC Supply

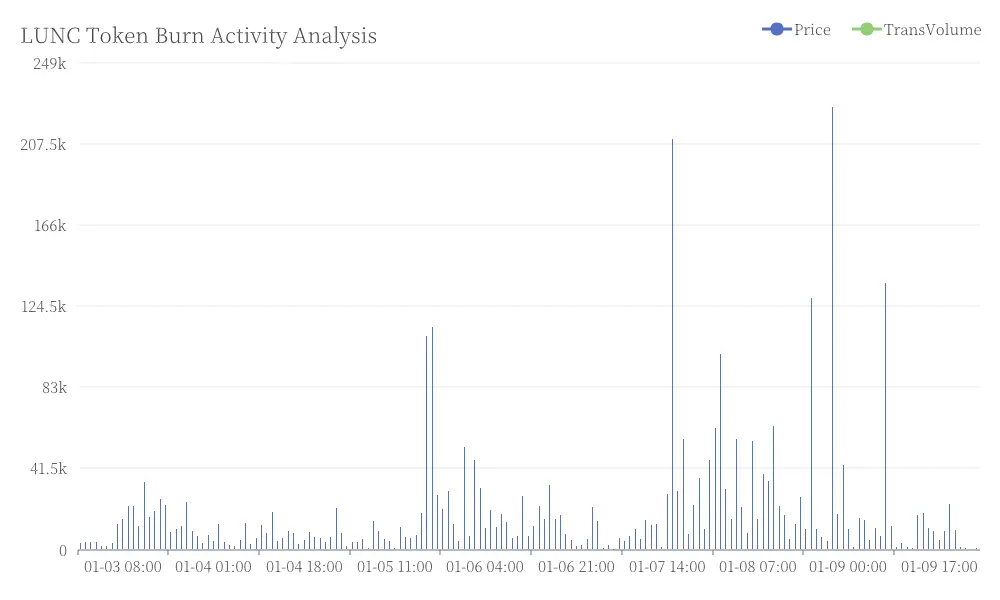

Since May 2022, a total of 397 billion LUNC tokens have been burned, aimed at reducing the circulating supply, which currently stands at 6.5 trillion. This deflationary mechanism is designed to create upward price pressure by diminishing the available supply.

Recent data indicates a surge in burn activity, with 341 million LUNC tokens burned in just the past week, and a remarkable 686 million tokens burned on January 10, 2025. Major players in the cryptocurrency space have been leading the burn efforts, contributing nearly 70 billion LUNC. LUNC Token Burn Activity Analysis

With these continued burn initiatives, there's potential for LUNC to see an increase in its value as the supply decreases over time.

LUNC Token Burn Activity Analysis

With these continued burn initiatives, there's potential for LUNC to see an increase in its value as the supply decreases over time.

###Rising Staking Activity and Long-Term Confidence

The staking ratio of LUNC has seen a notable rise, climbing to 15% (equivalent to 981 billion tokens), up from 14.8% previously. Staking allows users to lock their tokens in a network to support its security and operations, and this increase suggests growing long-term confidence in the Terra Luna Classic ecosystem.

A higher staking ratio has the dual effect of reducing the circulating supply and alleviating selling pressure on the token, which could positively impact the price over time. Investors staking their tokens are less likely to sell in the short term, helping to stabilize the market sentiment surrounding LUNC.

###Challenges Facing LUNC's Price Action

Despite the positive effects of burns and staking, LUNC has faced substantial challenges. The token recently broke through critical support levels, falling below $0.0001054, which has triggered bearish momentum. Furthermore, the token is trading below its 50-day and 200-day moving averages, technical indicators commonly used to assess the overall market trend.

Additionally, the broader cryptocurrency market is experiencing weak sentiment, with many tokens underperforming due to factors such as global economic conditions, regulatory concerns, and investor caution. This broader market pressure continues to weigh on LUNC's price performance.

###Potential Catalysts for LUNC's Recovery

While LUNC is facing some headwinds, there are several potential catalysts that could drive its recovery. Accelerated token burns could reduce the circulating supply more rapidly, potentially boosting scarcity and driving demand. Greater ecosystem adoption, particularly in decentralized finance (DeFi) applications, could lead to increased demand for LUNC tokens, positively affecting the price. Additionally, a broader recovery in the cryptocurrency market, driven by upward momentum in major cryptocurrencies and other altcoins, could lift the value of LUNC along with other tokens.

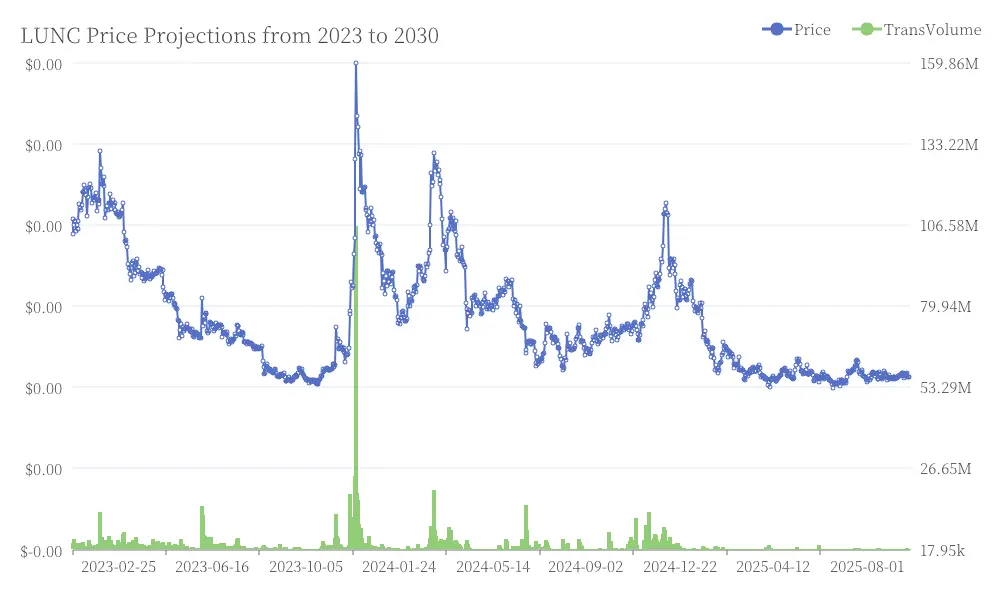

###Future Outlook and Price Projections

Looking ahead, some analysts project a maximum price for LUNC of around $0.000135 in 2023, $0.000304 in 2025, and $0.000739 by 2030. However, these projections should be approached with caution, as the cryptocurrency market is highly volatile and subject to rapid changes. LUNC Price Projections from 2023 to 2030

LUNC Price Projections from 2023 to 2030

The $0.00010 price point remains a critical support level for LUNC. If the token can build momentum, a retest of the $0.0001054 resistance level is possible. However, the token's future remains uncertain, and its recovery will largely depend on broader market sentiment and demand for the token.

For now, LUNC investors should keep a close eye on key indicators such as burn rates, staking activity, and overall market conditions as they monitor the token's recovery prospects. While the Terra Luna Classic ecosystem is showing promising signs with growing staking activity and ongoing burns, its path to recovery remains challenging in the current market environment.