一文讀懂 Codex

Codex 作爲穩定幣領域的創新項目,致力於構建通用電子現金系統。憑藉其專爲穩定幣設計的獨特模塊化多鏈架構和強大的生態系統,Codex 展現出巨大的發展潛力。通過 Codex Chain、Codex API、Codex FX 以及 Stargate 和 Conduit 等創新技術,Codex 爲企業構建了一個高效、安全且易於集成的穩定幣生態系統。前言

Codex 是一家專注於穩定幣的區塊鏈公司,致力於構建一個通用的電子現金系統,以推動金融普惠和創新。隨着穩定幣市場的快速增長(過去五年間規模擴大了 40 倍),Codex 通過其專爲穩定幣設計的區塊鏈架構,爲支付、借貸和去中心化金融(DeFi)等領域提供了高效、安全且合規的解決方案。Codex 的使命是通過技術創新和合規設計,打造一個穩定、透明且易於使用的電子現金系統,重新定義傳統金融與區塊鏈技術的融合方式。本文將深入探討 Codex 的運行機制、競爭優勢及潛在風險,分析其在穩定幣生態系統中的定位與未來發展潛力。

Codex 是什麼?

Codex 是一家專注於穩定幣的區塊鏈公司,其使命是創建一個通用的電子現金系統,以推動金融普惠和創新。Codex 通過其專爲穩定幣設計的區塊鏈架構,爲支付、借貸和去中心化金融(DeFi)等領域提供了高效、安全且合規的解決方案。

Codex 的願景是實現加密貨幣領域最古老、最宏偉的夢想之一:創建一個通用的電子現金系統。這一系統旨在使穩定幣的使用變得簡單、可靠且成本低廉,從而幫助企業無縫地將加密貨幣整合到其財務運營中,無需擔心波動性、高昂費用、復雜的錢包或不兼容的區塊瀏覽器等問題。

Codex 旨在解決現有區塊鏈解決方案未能解決的現實世界企業挑戰,通過彌合區塊鏈技術和實際業務應用之間的差距,爲企業解鎖巨大價值。Codex 的使命驅動方法和創新基礎設施已經吸引了主要投資者和企業的關注,其未來規劃包括進一步推動穩定幣的採用和生態系統的發展。

項目背景

團隊成員

Codex 的創始人和核心團隊成員都有豐富的行業經驗。其團隊成員包括:

Haonan Li|聯合創始人兼 CEO

Haonan Li 是 Codex 的聯合創始人兼首席執行官。此前,他曾在 Optimism 領導代幣/空投設計、協議經濟學和 rpgf。Li 畢業於沃頓商學院。Victor Yaw|聯合創始人

Victor Yaw 是 Codex 的聯合創始人。他畢業於聖路易斯華盛頓大學。Momo Ong|聯合創始人

Momo Ong 是 Codex 的聯合創始人,曾在 Sequoia Capital 和 Meta 工作過。他畢業於普林斯頓大學。

除此之外,其團隊還得到了來自 TikTok、Palantir、Coinbase 和 Jane Street 的人才支持。

融資情況

Codex 項目的融資如下:

- 2025 年 4 月 4日 Codex 完成 1580 萬美元種子輪融資。

- Codex 的投資方包括:Dragonfly Capital 領投,Coinbase 和 Circle、Cumberland、Wintermute 和 Selini Capital 等參投,Dragonfly 在本輪融資中投入了約 1400 萬美元。

Codex 核心技術

在 Codex 的項目背景和發展現狀中,我們可以看到穩定幣在企業應用中的巨大潛力和現實挑戰。爲了真正實現穩定幣在企業金融基礎設施中的廣泛應用,Codex 團隊深入分析了企業需求,並基於這些需求開發了一系列創新技術。這些技術不僅解決了現有穩定幣使用中的痛點,還爲企業提供了一個高效、安全且易於集成的解決方案。接下來,我們將詳細探討 Codex 的核心技術,這些技術是實現其願景和使命的關鍵所在。

來源:https://docs.codex.xyz/core-concepts/identities.html

Codex Chain

Codex Chain 是 Codex 專爲穩定幣交易設計的區塊鏈,旨在爲企業提供高效、安全且易於集成的穩定幣解決方案。

- 基於 OP Stack 構建:Codex Chain 基於 OP Stack 構建,利用 Optimism 的擴展能力和以太坊的安全性,確保了鏈的穩定性和可靠性。

- 模塊化多鏈架構:支持 AI、DePIN 及 DeFi 應用的鏈上計算,爲企業提供了強大的基礎設施支持。

- 鏈詳情:具體參數包括鏈 ID 爲 81224,RPC 地址爲 https://rpc.codex.xyz,WebSocket 地址爲 wss://rpc.codex.xyz,區塊瀏覽器地址爲 https://explorer.codex.xyz,爲企業和開發者提供了訪問和交互的接口。

- Gas 和撤回週期:Gas 限制爲 30000000,撤回週期爲 604,800 秒(標準的 7 天撤回),確保了交易的穩定性和可預測性。

- 跨鏈橋接:支持通過 Stargate 橋接 USDC 從 L1 到 Codex Mainnet,使得用戶能夠方便地將 USDC 轉換爲 USDC.e,進一步擴展了穩定幣的使用場景。

- Conduit 托管:Conduit 作爲托管服務,爲 Codex Chain 提供了可靠的基礎設施支持,確保了鏈的穩定運行和高可用性。

Codex API

Codex API 通過採用 JWT(JSON Web Token)認證機制,確保了 API 請求的安全性和時效性。每個請求必須包含一個新鮮的 JWT 令牌,且令牌的有效期僅爲 15 秒,從而有效防止了未授權的訪問和潛在的安全威脅。令牌必須使用 ES256 算法進行籤名,並包含特定的 JWT 聲明,如 iss(issuer)和 kid(key ID),這些信息在用戶註冊過程中提供,確保了認證的準確性和唯一性。

除了強大的安全性,Codex API 還提供了豐富的功能,使得企業能夠輕鬆地將穩定幣集成到現有的財務系統中,並實現自動化操作。API 支持法幣與穩定幣的轉換,方便企業進行跨境支付和資金管理。此外,它還提供了穩定幣的自動化轉帳和結算功能,簡化了企業的財務操作。API 還支持虛擬帳戶的創建和管理,使得企業能夠方便地接收和管理資金。

存款渠道圖:

來源:https://docs.codex.xyz/guides/on-ramp.html

提款渠道圖:

來源:https://docs.codex.xyz/guides/off-ramp.html

Codex FX

Codex FX 是 Codex 提供的一項全球、批發穩定幣外匯服務,旨在幫助企業在全球範圍內進行穩定幣的兌換和支付。通過這一服務,企業能夠以更低的成本和更高的效率完成跨境支付和資金管理。Codex FX 的優勢在於其全球覆蓋範圍和對批發交易的支持,使得企業能夠以更優惠的匯率進行大規模的穩定幣兌換,從而顯著降低交易成本並提高操作的便利性。

市場與競爭分析

Codex 的核心技術特性不僅解決了現有穩定幣使用中的痛點,還爲企業提供了一個高效、安全且易於集成的解決方案。通過專爲穩定幣設計的 Codex Chain、強大的 Codex API、全球穩定幣外匯服務 Codex FX,以及支持跨鏈橋接的 Stargate 和可靠的 Conduit 托管服務,Codex 構建了一個完整的生態系統。這些技術不僅提升了穩定幣的使用效率和安全性,還爲企業在實際應用中提供了顯著的競爭優勢。接下來,我們將詳細探討 Codex 的競爭優勢,分析這些技術如何轉化爲實際的市場價值和用戶信任。

性能優勢

Codex Chain 是專爲穩定幣交易設計的區塊鏈,相較於通用區塊鏈,具有顯著的性能優勢。其核心設計目標是滿足企業對穩定幣交易的高效性和可靠性需求。通過模塊化多鏈架構,Codex Chain 能夠支持 AI、DePIN 及 DeFi 應用的鏈上計算,確保了高效性和可擴展性。這種架構允許不同類型的交易和應用在獨立的鏈上運行,從而避免了資源競爭和性能瓶頸。

- 模塊化多鏈架構:Codex Chain 採用模塊化設計,支持多鏈並行處理交易。這種架構不僅提高了交易處理速度,還增強了系統的可擴展性,使得平台能夠輕鬆應對高並發場景。

- 低延遲和高吞吐量:Codex Chain 優化了交易處理流程,實現了低延遲和高吞吐量。其每秒交易處理量(TPS)遠高於通用區塊鏈,確保了交易的快速確認和執行。這對於需要實時結算的企業應用尤爲重要。

成本效益

Codex Chain 的設計不僅注重性能,還兼顧了成本效益。低交易費用和高吞吐量使得 Codex 在穩定幣交易中具有顯著的成本優勢,尤其適合高頻交易和大規模資金管理。

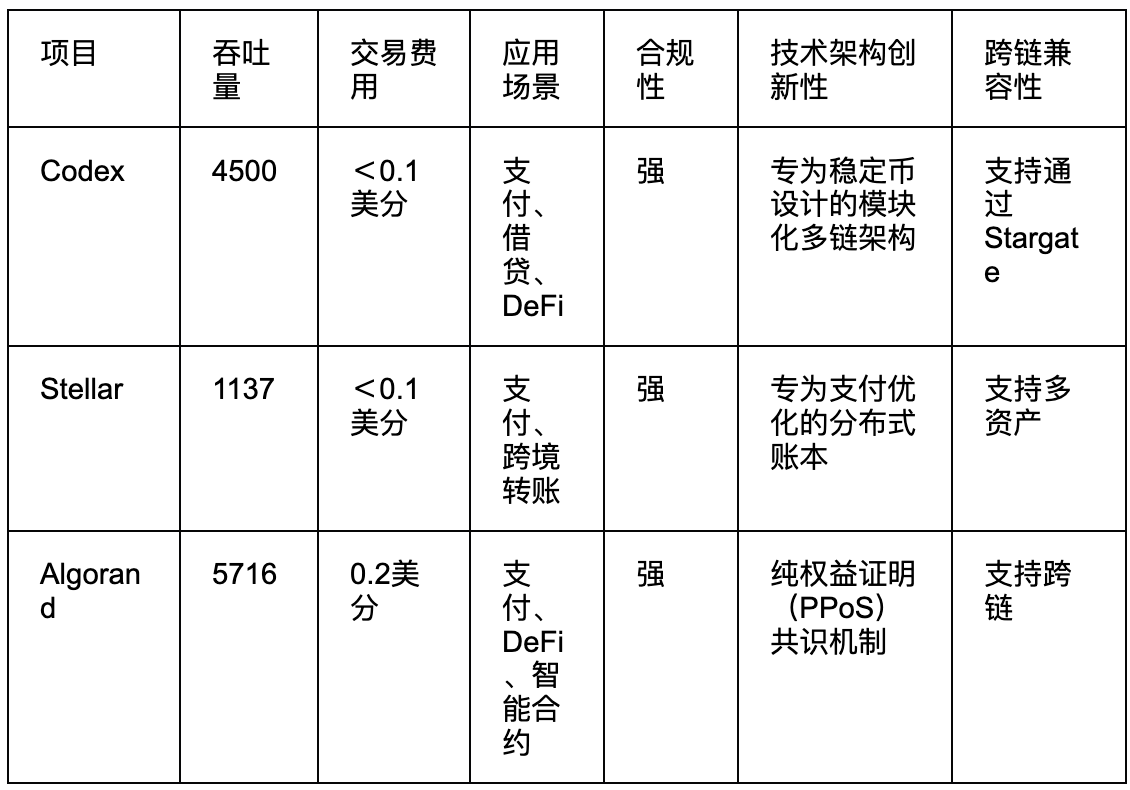

- 低交易費用:通過優化的共識機制和資源分配,Codex Chain 能夠顯著降低每筆交易的費用至 0.0000001 ETH (小於 0.1 美分)。而 Algorand 的交易費用則在 0.2 美分左右波動。這對於高頻交易和小額支付場景尤爲重要,因爲高昂的交易費用會顯著影響整體成本。

來源:https://kimi.moonshot.cn/chat/cvuankpnu959jiql1mhg

- 高吞吐量支持大規模資金管理:高吞吐量使得 Codex 能夠處理大量交易而不出現擁堵,確保了大規模資金管理的高效性和可靠性。這對於需要處理大量跨境支付和資金流動的企業來說是一個關鍵優勢。

與同類對比

在穩定幣區塊鏈項目領域,Codex 憑藉其專爲穩定幣設計的模塊化多鏈架構和創新技術,展現出顯著的競爭力。與同類項目相比,Codex 在交易速度和吞吐量方面表現優異,能夠快速處理大量交易,特別適合高頻交易和大規模資金管理場景。其低交易費用進一步增強了其在支付和小額交易中的吸引力。

在合規性方面,Codex 表現出色,適應全球監管環境,爲企業提供了可靠的信任基礎。其技術架構的創新性,如模塊化多鏈設計和跨鏈橋接支持,使得 Codex 能夠靈活應對多種應用場景,並確保高效性和可擴展性。

盡管在開發者社區活躍度和市場接受度方面,Codex 相較於一些成熟項目如 Stellar 和 USDC 仍處於發展階段,但其強大的生態系統和合作夥伴網路正在迅速擴展,顯示出巨大的增長潛力。

生態發展

Roadmap

- 2023 年 Q1:項目啓動,核心團隊組建完成,開始進行 Codex Chain 的底層架構設計和開發。

- 2023 年 Q3:發布 Codex API 的第一個測試版本,開始與合作夥伴進行集成測試,優化穩定幣轉換和支付功能。

- 2024 年 Q1:Codex Chain 正式上線主網,支持企業級應用,同時發布完整的 API 文檔,吸引開發者社區參與。

- 2024 年 Q2:與多家金融機構和支付平台建立合作關係,擴大市場覆蓋範圍,優化用戶體驗。

- 2024 年 Q4:完成跨鏈橋接功能的全面部署,支持多種穩定幣的轉換,增強平台的互操作性。

- 2025 年 Q1:獲得 Dragonfly Capital、Coinbase Ventures 等知名投資者的種子輪融資,加速市場擴展和技術迭代。

- 2025 年 Q2:在新加坡、英國、迪拜和香港等地區開通服務入口,進一步擴大全球市場覆蓋。

- 2026 年 Q1:探索更多金融產品和服務,如穩定幣計息帳戶和保險服務,進一步完善生態系統。

生態合作

Codex 通過與全球各地的金融機構和企業建立合作關係,不斷擴展其生態系統並推動穩定幣在實際業務中的應用。這些合作不僅展示了 Codex 在穩定幣領域的技術優勢,還體現了其在金融普惠和創新方面的承諾。以下是 Codex 在生態合作方面的一些重要案例和進展:

- 東南亞支付平台合作:Codex 與東南亞的支付平台建立了合作關係,幫助當地中小企業解決跨境支付中的痛點。通過 Codex 的穩定幣解決方案,企業能夠更高效地進行跨境支付,降低交易成本和時間。

- 歐洲銀行合作:Codex 與歐洲的多家銀行合作,提供穩定幣的兌換和支付服務。這些合作使得銀行能夠爲客戶提供更快捷、更安全的跨境支付解決方案,同時滿足監管要求。

- 大型企業資金管理:一家大型跨國企業通過 Codex 的 API 集成,實現了穩定幣在企業資金管理中的應用。該企業利用 Codex 的低費用和高吞吐量特性,優化了其全球資金流動和管理流程。

- 全球擴展:Codex 已在菲律賓開通機構級服務入口,並計劃在新加坡、英國、迪拜和香港等地區擴展業務。這些擴展計劃旨在進一步擴大其全球市場覆蓋,滿足不同地區企業的需求。

- 開發者社區建設:Codex 積極構建開發者社區,提供豐富的 API 和開發工具,吸引了大量開發者參與生態系統建設。通過舉辦黑客松和開發者大會,Codex 不斷推動技術創新和生態發展。

風險分析

技術風險

Codex Chain 作爲專爲穩定幣設計的區塊鏈,其模塊化多鏈架構雖然提供了高效性和可擴展性,但也增加了系統的復雜性。這種復雜性可能導致在高並發和復雜交易場景下的系統不穩定,增加了技術維護和升級的難度。

此外,盡管 Codex 在技術實現上採用了先進的架構和算法,但在實際應用中,仍可能存在未被發現的漏洞或技術問題。這些問題可能影響系統的穩定性和安全性,尤其是在處理大規模交易時。同時,區塊鏈技術發展迅速,Codex 需要不斷更新和優化其技術架構以保持競爭力。如果無法及時跟上技術發展的步伐,可能導致系統性能下降,影響用戶體驗和市場競爭力。

市場風險

穩定幣市場近年來發展迅速,競爭激烈。Codex 面臨來自其他穩定幣項目和區塊鏈平台的競爭,這些競爭對手可能在技術、市場覆蓋、用戶基礎等方面具有優勢。

例如,USDC 等項目在市場上已經擁有較高的接受度和廣泛的用戶基礎。

此外,市場需求的不確定性和變化可能導致 Codex 的市場表現受到影響。如果市場需求轉向其他類型的穩定幣或區塊鏈解決方案,Codex 可能需要調整其產品策略,以適應市場變化。盡管穩定幣的設計目標是保持價格穩定,但市場上的穩定幣價格仍可能受到宏觀經濟、政策變化等因素的影響而出現波動。這種波動可能影響用戶對穩定幣的信任和使用意願,進而影響 Codex 的市場表現。

監管風險

Codex 作爲穩定幣領域的創新項目,面臨着來自不同國家和地區的監管挑戰。美國證券交易委員會(SEC)對穩定幣的監管政策較爲嚴格,要求穩定幣發行人必須遵守一系列的合規要求,包括信息披露、反洗錢和反恐怖融資措施等。此外,歐盟的《加密資產市場監管法案》(MiCA)也對穩定幣發行人提出了嚴格的監管要求,涵蓋資本要求、治理安排、風險管理、信息披露、客戶保護、反洗錢和反恐怖融資等多個方面。

美國證券交易委員會(SEC)要求穩定幣發行人進行定期審計,以確保儲備資產的透明度和安全性,其中 SOC2 Type II 認證是一個重要的審計標準。該認證涉及對服務組織控制環境的全面評估,包括安全性、可用性、處理完整性、機密性和隱私等方面。獲得 SOC2 Type II 認證不僅能增強 Codex 的市場信任度,還能爲其業務擴展提供有力支持。目前,Codex 正在積極準備相關審計工作,以確保符合 SEC 的嚴格要求 。

此外,歐盟的《加密資產市場監管法案》(MiCA)對穩定幣發行人提出了嚴格的監管要求,包括資本要求、治理安排、風險管理、信息披露、客戶保護、反洗錢和反恐怖融資等。特別是對於非歐元支持的資產參考代幣,MiCA 規定了每日交易筆數不得超過 100 萬筆,交易總額不得超過 2 億歐元的限制。例如,2024 年 3 月 31 日起,幣安在歐盟 / 歐洲經濟區下架了多款未合規穩定幣,包括 Tether(USDT)、Dai(DAI)、Frax Protocol(FRAX)、Gemini Dollar(GUSD)、Pax Dollar(USDP)和 TrueUSD(TUSD)。這一案例提醒 Codex 必須嚴格遵守 MiCA 規定,以避免潛在的業務限制和法律風險 。

這些監管政策對 Codex 的影響主要體現在合規成本的增加和運營復雜性的提升。爲了適應這些政策,Codex 需要投入更多資源進行法律諮詢、審計和報告。同時,不同地區的監管政策差異可能導致 Codex 在全球擴展業務時面臨復雜的合規環境。如果未能及時適應新的監管政策,Codex 還可能面臨法律訴訟和罰款的風險。

未來展望

Codex 作爲穩定幣領域的創新項目,憑藉其專爲穩定幣設計的模塊化多鏈架構和強大的生態系統,展現出巨大的發展潛力。在未來的發展中,Codex 將繼續專注於技術創新和市場擴展,進一步鞏固其在穩定幣市場中的地位。

通過持續優化 Codex Chain 的性能和安全性,Codex 將能夠更好地滿足企業對高效、安全和合規穩定幣解決方案的需求。同時,Codex 將積極探索更多金融產品和服務,如穩定幣計息帳戶和保險服務,進一步完善其生態系統。

在全球市場擴展方面,Codex 計劃在新加坡、英國、迪拜和香港等地區開通服務入口,以滿足不同地區企業的需求。此外,Codex 還將加強與全球金融機構和金融科技公司的合作,構建一個更加開放和包容的穩定幣生態系統。

通過這些努力,Codex 有望在穩定幣市場中發揮更大的作用,爲全球企業和用戶提供了一個高效、安全且易於集成的穩定幣解決方案。

總結

Codex 作爲穩定幣領域的創新項目,憑藉其專爲穩定幣設計的模塊化多鏈架構和強大的生態系統,展現出巨大的發展潛力。通過 Codex Chain、Codex API、Codex FX 以及 Stargate 和 Conduit 等創新技術,Codex 構建了一個高效、安全且易於集成的穩定幣生態系統。其在性能、成本效益和合規性方面的競爭優勢,以及與東南亞支付平台、歐洲銀行等金融機構的合作,進一步增強了市場競爭力。盡管面臨技術、市場和監管等多方面的風險,如 SEC 和 MiCA 的嚴格監管政策,但通過持續的技術創新和積極的市場適應策略,Codex 有望有效應對這些挑戰。未來,Codex 將繼續專注於技術創新和市場擴展,進一步優化穩定幣解決方案,並探索更多金融產品和服務,爲全球企業提供高效、安全且易於集成的穩定幣解決方案。

相關文章

主流 U 卡類型

Yala的深入解釋:以$YU穩定幣為媒介打造模塊化DeFi收益聚合器

USDe是什麼?揭示USDe的多種賺錢方法