JsBigShark

The timing is perfectly aligned, as if I'm trading!😂

Here comes the needle!

View OriginalHere comes the needle!

- Reward

- 12

- 7

- Repost

- Share

TheReflectionOfColombia :

:

Good luck and prosperity 🧧View More

Latest aggressive entry points share! #CryptoMarketRebound

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- 1

- 7

- Repost

- Share

ReturnOnInvestmentDia :

:

The result of making three trades, one long position was completely closed again 😂View More

⚔️🐂🐻📈📉💰🔥🚀🧨🎯💎

"After the darkest night always comes the sunrise." This thought reminds us that any turbulence is just part of a larger cycle, and markets, like life, move in waves. Today, the crypto community's attention is focused on #ETHLongShortBattle, as the tension between bulls and bears around Ethereum increases. As of 17:55 on February 26, 2026, ETH is trading at $2031.72, and this level already appears to be symbolic in itself. The price is slightly above the psychological mark of $2000, where over $2 billion in short positions are concentrated. The market seems to be holdi

"After the darkest night always comes the sunrise." This thought reminds us that any turbulence is just part of a larger cycle, and markets, like life, move in waves. Today, the crypto community's attention is focused on #ETHLongShortBattle, as the tension between bulls and bears around Ethereum increases. As of 17:55 on February 26, 2026, ETH is trading at $2031.72, and this level already appears to be symbolic in itself. The price is slightly above the psychological mark of $2000, where over $2 billion in short positions are concentrated. The market seems to be holdi

ETH-4.6%

- Reward

- 12

- 12

- Repost

- Share

Pallada :

:

Hold tight 💪View More

The trolls are talking, didn't I say a few days ago that I was bullish to 2160? 1830 also indeed led you to go long, but I took some profits along the way, opened a short position, and was stopped out when the US called for a halt on tariffs and the market surged. I also said these days it would go down, although the post was deleted, those who saw it should know. Seeing you all actively cut losses, losing a few hundred USD really hurts. My entire assets are also in this, I don't joke with real money, but this trade indeed didn't have a stop loss. My mistake, I will set a stop loss in the futu

View Original

- Reward

- 3

- 10

- Repost

- Share

GateUser-256b4a8c :

:

Should I continue to be bearish or what? I have a manually entered short position with a cost basis of 1969. Should I close it?View More

- Reward

- 2

- 4

- Repost

- Share

Yuebei2026 :

:

How much is Machi爆View More

- Reward

- like

- 2

- Repost

- Share

**5427410** :

:

Happy New Year 🧨View More

#CircleQ4EarningsSurge22.4% – A Powerful Signal for the Stablecoin Economy

The latest quarterly results from Circle have sent a strong message across the digital asset industry: the stablecoin economy is not slowing down it’s accelerating. With Q4 earnings surging by an impressive 22.4%, Circle has once again proven that infrastructure-focused crypto companies are quietly building the financial backbone of the future.

While price volatility often dominates headlines in crypto markets, Circle’s performance highlights a different narrative sustainable revenue growth driven by real-world usage, i

The latest quarterly results from Circle have sent a strong message across the digital asset industry: the stablecoin economy is not slowing down it’s accelerating. With Q4 earnings surging by an impressive 22.4%, Circle has once again proven that infrastructure-focused crypto companies are quietly building the financial backbone of the future.

While price volatility often dominates headlines in crypto markets, Circle’s performance highlights a different narrative sustainable revenue growth driven by real-world usage, i

- Reward

- 4

- 6

- 1

- Share

Lock_433 :

:

To The Moon 🌕View More

This Ether was so hard yesterday and so soft today. My 2000U, I want to cry.

ETH-4.6%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 3

- Repost

- Share

GateUser-09ea5dd8 :

:

Bro, I lost 1200 USD yesterday.View More

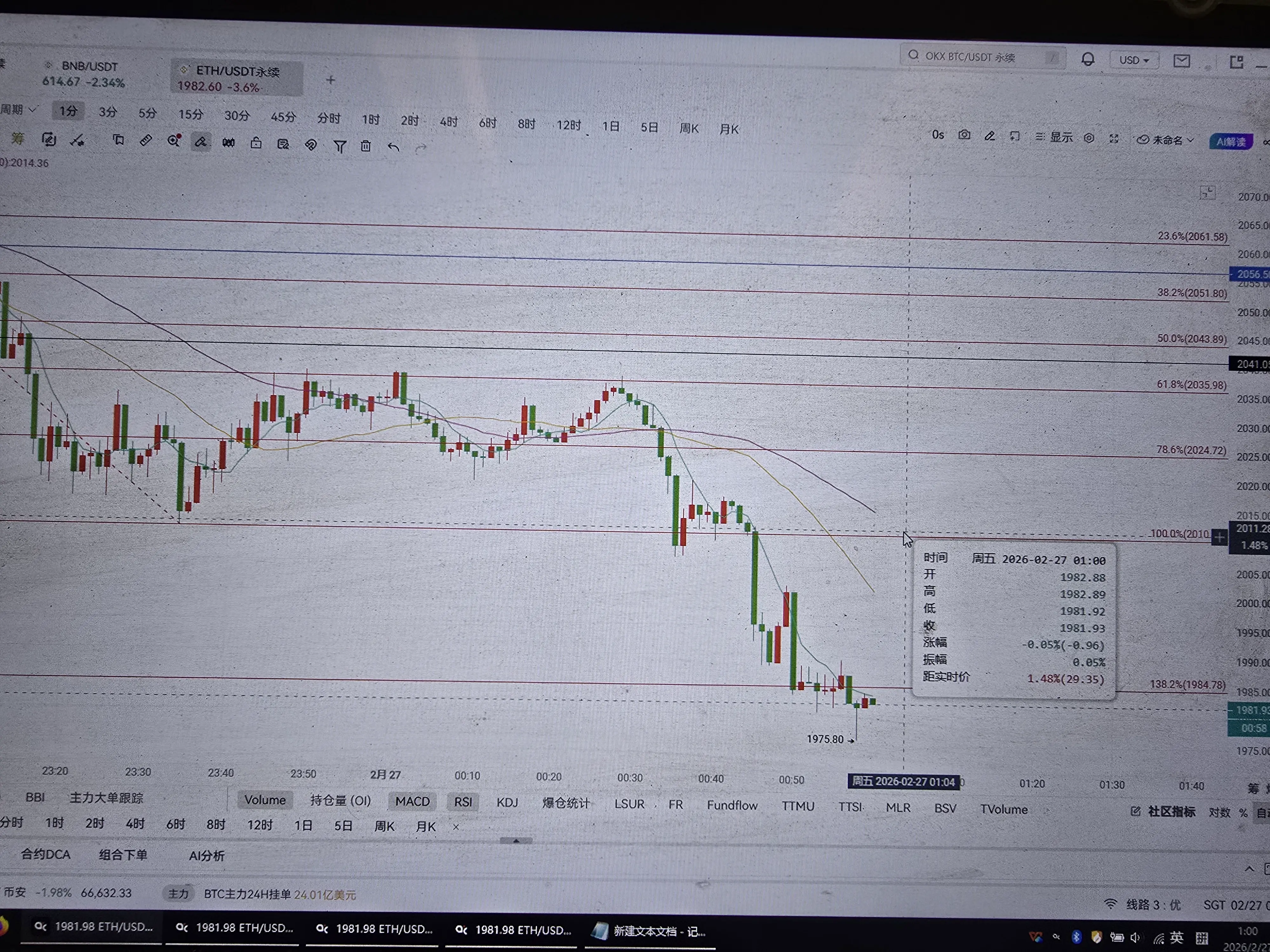

$ETH Night Strategy:

Take profit at 15-20 points, remember to reduce positions

ETH: Short at 2055, stop loss at 2085

Take profit: 2000 and 1985

ETH 1981, long at 1940, stop loss at 1910

Take profit: 2010 and 2025

BTC: Short at 68400-69900, stop loss at 70300

Take profit: 67600-66800

BTC: Long at 66400, stop loss at 65200

Take profit: 68700-69300

#深度创作营 $ETH

Take profit at 15-20 points, remember to reduce positions

ETH: Short at 2055, stop loss at 2085

Take profit: 2000 and 1985

ETH 1981, long at 1940, stop loss at 1910

Take profit: 2010 and 2025

BTC: Short at 68400-69900, stop loss at 70300

Take profit: 67600-66800

BTC: Long at 66400, stop loss at 65200

Take profit: 68700-69300

#深度创作营 $ETH

ETH-4.6%

- Reward

- 2

- 3

- Repost

- Share

PleaseCallMeGeneralJiang. :

:

Happy New Year 🧨View More

Wuwuwu, this Ethereum is making me hold the position again

Every time I go long to the top, go short to the bottom 😭

I've been trading contracts intermittently for so long, constantly adding money and never withdrawing 😂

It's too difficult. I'm not someone chosen by the heavens.

Every time I go long to the top, go short to the bottom 😭

I've been trading contracts intermittently for so long, constantly adding money and never withdrawing 😂

It's too difficult. I'm not someone chosen by the heavens.

ETH-4.6%

- Reward

- 1

- 7

- Repost

- Share

Uling :

:

Play with isolated margin; otherwise, you'll be wiped out after one hit. Always maintain your opening position ratio. After adding to your position, sell the added position when it rebounds.View More

#VitalikSellsETH $ETH

📉 #VitalikSatıyorETH — Is It Real or Perception, What Is It Telling?

News that "Vitalik is selling" generally triggers psychological reactions in the market because Vitalik's on-chain movements as the founder of Ethereum are often misinterpreted by many investors.

Let's be clear first: an ETH withdrawal from an address does not necessarily mean a sale. But the market often interprets this as unexpected selling pressure, affecting prices.

🧠 1. Signal + Context Separation

When there is ETH flow from Vitalik’s wallet, the market assumes three things:

1️⃣ Individual sale —

📉 #VitalikSatıyorETH — Is It Real or Perception, What Is It Telling?

News that "Vitalik is selling" generally triggers psychological reactions in the market because Vitalik's on-chain movements as the founder of Ethereum are often misinterpreted by many investors.

Let's be clear first: an ETH withdrawal from an address does not necessarily mean a sale. But the market often interprets this as unexpected selling pressure, affecting prices.

🧠 1. Signal + Context Separation

When there is ETH flow from Vitalik’s wallet, the market assumes three things:

1️⃣ Individual sale —

ETH-4.6%

- Reward

- 3

- 2

- Repost

- Share

Atilss :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 2

- Repost

- Share

海沧大桥 :

:

Bear trap,View More

- Reward

- 1

- 2

- Repost

- Share

GateUser-a12a504f :

:

Go short immediatelyView More

#CryptoRelatedStocksRallyBroadly 🌋 The "Why" Behind the Hype

If Stripe were to actually pull this off, the landscape wouldn't just change; it would be rewritten. Here is how that "Conquest" looks under the hood:

The Braintree Irony: Stripe acquiring Braintree (which PayPal bought in 2013) would be the ultimate full-circle moment. It would give Stripe access to massive enterprise legacy contracts that have traditionally been hard to flip.

The Venmo Factor: Stripe has always been "business-facing." Buying Venmo gives them a direct-to-consumer heartbeat. It turns Stripe from a "hidden" layer int

If Stripe were to actually pull this off, the landscape wouldn't just change; it would be rewritten. Here is how that "Conquest" looks under the hood:

The Braintree Irony: Stripe acquiring Braintree (which PayPal bought in 2013) would be the ultimate full-circle moment. It would give Stripe access to massive enterprise legacy contracts that have traditionally been hard to flip.

The Venmo Factor: Stripe has always been "business-facing." Buying Venmo gives them a direct-to-consumer heartbeat. It turns Stripe from a "hidden" layer int

- Reward

- 3

- 3

- Repost

- Share

Surrealist5N1K :

:

Thank you for the information and sharing 💜🌹✨View More

- Reward

- 5

- 2

- Repost

- Share

YangYangEarnsEarnEarnEarn :

:

Insider Bro, damn, that was a satisfying one-bite.View More

- Reward

- 1

- 2

- Repost

- Share

StewTheRedDustOme :

:

Ask the group members to go all-in in a game of poker.View More

- Reward

- like

- 2

- Repost

- Share

Mr.WarGod :

:

If it drops, it looks like zero; if it rises, it looks like one dollar.View More

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=XlNDU1sM

- Reward

- 2

- 4

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

It’s infuriating. As soon as I go offline, it hits my take-profit level. If I don’t go offline, it doesn’t drop!😠

View Original

- Reward

- 2

- 2

- Repost

- Share

Ajiokiao :

:

Then I'll leave work a bit later from now on~View More

Load More