Post content & earn content mining yield

placeholder

比特姐夫_连长

Ethereum Today Strategy Sharing:

The current market remains within a daily chart-level oscillating upward channel, with relatively weak momentum.

At the 4-hour and 1-hour levels, there are clear horizontal trading ranges with distinct support and resistance levels. Resistance is at 3170-3185, and support is at 3050-3070.

Entry Strategy:

Short positions: Observe for short entries above 3165, with a stop loss at 3189. First target at 3120, second target at 3080.

Long positions: Enter near the lower band at 3065, with a stop loss at 3041. First target at 3095, second target at 3120, third target

The current market remains within a daily chart-level oscillating upward channel, with relatively weak momentum.

At the 4-hour and 1-hour levels, there are clear horizontal trading ranges with distinct support and resistance levels. Resistance is at 3170-3185, and support is at 3050-3070.

Entry Strategy:

Short positions: Observe for short entries above 3165, with a stop loss at 3189. First target at 3120, second target at 3080.

Long positions: Enter near the lower band at 3065, with a stop loss at 3041. First target at 3095, second target at 3120, third target

ETH-0.94%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

Iseefreedom2020 :

:

Zeroing coin, blindfolded shortingView More

GAIA

GAIA

Created By@0x6050...1f73

Listing Progress

100.00%

MC:

$7.04K

Create My Token

In the past, the industry relied on token incentives to motivate users to learn complex tools, but Tria chooses to eliminate complexity through infrastructure. The emergence of @useTria is reshaping the growth logic of Web3.

Its account abstraction and cross-chain asset management capabilities allow an address to function like a cloud account across different ecosystems, which is crucial for DeFi, GameFi, and even AI applications.

$TRIA 's role in this system is not just simple asset transactions, but a core element supporting account services, network security, and ecosystem collaboration.

As

View OriginalIts account abstraction and cross-chain asset management capabilities allow an address to function like a cloud account across different ecosystems, which is crucial for DeFi, GameFi, and even AI applications.

$TRIA 's role in this system is not just simple asset transactions, but a core element supporting account services, network security, and ecosystem collaboration.

As

- Reward

- like

- Comment

- Repost

- Share

#BTCMarketAnalysis 🟡

Bitcoin is consolidating near 91,258 USDT, showing a balanced battle between buyers and sellers. Momentum is paused, making this zone critical for the next move.

📈 Key Levels:

Support: 91,111 USDT | Major: 90,000–89,500 USDT

Resistance: 91,544 USDT | Next: 92,800–93,500 USDT

Breakout targets: 95,000–98,000 USDT | 100,000+ USDT with volume

💡 Insights:

MACD flat, RSI neutral → resting, not exhausted

Declining volume → next surge defines direction

Fear & Greed: 26 → accumulation phase

Whale activity controlled → positioning, not panic

🔮 Scenarios:

🟢 Bullish: Break 91,544

Bitcoin is consolidating near 91,258 USDT, showing a balanced battle between buyers and sellers. Momentum is paused, making this zone critical for the next move.

📈 Key Levels:

Support: 91,111 USDT | Major: 90,000–89,500 USDT

Resistance: 91,544 USDT | Next: 92,800–93,500 USDT

Breakout targets: 95,000–98,000 USDT | 100,000+ USDT with volume

💡 Insights:

MACD flat, RSI neutral → resting, not exhausted

Declining volume → next surge defines direction

Fear & Greed: 26 → accumulation phase

Whale activity controlled → positioning, not panic

🔮 Scenarios:

🟢 Bullish: Break 91,544

MC:$4.32KHolders:64

3.88%

- Reward

- like

- Comment

- Repost

- Share

Grayscale expands its list of assets under consideration with 36 altcoins for Q1 2026 - - #cryptocurrency #bitcoin #altcoins

BTC0.05%

- Reward

- like

- Comment

- Repost

- Share

Gm my internet frens

- Reward

- like

- Comment

- Repost

- Share

🚨 HAWKISH SHIFT: NO RATE CUTS IN 2026?

The world’s biggest banks have changed their stance on interest rates. Getting cheap money is now going to be even harder.

√ JPMorgan: No rate cuts expected in 2026 anymore; instead, a 25bp rate hike is expected in Q3 2027.

√ Goldman & Barclays: Rate cuts have been pushed back to mid-2026 (June/September).

The labor market is still strong and inflation is declining slowly, so the Fed is in no hurry to cut rates.

The world’s biggest banks have changed their stance on interest rates. Getting cheap money is now going to be even harder.

√ JPMorgan: No rate cuts expected in 2026 anymore; instead, a 25bp rate hike is expected in Q3 2027.

√ Goldman & Barclays: Rate cuts have been pushed back to mid-2026 (June/September).

The labor market is still strong and inflation is declining slowly, so the Fed is in no hurry to cut rates.

- Reward

- like

- Comment

- Repost

- Share

January 13 BTC/ETH:

The current market liquidity is really poor. On Monday, the major A-shares' trading volume hit a record 3.64 trillion, with gold surpassing 4600. In contrast, the crypto market 📉 is not following the upward trend. The overall macro pattern is in the early stage of a bear market, with market makers frequently manipulating prices with upward and downward spikes to shake out traders. Institutions are also lying flat, leaving retail investors hoping for a bull return!

BTC

Currently, the moving averages are arranged in a head-and-shoulders pattern alongside a bullish engulfing

The current market liquidity is really poor. On Monday, the major A-shares' trading volume hit a record 3.64 trillion, with gold surpassing 4600. In contrast, the crypto market 📉 is not following the upward trend. The overall macro pattern is in the early stage of a bear market, with market makers frequently manipulating prices with upward and downward spikes to shake out traders. Institutions are also lying flat, leaving retail investors hoping for a bull return!

BTC

Currently, the moving averages are arranged in a head-and-shoulders pattern alongside a bullish engulfing

BTC0.05%

- Reward

- like

- Comment

- Repost

- Share

Some days you just want to stay in bed all day because living is expensive 😞.. who can relate?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

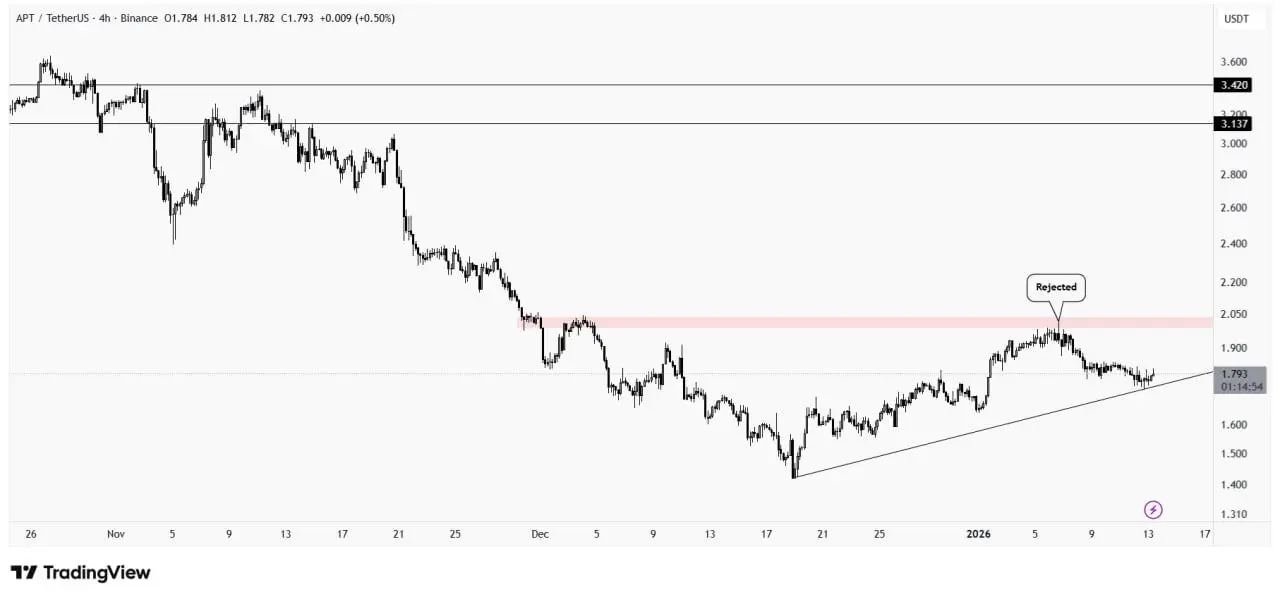

$APT rejected from resistance and now holding trendline support.

Market is waiting for confirmation.

Longs only make sense on a strong close above $2.00.

Patience before aggression.

#GateProofOfReservesReport #MyFavouriteChineseMemecoin

Market is waiting for confirmation.

Longs only make sense on a strong close above $2.00.

Patience before aggression.

#GateProofOfReservesReport #MyFavouriteChineseMemecoin

APT0.77%

- Reward

- like

- Comment

- Repost

- Share

CPI data will be released tonight at 9:30 PM

Lao Xiao personally on the scene to target the manipulative traders

Recruiting three small investors with over $5,000

Free guidance to trade futures together

Conservative plan with a profit of 3,000 points

Those who understand, understand; those who miss out, miss out

View OriginalLao Xiao personally on the scene to target the manipulative traders

Recruiting three small investors with over $5,000

Free guidance to trade futures together

Conservative plan with a profit of 3,000 points

Those who understand, understand; those who miss out, miss out

- Reward

- like

- Comment

- Repost

- Share

G

格局

Created By@It'sNotEasyToMakeMoney.

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- 1

- 1

- Repost

- Share

Engin1979 :

:

2026 GOGOGO 👊Next time you think of giving up, remember this photo of Elon in 2008.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- 5

- Repost

- Share

WonderfullOfBEAT :

:

Absolute victoryView More

$BTC USDT

Price is holding above key moving averages and grinding higher after defending the $90,1xx zone. Buyers are clearly stepping in on dips and momentum is slowly building. As long as $BTC stays above this base, upside pressure remains in play toward the recent highs. A clean push and follow-through could open the door for continuation, while a slip back below support would slow things down.

Let’s go and Trade now $

Price is holding above key moving averages and grinding higher after defending the $90,1xx zone. Buyers are clearly stepping in on dips and momentum is slowly building. As long as $BTC stays above this base, upside pressure remains in play toward the recent highs. A clean push and follow-through could open the door for continuation, while a slip back below support would slow things down.

Let’s go and Trade now $

BTC0.05%

- Reward

- like

- Comment

- Repost

- Share

Hold on! Take off! MalgeCoin has been featured on the homepage of gatefun!!!

View Original

MC:$73.87KHolders:34

100.00%

- Reward

- 3

- 1

- Repost

- Share

0xe03e...Bf0D :

:

Get in the car, get in the carLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More18.59K Popularity

24.03K Popularity

44.09K Popularity

16.52K Popularity

98.81K Popularity

News

View MoreGlobal banks shift to a cautious stance, Fed rate cut expectations reshape the 2026 market landscape

5 m

Venezuela Bitcoin seizure rumors heat up? The $60 billion figure sparks widespread speculation in the crypto market

8 m

SAFE (Safe) increased by 34.54% in the past 24 hours

16 m

Data: 5,155,900 EIGEN transferred from an anonymous address to Uniswap, worth approximately $2.1 million

20 m

Cryptocurrency concept stocks under the Fed turmoil spotlight: MSTR and Metaplanet become market focal points

20 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693