Search results for "BERT"

11:50

Is this the ultimate ALTBAG for the next bullrun? 👇

AI → $BERRY, $QF, $FET, $XMW, $MLMX, #TAOBOT, $NEURAL

Cult → $SIGMA, $BERT, $SKI, $TROLL, $WKC, $MASK

Memes → $AURA, $HOSICO, $MANYU, $UFD, $KORI

Strategies → $SSX, $SSR

RWAs → $CREDI, $BST, $AUTOS, $RIO, $PRO

What else belongs in this bag?

04:45

Best MEMEBAG for this bullrun 👇

Cults → $KENDU, $MASK, $SIGMA, $BERT, $SKI, $TROLL, $WKC

BONK → #USELESS, #BAOBAO, $BEST, $JAIL, $KORI, $STUPID

FART → #FARTBOY, #FARTCOIN, $UFD, #FARTLESS

Memes → $MANYU, $HOSICO, #CaptainBNB, $URANUS, $NPC

Strategies → $SSR, $SSX

Locked, loaded, and ready to send.

06:20

Is this the ultimate ALTBAG for the next bullrun? 👇

AI → $BERRY, $QF, $FET, $XMW, $MLMX, #TAOBOT, $NEURAL

Cult → $SIGMA, $BERT, $SKI, $TROLL, $WKC, $MASK

Memes → $AURA, $HOSICO, $MANYU, $UFD, $KORI

Strategies → $SSX, $SSR

RWAs → $CREDI, $BST, $AUTOS, $RIO, $PRO

What else belongs in this bag?

05:11

Best MEMEBAG for this bullrun 👇

Cults → $KENDU, $MASK, $SIGMA, $BERT, $SKI, $TROLL, $WKC

BONK → #USELESS, #BAOBAO, $BEST, $JAIL, $KORI, $STUPID

FART → #FARTBOY, #FARTCOIN, $UFD, #FARTLESS

Memes → $MANYU, $HOSICO, #CaptainBNB, $URANUS, $NPC

Strategies → $SSR, $SSX

Locked, loaded, and ready to send.

11:58

Best MEMEBAG for this bullrun 👇

Cults → $KENDU, $MASK, $SIGMA, $BERT, $SKI, $TROLL, $WKC

BONK → #USELESS, #BAOBAO, $BEST, $JAIL, $KORI, $STUPID

FART → #FARTBOY, #FARTCOIN, $UFD, #FARTLESS

Memes → $MANYU, $HOSICO, #CaptainBNB, $URANUS, $NPC

Strategies → $SSR, $SSX

Locked, loaded, and ready to send.

- 2

04:34

BERT Price Prediction: Is Bertram The Pomeranian the Best Meme Coin to Buy in September?

Low-cap meme coins continue to defy broader market bearishness, making them appealing investments in September, even as macroeconomic headwinds drive heavy selling pressure on large-cap assets.

Bertram The Pomeranian (BERT) surged by more than 250% in August. Despite a near 30% pullback to start th

08:54

What Is a Token Economic Model and How Does It Balance Team/Investor/Community Distribution?

Token distribution: 20% team, 30% investors, 50% community

BERT token distribution follows a strategic allocation model with 20% dedicated to the team, 30% to investors, and 50% to the community. This balanced approach creates an optimal framework for project sustainability and decentralization.

08:46

How Do BERT Models Help Detect Compliance and Regulatory Risks in Crypto?

BERT enhances regulatory compliance detection by 57% in audit reports

Recent research has demonstrated the significant impact of BERT (Bidirectional Encoder Representations from Transformers) models in revolutionizing regulatory compliance detection within audit reports. The implementation of

02:04

BERT Price Eyes $0.063–$0.077 Range As Charts Highlight Gradual Recovery

BERT is currently trading within defined horizontal levels, showcasing gradual recovery and consolidation after upward movements. Traders are focused on identified resistance zones, guiding short-term momentum, despite recent minor price declines.

BERT-14.4%

19:34

Why Bertram the Pomeranian and Layer Brett Are Trending in August, but Still No Joy for Dogecoin

The meme coin market is full of surprises, and August has delivered two new names everyone is talking about: Bertram the Pomeranian (BERT) and Layer Brett ($LBRETT). Both are generating huge buzz for very different reasons. Meanwhile, Dogecoin (DOGE) — the original meme coin — is struggling to

12:34

Best Meme Coin to Buy in 2025 for a Shiba Inu-Style Rally: MANYU, BERT, PENGU or LBRETT?

Every crypto investor is on the hunt for the holy grail: the next best meme coin to buy, a token that could even begin to approach the legendary, face-melting rally of SHIB. As money pours into the market searching for that next 100x rocket, a handful of contenders are making noise. We’re seeing pro

08:09

How Active is Bertram The Pomeranian (BERT) Community with 50+ Trading Markets and 157% Growth in 30 Days?

BERT's social media following surges with 157% growth in 30 days

Bertram The Pomeranian (BERT) has experienced a remarkable surge in social media popularity, mirroring its impressive market performance over the past month. Recent data reveals BERT's social following has expanded by an

08:49

What Is Bertram The Pomeranian (BERT) and How Does Its Tokenomics Support Its Roadmap?

Bertram The Pomeranian: A Meme Token on Solana with 979.9M Total Supply

Bertram The Pomeranian emerged as a distinctive meme token on the Solana blockchain in 2024, capturing market attention with its cute canine mascot. The token operates with a capped supply structure of 979.9 million BERT token

BERT-14.4%

08:52

What Is the Current Crypto Market Overview: Top Rankings, Supply, and Trading Volume in 2025?

Bertram The Pomeranian (BERT) ranks 421st with $83.45M market cap

Bertram The Pomeranian has established itself as a notable contender in the cryptocurrency market, currently holding position 419 in the global rankings with a market capitalization of approximately $83.45 million. This

IN-26.19%

08:54

Why Is Bertram The Pomeranian (BERT) Price Up 90% in the Last 30 Days?

BERT price surges 90% in 30 days, reaching $0.084

Bertram The Pomeranian (BERT) has demonstrated remarkable market performance over the past month, with its value increasing by an impressive 90% to reach $0.084. This significant growth positions BERT as one of the standout performers in the

02:22

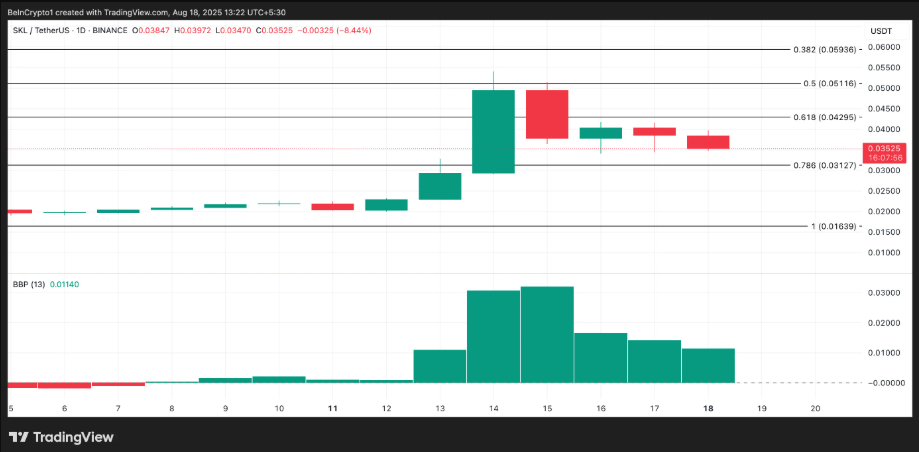

This week's three "Made in America" tokens that are surging against the trend! Comprehensive technical analysis of SKL, VVV, and BERT.

The global market capitalization of Crypto Assets has recently plunged sharply, and market trading activities have cooled down. However, amidst this slump, three US-made Tokens have strengthened against the trend, attracting investors' attention. SKL, VVV, and BERT recorded gains of 50%, 40%, and 37% respectively over the past week, with technical signals indicating that there is still room for upward movement in the short term.

###SKL: After a 50% pump, still has upward potential

Current price: approximately 0.034 USD

Price Increase: Over 50% increase in the last 7 days

Technical Analysis: Elder-Ray Indicator since August

07:49

This is the best MEMEBAG to hold for the current bullrun 👇

cults :- $KENDU, $MASK, $SIGMA, $BERT, $SKI, $TROLL, $MOMO

BONK :- #USELESS, #BAOBAO, $BEST, $JAIL, $KORI

FART - #FARTBOY, #FARTCOIN, $UFD, #FARTLESS

memes: $MANYU, $HOSICO, #CaptainBNB, #BOATKID, $URANUS

what el

- 1

19:06

My $Bert bags are performing very nicely.

The Bert community proves that even with all the noise and hyper rotational culture on SOL, proven communities will thrive in the end.

Very impressed.

The fact that I don't see too many KOLs bullposting this (yet), is also very bullish imo.

Much higher.

Woof woof

@bertcoincto

08:23

Analysts Top 3 Choices to Echo SHIB’s 40,000% 2021 Rally in Today’s Bull Market Environment

In 2021, Shiba Inu (SHIB) delivered a jaw-dropping 40,000% rally, setting the benchmark for meme coin success. Now, analysts have their eyes on TROLL, BERT, and MIGGLES as top picks to potentially mirror that explosive run in today’s bull market environment. Each project blends meme appeal with

09:10

What Is a Token Economic Model and How Does It Govern Crypto Distribution?

Token distribution: Team, investors, and community allocations

The allocation of BERT tokens follows a carefully structured distribution model that balances the interests of key stakeholders while ensuring sustainable project development. Based on industry standards, BERT distributes tokens

TOKEN-3.73%

08:54

What Is Bertram The Pomeranian (BERT): How Does This Solana Meme Token's Fundamentals Support Its 101% Monthly Growth?

Bertram The Pomeranian: A Solana-based meme token with 101% monthly growth

Bertram The Pomeranian (BERT) has emerged as a significant player in the Solana ecosystem, demonstrating remarkable performance with a 101.04% price increase over the past month. Currently trading at $0.0439 USD, BERT

08:58

What is the Current Crypto Market Overview: Rankings, Supply, Volume, and Liquidity in July 2025?

BERT token ranks 655th with $38M market cap

Bertram The Pomeranian (BERT) currently holds the 655th position in the cryptocurrency market capitalization rankings with a valuation of approximately $38 million. This Solana-based token, launched in September 2024, has demonstrated significant market

BERT-14.4%

08:45

How Do Federal Reserve Policies and Inflation Data Affect Cryptocurrency Market Performance?

Federal Reserve's hawkish stance drives 2.55% daily increase in BERT token price

The recent Federal Reserve's hawkish stance has catalyzed significant movement in the cryptocurrency market, with BERT token experiencing a notable 2.55% daily price increase. This upward momentum reflects

BERT-14.4%

03:09

Why Sentiment Analysis Matters in Fundamental Analysis And the Tools You Need

When most people think of fundamental analysis, they picture earnings reports, profit margins, and macroeconomic data. While these are essential, there’s one often-overlooked component that can make or break your investment decisions: market sentiment.

In today’s hyper-connected world, how people feel about an asset can matter just as much as its intrinsic value. Understanding sentiment is like having an emotional barometer for the market — and ignoring it can leave you blind to major opportunities or looming risks.

What Is Sentiment in Fundamental Analysis?

Sentiment refers to the general mood or attitude investors have toward a particular asset, market, or sector. It’s often driven by:

• News headlines

• Social media trends

• Influencer opinions

• Market rumors

• Economic and geopolitical developments

Even if a company’s fundamentals are strong, negative sentiment can tank its stock, just as hype and positive sentiment can send a weak project soaring temporarily.

So, why does this matter in fundamental analysis?

Because fundamental analysis isn’t just about the “what”, it’s also about the why and when.

Why Sentiment Matters in Fundamental Analysis

Here are a few reasons why you should care about sentiment:

1. Sentiment Can Explain Market Overreactions

Markets aren’t always rational. Fear, hype, and FOMO (fear of missing out) can lead to price moves that defy fundamentals. Understanding sentiment helps you recognize when prices are being driven by emotion rather than data.

2. It Helps Time Entries and Exits

Strong fundamentals might tell you that a stock or token is undervalued, but bad timing can still lead to losses. Monitoring sentiment allows you to avoid jumping in during a pessimistic downtrend or exiting too early in a bullish wave.

3. Better Risk Management

If sentiment turns bearish around a fundamentally strong asset due to bad PR or macro news, you can prepare to hedge your position, rebalance, or simply wait out the storm.

4. It Complements the Full Picture

Fundamental analysis tells you what the asset is worth. Sentiment analysis tells you what the market thinks it’s worth right now. When you combine both, your decisions become more strategic and less reactive.

Tools You Can Use for Sentiment Analysis

Now that you understand the “why”, let’s look at the “how.” Several tools can help you gauge market sentiment effectively:

1. Twitter (X) Sentiment Trackers

Platforms like:

• LunarCrush – Analyzes crypto-specific social media engagement and sentiment.

• Santiment – Provides on-chain data and social sentiment analytics.

• CryptoMood – Tracks news, social media, and Reddit to provide a sentiment score.

For stocks:

• StockTwits – Community-driven sentiment platform focused on stocks and crypto.

• MarketPsych – Offers sentiment data powered by AI, scraping thousands of news and social media sources.

2. Reddit and Discord Monitoring

Tools like:

• GummySearch or BrandMentions can track Reddit discussions.

• Discord Analyzer bots (for crypto) can show what communities are buzzing about.

3. News Sentiment Platforms

• Finviz – Offers a heatmap of sentiment based on headlines.

• Bloomberg Terminal – For professionals, with AI-driven sentiment tracking.

• TradingView News & Analysis – Aggregates market sentiment and user-generated ideas.

4. Alternative Data Tools

These go beyond just tweets and headlines:

• The Tie – Offers institutional-grade crypto sentiment data.

• Quiver Quant – Uses alternative data like political sentiment, corporate lobbying, etc.

• Google Trends – Free and useful to see search interest spikes in specific assets or topics.

5. AI Tools & NLP Models

If you want to go deep, tools like:

• ChatGPT + news summarization prompts

• Hugging Face transformers (e.g., BERT sentiment models)

Can be used to create custom sentiment analysis pipelines if you have some coding skills.

Final Thoughts: Combine Logic with Emotion

Sentiment is not about abandoning logic — it’s about balancing logic with real-world market behavior. In volatile markets like crypto, or during earnings season in traditional finance, understanding sentiment can be the difference between catching a wave or getting crushed by it.

So next time you open a company’s income statement or research a crypto whitepaper, don’t forget to ask:

“How do people feel about this right now?”

Because sometimes, perception really is reality at least in the short term.

TL;DR:

• Sentiment helps explain irrational market movements.

• It’s a powerful complement to traditional financial analysis.

• Use tools like LunarCrush, The Tie, StockTwits, Reddit analyzers, and even Google Trends to stay ahead.

In investing, numbers tell a story but emotions write the headlines.

- 1

01:13

The U.S. Department of Homeland Security announced on the 22nd that it has canceled Harvard University's eligibility for the Student and Exchange Visitor Program, prohibiting the school from enrolling international students, which has sparked public controversy. Reports indicate that Princess Elisabeth, the first in line to the Belgian throne, may be unable to continue her studies due to the aforementioned U.S. government policy. The 23-year-old future queen of Belgium has just completed her first year at Harvard University. "Princess Elisabeth has just finished her first year at Harvard, and the impact of the new U.S. regulations will gradually become clear in the coming days or weeks; we are investigating the situation," confirmed the spokesperson for the Belgian royal family, Vanderhoeven. Bert, the communications director for the Belgian royal family, added: "We are currently assessing the issue and will resolve it. Many things may happen in the coming days and weeks." As the eldest daughter of King Philippe and Queen Mathilde of Belgium, Princess Elisabeth will become the first queen in the country's history.

03:38

90% Rug Risk? Here Are 5 Best Meme Coins With Better Survival Rates

Meme coins like $DROP, $PHNIX, $ARMY, $BERT, and $SIGMA show resilience in volatile markets through community governance, utility, and innovative strategies, making them stand out among the market's high-risk tokens. Their stability is attributed to strong community engagement, practical use cases, and unique governance structures, setting them apart from the majority susceptible to market fluctuations. These tokens offer valuable insights for navigating the risky meme coin landscape.

MEME-6.62%

19:48

GenLayer promotes the AI smart court system into the encryption field.

The GenLayer project aims to build a decision-making system based on Blockchain, leveraging multiple AIs to coordinate and reach consensus on subjective decisions, similar to a court system. The protocol offers a network of 1,000 validators through the ZKsync chain, with each validator connected to a large language model (LLM) such as ChatGPT, Bert, or Llama. When contentious decisions arise in prediction markets like Polymarket, users can initiate a transaction to GenLayer's virtual court system for appeals. The system employs the Condorcet majority theorem, significantly increasing the probability of correct decisions as the number of participants grows. Additionally, validators must make decisions within 100 seconds, and each appeal extends the time by 30 minutes. This allows significant issues to be resolved in a very short time, without the lengthy real-world legal litigation process. GenLayer utilizes each validator.

- 1

10:38

The elastic economy supports eurozone inflation.

Jin10 data reported on May 2, economists at ING, Bert Colijn, stated that inflation in the Eurozone is unlikely to fall significantly in the future because the underlying resilience of the economy offsets the dampening effects of trade tariffs. Data released on Friday showed that prices in the Eurozone rose 2.2% year-on-year in April, remaining stable compared to the previous month. Colijn said that trade turmoil and the ensuing drop in energy prices have brought the inflation rate close to the European Central Bank's target of 2%. However, investors should not expect inflation to decline significantly in the coming months. He remarked, "Even if the trade war initially suppressed inflationary pressures, a robust Eurozone economy with a strong labor market and high wage growth is likely to keep inflation elevated to some extent in the coming months."

BERT-14.4%

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreProject Updates

Foresight News reports that Theta Network announced via Twitter that the mobile version of Theta Edge Node for Android devices is scheduled to be launched on September 25, featuring a video object detection AI model (VOD_AI) that can run on consumer-grade Android mobile devices.

2025-09-25

Token unlock

Venom (VENOM) will unlock 59.26 million Tokens on September 25 at 16:00, worth approximately 8.49 million USD, accounting for 2.28% of the Circulating Supply.

2025-09-25

Upcoming Activities

The AMA "How AI and RWA Build the Next Trillion-Dollar crypto market" hosted by ULTILAND will take place on September 25th from 19:00 to 19:45. Guests include ULTILAND Market Head Ryan, The StarAI Market Head Joseph, Cosmic Cipher Chief Marketing Officer Michael Yumin Gehles, Notes SocialFi Chief Marketing Officer Gregory, and PredicXion Chief Strategy Officer Patrick.

2025-09-25

Seoul Meetup

Delysium will host a meetup in Seoul on September 26th during Korea Blockchain Week on September 26th.

2025-09-25

When Pixels Learned to Samba in New York

SuperRare, in collaboration with Rio Art Residency, will present the exhibition When Pixels Learned to Samba on September 26 in New York. The event will feature 13 digital artists who reinterpret Brazil’s vibrant cultural landscape through their works, including Abeguar, Alienqueen, Dave Krugman, and others. The exhibition explores how digital art intersects with traditional Brazilian cultural motifs.

2025-09-25