What is SUSD: Understanding the Stablecoin's Role in Decentralized Finance

sUSD's Positioning and Significance

In 2018, the Havven Foundation launched sUSD (SUSD), aiming to address the need for a stable cryptocurrency within the Synthetix ecosystem. As a decentralized stablecoin, sUSD plays a crucial role in the DeFi sector, particularly within the Synthetix protocol.

As of 2025, sUSD has become an integral part of the Synthetix ecosystem, with a market cap of $47,253,214 and a circulating supply of 48,276,680 tokens. This article will delve into its technical architecture, market performance, and future potential.

Origins and Development History

Birth Background

sUSD, originally known as nUSD, was created by the Havven Foundation in 2018 to provide a stable unit of account within the Synthetix ecosystem. It emerged during the rise of decentralized finance (DeFi), aiming to offer a stable cryptocurrency that could facilitate trading and borrowing on the Synthetix platform.

The launch of sUSD brought new possibilities for traders and liquidity providers in the Synthetix ecosystem, enabling more efficient and stable transactions.

Important Milestones

- 2018: sUSD (then nUSD) launched as part of the Synthetix protocol.

- 2020: Reached its all-time high price of $2.45 on February 18.

- 2020: Experienced its all-time low of $0.429697 on March 18, demonstrating resilience during market volatility.

With support from the Synthetix community and ongoing development, sUSD continues to improve its stability and utility within the DeFi ecosystem.

How Does sUSD Work?

Decentralized Control

sUSD operates on the Ethereum blockchain, leveraging its decentralized network of nodes. This structure eliminates the need for central bank or government control, providing users with greater autonomy and enhancing network resilience.

Blockchain Core

sUSD utilizes Ethereum's blockchain, a public, immutable digital ledger that records every transaction. Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain. Anyone can view the records, establishing trust without intermediaries.

Ensuring Fairness

As an ERC-20 token on the Ethereum network, sUSD benefits from Ethereum's consensus mechanism. The stability of sUSD is maintained through the Synthetix protocol's mechanisms and the foundation's market interventions when necessary.

Secure Transactions

sUSD employs public-private key encryption technology to secure transactions:

- Private keys (similar to secret passwords) are used to sign transactions

- Public keys (similar to account numbers) are used to verify ownership

This mechanism ensures fund security while maintaining pseudonymity for transactions. Additionally, sUSD's value is pegged to the US dollar, providing stability in the volatile cryptocurrency market.

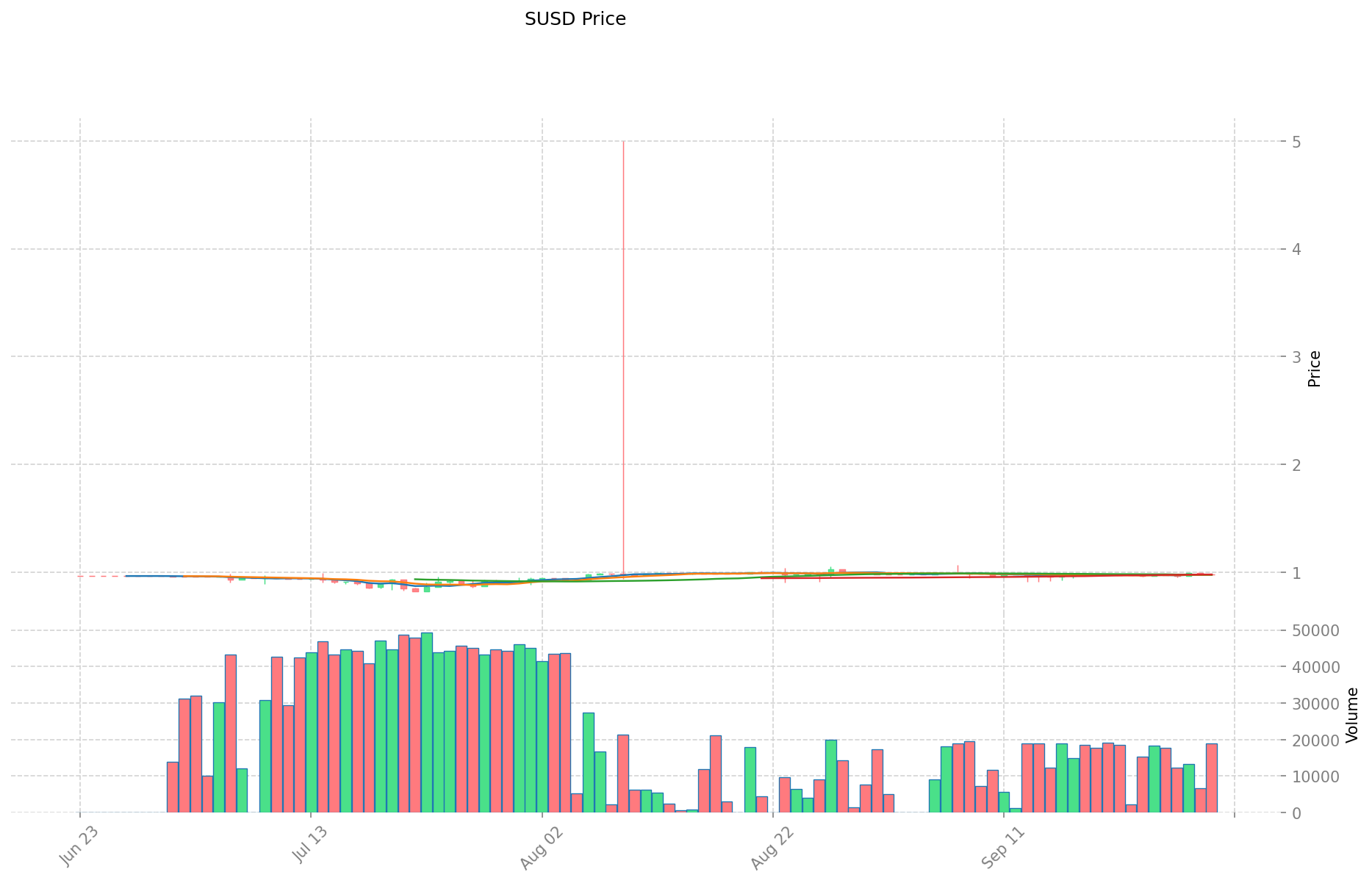

SUSD Market Performance

Circulation Overview

As of September 30, 2025, SUSD's circulating supply is 48,276,680.23772181 coins, which is equal to its total supply.

Price Fluctuations

SUSD reached its all-time high of $2.45 on February 18, 2020. Its lowest price was $0.429697, occurring on March 18, 2020. These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current market price of SUSD

On-Chain Metrics

- Daily Transaction Volume: $17,974.254778 (indicates network activity)

- Active Addresses: 14,309 (reflects user engagement)

sUSD Ecosystem Applications and Partnerships

Core Use Cases

sUSD's ecosystem supports various applications:

- DeFi: Synthetix, providing synthetic asset trading.

- Stablecoin: sUSD serves as a USD-pegged stablecoin in the Synthetix ecosystem.

Strategic Collaborations

sUSD has established partnerships with Ethereum and Optimism networks, enhancing its technological capabilities and market influence. These partnerships provide a solid foundation for sUSD's ecosystem expansion.

Controversies and Challenges

sUSD faces the following challenges:

- Technical Issues: Scalability and transaction speed on Ethereum

- Regulatory Risks: Potential stablecoin regulations

- Competitive Pressure: Other stablecoins like USDC and USDT

These issues have sparked discussions within the community and market, driving continuous innovation for sUSD.

sUSD Community and Social Media Atmosphere

Fan Enthusiasm

sUSD's community shows moderate activity, with 48,276,680 tokens in circulation. On X platform, posts and hashtags related to sUSD occasionally gain traction. Price stability and integration with Synthetix fuel community interest.

Social Media Sentiment

Sentiment on X presents a mixed picture:

- Supporters praise sUSD's stability and integration with Synthetix, viewing it as a "reliable DeFi stablecoin".

- Critics focus on limited adoption outside the Synthetix ecosystem.

Recent trends show cautious optimism amidst broader crypto market conditions.

Hot Topics

X users discuss sUSD's role in DeFi, stablecoin regulations, and integration with other protocols, highlighting both its potential and challenges in mainstream adoption.

More Information Sources for sUSD

- Official Website: Visit sUSD official website for features, use cases, and latest updates.

- Whitepaper: Synthetix Litepaper details its technical architecture, goals, and vision.

- X Updates: On X platform, sUSD updates are shared through @synthetix_io, with 368.7K followers as of September 30, 2025, Posts cover protocol upgrades, community events, and integration news, generating significant engagement.

sUSD Future Roadmap

- Ongoing: Enhance integration with layer 2 solutions to improve scalability and reduce transaction costs

- Ecosystem Goals: Expand adoption across various DeFi protocols

- Long-term Vision: Become a leading decentralized stablecoin in the DeFi ecosystem

How to Participate in sUSD?

- Purchase Channels: Buy sUSD on Gate.com

- Storage Solutions: Use Web3 wallets compatible with Ethereum for secure storage

- Participate in Governance: Through Synthetix governance platform

- Build Ecosystem: Visit Synthetix developer docs to integrate or develop with sUSD

Summary

sUSD redefines stablecoins through blockchain technology, offering stability, transparency, and DeFi integration. Its active community, rich resources, and strong market performance make it stand out in the cryptocurrency field. Despite facing regulatory uncertainties and adoption challenges, sUSD's innovative spirit and clear roadmap secure its important position in the future of decentralized finance. Whether you're a newcomer or an experienced player, sUSD is worth watching and participating in.

FAQ

How does sUSD work?

sUSD is a synthetic stablecoin pegged 1:1 to USD, using algorithmic backing to maintain value. It's issued and redeemed based on collateral, ensuring stability without direct fiat reserves.

Is sUSD safe?

sUSD is designed with robust security measures and is backed by collateral, making it generally considered safe. However, like all cryptocurrencies, it carries inherent risks.

What does the acronym sUSD stand for?

sUSD stands for Synthetic USD, a stablecoin pegged to the US dollar in the Synthetix ecosystem.

How much is sUSD?

As of 2025-09-30, sUSD is worth $0.9946, showing a slight decline from the previous hour but a minor increase over the last day.

What is ENA: A Comprehensive Guide to the European Nucleotide Archive

What is USDE: Understanding the United States Department of Education and Its Role in American Education

What is USDP: Understanding the Stablecoin Backed by US Dollar Deposits

USDe Explained: How Ethena's Stablecoin Stays Pegged Without Fiat

What Is ENA and How Does It Support the $1.3 Billion USDe Ecosystem?

What is SLICE: A Comprehensive Guide to the Software Development Lifecycle Enhancement Method

What is VIRTUAL Token's Current Market Cap, Price, and Trading Volume in 2025?

How Does Fed Policy and Inflation Data Impact Cryptocurrency Prices in 2025?

What are the compliance and regulatory risks of PEPE crypto in 2025?

What Are Technical Indicators: How to Use MACD, RSI, and Moving Averages for Crypto Trading in 2025

What is AIOT Price Volatility: Historical Trends, Support and Resistance Levels in 2025?