Is Power Protocol (POWER) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Outlook for 2024

Introduction: Power Protocol (POWER) Investment Position and Market Prospects

Power Protocol (POWER) has emerged as a significant asset in the crypto ecosystem. As of December 18, 2025, the token maintains a market capitalization of $76,356,000 with a circulating supply of 210 million tokens out of a total supply of 1 billion. The current price stands at $0.3636, reflecting recent market dynamics.

Power Protocol functions as an incentive layer that connects mainstream applications to Web3 by converting user behavior and application revenue into on-chain rewards. Launched alongside Fableborne—one of the first Web3-enabled mobile games to achieve mass-market metrics—the protocol has garnered support from prominent gaming and Web3 leaders including Delphi, Spartan, Mechanism, and Sky Mavis. This positions POWER as an innovative solution bridging Web2 and Web3 environments.

The token has demonstrated notable price movement, with a 24-hour increase of 43.49% and a 7-day surge of 74.54%, reflecting growing market interest. However, the asset currently ranks 401st by market capitalization with a market dominance of 0.011%, indicating it remains a mid-tier cryptocurrency by market presence.

As market participants increasingly evaluate whether Power Protocol (POWER) represents a sound investment opportunity, this analysis provides a comprehensive examination of the token's investment value, historical price trends, price forecasts, and associated risks to inform decision-making.

Power Protocol (POWER) Cryptocurrency Asset Research Report

I. POWER Price History Review and Current Investment Value Assessment

POWER Historical Price Performance and Investment Returns

Based on available data as of December 18, 2025:

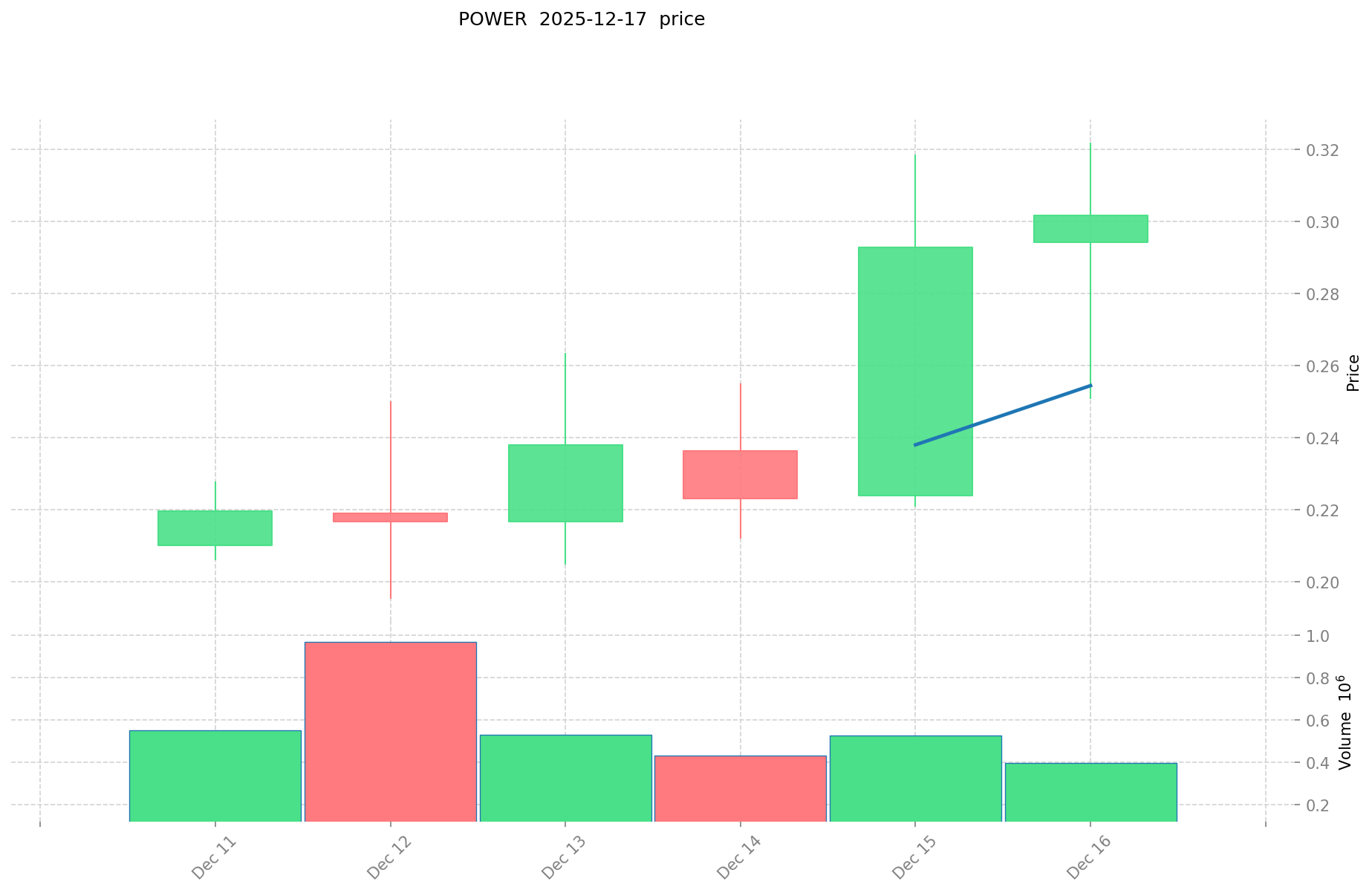

- December 12, 2025: All-time low recorded at $0.1953

- December 17, 2025: All-time high achieved at $0.4595

- December 18, 2025: Current trading price at $0.3636

The token demonstrates significant volatility within a short timeframe, with a maximum upside of 135.1% from the December low to the December high.

Short-Term Price Movement Analysis (as of December 18, 2025)

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | -0.84% | -$0.0031 |

| 24 Hours | +43.49% | +$0.1102 |

| 7 Days | +74.54% | +$0.1553 |

| 30 Days | +355.013% | +$0.2837 |

| 1 Year | +355.013% | +$0.2837 |

Current POWER Market Status (December 2025)

- Current Price: $0.3636 USD

- Market Capitalization: $76,356,000 USD

- Fully Diluted Valuation (FDV): $363,600,000 USD

- 24-Hour Trading Volume: $359,452.49 USD

- Market Dominance: 0.011%

- All-Time High: $0.4595 (December 17, 2025)

- All-Time Low: $0.1953 (December 12, 2025)

- Current Market Sentiment: 2/10 (Indicating fear or bearish sentiment)

Token Supply Metrics

- Circulating Supply: 210,000,000 POWER

- Total Supply: 1,000,000,000 POWER

- Max Supply: 1,000,000,000 POWER

- Circulation Ratio: 21.0%

- Total Token Holders: 243

For real-time POWER pricing and market data, visit Gate POWER Market

II. Project Overview and Technical Foundation

Project Description

Power Protocol is an incentive layer that connects mainstream applications to Web3 by converting user behavior and application revenue into on-chain rewards. The protocol launched alongside Fableborne, described as one of the first Web3-enabled mobile titles to achieve mass-market metrics, and received backing from prominent gaming and Web3 industry leaders including Delphi, Spartan, Mechanism, and Sky Mavis.

The protocol transforms user engagement into real economic value, providing millions of Web2 users their first meaningful on-chain experience through games, consumer applications, and creator platforms.

Technical Specifications

- Blockchain: Ethereum (ETH)

- Token Standard: ERC-20

- Contract Address: 0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223

- Supported Exchanges: 12 trading pairs available

III. Market Position and Competitive Landscape

Market Ranking and Status

- Market Rank: #401 by market capitalization

- Market Cap Ratio to FDV: 21%

- Total Market Capitalization: $363,600,000 USD

IV. Project Resources and Community Engagement

Official Channels and Information

| Resource Type | Links |

|---|---|

| Official Website | https://powerprotocol.xyz/en |

| Whitepaper | https://power-protocol.gitbook.io/power-protocol-whitepaper |

| https://x.com/PowerPrtcl, https://x.com/fableborne | |

| Discord Community | https://discord.gg/fableborne |

| Block Explorer | https://etherscan.io/token/0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223 |

V. Risk Disclosure

This report provides factual market data and project information as of December 18, 2025. The cryptocurrency market exhibits high volatility and carries substantial investment risk. Price movements shown in this report (including the 355% surge over 30 days) reflect extreme market conditions. Investors should conduct independent research and consider their risk tolerance before making investment decisions.

Power Protocol (POWER) Investment Analysis Report

Report Date: December 18, 2025

Current Price: $0.3636

Market Cap: $76,356,000

Ranking: #401

I. Executive Summary

Power Protocol (POWER) is an incentive layer that connects mainstream applications to Web3 by converting user behavior and app revenue into on-chain rewards. Launched alongside Fableborne—a Web3-enabled mobile game achieving mass-market metrics—the protocol has garnered backing from prominent industry players including Delphi, Spartan, Mechanism, and Sky Mavis. The token operates as a multi-chain utility asset on Ethereum, BSC, and Ronin blockchains, facilitating AI-driven user incentives and supporting gaming and application infrastructure.

II. Key Factors Influencing Investment Potential

Supply Mechanism and Scarcity

Token Supply Structure:

- Circulating Supply: 210,000,000 POWER (21% of total supply)

- Total Supply: 1,000,000,000 POWER

- Max Supply: 1,000,000,000 POWER

The token maintains a controlled supply distribution with 79% of the total supply not yet in circulation. This gradual release mechanism affects price discovery and investor returns. The currently circulating 210 million tokens represent a modest portion of the eventual maximum supply, indicating ongoing dilution potential as more tokens enter circulation.

Market Performance and Recent Volatility

Price Dynamics (as of December 18, 2025):

- Current Price: $0.3636

- 24-Hour Change: +43.49%

- 7-Day Change: +74.54%

- 30-Day Change: +355.013%

- 1-Year Change: +355.013%

- Historical High: $0.4595 (December 17, 2025)

- Historical Low: $0.1953 (December 12, 2025)

Trading Activity:

- 24-Hour Volume: $359,452.49

- Market Dominance: 0.011%

- Token Holders: 243 addresses

- Exchange Listings: 12 platforms

The token exhibits significant volatility with substantial intra-period fluctuations, characteristic of recently launched assets. The 74.54% weekly gain contrasts with limited trading volume, suggesting price movements may be driven by concentrated trading activity rather than broad market adoption.

Institutional Adoption and Market Positioning

Current Institutional Landscape:

- Institutional allocation to crypto remains cautious, with approximately 59% of institutions allocating less than 5% of assets under management to digital assets

- POWER faces competitive pressures from established protocols like Aave and Uniswap in the DeFi sector

- No explicit major institutional partnerships or integrations with POWER were identified in 2025 data

Backer Support: The protocol secured backing from recognized industry entities including Delphi, Spartan, Mechanism, and Sky Mavis, though institutional-grade infrastructure integration remains limited.

Macroeconomic Environment

External Pressures:

- Rising U.S. interest rates have negatively impacted GameFi tokens, including POWER

- SEC regulatory announcements have created investor uncertainty and volatility

- Market-wide sell-offs in GameFi tokens (e.g., GALA experienced 3% declines amid similar regulatory concerns)

Technology and Ecosystem Development

Multi-Chain Infrastructure: POWER operates across multiple blockchain networks (Ethereum, BSC, Ronin), providing diversified deployment options and reducing single-chain dependency risks.

Token Utility Framework: The protocol employs a threefold utility model:

- In-game currency for supported applications

- Infrastructure fuel for the Power Protocol network

- Incubator resource for ecosystem development

Live Deployment Proof: Fableborne represents real-world implementation of the protocol's model, providing functional validation of the incentive mechanism. However, expansion beyond this flagship application remains a critical challenge.

III. Risk Factors

Ecosystem Concentration Risk: The protocol's current utility is heavily dependent on Fableborne. Broader developer integration and multi-application adoption are essential for sustainable growth.

Market Competition: Power Protocol operates in a crowded Web3 gaming and DeFi landscape where numerous competing protocols and tokens vie for user adoption and developer integration.

Token Unlock Dynamics: With only 21% of tokens currently in circulation, significant unlocks could create selling pressure and downward price volatility as vested tokens enter the market.

Regulatory Uncertainty: Ongoing cryptocurrency regulation, particularly regarding gaming tokens and reward mechanisms, presents potential operational risks.

IV. Market Sentiment and Price Predictions

Near-Term Outlook: Multiple sources indicate technical analysis sentiment is bullish, supported by recent price momentum. However, predictions vary significantly:

- 2025 Average Prediction: $0.2417–$0.2707 range

- Short-term volatility expected given limited trading depth

Long-Term Projections:

- 2026 Average: $0.2562 (potential 8% ROI from certain baseline levels)

- 2028 Average: $0.3295 (potential 39% appreciation)

- 2029 Potential: $1.00 (conditional on GameFi adoption acceleration)

- 2030 Average: $0.3933

Forecast Uncertainty: Expert predictions show wide variance, with some models forecasting price declines or minimal growth. The limited direct market data available constrains forecast reliability.

V. Project Resources

Official Channels:

- Website: https://powerprotocol.xyz/en

- Whitepaper: https://power-protocol.gitbook.io/power-protocol-whitepaper

- Smart Contract: 0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223 (Ethereum)

- Community: Discord available at https://discord.gg/fableborne

- Social Media: https://x.com/PowerPrtcl, https://x.com/fableborne

VI. Conclusion

Power Protocol represents an emerging incentive layer technology with innovative mechanisms for converting Web2 user engagement into on-chain economic value. The protocol demonstrates technical viability through Fableborne's deployment and enjoys backing from respected industry participants. However, investment considerations must account for:

- Early-stage project status with limited operational history

- Significant token supply dilution potential (79% unreleased)

- Ecosystem dependence on Fableborne expansion and multi-application adoption

- Market-wide headwinds from regulatory uncertainty and macroeconomic pressures

- Highly volatile price action reflecting limited market depth

Long-term value realization depends critically on achieving widespread developer integration, demonstrating sustainable user acquisition costs, and maintaining functionality amid regulatory evolution. Current market conditions reflect elevated risk-return dynamics typical of early-stage protocol tokens.

III. POWER Future Investment Predictions and Price Outlook (Is Power Protocol(POWER) worth investing in 2025-2030)

Short-term Investment Prediction (2025, short-term POWER investment outlook)

- Conservative forecast: $0.2317 - $0.2890

- Neutral forecast: $0.3621 - $0.3900

- Optimistic forecast: $0.4200 - $0.4744

Mid-term Investment Outlook (2026-2028, mid-term Power Protocol(POWER) investment forecast)

- Market phase expectation: The protocol is expected to experience consolidation and ecosystem expansion as Fableborne and consumer applications drive user adoption across Web3-enabled platforms. Network growth and developer engagement will be critical during this phase.

- Investment return predictions:

- 2026: $0.4015 - $0.4475

- 2027: $0.3593 - $0.6277

- 2028: $0.4348 - $0.6840

- Key catalysts: Mainstream application integration, Fableborne user base expansion, institutional adoption from backing partners (Delphi, Spartan, Mechanism, Sky Mavis), ecosystem developer growth, and token economics implementation.

Long-term Investment Outlook (Is POWER a good long-term investment?)

- Base case: $0.4872 - $0.9242 USD by 2030 (assuming steady protocol adoption, sustainable game ecosystem growth, and consistent Web2-to-Web3 migration)

- Optimistic case: $0.6500 - $1.2000+ USD by 2030 (assuming accelerated mainstream adoption, successful consumer app launches, creator platform expansion, and favorable market conditions)

- Risk case: $0.2500 - $0.4000 USD by 2030 (assuming regulatory headwinds, limited mainstream adoption, competitive pressures, or macro market deterioration)

Click to view POWER long-term investment and price predictions: Price Prediction

2025-12-18 to 2030 Long-term Outlook

- Base scenario: $0.4872 - $0.7164 USD (corresponding to steady protocol adoption and mainstream application growth)

- Optimistic scenario: $0.7000 - $0.9242 USD (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: $1.0000+ USD (if the ecosystem achieves breakthrough progress and mainstream adoption)

- 2030-12-31 predicted high: $0.9242 USD (based on optimistic development assumptions)

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and subject to regulatory, technological, and market risks. Past performance does not guarantee future results. Investors should conduct their own research and consult with financial professionals before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.474351 | 0.3621 | 0.231744 | 0 |

| 2026 | 0.447501285 | 0.4182255 | 0.40149648 | 15 |

| 2027 | 0.627651919125 | 0.4328633925 | 0.359276615775 | 19 |

| 2028 | 0.684032375998125 | 0.5302576558125 | 0.43481127776625 | 45 |

| 2029 | 0.825717221631225 | 0.607145015905312 | 0.3885728101794 | 66 |

| 2030 | 0.924196143211066 | 0.716431118768268 | 0.487173160762422 | 97 |

Power Protocol (POWER) Comprehensive Research Report

I. Project Overview

Basic Information

Power Protocol is an incentive layer protocol designed to connect mainstream applications to Web3 by converting user behavior and application revenue into on-chain rewards. The protocol launched alongside Fableborne, one of the first Web3-enabled mobile titles to achieve mass-market metrics, and has received backing from global gaming and Web3 leaders including Delphi, Spartan, Mechanism, and Sky Mavis.

Core Value Proposition

The protocol transforms user engagement into real economic value, providing millions of Web2 users with their first meaningful on-chain experience through games, consumer applications, and creator platforms. This bridge-building approach positions Power Protocol as an infrastructure layer facilitating mainstream adoption of blockchain technology.

II. Token Economics & Market Data

Token Specifications

| Metric | Value |

|---|---|

| Token Symbol | POWER |

| Blockchain | Ethereum (ERC-20) |

| Contract Address | 0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223 |

| Current Price | $0.3636 |

| Total Supply | 1,000,000,000 |

| Circulating Supply | 210,000,000 |

| Circulation Ratio | 21.0% |

| Market Capitalization | $76,356,000 |

| Fully Diluted Valuation | $363,600,000 |

| Market Dominance | 0.011% |

Price Performance

| Period | Change | Absolute Change |

|---|---|---|

| 1 Hour | -0.84% | -$0.00308 |

| 24 Hours | 43.49% | +$0.11020 |

| 7 Days | 74.54% | +$0.15528 |

| 30 Days | 355.013% | +$0.28369 |

| 1 Year | 355.013% | +$0.28369 |

Price Range

- All-Time High: $0.4595 (December 17, 2025)

- All-Time Low: $0.1953 (December 12, 2025)

- 24-Hour Range: $0.2549 - $0.4595

Market Activity

| Metric | Value |

|---|---|

| 24-Hour Trading Volume | $359,452.49 |

| Exchange Listings | 12 exchanges |

| Token Holders | 243 addresses |

| CoinGecko Ranking | #401 |

III. Fundamental Analysis

Protocol Architecture

Power Protocol functions as an incentive layer that bridges Web2 and Web3 ecosystems. By tokenizing user behavior and application monetization, the protocol enables:

- User Participation Monetization: Converting in-app activities into blockchain-based rewards

- Application Revenue Sharing: Routing application earnings into protocol incentives

- Creator Economy Integration: Enabling creators to participate in token economics

Strategic Partnerships

The project benefits from support by established industry leaders:

- Delphi: Prominent blockchain research and investment firm

- Spartan: Blockchain investment and advisory organization

- Mechanism: Web3 development and investment entity

- Sky Mavis: Gaming studio behind Axie Infinity ecosystem

Fableborne Integration

Fableborne serves as the flagship application demonstrating Power Protocol's functionality. As one of the first Web3-enabled mobile games achieving mass-market metrics, it provides practical validation of the protocol's design and utility.

IV. Investment Strategy & Risk Management

Investment Methodology

Long-Term Holding (HODL POWER)

Suitable for investors with conviction in Web3 gaming infrastructure and mainstream blockchain adoption narratives. The project's focus on mass-market applications through gaming and consumer platforms aligns with longer-term Web3 infrastructure development.

Active Trading

Short-term traders may capitalize on the token's demonstrated volatility:

- Recent 24-hour swing: 43.49% gain

- 7-day movement: 74.54% increase

- Limited liquidity across 12 exchanges may amplify price movements

Risk Management

Asset Allocation Framework

- Conservative Investors: 1-3% portfolio allocation; emphasis on positions sized for complete loss tolerance

- Aggressive Investors: 5-10% allocation; suitable for investors with higher risk capacity and thesis conviction

- Professional Investors: Requires detailed volatility analysis, correlation assessments, and portfolio stress-testing given the emerging asset class and 243-holder concentration

Protective Strategies

- Portfolio Diversification: Combine with established blue-chip cryptocurrencies and non-correlated assets

- Risk Hedging: Utilize stablecoins for position management and volatility protection

- Dollar-Cost Averaging: Reduce timing risk through systematic periodic purchases

Secure Storage

- Hot wallets: MetaMask or Ethers for active trading (limit exposure)

- Cold Storage: Hardware wallets (Ledger, Trezor) for long-term position holdings

- Institutional Custody: Qualified custodians for significant positions

V. Investment Risks & Challenges

Market Risks

- High Volatility: 355% annual movement demonstrates extreme price sensitivity

- Limited Liquidity: 243 token holders and 12 exchange listings indicate concentrated ownership and potential slippage on large trades

- Price Discovery: Young token with volatile trading patterns may experience sudden reversals

Regulatory Risks

- Jurisdiction Uncertainty: Gaming tokens and reward mechanisms face evolving regulatory scrutiny across major markets

- Securities Classification: Different jurisdictions may classify token rewards under securities frameworks

- International Compliance: Multi-jurisdictional gaming and Web3 operations present complex regulatory exposure

Technology Risks

- Protocol Maturity: Early-stage infrastructure with limited operational history

- Smart Contract Vulnerabilities: ERC-20 implementation audit status requires verification

- Integration Dependencies: Protocol functionality depends on third-party game and application adoption

- Network Security: Ethereum mainnet exposure inherits base-layer risks

Business & Adoption Risks

- Fableborne Dependency: Protocol success heavily tied to single flagship game performance

- User Adoption: Millions of Web2 users must meaningfully engage with on-chain mechanisms

- Competitive Landscape: Multiple incentive layer protocols and gaming infrastructure projects competing for market share

VI. Conclusion: Is Power Protocol a Good Investment?

Investment Value Summary

Power Protocol operates at the intersection of gaming, Web3 infrastructure, and mainstream adoption. The project presents:

Positive Factors:

- Strategic positioning in Web3 gaming infrastructure

- Support from established industry leaders

- Integration with Fableborne demonstrating practical application

- Significant recent price appreciation (355% over evaluation period)

- Mass-market approach differentiates from pure infrastructure plays

Limiting Factors:

- Extremely early-stage with 243 token holders indicating concentrated risk

- Limited trading infrastructure (12 exchanges)

- Complete dependence on Fableborne adoption metrics

- Nascent protocol with minimal operational history

- Extreme volatility unsuitable for risk-averse portfolios

Investor Recommendations

✅ New Investors: Dollar-cost averaging with strict 1-3% portfolio limits; prioritize secure hardware wallet storage; conduct ongoing due diligence on Fableborne user metrics

✅ Experienced Investors: Tactical trading around demonstrated volatility ranges; combine with portfolio hedging tools; maintain strict stop-loss discipline given concentration risks

✅ Institutional Investors: Strategic assessment of Web3 gaming thesis conviction; formal smart contract audit review; evaluation of competitive incentive layer protocols; multi-year development timeline expectations

⚠️ Critical Disclaimer: Cryptocurrency investments carry substantial risk of total capital loss. This analysis is for informational purposes only and does not constitute investment advice, financial recommendations, or endorsements. Conduct independent research, consult qualified financial advisors, and only invest capital you can afford to lose completely. Past performance does not guarantee future results. Market data reflects conditions as of December 18, 2025.

VII. Additional Resources

| Resource | Link |

|---|---|

| Official Website | https://powerprotocol.xyz/en |

| Whitepaper | https://power-protocol.gitbook.io/power-protocol-whitepaper |

| Smart Contract | https://etherscan.io/token/0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223 |

| Discord Community | https://discord.gg/fableborne |

| https://x.com/PowerPrtcl |

Report Generated: December 18, 2025

Data Snapshot: 00:18:14 UTC

Power Protocol (POWER) - Frequently Asked Questions

I. Project Fundamentals

Q1: What is Power Protocol and how does it function?

Answer: Power Protocol is an incentive layer that bridges Web2 and Web3 ecosystems by converting user behavior and application revenue into on-chain rewards. The protocol launched alongside Fableborne, one of the first Web3-enabled mobile games achieving mass-market metrics. It enables millions of Web2 users to earn blockchain-based rewards through gaming, consumer applications, and creator platforms, transforming user engagement into real economic value.

Q2: What blockchain does Power Protocol operate on and what is its token standard?

Answer: Power Protocol operates on the Ethereum blockchain and uses the ERC-20 token standard. The contract address is 0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223. The token is also deployed across multiple blockchain networks including BSC (Binance Smart Chain) and Ronin to provide diversified deployment options and reduce single-chain dependency risks.

Q3: Who are the major backers and partners supporting Power Protocol?

Answer: Power Protocol has secured backing from prominent gaming and Web3 industry leaders including Delphi (blockchain research and investment firm), Spartan (blockchain investment organization), Mechanism (Web3 development entity), and Sky Mavis (gaming studio behind Axie Infinity). These strategic partnerships provide credibility and potential integration pathways for ecosystem expansion.

II. Token Economics & Market Performance

Q4: What is the current token supply structure and dilution outlook for POWER?

Answer: As of December 18, 2025, POWER has a circulating supply of 210 million tokens (21% of total supply) out of a maximum supply of 1 billion tokens. This means 79% of tokens remain unreleased, indicating significant future dilution potential as vested tokens enter the market. This gradual release mechanism affects price discovery and creates ongoing selling pressure as more tokens become available for trading.

Q5: How has POWER performed in terms of price movement and volatility?

Answer: POWER has demonstrated extreme volatility within a short timeframe. Since its all-time low of $0.1953 on December 12, 2025, the token surged to an all-time high of $0.4595 on December 17, 2025—a 135.1% increase. Over the past 30 days, POWER has gained 355.013%, while the 24-hour change stands at +43.49% and the 7-day change at +74.54%. This volatility is characteristic of recently launched, thinly-traded assets and reflects both opportunity and substantial downside risk.

III. Investment Analysis & Outlook

Q6: Is Power Protocol worth investing in during 2025-2030?

Answer: Power Protocol presents a high-risk, high-reward investment opportunity suitable only for risk-tolerant investors. Conservative projections suggest prices ranging from $0.2317-$0.2890 in the short term (2025), while long-term optimistic scenarios project $0.7000-$1.2000+ by 2030. However, realization of these gains depends critically on achieving mainstream developer integration, sustainable user acquisition through Fableborne and consumer applications, and favorable regulatory environments. The protocol's early-stage status, concentrated token holder base (243 addresses), and dependency on Fableborne adoption create substantial execution risks.

Q7: What are the primary risks investors should consider before investing in POWER?

Answer: Major risk factors include: (1) Market concentration risk—243 token holders and limited liquidity across 12 exchanges create potential for rapid price swings; (2) Ecosystem dependency—protocol success is heavily tied to Fableborne's adoption and expansion; (3) Token dilution—79% of supply remains unreleased, creating future selling pressure; (4) Regulatory uncertainty—gaming tokens and reward mechanisms face evolving regulatory scrutiny across jurisdictions; (5) Technology risk—early-stage protocol with limited operational history and unproven smart contract security; (6) Competition—numerous incentive layer protocols and gaming infrastructure projects compete for market share and developer adoption.

IV. Usage & Asset Management

Q8: What storage and portfolio allocation recommendations apply to POWER investments?

Answer: For storage, use MetaMask or Ethers wallets for active trading (limiting exposure), and hardware wallets (Ledger, Trezor) for long-term holdings. Portfolio allocation should follow risk tolerance guidelines: conservative investors (1-3% allocation with complete loss tolerance), aggressive investors (5-10% allocation with higher risk capacity), and institutional investors (requiring detailed volatility analysis and correlation assessments). Implement dollar-cost averaging to reduce timing risk, diversify with established cryptocurrencies and non-correlated assets, and consider stablecoins for position management and volatility protection.

Report Date: December 18, 2025

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry substantial risk of total capital loss. Conduct independent research and consult qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is ORBR: A Comprehensive Guide to Optimizing Real-time Business Response Systems

What is WAVES: A Comprehensive Guide to Understanding Wave Technology and Its Applications in Modern Society

What is USELESS: A Comprehensive Guide to Understanding Things That Serve No Purpose in Modern Life

what is CVAULTCORE: A Comprehensive Guide to Advanced Secure Data Storage and Management Solutions

2025 USELESS Price Prediction: Will the Memecoin Reach New Highs or Face Market Correction?