Gate Ventures Haftalık Kripto Özeti (25 Ağustos 2025)

Gate Ventures

Kısa ve Öz

- Jerome Powell, para politikasında bir gevşeme olasılığını sinyalini verdi ve piyasa bu Eylül'de 25 baz puanlık bir faiz indirimini fiyatlıyor.

- Bu haftaki ekonomik veriler arasında ABD GSYİH'si, çekirdek PCE, dayanıklı mal siparişleri, yeni konut satışları, tüketici güveni, kişisel gelir ve harcama verileri yer alıyor.

- ETH, Powell’ın faiz indirimi ipucu ve güçlü ETF girişleri ile yeni bir tüm zamanların en yüksek seviyesine ulaşarak BTC’yi geride bıraktı, oysa BTC devam eden çıkışlarla mücadele etti.

- BTC ve ETH hariç piyasa yükseldi, Aave gibi ETH ile ilgili DeFi token'ları güçlü kazançlar elde etti.

- OKB, X katmanlı meme ticaret faaliyetinde yüzde 70'ten fazla arttı, TON ise yüzde 4 düştü.

- Yeni tokenler WLFI ve Plasma, TGE öncesinde güçlü bir performans sergiledi. Plasma'nın ön satışı 30 dakikadan kısa sürede tükendi.

- Aave, Kredi Protokolünün İlk Non-EVM Genişlemesi Olarak Aptos'ta Dağıtım Yapıyor.

- Chainlink, TVS ile $90B'yi aşarak Oracle Hizmetleri için ISO 27001 ve SOC 2 Uygunluğuna ulaştı.

- USDe, yeni uygun varlık çerçevesi ile BTC ve ETH'nin ötesinde BNB ile desteklemeyi genişletiyor.

- En çok fonlanan sektör Veri sektörüdür.

Makro Genel Bakış

Jerome Powell, para politikasında bir gevşeme olasılığını işaret etti ve piyasa bu Eylül ayında 25 baz puanlık bir faiz indirimini fiyatlıyor.

2025 Jackson Hole Ekonomi Sempozyumu'nda, Federal Rezerv Başkanı Jerome Powell, artan ekonomik karmaşıklıkların gölgesinde bir konuşma yaptı ve para politikasında bir gevşeme olasılığına işaret etti. Faiz indirimine açıkça taahhüt vermekten kaçınsa da, piyasalar onun açıklamalarını Eylül ayında 25 baz puanlık bir faiz indirimine güçlü bir işaret olarak yorumladı. Temel PCE enflasyonu %2,9'a yükseldi ve malların fiyatlarında belirgin bir artış gözlemlendi. Powell, gümrük tarifelerinin tüketici fiyatları üzerindeki etkisini kabul etti ve fiyat artışlarının daha kalıcı bir enflasyonu tetikleyip tetiklemeyeceği konusunun ana politika kaygısı olduğunu vurguladı.

Riskler göz önüne alındığında, Fed politika çerçevesinde önemli bir ayarlama yaptı. Powell, daha geleneksel ve esnek bir enflasyon hedefine dönüşü duyurdu. Son yılların, enflasyonun kasıtlı olarak ılımlı bir şekilde aşılmasının pratikte iyi çalışmadığını — özellikle keskin ve sürdürülebilir enflasyon şokları ortamında — gösterdiğini belirtti. Bu değişim, politika araçlarına yapılan sadece teknik bir revizyon değil, Fed’in iletişim stratejisinin yeniden kalibrasyonunu temsil ediyor.

Bu haftaki yaklaşan veriler arasında ABD GSYİH'si, çekirdek PCE, dayanıklı mal siparişleri, yeni konut satışları, tüketici güveni, kişisel gelir ve harcama verileri bulunmaktadır. ABD, 3.0%’lik ilk okuma sonrasında 2025Q2 GSYİH verilerini güncellemektedir. Ayrıca, Temmuz ayına ait çekirdek PCE verileri de açıklanacak, ve önceki CPI verileri, %2.7'lik sabit bir artış ile beklenenden daha düşük bir başlık okuması göstermiştir. Fed’in tercih ettiği enflasyon göstergelerinin işaretleri, Eylül toplantısının öncesinde faiz oranı yolu ile ilgili beklentiler için kritik olacaktır ve piyasalar bir faiz indirimine güçlü bir olasılık vermektedir. Diğer önemli ABD ekonomik verileri arasında dayanıklı mal siparişleri, yeni konut satışları ve kişisel gelir ve harcama yer almaktadır.

DXY

Dolar endeksi, Jerome Powell'ın gelecekteki Fed politikaları ve faiz indirimleri üzerine yaptığı güvercin konuşmaya yanıt olarak geçen Cuma düştü, yatırımcılar Fed'in makroekonomiye dair görüşünde bir geçiş olacağına bahis oynuyor.

ABD 10 Yıllık Tahvil Getirisi

Yatırımcılar ve likit sermaye riskli varlıklara akmaya başladıkça, ABD Hazine 10 Yıl Vadeli Tahvil faizi önemli ölçüde düşerek yaklaşık %4,27'ye geriledi.

Altın

Altın fiyatları geçen Cuma hızlı bir şekilde yükseldi çünkü Powell'ın güvercin konuşması, yatırımcıların erken bir faiz indirimini fiyatlamaya olan ilgisini artırdı ve piyasaya daha fazla likidite girdi.

Kripto Pazarları Genel Görünümü

1. Ana Varlıklar

BTC Fiyatı

ETH Fiyatı

ETH/BTC Oranı

SOL/ETH Oranı

Ethereum, Jerome Powell'un Fed'in odak noktasını enflasyondan iş gücü piyasasına kaydırma konusundaki yorumlarının hemen ardından tüm zamanların en yüksek seviyesini kırdı ve Eylül ayında bir faiz indirim olasılığını işaret etti.

Geniş piyasalarda likidite koşullarının iyileşmesi üzerine bir iyimserlik görülürken, BTC momentum kazanamadı ve kısa bir süre için 115k $ seviyesinin altına düştü. Spot Bitcoin ETF'leri geçen hafta beş gün üst üste net çıkışlar kaydederek toplamda 1.17b $ değerinde oldu. Buna karşılık, Spot ETH ETF'leri 241m $ çıkış gördü ancak ETH'nin fiyatı momentum kazandıkça ve ATH'sini geçtikten sonra 21 Ağustos'tan itibaren net girişlere döndü; 22 Ağustos'ta girişler daha da hızlandı.

ETH, hem birincil hem de ikincil ETF piyasalarından önemli bir alım gücü göstermeye devam ederken, Bitcoin ABD hisse senetleri için bir öncü gösterge olabilir. ETH/BTC oranının hala yukarı yönlü bir potansiyele sahip olduğu görülüyor.

2. Toplam Piyasa Değeri

Kripto Toplam Piyasa Değeri

Kripto Toplam Piyasa Değeri BTC ve ETH Hariç

Kripto toplam piyasa değeri tüm hafta %0.96 düştü, oysa BTC ve ETH hariç kripto toplam piyasa değeri %0.55 arttı. ETH'nin fiyat artışı, Aave gibi DeFi ve LST token'larındaki büyümeyi destekleyerek BTC'deki piyasa değeri düşüşünün bir kısmını telafi etti. BTC rallilerine kıyasla, ETH fiyat artışları genellikle altcoin'lerde daha geniş kazançları teşvik etme eğilimindedir. Bitcoin'i destekleyen likiditenin ETH ve belirli ETH ile ilgili altcoin'lere dönebilme olasılığı bulunmaktadır.

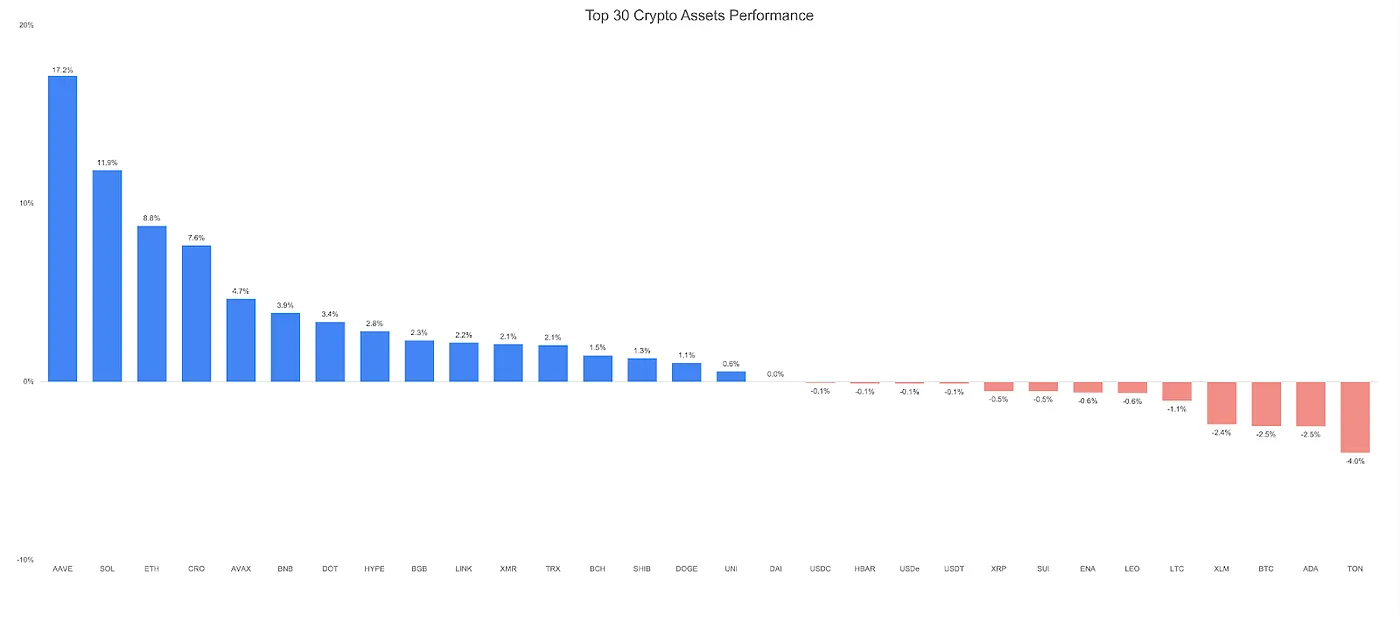

3. En İyi 30 Kripto Varlık Performansı

Kaynak: Coingecko ve Gate Ventures, 25 Ağustos 2025 itibarıyla

Aave, 25 Ağustos itibarıyla $335 seviyesinde işlem görerek son kazançlara öncülük etti. Bu yükseliş, ETH'nin fiyat artışıyla destekleniyor; 2021'deki önceki döngüde, ETH tüm zamanların en yüksek seviyesini kırdığında Aave $650'ye ulaştı. ETH'deki daha fazla değer artışı, DeFi token'ları arasında yukarı yönlü momentumu sürdürmeye devam edebilir.

Diğer yandan, TON %4'lük bir düşüşle en zayıf performansı sergiledi. Ağustos başından beri fiyatı konsolide oluyor ve 3.14 $–3.675 $ aralığında dalgalanıyor.

Geçtiğimiz haftanın kazançlarının ardından, OKB geçen hafta %70'ten fazla bir artış daha kaydetti. Mevcut FDV'si yaklaşık 3.9 milyar $ olup, BNB'nin FDV'sinin otuz katı daha küçüktür. X katmanındaki meme ekosistemi özellikle geçen hafta aktifti, yalnızca launchpad üzerinde dokuz proje başlatıldı ve bu durum OKB'nin hala önemli bir büyüme potansiyeline sahip olduğunu göstermektedir.

4. Yeni Token Piyasaya Sürüldü

En önemli yaklaşan TGE'ler WLFI ve Plasma. Trump ile ilgili defi platformu WLFI, şu anda halka arz fiyatına kıyasla 4.6 kat artışla 0.23 $'dan işlem görüyor. Bu arada, bu döngüde TGE'ye ulaşan ilk stablecoin zinciri olan Plasma, şu anda ön TGE pazarında 0.54 $'dan işlem görüyor. Bitfinex, Bybit ve Framework Ventures tarafından desteklenen Plasma, stablecoin ve ödeme odaklı bu döngünün en çok beklenen blok zincirlerinden biridir. Temmuz 2025'te gerçekleştirilen Plasma'nın ön satışı, 500 milyon $ FDV ile 30 dakikadan kısa sürede tükendi ve şu anda 5.3 milyar $ FDV ile işlem görüyor.

Ana Kripto Vurguları

1. Aave, İlk Non-EVM Genişlemesi Olarak Aptos'ta Kredilendirme Protokolünü Yayınlıyor

Aave, merkeziyetsiz finansın 50 milyar dolardan fazla net mevduat ve neredeyse 37 milyar dolarlık TVL ile en büyük kredi sağlayıcısı, Aptos'ta başlatıldı ve bu, EVM dışındaki bir blok zincirinde ilk dağıtımıdır. Bu adım, Aave'nin küresel kredi piyasalarına erişimi genişletme yönündeki çok zincirli stratejisini vurgulamaktadır. Başlangıçta, Aave USDC, USDT, APT ve sUSDe'yi desteklemektedir ve Aptos Vakfı, kullanıcı benimsemesini artırmak için teşvikler sunmaktadır. Oracle güvenli piyasalara güvenilir fiyatlandırma sağlamak için Chainlink Fiyat Beslemeleri entegre edilmiştir, dağıtım Aave V3'ün Move'daki tam yeniden uygulanmasını takip etmektedir. Aave ayrıca güvenliği daha da güçlendirmek için GHO'da 500.000 dolarlık bir hata ödülü sunmuştur.

Genel olarak, Aave ve Aptos, likit staking pazarlarında önemli fırsatlar görüyor, şu anda APT'nin yalnızca %8.1'inin LST'lerde olduğunu, doğrudan stake edilenlerin ise %76 olduğunu belirtiyorlar. Bu uygulama, Aave'yi Aptos için bir likidite motoru olarak konumlandırıyor ve geçen yıl boyunca azalan işlemler sonrası kullanıcı etkinliğini canlandırmayı amaçlıyor. Her iki ekip de iş birliğinin TVL büyümesini hızlandırmasını, teminat türlerini genişletmesini ve gelecekteki EVM dışı dağıtımlar için bir plan sunmasını bekliyor, bu da Aave DAO yönetimine tabi.

2. Chainlink, TVS ile 90 milyar doları aşan Oracle Hizmetleri için ISO 27001 ve SOC 2 Uygunluğunu elde etti.

Chainlink, Deloitte & Touche LLP tarafından yapılan denetimlerin ardından ISO 27001 sertifikasını ve SOC 2 Tip 1 belgesini güvence altına alan ilk blockchain oracle platformu olmuştur. Sertifikalar, Fiyat Beslemeleri, SmartData (Rezerv Kanıtı, NAV) ve Cross-Chain Interoperability Protocol (CCIP) kapsamını içermektedir. Chainlink, 90 milyar doların üzerinde varlığı güvence altına almakta ve oracle pazarının %68'ini elinde bulundurmaktadır. Aave, GMX, Ether.fi, Pendle ve Compound gibi önde gelen DeFi protokollerinin yanı sıra Swift, UBS ve SBI Digital Markets gibi büyük kuruluşları desteklemektedir.

Sertifikalar, Chainlink'in kurumsal düzeyde güvenlik ve operasyonel standartlarını doğrulamakta, tokenleştirilmiş varlık piyasalarını güçlendirmekteki rolünü pekiştirmektedir. Sertifikalı hizmetler arasında, çapraz zincir veri ve değer transferi için CCIP, gerçek zamanlı veri için Fiyat Akışları, teminat kontrolleri için Rezerv Kanıtı ve tokenleştirilmiş fonlar için NAVLink bulunmaktadır. Bu kilometre taşları, Chainlink'i onchain finansmanın bir sonraki dalgası için kritik bir altyapı olarak konumlandırmakta, gerçek dünya varlıklarının trilyonlarca dolarlık değerinin blok zincirlerine aktarılması beklenmektedir.

3. USDe, yeni uygun varlık çerçevesi ile BTC ve ETH'nin ötesinde BNB ile desteklemeyi genişletiyor.

Ethena, Binance’in BNB’sini USDe’nin perp-hedge teminatını desteklemek için uygun ilk yeni varlık olarak onayladı ve yeni bir "Uygun Varlık Çerçevesi"nin devreye alındığını duyurdu. Kurallar bazlı yapı, gelecekteki varlıkların eklenmesi için niceliksel ve yönetişim eşiklerini belirleyerek, USDe’nin sabitlenmesinin temeli olarak bitcoin ve ether’in ötesine geçiyor. Protokolün risk komitesi, XRP ve Hyperliquid’in HYPE’in öncelik eşiklerini karşıladığını onayladı ve bunların bir sonraki aşamada, daha fazla risk değerlendirmesine bağlı olarak, dahil edilebileceğini öne sürdü. Ethena’nın sentetik doları USDe, dolar cinsinden varlıkları delta-hedge edilmiş sürekli vadeli işlemler pozisyonlarıyla eşleştirerek istikrarını koruyor. 11.75B $ dolaşımda olan arz ile, şu anda kriptonun üçüncü en büyük stablecoin’i.

Çerçeve, USDe'nin bir kısmının, borç verme, borç alma ve piyasa yapısı kontrollerini karşılayan ek büyük ölçekli, likit varlıklara referans vermesine izin verirken, çoğu desteğinin sağlandığı yerleşik enstrümanlara olan bağımlılığı korur. Yönetim duyuruları, risk kontrollerini zayıflatmadan teminat kaynaklarını genişletmeyi amaçlayan varlık değerlendirme sürecini ayrıntılı olarak açıklamaktadır.

Anahtar Girişim Anlaşmaları

1. o1.exchange, Base'in ilk kapsamlı ticaret terminalini başlatmak için 4.2 milyon dolar güvence altına aldı.

o1.exchange, Coinbase Ventures ve AllianceDAO tarafından yürütülen bir finansman turunda 4.2 milyon dolar topladı ve Base üzerinde ilk tam ölçekli ticaret terminalini inşa etmeyi hedefliyor. Bu durum, ekosistemdeki en iyi finanse edilen altyapı projelerinden birini işaret ediyor. Fonksiyonel olarak, o1.exchange kendisini kurumsal düzeyde bir terminal olarak konumlandırıyor ve gerçek zamanlı DEX analitiği, TradingView entegrasyonu, cüzdan takibi, gelişmiş emir türleri (limit, TWAP, sniping) ve kaymayı en aza indirmek için ≤1 blok işlem hızı sunuyor. Platform ayrıca Zora ve BaseApp gibi büyük Base projeleri ile entegrasyon sağlayarak çoklu cüzdan yönetimi ve çapraz zincir köprüleme sunuyor; ayrıca likidite ve emir akışını artırmak için Uniswap V4 ile çalışıyor.

Platform, benimseme çekmek için agresif bir teşvik programı başlatıyor, işlem ücretlerinde %45 geri ödeme ve %41 referans gelir paylaşımı sunuyor. Bu kadar yüksek ödül yapıları, merkezi veya merkeziyetsiz borsalarda nadiren görülür ve hem perakende hem de profesyonel yatırımcıları çekmek için tasarlanmıştır. Bu girişim, Base ekosisteminin meme token'ları ve NFT'lerle büyüdüğü ancak olgun bir ticaret altyapısından yoksun olduğu bir dönemde geliyor. Profesyonel sınıf araçlar ve güçlü teşvikler sunarak, o1.exchange, merkezi borsaların erken stratejilerini yeniden uygulamayı ve Base üzerinde birincil ticaret merkezi olarak kendini kurmayı hedefliyor.

2. VanEck ve Fabric Ventures, Loop Kripto için 6 milyon dolarlık yatırım yaparak stablecoin ödeme altyapısını geliştirecek.

Loop Kripto, VanEck ve Fabric Ventures tarafından ortaklaşa yürütülen bir fonlama turunda 6 milyon dolar topladı ve stabilcoin tabanlı ödeme altyapısını inşa etme çabasını güçlendirdi. Bu fonlama, a16z Kripto ve Archetype'dan alınan önceki desteklere ek olarak geldi. Kurumsal yatırımcılar bu görüşü yineledi. VanEck, stabilcoinlerin bankacılık sektörünü yeniden şekillendirmedeki rolünü vurgularken, Fabric Ventures, ödeme alanında ölçeklenebilir blok zinciri çözümlerine olan bağlılıklarını vurguladı.

Loop Kripto, sınır ötesi stabilcoin ödemelerine odaklanmıştır ve geleneksel aracılara olan bağımlılığı azaltmayı, aynı zamanda işlem hızını ve maliyet verimliliğini artırmayı hedeflemektedir. Stabilcoinler, kurumsal stratejilerin ve DeFi benimsemesinin merkezinde giderek daha fazla yer aldıkça, Loop Kripto'nun konumu, dijital öncelikli, kapsayıcı ödeme sistemlerine yönelik daha geniş bir endüstri değişimini vurgulamaktadır. Şirket, hem işletmelerin hem de düzenleyicilerin blockchain tabanlı ödeme çözümlerini küresel finansal sisteme entegre etme yollarını keşfettiği bu dönemde stabilcoinlerin ivmesinden yararlanmayı amaçlamaktadır.

3. DigiFT, tokenleştirilmiş RWA Altyapısını genişletmek için SBI Holdings tarafından yönetilen 11 milyon dolarlık yatırım aldı.

DigiFT, Singapur merkezli bir gerçek dünya varlıkları (RWA) borsası, SBI Holdings liderliğinde yeni bir stratejik turda 11 milyon $ topladı ve toplam finansmanını 25 milyon $'a çıkardı. Diğer katılımcılar arasında Mirana Ventures, Offchain Labs, Yunqi Partners ve Polygon Labs yer aldı. Bu yatırım, finansal firmaların tokenizasyon için uyumlu çerçeveler arayışında RWA platformlarına olan artan kurumsal güveni vurguluyor ve hisse senetleri, sabit getirili menkul kıymetler, alternatifler ve kripto varlıklar arasında tokenleştirilmiş ürünlerin genişlemesini destekliyor; ayrıca, birlikte çalışabilirlik ve sermaye verimliliğini artırmak için akıllı sözleşme altyapısının geliştirilmesini sağlıyor.

Singapur'un Para Otoritesi ve Hong Kong'un Menkul Kıymetler ve Vadeli İşlemler Komisyonu'ndan lisanslar altında faaliyet gösteren DigiFT, tokenleştirilmiş varlıkların kurumsal benimsenmesi için düzenlenmiş yollar sunmaktadır. DigiFT, Invesco, UBS Asset Management, CMB International ve Wellington Management gibi önde gelen varlık yöneticileriyle ortaklık yaparak uçtan uca tokenleştirme ve dağıtım hizmetleri sağlamaktadır.

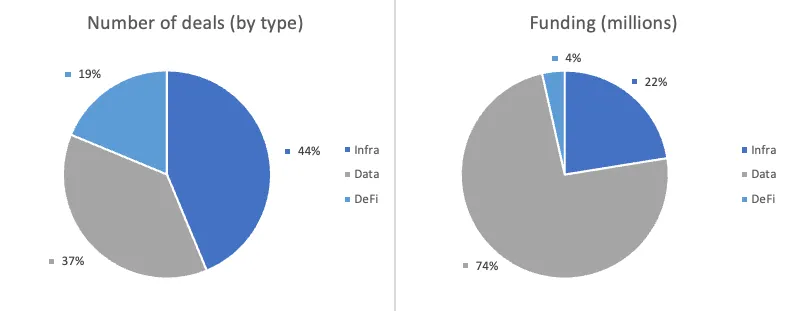

Girişim Pazar Metrikleri

Geçtiğimiz haftada kapatılan işlem sayısı 16'ydı, Infra'nın 9 işlemi vardı, bu da toplam işlem sayısının her sektörü için %44'e denk geliyor. Bu arada, Data'nın 6 (%38) ve DeFi'nın 3 (%19) işlemi vardı.

Haftalık Girişim İşlem Özeti, Kaynak: Cryptorank ve Gate Ventures, 25 Ağustos 2025 itibarıyla

Geçen hafta açıklanan toplam fonlama miktarı 148M$ idi, önceki haftadaki işlemlerin %19'u (3/16) toplanan miktarı açıklamadı. En yüksek fonlama, 109M$ ile Veri sektöründen geldi. En çok fonlanan işlemler: IVIX 60M$, DigiFT 11M$

Haftalık Girişim Anlaşması Özeti, Kaynak: Cryptorank ve Gate Ventures, 25 Ağustos 2025 tarihi itibarıyla

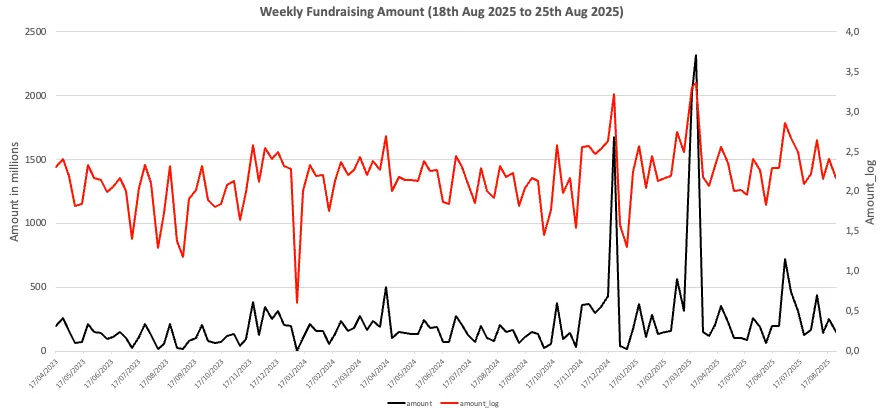

Aylık toplam fonlama, 2025 Ağustos'un 4. haftasında 148 milyon $'a düştü ve bu, bir önceki haftaya göre %42'lik bir azalma anlamına geliyor. Önceki haftadaki haftalık fonlama, aynı dönem için yıllık bazda %3 azalmıştı.

Gate Ventures Hakkında

Gate Ventures, Gate'in girişim sermayesi kolu, Web 3.0 çağında dünyayı yeniden şekillendirecek merkeziyetsiz altyapı, ara yazılım ve uygulamalara yatırım yapmaya odaklanmıştır. Tüm dünyadaki sektör liderleriyle çalışarak, sosyal ve finansal etkileşimleri yeniden tanımlamak için gerekli fikirlere ve yeteneklere sahip olan umut verici ekipler ve girişimcilere yardımcı olmaktadır.

Web sitesi: https://www.gate.com/ventures

Buradaki içerik herhangi bir teklif, talep oluşturmamaktadır.veya tavsiye. Her zaman herhangi bir yatırım kararı vermeden önce bağımsız profesyonel tavsiye almanız gerekir.. Lütfen dikkat edin ki Gate Ventures, kısıtlı konumlardan sağlanan hizmetlerin tümünü veya bir kısmını kısıtlayabilir veya yasaklayabilir. Daha fazla bilgi için lütfen geçerli kullanıcı sözleşmesini okuyun.

Dikkatiniz için teşekkürler.

Gate Ventures Haftalık Kripto Varlıklar İncelemesi (1 Eylül 2025)

Gate Ventures Haftalık Kripto Özeti (08 Eylül 2025)

Gate Ventures Haftalık Kripto Varlıklar İncelemesi (18 Ağustos 2025)

Japonya'da Labubu Nereden Alınır: En İyi Mağazalar ve Online Mağazalar 2025

2025 yılındaki Bitcoin Piyasa Değeri: Yatırımcılar için Analiz ve Trendler